The Failure of Banking Should be Attributed to Traditional Finance

2023-03-16 06:08:30Traditional finance had a role in Silicon Valley Bank's demise; opponents shouldn't confuse this with cryptocurrencies.

Source: www.kten.com

The entire idea of banking is predicated on the idea that depositors won't wish to withdraw their funds simultaneously. So what happens if this premise is incorrect? The bank asset-liability mismatch is the cause, which can have catastrophic effects on the larger financial system.

One of the nation's top banks for startups and venture capital firms, Silicon Valley Bank (SVB), folded as a result of a liquidity problem that had an impact on the whole startup ecosystem. The difficulties faced by Silicon Valley Bank highlighted the numerous dangers associated with banking, such as improper management of the economic value of equity (EVE), a failure to protect against interest rate risk, and a rapid decrease in deposits (funding risk). A bank runs the risk of large losses if its assets and liabilities are not appropriately matched (in terms of maturity or interest rate sensitivity).

Failure to hedge interest rate risk exposes banks to market fluctuations that might hurt profitability. A bank runs the danger of not being able to pay its commitments because of an unanticipated outflow of cash, such a run on the bank. In the case of SVB, these risks came together to form a perfect storm that put the bank's survival in jeopardy.

SVB recently took strategic choices to reorganize its balance sheet with the purpose of increasing profitability, taking advantage of possibly higher short-term interest rates, and protecting net interest income (NII) and net interest margin (NIM).

NII, which measures the difference between income received on assets (loans) and interest paid on liabilities (deposits) over a certain time, assuming the balance sheet remains unaltered, is a critical financial indicator used to assess a bank's future profitability. EVE, on the other hand, is a crucial instrument that offers a thorough picture of the bank's fundamental value and how it reacts to different market situations, such as fluctuations in interest rates.

Startups have extra money to deposit but little desire to borrow due to the overabundance of cash and investment in recent years. SVB reported $198 billion in deposits by the end of March 2022, up from $74 billion in June 2020. SVB decided to allocate the majority of the funds into bonds, primarily federal agency mortgage-backed securities (a popular choice) to balance the imbalance brought on by significant corporate deposits, which carry little credit risk but can be exposed to significant interest-rate risk. Banks make money by charging borrowers a higher interest rate than they pay depositors.

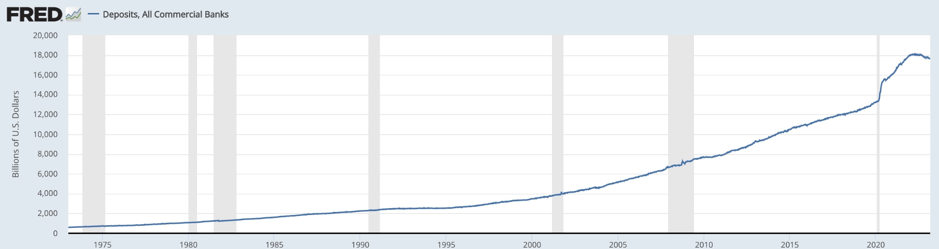

Deposits at all U.S. commercial banks from 1973 through 2023. Source: Federal Reserve Bank of St. Louis

Silicon Valley Bank's bond portfolio, however, took a severe hit in 2022 as a result of sharply rising interest rates and a sharp collapse in the bond market. At the end of the year, the bank's securities portfolio, which made up a sizeable chunk of its $211 billion in total assets, was valued $117 billion. As a result, SVB was forced to liquidate a section of its portfolio that was easily marketable in order to get cash, resulting in a $1.8 billion loss. However, the loss directly impacted the bank's capital ratio, requiring SVB to get extra capital in order to retain solvency.

A "too large to fail" situation also arose for SVB, whereby its financial turmoil threatened to topple the whole financial system, a predicament akin to that of banks during the 2007–2008 global financial crisis (GFC). Yet Silicon Valley Bank was unable to acquire more money or obtain a government rescue like Lehman Brothers, which filed for bankruptcy in 2008.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.