What Is Funding Rate? Understanding Market Signals and the Common Misuses

2025-12-01 06:05:10

In the perpetual futures market, the “funding rate” is often treated as a key indicator for reading market sentiment. Yet many traders still oversimplify it as nothing more than “positive means bullish, negative means bearish,” which usually leads to misguided decisions. The funding rate is not merely a fee. It reflects the distribution of leveraged capital, the concentration of market positions, overall sentiment, and potential risk build-up. Understanding it properly has a direct impact on your strategy and position management. This article breaks down the true meaning of the funding rate, how to interpret its signals, the typical mistakes traders make, and how to avoid getting trapped by misjudging market sentiment.

1. What is the Funding Rate?

The funding rate exists to keep perpetual futures prices anchored to spot prices. If the perpetual contract trades above the spot market, it indicates excessive long demand. The mechanism then requires longs to pay shorts, encouraging selling pressure that pulls the contract back toward spot. The opposite applies when the contract trades below spot. In other words, the funding rate is not a fee collected by the exchange, but a cost transferred between traders. It is a dynamic balancing tool that reflects the supply-demand imbalance within the leveraged market.

More fundamentally, the funding rate represents the market’s leveraged sentiment premium. When participants crowd into a single direction and aggressively use leverage, the rate naturally moves toward extremes. This imbalance itself is a form of market signal and a warning of risk accumulation. Put simply, the funding rate captures the tug-of-war between trend momentum and emotional pressure, not just a numeric cost.

2. How to Properly Read Long–Short Signals from Funding?

The biggest misconception about funding rate interpretation is treating it as a simple directional indicator. In practice, what matters is the strength, duration, and relationship between the funding rate, price action, and open interest. For example, when the funding rate stays positive for an extended period, but the price fails to rise while open interest continues climbing, it means longs are willing to keep paying to maintain leveraged positions. The trend may still lean bullish, but pressure is building beneath the surface. A market shock could easily trigger a sharp unwind.

Conversely, when the funding rate is negative while the price stops falling or even starts forming a bottom, it suggests shorts are paying to maintain control, but the selling momentum is weakening. Heavy negative funding with flat price action is often a precursor to a short squeeze or strong rebound.

Funding flips also carry meaning in the market trend. A turn from negative to positive implies shorts are losing dominance, while a shift from positive to negative funding typically signals that the market is entering a new phase of profit-taking or facing increasing downside pressure. Still, a flip does not guarantee a trend reversal; it simply signals a change in market regime. It must be confirmed with volume and open interest. Ultimately, reading the funding rate is about observing leveraged crowding, directional pressure, and how quickly risk is accumulating and not merely whether the number is positive or negative.

