Cryptocurrency ETF List and Comprehensive Guide for Investors in 2025

2025-07-02 08:20:17

Cryptocurrency ETFs let people invest in bitcoin and other cryptocurrencies without owning the coins themselves. In 2025, the SEC allowed more bitcoin and ether ETF products. This made the market grow to about $100 billion. Most ETF activity happens with big companies. Smaller funds have more risks. ETF fund flows can change fast when big news affects bitcoin prices. Many people now use these funds to invest in bitcoin. This makes crypto ETF investing popular for both regular people and big companies. Anyone using an investment guide for cryptocurrencies should know the risks and benefits. You need to understand these before investing in a cryptocurrency ETF or in bitcoin.

Key Takeaways

- Cryptocurrency ETFs help you invest in bitcoin and ethereum easily. You do not need to own the coins yourself.

- Spot ETFs have real cryptocurrencies and often cost less. Futures ETFs use contracts instead. These can be riskier and prices can change a lot.

- Leveraged and inverse ETFs can give bigger gains. But they also have more risk. They are better for short-term traders.

- New SEC rules in 2025 make ETF approvals faster. This gives investors more choices and safer products.

- Before you invest, look at ETF fees and how easy they are to trade. Check if they follow crypto prices well. Make sure they fit your risk and goals.

Cryptocurrency ETFs Overview

What Are Cryptocurrency ETFs

Cryptocurrency ETFs let people buy shares that follow bitcoin or ethereum prices. You can buy and sell these funds on stock exchanges. This makes it simple to invest in cryptocurrencies without owning them. Each ETF must follow rules from regulators. The SEC uses a process called 19b-4 to approve new cryptocurrency ETFs. This process takes time and needs a lot of paperwork. In 2025, the SEC made things faster for some ETFs. If they meet certain rules, they can skip the 19b-4 step. Now, a new ETF can start after filing an S-1 Registration Statement and waiting 75 days. This change lets more bitcoin and ethereum ETFs come to the market. Bitcoin ETFs have grown fast. They now manage about $150 billion after SEC approval. Bitcoin is popular for these funds because it has a limited supply of 21 million coins and uses secure blockchain technology.

Spot vs. Futures ETFs

Spot ETFs own real bitcoin or ethereum. They follow the actual price of these cryptocurrencies. Futures ETFs use contracts that guess the future price of bitcoin or ethereum. These contracts do not need the fund to own the real asset. Spot ETFs usually cost less and have smaller price changes. Futures ETFs can have bigger price swings and sometimes cost more. The table below shows some main differences:

| ETF Type | Fee Range | Price Change Range |

|---|---|---|

| Spot ETFs | 0.15% to 0.30% | -2.1% to -2.3% |

| Futures ETFs | Often no explicit fees | -2.17% to -5.76% |

Spot ETFs give you direct access to bitcoin and ethereum. Futures ETFs can be riskier because of how the contracts work.

Leveraged and Inverse ETFs

Leveraged ETFs try to make bigger daily gains from bitcoin or ethereum. Inverse ETFs try to move the opposite way of the asset’s price. These funds use special strategies and can be risky. They often cost more and have bigger daily price changes. The chart below shows that leveraged and inverse ETFs can lose a lot and have high ups and downs:

People should know that leveraged and inverse ETFs may not work as expected for a long time. These products are best for people who want to trade short-term moves in bitcoin or ethereum.

