FameEX Today’s Crypto News Recap | January 28, 2026

2026-01-28 07:28:38

Crypto markets saw a tactical rebound but sentiment stayed defensive as BTC and ETH remained range-bound. Gold hit record highs, NFT platforms continued to exit, and Tether launched USAT, reinforcing consolidation rather than recovery. Crypto markets showed a tactical rebound today, but sentiment remained defensive and positioning-driven. Prices stabilized as selective buying returned, yet flows suggested hesitancy rather than renewed conviction, with derivatives leverage and macro uncertainty continuing to cap follow-through.

Crypto Markets Overview

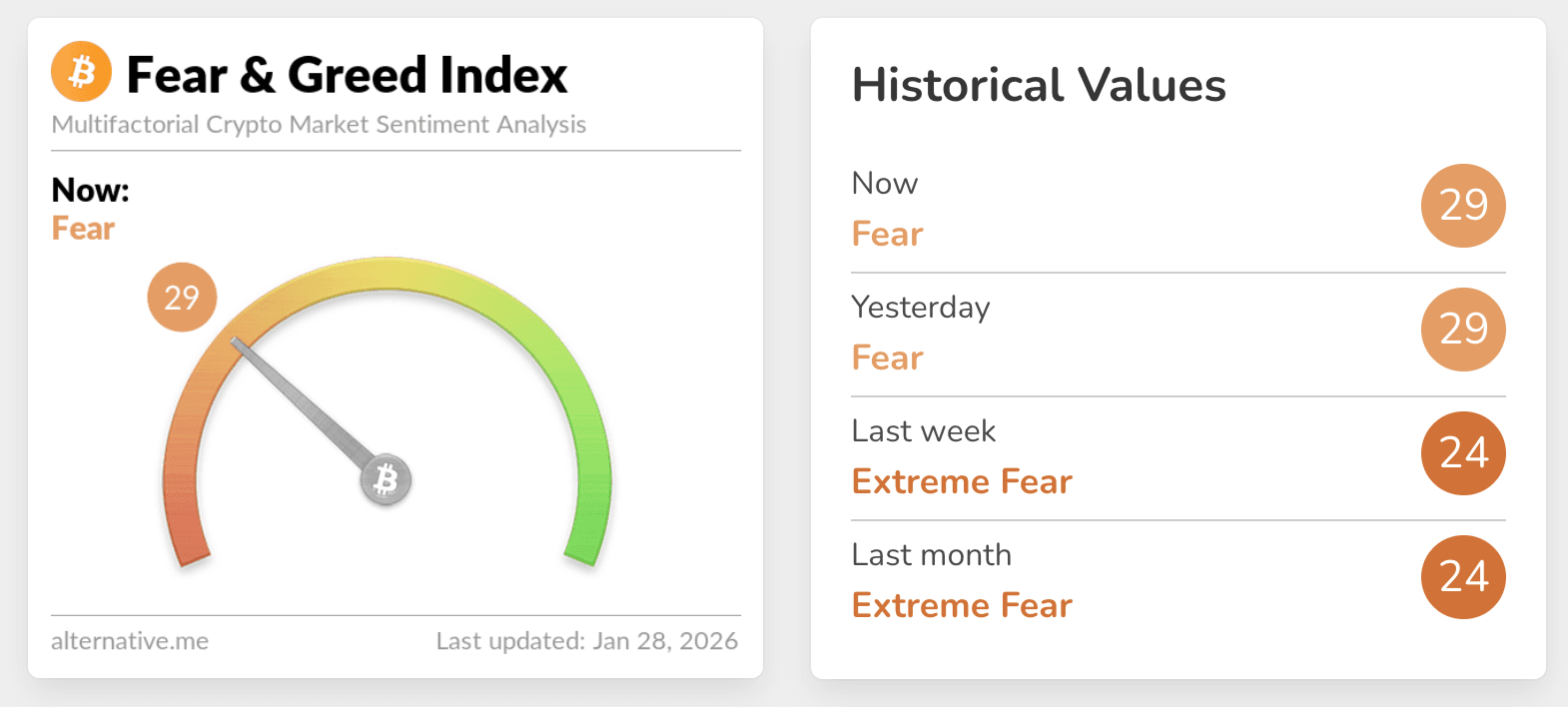

Crypto markets edged higher overall while sentiment stayed cautious, with the Crypto Fear & Greed Index unchanged at 29 (Fear). Bitcoin continued to act as the market anchor, which drew defensive allocation and served as the reference point for risk management across the complex. Ethereum saw mild gains but remained constrained by a fragile derivatives structure, where liquidation sensitivity and crowded leverage limited sustained continuation. Outside main coins, rotation favored higher-beta pockets particularly in DeFi sector, yet the broader perspective still reflected subdued risk appetite and tactical, not directional in participation.

Source: Alternative

BTC Consolidates Near $90K as Flow Signals Remain Mixed

Bitcoin remained range-bound despite repeated tests around $90K, with the broader $85K–$94K range still defining market behavior. A 60-day consolidation narrative has been reinforced by flow-linked price action: early-month strength coincided with ETF inflows, while subsequent pullbacks aligned with record ETF outflows. This suggests that institutional flow has shifted from supportive to restrictive at the margin. A major US exchange’s premium turning into a discount has further signaled net selling from US counterparties, which helps explain why upside probes have struggled to convert into sustained follow-through. Into this backdrop, positions have stayed short-horizon. Traders appear to be leaning on hedging and leverage rebalancing rather than rebuilding directional spot exposure. $85K remains the key support reference structurally, while supply has repeatedly emerged into the low-to-mid $90Ks. This keeps price pinned near the range’s center of gravity and reinforces consolidation dynamics over trend development.