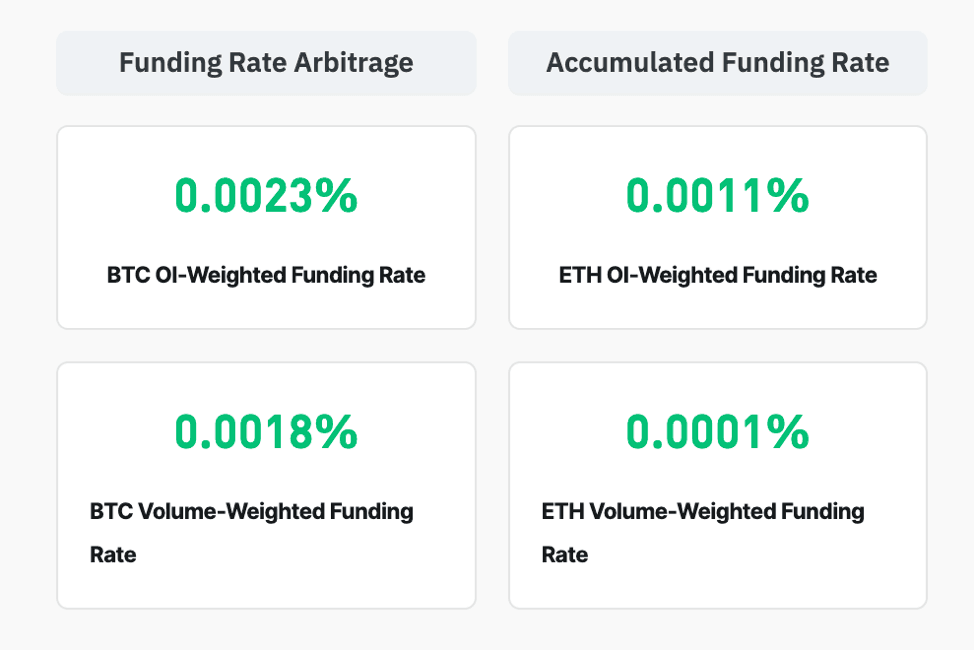

Source: coinglass

3. The Three Most Common Misuses of Funding Rate

Despite being highly informative, the funding rate is also one of the most misused metrics in derivatives trading. Here are three common misuses of funding rates in the market judgements:

The first common mistake is treating the funding rate as a direct buy or sell signal. Some traders short whenever funding turns positive or go long whenever it goes negative. But extreme funding can persist for long periods, especially in strong uptrends or deep downtrends. Counter-trend entries based solely on funding rate often result in premature entries or forced liquidations.

The second mistake is ignoring leverage and compounding costs. A funding rate of 0.03% or 0.05% may look small, but if you are using high leverage, the real cost is applied to the notional size of the position. Many traders hold positions thinking they can wait for the “right moment,” only to find their profits completely offset or even reversed by repeated funding payments.

The third mistake is failing to recognize divergence between the funding rate and price behavior. When funding remains high but the price stalls, or when funding stays negative but the price refuses to drop, these are strong reversal signals. Missing such divergences often leads to getting trapped at market turning points.

4. How to Use Funding Rate Correctly in a Trading Strategy?

To effectively integrate the funding rate into your strategy, it should be viewed as part of a multi-factor framework rather than as a standalone metric. Funding reflects sentiment, open interest reflects the scale of leverage, volume reflects actual participation, and price reflects the outcome of all forces combined. Only when these elements align can a conviction-level signal be formed. For example:

- If funding is positive, open interest rises, and volume increases, it suggests a strengthening long-term environment.

- If funding is negative but price stabilizes, short pressure may be exhausting, setting the stage for a potential rebound.

- If funding reaches extremes but open interest declines, the market may be deleveraging rather than trending.

The funding rate’s real value is not in telling you when to buy or sell, but in revealing which side of the market is absorbing the cost, which side is stretched, and which side is vulnerable. Understanding who is paying, who is holding on, and who is being forced out is the key to using funding rate meaningfully.

Conclusion

The funding rate is far more than a simple “longs pay shorts” or “shorts pay longs” mechanism. It is a key indicator in perpetual futures markets that reflects leveraged sentiment, capital distribution, and underlying supply-demand imbalances. Funding rates reveal which side of the market is crowded, who is bearing the cost of maintaining positions, and who faces heightened risks of liquidation or forced unwinding.

To interpret funding rates correctly, traders must analyze not just whether the rate is positive or negative, but also its magnitude, duration, and alignment with price action and open interest. Common mistakes include treating the funding rate as an absolute buy/sell signal, overlooking how leverage amplifies funding costs, and ignoring divergences between funding rates and price trends. The most effective way to use funding rates is to evaluate them alongside open interest, trading volume, and market price. This multi-dimensional approach helps identify trend strength, sentiment pressure, and potential risk buildup to ultimately improve the accuracy and reliability of your trading decisions.

FAQ

Q1: Does a high funding rate always signal an imminent reversal?

A: Not necessarily. A high positive funding rate simply indicates crowded long positioning. In strong bull markets, it can remain elevated for extended periods. A reversal becomes likely only when high funding, weak price action, and rising open interest appear simultaneously.

Q2: If the funding rate is negative, does it mean it’s safe to go long?

A: No. A negative funding rate indicates short dominance, but only when the price stops falling or begins showing strength does it indicate potential exhaustion of selling pressure. Traders should watch for negative-rate bullish divergence, not the rate alone.

Q3: What types of trading strategies rely heavily on funding rate analysis?

A: Funding rate is widely used in arbitrage, contrarian top-bottom hunting, leverage-cost management, and sentiment analysis. It is best used as a supplementary metric to assess leverage imbalance and market crowding, rather than as a standalone strategy.

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. For more information, please refer to here Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.