FameEX Daily Market Trend | Extreme Fear Persists While BTC & ETH Hold Support

2025-11-24 07:06:43

1. Market Summary

- Bitcoin trades in the high-$80,000s after a roughly 30% drawdown from its October all-time high, with about 24-hour liquidations near 228 million dollars and implied volatility rising toward an options-driven regime.

- Ether holds near 2,800 dollars, with mildly positive funding and large liquidation clusters forming around $82,110 and $90,610 dollars for BTC and $2,652 and $2,916 dollars for ETH.

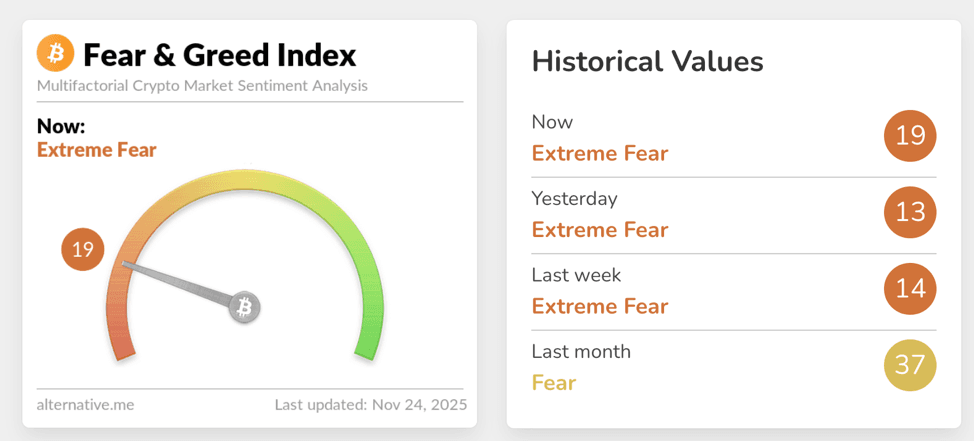

- The Fear & Greed Index prints 19, showing Extreme Fear, even as recent ETF flow data signal early stabilization after heavy November outflows.

- Structural flows lean toward self-custody: the past 7 days saw about 29,000 BTC and 211,000 ETH leave centralized exchanges, while stablecoin inflow to Sui exceeded 2.4 billion dollars.

- Macro turns modestly supportive: markets price a roughly 70% chance of a 25bp Fed cut in December as policymakers enter the pre-meeting blackout period.

2. Market Sentiment / Emotion Indicators

Market structure has shifted from an overheated rally to a stressed but orderly corrective phase. Extreme Fear reflects broadly defensive positioning, while rising implied volatility indicates that options flows may regain dominance in short-term price direction.

Source: Alternative

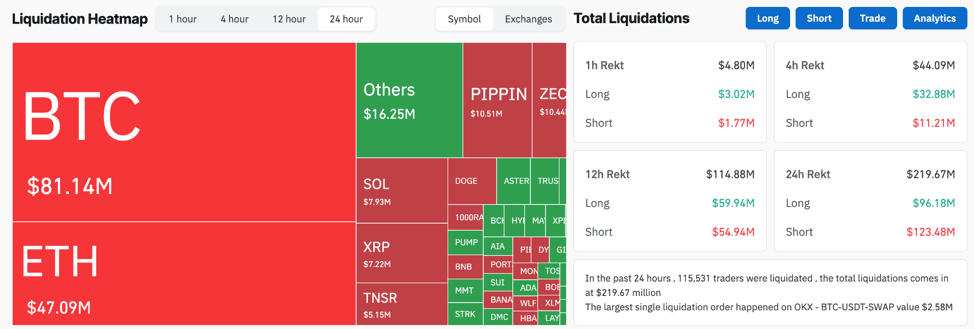

Liquidations of about 219 million dollars over the past day highlight two-way leverage unwinding, with shorts suffering heavier losses than longs, suggesting active counter-trend trading. Bitcoin and Ether both sit near major liquidation bands that can accelerate directional moves if triggered. Despite pressure, exchange balances continue to fall, showing that long-term holders and larger players are not panic-selling but repositioning risk across derivatives, staking, and custody rails. The structure suggests a fragile but not broken market where volatility, liquidation heatmaps, and macro catalysts drive near-term outcomes while long-term conviction remains intact.

Source: Coinglass

3. Key Events of the Day

- Bitcoin community backlash against a major U.S. bank intensified after signals that crypto-heavy treasury companies may be excluded from major stock indexes in 2026.

- The U.S. SEC will host a December 15 roundtable on crypto privacy and surveillance as regulatory focus increases following recent enforcement actions.

- A major asset manager’s Dogecoin ETF received approval to list on a U.S. exchange, with an XRP ETF expected to follow soon.

- Cardano experienced a temporary chain split caused by a malformed transaction exploiting an outdated code path, prompting scrutiny of AI-generated code practices.

