Crypto Rewards Tutorial 2025 Top 10 Ways to Earn More

2025-09-24 10:22:05

Wondering how you can earn cryptocurrency rewards in 2025? You now have more choices than ever. Staking, yield farming, cashback programs, and play-to-earn games top the list for most users. Check out this quick overview:

| Method | Description |

|---|---|

| Staking | Lock up crypto to support networks and get rewards. |

| Yield Farming | Provide liquidity and earn interest or tokens. |

| Crypto Cashback Programs | Earn crypto rewards when you shop or use special credit cards. |

| Play-to-Earn Games | Play games and collect digital assets or coins. |

Millions have joined platforms like PropW and Coinbuck recently. With so many ways to earn cryptocurrency rewards, you can find an option that fits your style. Stay alert for scams and always look for ways to maximize your returns. This crypto rewards tutorial will help you get started, whether you are new or already have some experience.

Staking

Overview

Staking lets you earn cryptocurrency rewards just by holding certain coins in your wallet or on staking platforms. You help run the network by locking up your crypto, and in return, you get staking rewards. In 2025, staking remains one of the most popular ways to earn cryptocurrency rewards. Many people love it because you don’t need fancy equipment or a lot of technical skill. You just pick the best crypto to stake, lock it up, and watch your rewards grow.

Getting Started

You can start staking in a few simple steps:

- Choose a trusted exchange or staking platform. Some popular options include Binance, Coinbase, and Kraken.

- Pick the best crypto to stake. Look for coins with a strong track record and good staking rewards.

- Transfer your coins to the staking platform and follow their instructions to lock them up.

- Sit back and collect your staking rewards. Most platforms pay out daily, weekly, or monthly.

Best Crypto to Stake

You want to find the best crypto to stake for the highest staking rewards. Here’s a quick look at some top choices and their average APY in 2025:

