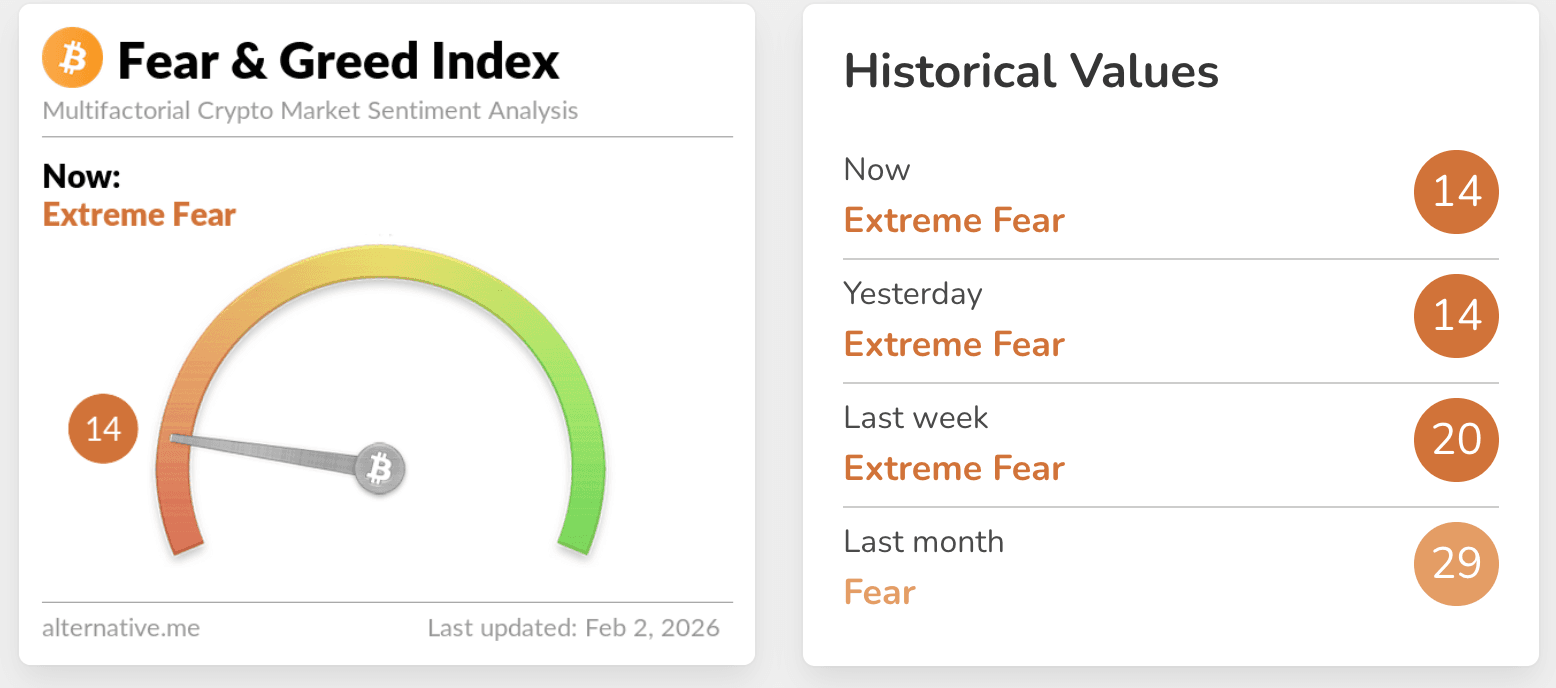

IBIT investor returns turned negative today as the White House advanced CLARITY Act talks on stablecoin yields, while CrossCurve suffered a bridge attack. Crypto sentiment remains in Extreme Fear, with BTC and ETH consolidating lower. Current market sentiment remains defensive with the Crypto Fear & Greed Index holding in the Extreme Fear zone. This signals that capital continues to reduce exposure and scale back risk. BTC trading activity remains concentrated around key liquidity areas, with flows not materially rotating into higher-volatility assets, while ETH performance is more constrained due to leverage and derivatives-driven positioning. Overall, the market is in a consolidation phase, focused on absorbing selling pressure as participants assess whether liquidity conditions can gradually stabilize.

Crypto Markets Overview

The Crypto Fear & Greed Index remained at 14, keeping sentiment pinned in Extreme Fear and shaping a market structure where participants prioritize liquidity, hedges, and defensibility over directional conviction. BTC acted as the primary market anchor, not because it was immune to volatility, but because it is where the deepest two-way liquidity concentrates when traders reduce exposure and reprice risk, effectively turning BTC into a temporary parking asset for capital that is not ready to rotate into smaller caps.

ETH’s performance stayed constrained as its price discovery continues to be heavily mediated by derivatives positioning, where leverage, funding, and liquidation sensitivity can interrupt sustained spot-led rebounds and compress follow-through into shorter, more mechanical moves. Sector action remained uneven, with certain themes showing localized strength while broader indices continued to reflect cautious allocation. This suggests that traders are expressing views through targeted catalysts rather than rebuilding broad beta. The day’s market behavior was dominated by risk control and positioning maintenance, with participants watching whether liquidity conditions can normalize after recent deleveraging and whether spot demand can reassert itself without being immediately offset by derivative-driven supply.

Source: Alternative

BTC & ETH Market Structure

BTC traded as a liquidity-first market, with attention dropped on key price zones around $75,000 and the nearby liquidation bands that tend to attract short-horizon flows, creating a “range-with-gravity” profile where both breakdowns and rebounds can be quickly absorbed by hedging and opportunistic mean reversion. The repeated pattern of limited upside follow-through reflects a mix of insufficient chase demand and a market still digesting leverage, where rallies face systematic selling from risk-off rebalancing, basis adjustments, and traders reducing exposure into strength rather than expanding risk.