Cryptocurrency ETF List 2025

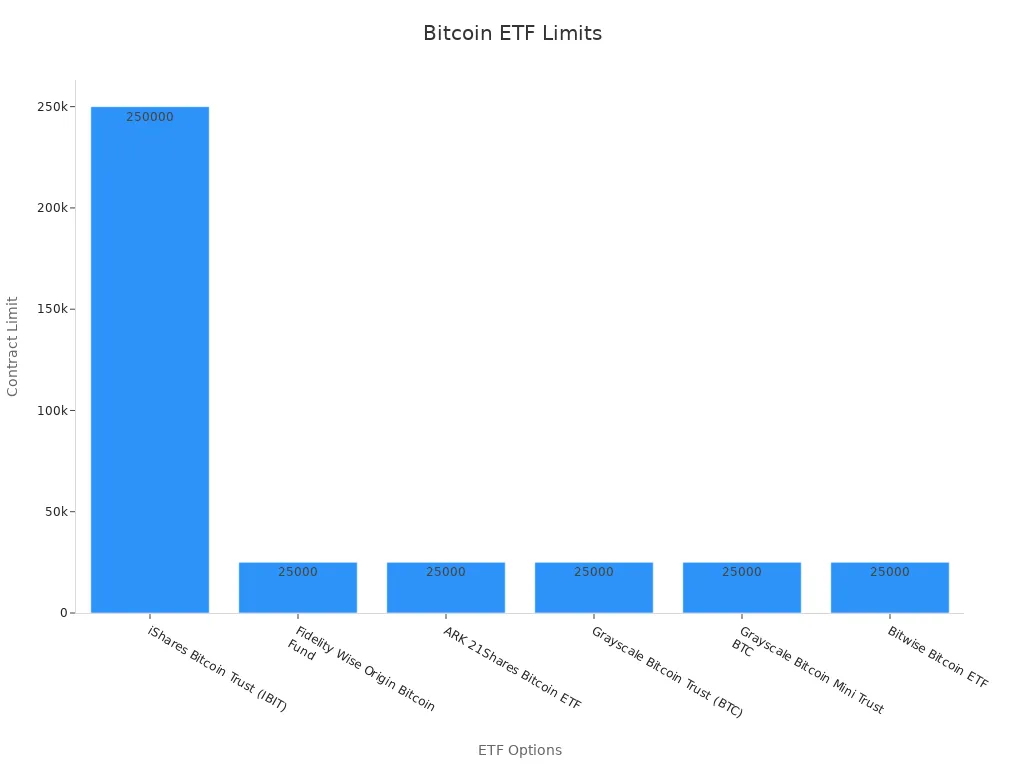

Bitcoin ETF Options

In 2025, people can pick from many bitcoin ETF choices. These funds let you buy shares that follow bitcoin’s price. Most bitcoin ETFs are on big U.S. exchanges. Some focus on spot bitcoin. Others use futures contracts. The table below lists popular bitcoin ETF choices, their contract limits, and other facts.

| Bitcoin ETF Option Name | Contract Position Limit | Exchange | Region | Notes |

|---|---|---|---|---|

| iShares Bitcoin Trust (IBIT) | 250,000 contracts | NASDAQ | US | Trading started Jan 11, 2024; Market cap approx. 866M shares at $54.02 each |

| Fidelity Wise Origin Bitcoin Fund | 25,000 contracts | NYSE Arca | US | Subject to position and exercise limits |

| ARK 21Shares Bitcoin ETF | 25,000 contracts | Cboe BZX | US | Subject to position and exercise limits |

| Grayscale Bitcoin Trust (BTC) | 25,000 contracts | OTCQX | US | Subject to position and exercise limits |

| Grayscale Bitcoin Mini Trust BTC | 25,000 contracts | OTCQX | US | Subject to position and exercise limits |

| Bitwise Bitcoin ETF | 25,000 contracts | NYSE Arca | US | Subject to position and exercise limits |

Most spot bitcoin ETFs have strict contract rules. The iShares Bitcoin Trust has the highest limit. These rules help keep investors and the market safe.