| Cryptocurrency | Average APY |

|---|---|

| Ethereum | 2.87% |

| Cardano | 2.44% |

| Binance Coin | 0.05% - 14.25% |

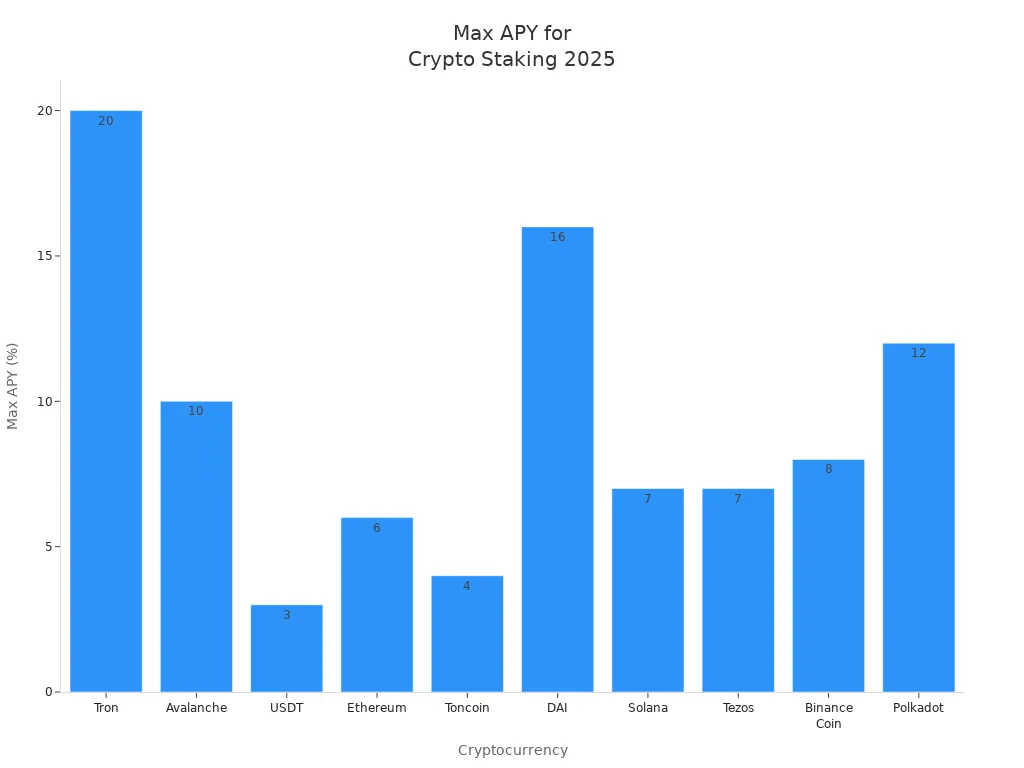

Some other coins also offer great staking rewards. Check out this chart to compare the highest staking rewards for popular coins:

You might also consider Tron, Avalanche, Solana, and Polkadot as the best crypto to stake. Each one offers different staking rewards and minimum requirements. Always check the latest rates on your chosen staking platforms.

Risks and Tips

Staking is easy, but you should stay alert. Here are some common risks and tips to keep your crypto safe:

- Scammers often create fake staking platforms or use fake endorsements. Always research before you trust a site.

- Phishing attacks can trick you into giving away your info. Double-check website addresses and never share your private keys.

- Crypto transactions can’t be reversed. If you send your coins to a scammer, you can’t get them back.

- Stick with well-known staking platforms and never rush into offers that seem too good to be true.

- Spread your crypto across several platforms to lower your risk.

Tip: Always verify the legitimacy of staking platforms before you deposit your coins. A little research can save you a lot of trouble.

Yield Farming

What Is It

Yield farming is a way for you to earn cryptocurrency rewards by putting your crypto into special pools on DeFi platforms. These pools help run the platform and let you collect rewards, usually paid out in more crypto. In 2025, yield farming has become huge. Top platforms now manage billions of dollars in total value locked (TVL). That means a lot of people trust these protocols with their money.

How to Start

You can start yield farming in just a few steps:

- Pick a trusted DeFi platform like Convex, Uniswap, or Aave.

- Choose a pool that fits your risk level. Some pools use stablecoins, while others use more volatile tokens.

- Deposit your crypto into the pool. The platform will guide you through the process.

- Watch your rewards grow over time.

Tip: Always double-check the platform’s reputation before you deposit your crypto.

Returns and Risks

Yield farming can offer high returns, but you need to know the risks. Here’s a quick look at average APY ranges for different pool types:

| Pool Type | Average APY Range |

|---|---|

| Stablecoin pools via Convex | 2-6% |

| Blue chip mixed pools via Convex | 4-10% |

| LST or ETH pairs via Convex | 2-4% |

| Governance token pairs | ~9.8% |

You might face these risks:

- Peg risk

- Smart contract risk

- Impermanent loss

- Market volatility

Maximizing Rewards

If you want to focus on maximizing returns in defi, try these strategies:

- Farm early and exit early. New pools often give the best rewards.

- Use auto-compounding platforms. These reinvest your rewards for you.

- Boost with stablecoin pools. They offer steady yields and lower risk.

- Stake LP tokens in the right pools. This can help you earn trading fees and reduce impermanent loss.

- Look for protocols that share revenue or offer governance incentives. This can give you extra rewards.

By following these tips, you can get closer to maximizing returns in defi while you earn cryptocurrency rewards.

Lending Platforms

Overview

You can earn cryptocurrency rewards by lending your crypto on special platforms. These platforms let you put your coins to work. You lend out your Bitcoin, Ethereum, or stablecoins. In return, you get interest payments. This is a great way to build passive income without trading or staking. Lending platforms have become very popular in 2025. You don’t need to be an expert to get started. You just need to pick a trusted platform and decide how much you want to lend.

Getting Started

Ready to try crypto lending? Here’s how you can begin:

- Choose a reputable lending platform. Some top choices include Nexo, YouHodler, Wirex, Ledn, and Nebeus.

- Create an account and complete any required identity checks.

- Deposit your crypto into your account.

- Select the type of lending you want. You can lend Bitcoin, Ethereum, or stablecoins.