ETH Trades Near $3,000 With Leverage Still Driving Short-Term Moves

Ethereum briefly slipped below $3,000 even as it posted modest gains, highlighting how tightly price is being steered by leverage conditions rather than spot conviction. Over the past 24 hours, total forced liquidations reached USD 299 million, with short-side liquidations dominating at USD 231 million versus USD 68.28 million on the long side. This is the evidence of a positioning-driven tape prone to sharp intraday unwinds. Within majors, ETH contributed meaningfully to the unwind, suggesting crowded leverage around key psychological levels. The takeaway remains structural. Thin spot follow-through and compressed liquidity leave derivatives flows setting the pace, so rebounds can remain vulnerable to abrupt liquidation cascades near heavily watched thresholds.

Key News Highlights:

Gold Breaks $5,200/oz as Markets Reprice Sovereign Risk and the Global Policy Regime

Spot gold pushed to fresh highs and cleared $5,200 per ounce, extending a sharp monthly advance as investors increasingly framed the move as more than short-term inflation hedging. The demand mix has been characterized by stronger central-bank and sovereign allocation behavior, which typically reflects a longer-horizon repricing of currency credibility, geopolitical fragmentation, and policy uncertainty rather than tactical risk-off trading alone. The signal is about collateral preference and confidence in the “rules of the game,” where investors gravitate toward assets perceived as resilient to policy shifts and cross-border frictions. For crypto, the implication is indirect but important. When capital prioritizes governance certainty and balance-sheet durability, risk appetite tends to stay selective, and narratives like “digital gold” face a higher bar to attract defensive allocation in the near term. This dynamic supports the broader read-through of stabilization and consolidation across crypto, rather than a broad-based risk-on rotation.

NFT Platforms Accelerate Wind-Downs as Liquidity and User Growth Fail to Rebuild

A second NFT platform this week announced plans to shut down, underscoring the persistent gap between product resonance and sustainable scale in the post-2022 market environment. The closure plan emphasizes asset and data migration, pointing to a market structure where custody, portability, and infrastructure continuity have become more critical than venue loyalty. The broader context remains challenging. NFT activity has struggled to regain depth, and sporadic spikes have not translated into a sustained liquidity recovery. This keeps creators, collectors, and platforms locked in a low-confidence feedback loop. From a market-impact perspective, continued venue consolidation tends to concentrate order flow into fewer endpoints while increasing the importance of reliable onchain storage and migration tooling. The result is a gradual reshaping of NFT liquidity toward infrastructure-first survivability rather than rapid growth narratives.

Tether Launches USAT for the US Market, Signaling a Dual-Track Stablecoin Strategy

Tether announced USAT, a new USD stablecoin positioned specifically for the US market and designed to align with a federal stablecoin regulatory framework, while keeping USDT focused on offshore liquidity needs. The rollout model emphasizes regulated issuance and institutional-grade custody/settlement pathways. This indicated that stablecoin competition is increasingly being shaped by compliance architecture rather than distribution alone. Market-structure implications include potential liquidity fragmentation across stablecoin pairs, shifting incentives as issuers compete for institutional rails, and a sharper distinction between onshore and offshore stablecoin use cases. Because stablecoins remain the primary settlement layer for both spot and derivatives, changes in market share and distribution mechanics can ripple into trading depth, funding conditions, and cross-venue liquidity efficiency. Attention will likely center on whether USAT can scale without destabilizing USDT’s role as the dominant global liquidity backbone.

Trending Tokens:

- $LISA (LISA)

LISA is positioned within the Web3 security stack as an LLM-driven analysis layer for Solidity contracts, aligning with persistent demand for scalable vulnerability detection and audit workflows. Recent visibility has been supported by a spot listing and time-boxed trading incentives on a decentralized venue, which mechanically concentrates liquidity and participation into a narrow window. From a trading-behavior perspective, reward structures that privilege one-sided flow can amplify volume-to-volatility transmission and make short-term price discovery more reactive to marginal flows. The more durable question for positioning is whether LISA’s security narrative translates into recurring developer usage and workflow integration beyond event-led liquidity spikes. If token utility becomes tied to access, governance, or service coordination, the market may begin to price it as infrastructure exposure rather than pure speculative beta. For now, attention remains driven by the intersection of security-sector relevance and incentive-driven activity concentration.

- $IR (Infrared)

Infrared’s IR token launch has been framed as a protocol-native asset for governance and revenue distribution within the Berachain liquidity ecosystem. The initial distribution mechanics combine onchain claims with broad trading availability, which typically accelerates early circulation while dispersing liquidity across venues and pools. The protocol’s stated design such as staking IR for a voting and fee-sharing representation and routing a portion of protocol fees into a buyback-oriented fund. This signals an intent to formalize value capture rather than relying solely on narrative momentum. Market focus is likely to remain on implementation cadence and onchain transparency, particularly how quickly staking and revenue-sharing functions become operational and measurable.

- $THQ (Theoriq)

Theoriq is positioned around agent-led DeFi infrastructure, aiming to scale strategy execution and vault curation through autonomous systems rather than manual management. Its roadmap messaging emphasizes a “flywheel” of TVL, fees, agent curators, and performance, seeking to convert the AI x crypto narrative into measurable, repeatable outcomes. From a market-structure lens, the key differentiator is whether transparent onchain telemetry and operational reliability can reduce the trust gap that typically limits adoption of automated allocation products.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.