Ethereum ETF Options

Ethereum ETFs are more common in 2025. These funds let people invest in ethereum without owning coins. Some focus on spot ethereum. Others use futures contracts. The table below shows top ethereum ETF choices, their prices, and assets.

| ETF Name | Price (USD) | % Change | Assets Under Management (USD) | Type | Exchange | Region |

|---|---|---|---|---|---|---|

| T-Rex 2X Long Ether Daily Target ETF | 13.26 | -9.98% | 9.35M | Leveraged | NYSE Arca | US |

| ProShares Short Ether ETF | 16.12 | 4.68% | 5.58M | Inverse | NYSE Arca | US |

| ARK 21Shares Active Ethereum Futures Strategy ETF | 25.36 | -4.31% | 5.14M | Futures | Cboe BZX | US |

| Bitwise Trendwise Ether and Treasuries Rotation Strategy ETF | 35.65 | 0.01% | 6.24M | Mixed | NYSE Arca | US |

| T-Rex 2X Inverse Ether Daily Target ETF | 7.39 | 8.52% | 585.19K | Inverse | NYSE Arca | US |

These ethereum ETFs give people many ways to follow ethereum’s price. Some use leverage or inverse plans for bigger risk and reward.

Mixed and Basket ETFs

Mixed and basket ETFs hold more than one cryptocurrency or mix crypto with other things. These funds help people spread out their risk. Some have both bitcoin and ethereum. Others add stocks or bonds. The table below shows some mixed and basket ETFs.

| ETF Name | Price (USD) | % Change | Assets Under Management (USD) | Holdings | Exchange | Region |

|---|---|---|---|---|---|---|

| ProShares Bitcoin & Ether Equal Weight ETF | 63.82 | -5.32% | 7.91M | Bitcoin, Ethereum | NYSE Arca | US |

| Bitwise Trendwise BTC/ETH and Treasuries Rotation Strategy ETF | 29.45 | -2.79% | 4.54M | Bitcoin, Ethereum, Treasuries | NYSE Arca | US |

| Return Stacked U.S. Stocks & Gold/Bitcoin ETF | 20.95 | 0.07% | 6.18M | US Stocks, Gold, Bitcoin | NYSE Arca | US |

| Cyber Hornet S&P 500 and Bitcoin 75/25 Strategy ETF | 28.65 | 0.02% | 5.73M | S&P 500, Bitcoin | NYSE Arca | US |

| One Nasdaq-100 and Bitcoin ETF 1Shs | 15.14 | -3.11% | 925.15K | Nasdaq-100, Bitcoin | NYSE Arca | US |

| One S&P 500 and Bitcoin ETF | 15.68 | -2.24% | 795.01K | S&P 500, Bitcoin | NYSE Arca | US |

These ETFs let people invest in both crypto and regular assets. Investors can use them to balance risk and reward.

Leveraged and Inverse Cryptocurrency ETFs

Leveraged and inverse ETFs let people try for bigger gains or losses in crypto prices. These funds use special plans to make gains or losses larger. The table below lists some leveraged and inverse ETFs for bitcoin and ethereum.

| ETF Name | Price (USD) | % Change | Assets Under Management (USD) | Type | Underlying Asset | Exchange | Region |

|---|---|---|---|---|---|---|---|

| T-Rex 2X Long Ether Daily Target ETF | 13.26 | -9.98% | 9.35M | Leveraged | Ethereum | NYSE Arca | US |

| Volatility Shares Trust XRP 2X ETF | 11.15 | -15.02% | 8.86M | Leveraged | XRP | NYSE Arca | US |

| T-Rex 2X Inverse Bitcoin Daily Target ETF | 3.57 | 4.39% | 4.15M | Inverse | Bitcoin | NYSE Arca | US |

| Direxion Daily Crypto Industry Bull 2X Shares | 24.75 | -1.12% | 4.15M | Leveraged | Crypto Industry | NYSE Arca | US |

| Direxion Daily Crypto Industry Bear 1X Shares | 19.66 | 0.73% | 2.01M | Inverse | Crypto Industry | NYSE Arca | US |

| T-Rex 2X Inverse Ether Daily Target ETF | 7.39 | 8.52% | 585.19K | Inverse | Ethereum | NYSE Arca | US |

⚠️ Leveraged and inverse ETFs can change fast. These products are best for traders who want to use short-term price moves in bitcoin or ethereum.