- Start earning interest. Most platforms pay out weekly or monthly.

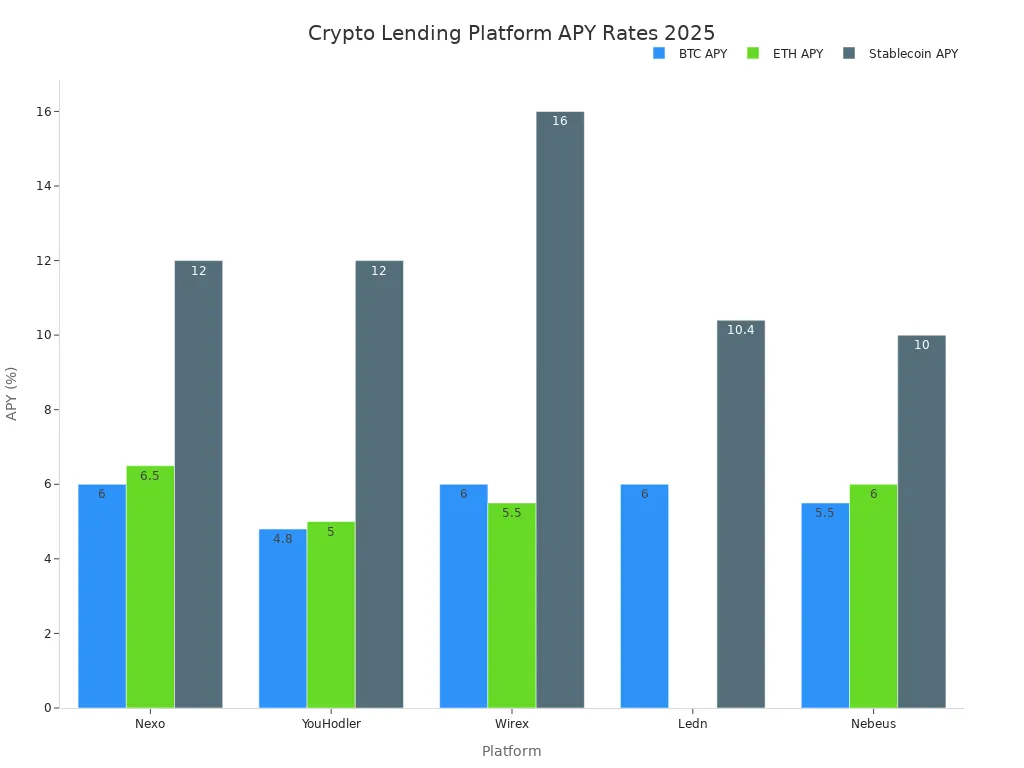

Check out this table to see the average interest rates in 2025:

| Platform | BTC APY | ETH APY | Stablecoin APY |

|---|---|---|---|

| Nexo | 6% | 6.5% | 12% |

| YouHodler | 4.8% | 5% | 12% |

| Wirex | 6% | 5.5% | 16% |

| Ledn | 6% | N/A | 10.4% |

| Nebeus | 5.5% | 6% | 10% |

Earnings and Risks

Crypto lending can help you grow your passive income. You get paid interest just for letting others borrow your coins. Stablecoins often give the highest rates. Bitcoin and Ethereum also offer solid returns. But you need to watch out for risks. Crypto prices can change fast. Some platforms might not protect your funds if something goes wrong. Always check if the platform has insurance or other safety features.

Note: Lending platforms are not banks. If the platform fails, you might lose your crypto.

Safety Tips

You want to keep your crypto safe while you earn. Here are some important tips:

- Make sure the platform follows local rules, like KYC and AML checks.

- Pick platforms with a good reputation and strong security.

- Watch out for high volatility and security threats.

- Look for platforms that work to reduce risks for users.

Tip: Always read reviews and check for regulatory compliance before you lend your crypto.