- Fed officials signaled December as a “close call” for a 25bp cut, reinforcing market expectations of a near-term easing pivot.

3.1 Institutional Insights

Institutional flows remain mixed but resilient. Spot Bitcoin ETFs have endured one of their toughest months with billions in redemptions, yet inflows have recently returned, including one day with more than 200 million dollars of net buying. Ether ETFs also saw inflows after over a week of continuous outflows, and Solana products have logged a multi-day inflow streak. This behavior reflects risk rebalancing rather than abandonment, as institutions are rotating exposure rather than exiting. At the same time, index-inclusion risks for crypto-heavy public companies have become a flashpoint, with the industry’s largest Bitcoin treasury firm publicly rejecting classification changes that could impact passive capital flows. Major asset-management executives continue to frame Bitcoin primarily as digital gold, indicating institutions see it more as macro collateral and less as a payments network. Institutional appetite is adjusting to volatility, not disappearing.

3.2 Ecosystem/Protocol Updates

Ethereum ecosystem debates intensified as researchers from a leading Layer-2 team publicly challenged the proposal to adopt RISC-V as the execution-layer instruction set, arguing instead for a long-term shift toward WebAssembly. Their argument centers on decoupling contract bytecode formats from proving architectures, allowing the ecosystem to evolve modularly as zero-knowledge proving technologies advance. In parallel, the Hemi ecosystem unveiled a multi-stage economic model built around veHEMI and hemiBTC, converting protocol fees into yields, periodic burns, and protocol-owned liquidity expansion. Stage 1 is already active with fee-derived HEMI and hemiBTC distributions, while later phases introduce automated pools, long-term liquidity treasuries, a vote marketplace, and dual staking. The model aims to create a self-reinforcing liquidity and governance loop. An oracle-related price distortion on a gold-denominated market pair also highlighted the continued reliance on accurate external data sources, though affected platforms committed to full compensation.

3.3 Macro & Tech Developments

Fed officials now describe December’s policy decision as a close call, with markets heavily pricing a 25bp cut. Unusual macro conditions persist: slowing employment growth contrasts with strong productivity and resilient GDP, complicating policy judgments on whether the economy needs cooling or support. AI-related equities and crypto-exposed stocks have endured significant swings, driven more by positioning pressure than fundamental deterioration. Analysts argue the “AI bubble burst” narrative is overstated, viewing recent volatility as normalization rather than systemic unraveling. For crypto, these dynamics imply a macro regime where liquidity pulses rather than long-lasting trends determine direction, raising the importance of timing around Fed decisions and high-volatility catalysts.

4. BTC & ETH Technical Data

4.1 BTC Market

Bitcoin trades at a high of $80K as it attempts to stabilize after a sharp two-month pullback from its all-time high above $120K. Funding is mildly positive, showing a slight long bias but not extreme leverage expansion. Key liquidation zones sit below $82,110 and above $90,610, carrying over a billion dollars of notional leverage on each side. Recent liquidations show shorts absorbing larger losses than longs, yet leverage has not reset to historical washout levels. About 29,000 BTC left centralized exchanges over the past week, signaling that spot-side conviction is holding firm even as derivatives markets remain choppy. The structure resembles a late-correction environment with elevated volatility, two-way leverage, and strong potential for option-driven breakouts.