European ETNs and ETPs

Europe has many cryptocurrency ETNs and ETPs. These products follow bitcoin, ethereum, and other cryptocurrencies. Many trade on exchanges in Germany, Switzerland, and the UK. Some well-known European ETNs and ETPs are:

- 21Shares Bitcoin ETP (ABTC) – SIX Swiss Exchange, Switzerland

- ETC Group Physical Bitcoin (BTCE) – XETRA, Germany

- WisdomTree Physical Bitcoin (BTCW) – SIX Swiss Exchange, Switzerland

- VanEck Vectors Ethereum ETN (VETH) – Deutsche Börse, Germany

- 21Shares Ethereum ETP (AETH) – SIX Swiss Exchange, Switzerland

These products let European investors buy spot bitcoin ETFs and ethereum ETF choices. Many European ETPs and ETNs follow strong safety and openness rules.

📊 The market for cryptocurrency ETFs, ETNs, and ETPs keeps getting bigger. Investors now have more ways than ever to get bitcoin, ethereum, and other cryptocurrencies through safe funds.

SEC and Global Regulation

SEC Approval Process

The SEC is very important for approving cryptocurrency ETFs. The U.S. Securities and Exchange Commission checks each fund application. They want to make sure every fund follows strict rules. The SEC’s Division of Investment Management gives out letters and guides. These talk about things like how to value assets, keep enough cash, and store coins safely. They also cover how to stop cheating and unfair trading. The SEC works with fund managers to set up rules for new crypto funds. The SEC keeps track of how many funds are registered and how much money they manage. They also watch how funds handle risks with their cash. This information helps the SEC decide if a new ETF can start. The SEC uses these steps to keep investors safe and make markets fair.

Streamlined SEC Initiatives

In 2025, the SEC made new rules to make ETF approval faster. Some ETFs do not have to do the old 19b-4 step if they follow certain rules. Now, these funds just file an S-1 Registration Statement and wait 75 days. This makes it quicker for bitcoin and ethereum ETFs to get approved. The SEC wants new products to reach investors more easily but still be safe. These new steps help the market grow and give people more choices.

EU and UK Regulation

Europe and the UK have their own rules for cryptocurrency ETFs. The EU uses the Markets in Crypto-Assets (MiCA) plan. This plan gives clear rules to protect people who invest in crypto funds. The UK’s Financial Conduct Authority checks crypto ETF products too. Both places want to make sure everything is open, safe, and watched closely. Many European exchanges have ETNs and ETPs that follow rules like ETFs. These rules help keep investors safe and help the market get bigger.

Regulatory Impact on ETFs

Rules decide which ETFs people can buy. In the US, the SEC’s rules pick which funds can be sold. Faster approval means investors get more choices. In Europe and the UK, strong rules keep funds safe and open. These rules also help stop cheating and big risks. Good rules make people trust ETFs and help the market grow everywhere.