Play-to-Earn Games

How It Works

Play-to-earn games let you have fun and make money at the same time. You play these games online and get rewards in the form of tokens or digital items. Some games give you tokens for winning battles, finishing quests, or trading special items called NFTs. You can sell these tokens or NFTs for real money or use them inside the game. Many people love play-to-earn games because you can earn cryptocurrency rewards while enjoying your favorite hobby.

Getting Started

You can jump into play-to-earn games with just a few steps:

- Pick a game that matches your interests. Some focus on battles, others on collecting or crafting.

- Create an account and connect a crypto wallet. Most games use wallets like MetaMask.

- Learn the rules and start playing. Some games need you to buy a starter pack or character.

- Collect tokens or NFTs as you play. You can trade or sell these for more crypto.

Here’s a quick look at some of the most popular play-to-earn games in 2025:

| Game | Token | How You Earn | Est. Earning Potential | Risk Note |

|---|---|---|---|---|

| Harry Hippo | HIPO | PvP wins, token staking | Up to 600% APY (variable) | Based on staking pool size & performance |

| Gunz | GUN | PvP victories, loot crates, NFT sales | 20–50% monthly ROI | ROI depends on rank, token liquidity, demand |

| Illuvium | ILV | Land staking, battle wins, NFT trading | 15-30% APY + event rewards | ILV price volatility and NFT market changes |

| DeFi Kingdoms | JEWEL | Questing, Hero rentals, LP staking | 10-20% APY | Multi-chain risk, DEX volatility |

| Big Time | BIGTIME | NFT gear drops, cosmetic crafting | Some NFTs resell for $500+ | Earnings depend on rarity and timing |

Earnings Potential

You can make real money with play-to-earn games. Some players earn a little extra each month, while others turn gaming into a full-time job. Your earnings depend on the game, your skill, and the time you spend. For example, Harry Hippo offers up to 600% APY if you stake tokens, but this can change based on the pool size. Gunz players see 20–50% monthly ROI, but only if they rank high and sell rare NFTs. Always remember, your results may vary.

Risks and Strategies

Play-to-earn games come with risks. You should know what to watch out for and how to protect yourself:

- Token prices can change fast. This can affect how much you actually earn.

- Some games may have bugs or security issues. Always choose games with audited smart contracts.

- Local laws may affect your ability to cash out or play certain games.

- Not every game lasts. Research each project before you invest your time or money.

Tip: Stick with well-known games and never spend more than you can afford to lose. Diversify your play-to-earn games to spread out your risk.

Cloud Mining

What Is Cloud Mining

Cloud mining lets you earn Bitcoin and other cryptocurrencies without buying expensive mining equipment. You join a platform that runs the mining hardware for you. You just sign up, pick a contract, and start earning rewards. Many people like cloud mining because you can earn free crypto every day, even if you have no technical skills. You do not need to worry about electricity bills or setting up machines at home.

How to Join

Getting started with cloud mining is simple. First, choose a trusted platform. In 2025, DefiMiner stands out for its advanced AI, flexible contracts, and easy-to-use dashboard. It is popular with American users because you can start with small trial funds and see how it works. Other top choices include StormGain, which lets you mine and trade in one place, and ZA Miner, known for its welcome bonuses and adjustable contracts. You can also check out ETNCrypto, Genesis Digital Assets, and BitDeer for strong security and clear operations.

Daily Rewards

Cloud mining can bring you big daily rewards. Here are some numbers from real users in 2025:

- Some users report earning up to $9,877 every day.

- Advanced miners often make over $8,600 daily, which used to be possible only for big mining farms.

- Top performers on platforms like BAY Miner can earn more than $9,000 a day, or almost $300,000 each month.

Your actual rewards depend on the platform, contract, and market prices. Always check the latest rates before you start.

Avoiding Scams

You need to watch out for scams in cloud mining. Some fake companies pretend to be real mining services. They promise high profits but do not own any mining machines. These scams often work like Ponzi schemes, paying old users with money from new ones. HashOcean is a famous example. To stay safe:

- Avoid sites that offer huge returns with no proof of real mining.