ETH’s structure looked more fragile as it slipped below $2,200, and its tape remained more reactive to derivatives mechanics, with the market repeatedly oscillating between forced selling pockets and short-lived stabilization attempts that struggle to compound into sustained momentum. Liquidation data underscored the leverage-clearout phase, with total liquidations at USD 513 million over 24 hours, including USD 374 million in longs and USD 140 million in shorts, highlighting that the dominant pressure still comes from crowded long positioning being unwound rather than from a clean, one-sided short squeeze. In practical terms, this setup tends to produce choppy price discovery, where local bounces can occur but are frequently capped by residual supply and risk reduction, keeping both BTC and ETH biased toward consolidation until positioning and liquidity reach a more balanced state.

Key News Highlights:

IBIT Investor Returns Weaken As Cost-Basis Pressure Builds

As BTC pulled back recently, the investor-level return profile of BlackRock’s iShares Bitcoin Trust (IBIT) has shown signs of deterioration. Dollar-weighted return data shared by Bob Elliott indicate that, as of late January, aggregate investor performance has shifted from modest gains into slight losses. The market significance of this change extends beyond softer ETF sentiment, reflecting that the cost basis of marginal inflows now sits above the current market clearing price. As a result, price rebounds are more likely to encounter selling near these cost levels, as newer holders reduce exposure rather than add risk, altering the supply-demand balance during recovery attempts. From a market microstructure perspective, cost-basis pressure within major passive channels can reshape liquidity distribution and selling behavior. This makes BTC’s upside more dependent on genuine spot demand and a cleaner leverage structure.

White House Convenes Banks and Crypto Industry Leaders To Unlock Stalled u.s. Crypto Legislation

Policy headlines returned to the foreground with the White House scheduled to meet banking and crypto industry executives to broker a compromise on the Clarity Act, with discussions reportedly focusing on whether crypto firms can offer interest or rewards on customer stablecoin holdings. This issue is important because stablecoin yield is not just a product feature, it is a distribution mechanism that can influence deposit behavior, liquidity formation, and how capital migrates between traditional banking and on-chain settlement rails. Banks argue that permitting yield could accelerate deposit outflows and increase systemic risk, while crypto advocates frame it as essential for competitiveness and user adoption, effectively turning “stablecoin rewards” into a pivotal lever in market structure design. If the policy path clarifies, the near-term impact is likely to be seen in stablecoin-related positioning and sentiment rather than immediate price direction, as participants re-evaluate the regulatory feasibility of yield-bearing stablecoin models and the knock-on effects for liquidity and payment rails.

Cross-Chain Bridge Crosscurve Reports Smart Contract Exploit With USD 3 Million Stolen

Security risk reasserted itself as CrossCurve reported its cross-chain bridge was under attack, with around USD 3 million reportedly exploited across multiple networks and users urged to pause interactions while the investigation proceeds. Beyond the immediate loss figure, the market relevance lies in how bridge incidents can rapidly reshape liquidity preferences, prompting participants to rotate away from exposed pools, reduce cross-chain activity, and widen risk premiums for protocols that depend on message passing and validation assumptions. The technical allegation that spoofed messages could bypass validation highlights the persistent complexity risk in cross-chain designs, where a single weak verification path can translate into unlock events and cascading confidence damage. In practice, these episodes often tighten on-chain liquidity in the affected ecosystem, increase the cost of moving capital across venues, and reinforce a “safety-first” stance that can spill over into broader DeFi risk sentiment during already fragile tape conditions.

Trending Tokens:

Bankr has drawn market attention as an AI-driven platform positioned at the intersection of intelligent agents and on-chain financial execution, with its core narrative centered on lowering operational friction for wallet creation and blockchain transactions. Rather than focusing on speculative use cases, the project frames AI as an execution and coordination layer that assists users in managing transfers, trades, and asset interactions across wallets. Recent discussion around Bankr reflects growing interest in AI-native interfaces that abstract complexity for both retail and advanced users, especially as on-chain activity becomes more fragmented across networks. From a market perspective, BNKR’s relevance stems from its positioning within the broader AI-infrastructure and tooling narrative, which continues to attract incremental attention during periods of cautious risk appetite.

Tria has emerged as a focal point in discussions around self-custodial banking and interoperable payment infrastructure designed for developers and AI-native use cases. The project positions itself as a modular financial layer that integrates spending, trading, and yield generation while maintaining user custody, aligning with broader market interest in programmable finance. Attention has intensified following updates around its points program, with Season 1 concluding and Season 2 scheduled to begin shortly, reinforcing ongoing user engagement without shifting toward speculative incentives. The narrative resonates with a market environment that favors infrastructure-level experimentation over directional risk-taking. Therefore, TRIA is being tracked as a participation-based token linked to long-term payment and developer tooling themes.

XDC Network has returned to market focus following the successful activation of its v2.6.8 “Cancun” hard fork, an upgrade that reinforces the network’s core infrastructure without disrupting ongoing operations. The upgrade emphasizes improvements in EVM performance, protocol stability, and compatibility, strengthening XDC’s positioning as an enterprise-oriented Layer 1 tailored for trade finance, RWAs, and cross-border payment use cases. Market attention has centered on the operational execution of the upgrade, with consensus and block production continuing normally among upgraded nodes, reflecting institutional-grade network coordination. From a market behavior perspective, XDC’s relevance is tied to its role within the ISO 20022-aligned and hybrid public-private blockchain narrative, rather than short-term speculative flows. Temporary explorer indexing issues have been communicated transparently, reinforcing a focus on infrastructure reliability over price reaction. As a result, XDC is being observed as a structurally driven asset aligned with real-world financial integration themes.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.