Performance Comparison

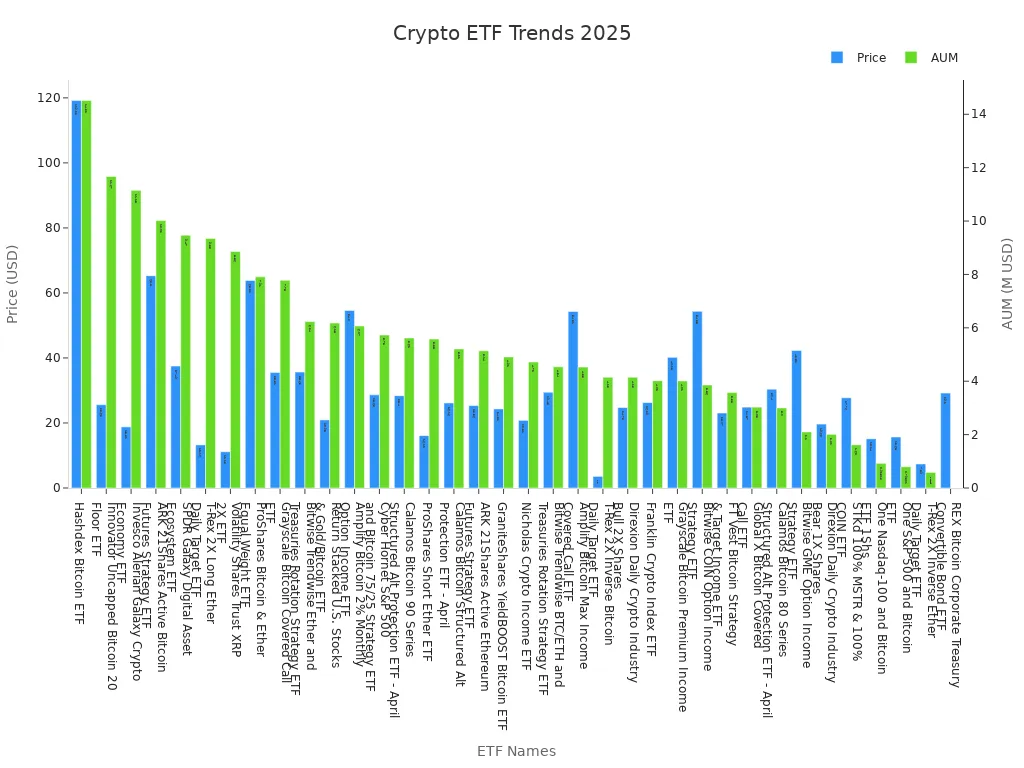

Bitcoin ETF Performance

Bitcoin ETFs were the top choice in 2025. Their prices changed a lot each day. Some days had big gains or losses. IBIT made up 71.3% of trading by October 2024. This showed that many investors liked IBIT. Six main ETFs, like IBIT and GBTC, helped set prices. These funds moved fast when news came out. Sometimes, they changed before the bitcoin spot price did. CoinMarketCap watched net flows and market size. On February 17, 2025, bitcoin ETF inflows hit $66.19 million. This happened after a time when money was leaving. It showed that people were interested in bitcoin ETFs again. A ScienceDirect study found a close link between bitcoin and ETF flows. A 3.4% change in bitcoin price led to a 0.2% change in ETF flows. This means bitcoin’s price affects how much people buy or sell ETFs.

Other Cryptocurrency ETF Returns

Ethereum ETFs held $10.35 billion in assets. This was about 3.15% of all ETH value. In one week in February 2025, these funds lost $26.26 million but gained $11.65 million. This showed that investors felt mixed about ethereum ETFs. Total inflows for ethereum ETFs went over $3.17 billion. This happened even though ETH price dropped 14.38% in 30 days. Solana ETFs got more attention as new products were planned. But the SEC had not approved them yet. These facts show that other crypto ETFs can have bigger price swings. Investor confidence can change more than with bitcoin ETFs.

Leveraged and Inverse ETF Results

Leveraged and inverse ETFs had even bigger daily changes. These funds use futures contracts and special plans. Tracking error and tracking difference became important to watch. A Duke University report said these ETFs can cost more. They may not match their goals over time. Futures-based ETFs had extra risks from contract limits and roll yield. Investors saw that leveraged ETFs could bring big gains or losses fast. This makes them better for short-term trades.

ETF Expense Ratios

Expense ratios change how much investors earn. The iShares Bitcoin Trust (IBIT) had a low expense ratio of 0.12%. The ETF Database average was 0.58%. IBIT’s management fee was 0.25%. There were no extra fund fees. Other commodity ETFs, like crude oil and gold, had higher expense ratios. Crude oil was 0.83% and gold was 0.4%. Lower fees made bitcoin ETFs more popular with investors.

| Metric | Value for IBIT ETF | Category/Segment Average |

|---|---|---|

| Expense Ratio | 0.12% | 0.58% (ETF Database Avg) |

| Expense Ratio | 0.12% | 0.39% (FactSet Segment) |

| Management Fee (Prospectus) | 0.25% | N/A |

| Acquired Fund Fees & Expenses | 0.00% | N/A |

| Other Expenses | 0.00% | N/A |

| Overall Expense Ratio (Prospectus) | 0.25% | N/A |

Lower expense ratios and strong bitcoin results made ETFs more attractive to both new and experienced investors.