- Do not trust companies that only give signup bonuses and no real service.

- Always research the platform and read reviews before you join.

Tip: If a cloud mining offer sounds too good to be true, it probably is. Stick with well-known platforms and never invest more than you can afford to lose.

Airdrops

What Are Airdrops

Airdrops give you free cryptocurrency. Projects send tokens to your wallet as a reward. You do not need to buy anything. Sometimes, you get airdrops for holding certain coins or for using a new platform. In 2025, airdrops have become a popular way for projects to grow their communities. You might see airdrops for joining a beta test, voting in a DAO, or just being an early user. It feels like getting a surprise gift in your wallet!

How to Qualify

You want to know how to get these free tokens? Here are the main ways you can qualify for high-value airdrops:

| Eligibility Criteria | Description |

|---|---|

| Hold or Stake Eligible Tokens | Keep certain tokens in your wallet during special snapshot times. |

| Participate in Ecosystem Activities | Swap, stake, or vote in DAOs to boost your chances. |

| Join Early User or Beta Tester Programs | Sign up for testnets and beta programs to get noticed. |

You can also:

- Try out test networks and deploy smart contracts.

- Join social media campaigns or help the community.

- Climb leaderboards by completing tasks or inviting friends.

Tip: Stay active in crypto communities. Projects often reward loyal users with the best airdrops.

Rewards and Risks

Airdrops can give you valuable tokens. Sometimes, these tokens rise in value fast. You might get a small amount, or you could receive a big reward if the project grows. But you should know about the risks. Some airdrops come from fake projects. Others might ask you to connect your wallet to unsafe sites. Always check if the project is real before you claim any tokens.

Scam Prevention

Scammers love to target airdrop hunters. You need to stay sharp. Here are some ways to protect yourself:

- Never share your private key. No real airdrop will ever ask for it.

- Always check the official website or social media for airdrop news.

- Research the project before you join. Look for real team members and clear goals.

- Watch out for fake domains and offers that sound too good to be true.

🚨 If something feels off, trust your gut and walk away. Your crypto safety comes first!

Learn-to-Earn

How It Works

Learn-to-earn lets you pick up new crypto skills and earn rewards at the same time. You watch videos, read guides, or complete quizzes. When you finish a lesson, you get paid in crypto. You don’t need to be an expert. You just need curiosity and a little time. Many platforms want to help you learn about blockchain, wallets, and trading. They reward you for every step you take.

Where to Find

You can find learn-to-earn programs on several popular platforms. Some focus on beginners, while others offer advanced lessons. Here’s a quick look at where you can start:

| Platform | Features | Target Users |

|---|---|---|

| ETNCrypto | Transparency, low fees, eco-friendly, daily payouts | Beginners |

| StormGain | User-friendly interface, easy to use | Beginners |

| BitHarbor | Dual income opportunities, advanced lessons | Advanced users |

ETNCrypto and StormGain make it easy for you to jump in. You get clear lessons and daily rewards. BitHarbor gives you more complex topics and a chance to earn in two ways—by learning and by staking.

Rewards

You can earn real crypto for every lesson you finish. Some platforms pay you in Bitcoin, Ethereum, or their own tokens. Daily payouts keep you motivated. ETNCrypto offers steady rewards for each completed module. StormGain gives you small bonuses for quizzes and tutorials. BitHarbor lets you earn extra by staking what you learn. The more you study, the more you earn.

Tip: Track your progress and rewards. Some platforms have dashboards that show your earnings and completed lessons.

Tips

Want to get the most out of learn-to-earn? Try these ideas:

- Pick platforms with clear lessons and easy payouts.

- Start with beginner modules if you’re new.

- Set a daily goal for learning.

- Watch out for fake sites. Only use trusted platforms.

- Share what you learn with friends. You might earn referral bonuses.

Learning about crypto can be fun and rewarding. You build your skills and grow your wallet at the same time.