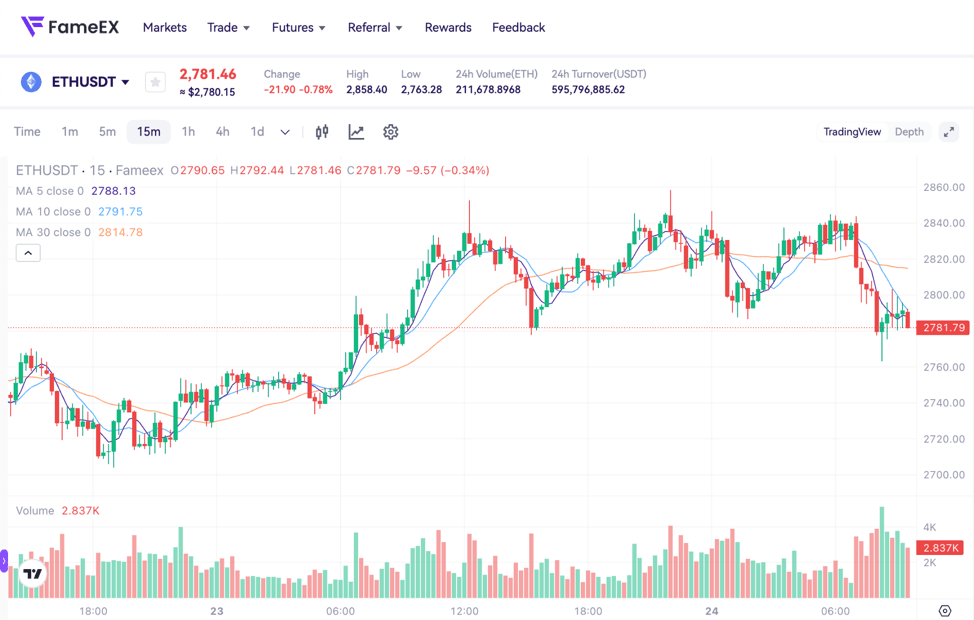

4.2 ETH Market

Ether mirrors Bitcoin’s corrective structure but with staking-based dynamics providing additional support. ETH currently trades around $2,800 after a roughly 25–30% retracement. Funding is modestly positive and less stretched than BTC. Liquidation clusters are concentrated near $2,916 on the upside, where over a billion dollars in shorts could be triggered, and around $2,652 on the downside, where more than half a billion dollars of long exposure is vulnerable. A high-leverage whale added a 25X ETH long of nearly 4,700 ETH with a liquidation level tightly aligned to current ranges, illustrating the sensitivity of near-term moves. The ETH staking ratio is now near 28.8%, with the leading liquid-staking provider holding almost a quarter of all staked supply. The 7-day ETH exchange outflows exceed 211,000 ETH, reinforcing the view that ETH continues to migrate toward long-term yield strategies rather than speculative hot wallets.

5. Altcoin Trends & Sector Rotations

Altcoin flows favor infrastructure-grade assets and governance tokens over pure beta. Sui’s 24-hour stablecoin inflow of about 2.4 billion dollars stands out as a strong signal of revived liquidity deployment and yield preparation. Governance tokens such as 1INCH saw significant insider accumulation, with a core address expanding holdings beyond 110 million tokens, indicating long-term confidence despite market weakness. High-leverage positioning reappeared in select assets: a whale opened a 20X SOL long, and another address built more than 6.6 million dollars of HYPE with additional limit orders. An AAVE mega-whale re-accumulated about 4 million dollars of tokens after prior liquidation losses, reinforcing the narrative that convicted participants are selectively reloading exposure. Overall, capital rotates toward ecosystems with clear utility, strong treasuries, or deep liquidity pathways.

6. Trending Tokens

- IRYS (IRYS)

IRYS gains attention as it launches through a major exchange’s early-access platform. The airdrop-eligible structure increases community participation and ensures an active user base at launch, but also increases the risk of immediate profit-taking. IRYS is likely to exhibit high volatility during initial trading as supply from airdrop recipients meets speculative inflows. Medium-term performance will depend on the protocol’s ability to convert listing momentum into real ecosystem usage and integration.

- TEN (TEN)

TEN introduces FUSE, a community-driven token-launch framework designed to mitigate forced unlocks and post-TGE dump cycles. Participants earn distribution eligibility by engaging with educational materials and demonstrating understanding through interactive steps, creating a more aligned holder base. FUSE reflects a broader shift toward fairer, more sustainable tokenomics. TEN becomes a key experiment in whether redesigned launch mechanics can meaningfully improve early-stage price stability and community cohesion.

- HEMI (HEMI)

HEMI positions itself at the intersection of Bitcoin and DeFi. Its new multi-stage economic model routes protocol fees into staking rewards, token burns, protocol-owned liquidity, and cross-chain yield pathways. Stage 1 already distributes hemiBTC and HEMI to veHEMI stakers and burns part of the fee-converted supply. Later stages introduce automated pools, a vote-market, and dual-staking. The model aims to create a reflexive loop where increased BTC-based activity drives higher fees, deeper liquidity, and greater governance rewards, strengthening HEMI’s role as a foundational asset within Bitcoin-aligned DeFi.

7. Today Token Unlocks

- $NRN: Unlocking 29.92 million tokens, about 6.66% of circulating supply.

- $NIL: Unlocking 6.14 million tokens, about 2.27% of circulating supply.

- $REZ: Unlocking 398.17 million tokens, about 8.85% of circulating supply, the largest unlock of the day.

- $SOSO: Unlocking 6.66 million tokens, about 2.42% of circulating supply.

8. Conclusion

The market is undergoing a transition rather than a breakdown. While Bitcoin and Ether remain well below their recent highs, long-term positioning remains constructive as exchange balances decline and whales selectively rebuild leverage in key assets. ETF outflows are softening, institutional rotation continues, and macro conditions lean toward a December rate cut. Infrastructure tokens, governance assets, and BTC-centric DeFi ecosystems attract capital even amid elevated volatility. With sentiment at Extreme Fear and leverage reset but not extinguished, the market resembles a mid-cycle reset which is challenging for momentum traders but attractive for strategic positioning. Volatility, liquidation clusters, and macro catalysts will likely determine the next major move, while long-term fundamentals remain intact across BTC, ETH, and high-conviction infrastructure narratives.

Disclaimer: The information provided in this section is for reference only and does not represent any investment advice or the official views of FameEX.