Risks and Benefits

Main Risks of Cryptocurrency ETFs

Buying a crypto ETF has some risks. Bitcoin prices can go up or down very fast. This makes the market jumpy. A study by Pastorek and Albrecht (2025) says bitcoin ETFs make prices move more and can cause bigger losses. The study also says spot ETFs follow bitcoin prices better than futures ETFs. But both types can have mistakes in tracking prices. Sometimes, bitcoin ETFs have fail-to-deliver events. These can make prices less steady. Liquidity is important too. If an ETF is not traded much, it can have more price mistakes and bigger jumps. The Alpha Architect article says illiquid ETFs have more tracking problems. Rules for crypto ETFs can change. This can make it harder or easier to invest in bitcoin or other cryptocurrencies.

Benefits for Investors

Crypto ETFs have many good points for investors. These funds make it simple to buy bitcoin and other cryptocurrencies. You do not need to keep wallets or private keys. Spot ETFs let you get bitcoin and ethereum right away. This helps prices and trading work better. Studies show that adding 5% bitcoin to a normal portfolio can give better returns for the risk. Bitcoin does not move the same way as stocks or bonds. This helps people spread out their risk. Regulated ETFs also give you expert help and safety.

Due Diligence Tips

People should always learn before buying a crypto ETF. They need to check the ETF’s fees, how easy it is to trade, and how well it follows bitcoin’s price. Reading the fund’s prospectus helps you know the risks. Looking at both spot and futures ETFs can help you pick the best one for your needs. People should also watch for rule changes that could change their investments.

Practical Considerations

A crypto ETF works best if it fits your risk level and money goals. It is smart to start small, like using 5% of your portfolio, to see how it goes. Pick funds that follow the rules to lower your risk. Talking to a financial advisor can help you make good choices. Remember, bitcoin prices can change fast, so check your investments often.

Cryptocurrency ETFs can help people earn more and spread out risk. Market studies and math models show this is true. The SEC lets more coins be in ETFs now. This means more people can invest and the market is steadier. The Amberdata Q1 2025 report says new rules and big companies change how ETFs do. Investors should read this guide, look at ETF lists, and check expert sites like Seeking Alpha Premium or Finviz. Doing research and checking risks helps everyone make good choices.

📈 The SEC’s new rules and expert websites help people make better choices as the ETF market grows.

| Platform | Best For | Cost Range |

|---|---|---|

| Seeking Alpha | Fundamental investors | $299/year |

| Finviz | All investors, active traders | Free/$39.50/month |

- The SEC now lets up to 95% of top coins be in ETFs.

- More people can invest and trading will get easier.

FAQ

What is a cryptocurrency ETF?

A cryptocurrency ETF is a fund that follows the price of digital coins like bitcoin or ethereum. People can buy shares of this fund on stock exchanges. They do not have to own the coins themselves.

Are cryptocurrency ETFs safe for beginners?

Cryptocurrency ETFs are safer than buying coins by yourself. These funds follow rules and use trusted exchanges. Beginners should still learn about risks like price changes and new rules.

How do spot and futures cryptocurrency ETFs differ?

Spot ETFs own real cryptocurrencies. Futures ETFs use contracts that guess future prices. Spot ETFs usually change less in price. Futures ETFs can move more and sometimes cost more.

Can investors lose money with cryptocurrency ETFs?

Yes, people can lose money with these funds. Cryptocurrency prices can fall fast. ETFs might not always match the coin’s price. Fees and mistakes in tracking can also lower what you earn.