Referral Programs

How They Work

Referral programs let you earn crypto by inviting friends or followers to join a platform. You share a special link or code. When someone signs up and starts using the service, you get a reward. Sometimes, you earn a percentage of their trading fees. Other times, you get a bonus when they make their first deposit. Many crypto exchanges and wallets offer these programs. You do not need to be an expert. You just need to share your link and help others get started.

Finding Offers

You can find referral programs on most big crypto platforms. Some companies pay you more than others. Here is a quick look at popular offers:

| Platform/Company | Affiliate Offer | Payout Data |

|---|---|---|

| Binance | 20% commission | Monthly payments |

| PrimeXBT | 70% commission | Weekly payments |

| BitMEX | 10% to 20% commission | Monthly payments |

| Bitpanda | Up to 20% revenue share | Monthly payments |

| Bybit | 30% on trading fees | 30-day payments |

| Trezor | 12% to 15% per sale | Monthly payments |

PlanMining stands out for cloud mining referrals. You can start with low upfront costs and track your profits in real time. The platform supports multi-currency withdrawals and uses strong security from McAfee and Cloudflare.

Maximizing Earnings

You want to earn as much as possible from referrals. Try these tips:

- Pick platforms with high commission rates. PrimeXBT gives you up to 70%. Binance offers up to 40% for lifetime commissions.

- Share your referral link on social media, blogs, or with friends.

- Explain the benefits to new users. Bybit gives new users fee discounts and bonuses up to $30,000.

- Stay active. The more people you invite, the more you earn.

- Track your rewards. Most platforms show your earnings in a dashboard.

Tip: Bybit’s Proof of Reserves system and regulatory licenses in Dubai and Cyprus make it a trusted choice for referrals.

Avoiding Scams

You need to stay safe when joining referral programs. Some fake sites promise big rewards but steal your info. Always check if the platform is licensed and has strong security. Bybit partners with Mastercard and shows real-time holdings, which builds trust. Never share your private keys or passwords. Stick with well-known companies like Binance, PrimeXBT, and Trezor.

🚨 If a referral offer seems suspicious or asks for sensitive info, walk away. Your safety comes first.

Liquidity Pools

What Are Liquidity Pools

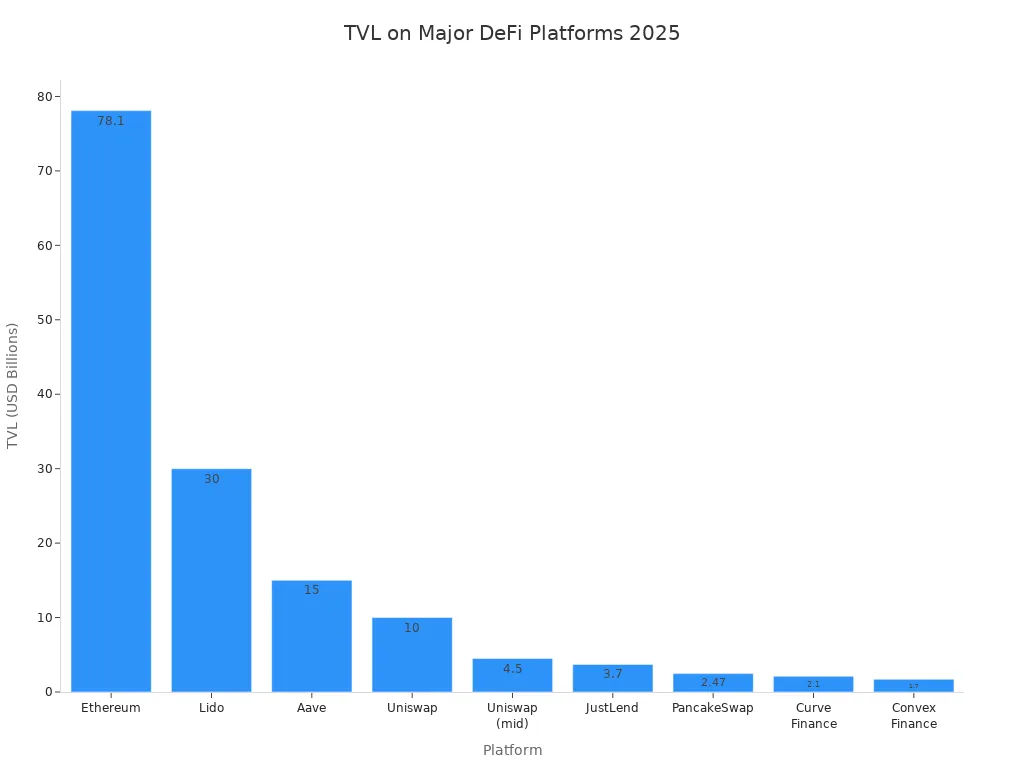

Liquidity pools let you earn crypto rewards by adding your coins to a shared pool on a decentralized exchange. When you join a pool, you help others trade tokens quickly and easily. In return, you get a share of the trading fees and sometimes extra tokens. These pools power many DeFi platforms in 2025. You can see how much money people trust in these pools by looking at the total value locked (TVL) on top platforms:

| Platform | Total Value Locked (TVL) |

|---|---|

| Lido | ~$30 billion |

| Aave | ~$15 billion |

| Uniswap | ~$10 billion |

| Ethereum | ~$78.1 billion |

| PancakeSwap | ~$2.47 billion |

| Curve Finance | ~$2.1 billion |

| JustLend | ~$3.7 billion |

| Convex Finance | ~$1.7 billion |

How to Participate

You can join a liquidity pool in just a few steps:

- Pick a platform like Uniswap, Aave, or Curve.

- Deposit your crypto into the pool. Most pools ask for two types of tokens, like ETH and USDC.

- Start earning rewards from trading fees and sometimes bonus tokens.

Tip: Always check the pool’s rules and rewards before you add your coins.

Rewards and Risks

Liquidity pools offer both benefits and risks. Here’s a quick look:

| Benefits | Risks |

|---|---|

| Passive income | Impermanent loss |

| Public exposure | High exchange commission |

| Low risk | Low trading volume |

| Hacks |

You can earn steady income, but you might lose money if token prices change a lot. Some pools have high fees or low trading, which can lower your rewards. Hacks can also happen, so always stay alert.

Best Practices

Want to get the most from liquidity pools? Try these best practices:

- Choose stablecoin pools for steady returns.

- Pair blue-chip tokens with stablecoins for safer rewards.

- Explore cross-chain pools for higher APYs.

- Use auto-compounding vaults to boost your earnings.

- Stake governance tokens for extra rewards and voting power.

Remember: Spread your funds across different pools to lower your risk and keep your crypto safe.

Crypto Cashback and Rewards Programs

Overview

You can earn extra crypto every time you shop or pay bills with crypto cashback and rewards programs. These programs work with crypto rewards credit cards and shopping platforms. When you use your card or shop through a partner site, you get a percentage of your spending back as crypto. Some cards even let you choose which coins you want as rewards. Crypto cashback and rewards programs make it easy to grow your wallet while you spend on things you already need.

Here’s a quick look at the average cashback rates for popular crypto rewards credit cards in 2025:

| Card | Rewards |

|---|---|

| Gemini Credit Card | 4% on gas/EV charging, 3% on dining, 2% on groceries, 1% on others |

| Nexo Card | 0.1%–0.5% in Bitcoin, 0.5%–2% in NEXO |

| Crypto.com Visa Card | 2%–8% on everyday, 5%–10% on travel |

| Bybit Card | 2%–10% on everyday transactions |

| Coinbase Card | 1%–4% on everyday transactions |

| Venmo Credit Card | 3% on top category, 2% on next, 1% on others |

| Gnosis Pay Card | Up to 5% cashback on everyday spending |

How to Join

You can join most crypto cashback and rewards programs in just a few steps:

- Pick a crypto rewards credit card or shopping platform that fits your needs.

- Sign up and complete any ID checks.

- Link your wallet or bank account.

- Start using your card or shop through the platform to earn rewards.

Many programs, like Rewards+, have no cost to join and work in over 110 countries.

Maximizing Benefits

Want to get the most out of your crypto rewards credit card? Try these tips:

- Use your card for everyday spending, like groceries or gas.

- Look for bonus categories with higher cashback rates.

- Move up program levels for better perks. Some programs have up to 20 levels with extra bonuses.

- Refer friends to earn referral bonuses—some pay up to $200 per person.

Tip: Track your rewards in your dashboard so you never miss a payout.

Security Tips

Stay safe while using crypto rewards cards. Always check if the program has strong security and works in your country. Pick cards from trusted companies. Never share your private keys or passwords. If a deal sounds too good to be true, it probably is.

| Feature | Description |

|---|---|

| Cashback | Up to 0.5% rebate on every trade (some coins excluded) |

| Earn Plus Bonus | Up to 10% p.a. on stablecoins |

| Referral Bonus | Up to $200 per referral, no limits |

| Levels | 20 levels, more benefits as you progress |

| Cost | No cost to join Rewards+ |

| Availability | Over 110 jurisdictions |

Note: Always use official apps and websites to keep your crypto safe.

Crypto Rewards Tutorial Summary

Top Ways to Earn Cryptocurrency Rewards

You have so many choices when it comes to earning crypto in 2025. This crypto rewards tutorial has shown you the most popular ways to earn cryptocurrency rewards. Here’s a quick list to help you remember:

- Staking: Lock up your coins and get rewards for helping the network.

- Yield Farming: Add your crypto to DeFi pools and collect interest or bonus tokens.

- Lending Platforms: Lend your coins and earn interest payments.

- Play-to-Earn Games: Play games and win tokens or NFTs you can sell.

- Cloud Mining: Rent mining power and get daily payouts.

- Airdrops: Get free tokens for joining new projects or holding certain coins.

- Learn-to-Earn: Complete lessons and quizzes to earn crypto.

- Referral Programs: Invite friends and get bonuses.

- Liquidity Pools: Add coins to trading pools and share in the fees.

- Crypto Cashback Programs: Use special cards or shop online and get crypto back.

Tip: You don’t need to try every method at once. Pick one or two that fit your style and start there.

Choosing the Right Methods

You might wonder which ways to earn cryptocurrency rewards work best for you. The answer depends on your goals, risk level, and how much time you want to spend. Here’s a simple table to help you decide:

| Method | Best For | Risk Level |

|---|---|---|

| Staking | Beginners, long-term | Low |

| Yield Farming | Active users | Medium |

| Play-to-Earn Games | Gamers | Medium |

| Cloud Mining | Passive earners | Medium |

| Airdrops | Early adopters | Low |

| Learn-to-Earn | Learners | Low |

| Referral Programs | Social users | Low |

| Liquidity Pools | DeFi fans | Medium |

| Cashback Programs | Shoppers | Low |

You can always come back to this crypto rewards tutorial for ideas. Try different ways to earn cryptocurrency rewards as you learn more. Stay safe, do your research, and enjoy growing your wallet!

You have many ways to earn crypto rewards in 2025. Try staking, lending, or even playing games. Stay safe by doing your own research and spreading out your choices. Start with one or two methods that feel right for you. As you learn, add more options.

Keep exploring new trends and updates. Your crypto journey starts now—go earn those rewards! 🚀

FAQ

How do I pick the safest crypto rewards platform?

You want to check reviews and look for platforms with strong security. Make sure the company has a good reputation. Always use official websites and apps. If something feels off, trust your gut and walk away.

Can I earn crypto rewards without spending money?

Yes! You can join airdrops, learn-to-earn programs, or referral offers. Some games let you earn tokens for free. You just need to sign up and start participating.

What is the fastest way to earn crypto rewards?

Staking and cashback cards give you quick rewards. Play-to-earn games and airdrops also pay fast. You can start earning within a day on most platforms.

Do I need to pay taxes on crypto rewards?

Most countries ask you to report crypto earnings. You should keep track of your rewards. Check local rules or ask a tax expert if you are not sure.