TNSR (Tensor) Token Price & Latest Live Chart

2024-05-08 15:44:25

What is TNSR (Tensor)?

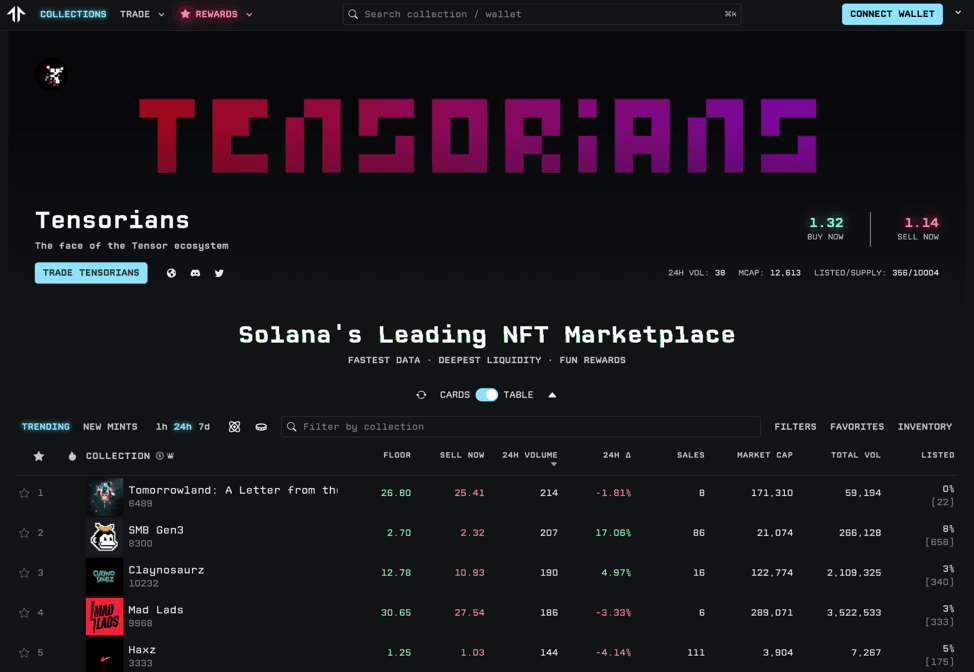

TNSR is the native governance token of the Tensor platform, a comprehensive NFT trading ecosystem built on the Solana blockchain. Tensor’s core mission is to transform NFTs from static collectibles into liquid, tradeable assets by providing a fast, data-rich environment tailored to active traders, market makers, and professional participants. The platform offers a terminal-style interface with real-time order books, historical candlestick charts, and tools for bulk trading and advanced order execution, positioning itself as a “pro trader’s hub” rather than a simple gallery for collectors.

After its launch in 2021, Tensor rapidly emerged as one of the most important NFT venues on Solana, at times capturing a dominant share of the chain’s NFT trading activity. This growth was driven by its focus on speed, low fees, and aggregated liquidity across collections and markets. The introduction of TNSR as a governance token marked a significant milestone in Tensor’s evolution. Instead of being just a centralized marketplace front end, Tensor became a protocol ecosystem with a community-driven decision-making layer.

Within this ecosystem, TNSR functions as more than just a medium of exchange. It is designed to empower holders with voting rights over key aspects of the platform from fee parameters and incentive programs to protocol upgrades and treasury allocations. This governance framework allows users to propose, debate, and implement changes, encouraging active participation and helping ensure that Tensor’s development remains aligned with the needs and preferences of its most engaged users. Over time, this model aims to create a self-reinforcing loop where traders, builders, and token holders all have a stake in the platform’s success.

How does TNSR (Tensor) work?

Tensor integrates an Automated Market Maker (AMM) with an NFT marketplace aggregator to create a deep, efficient liquidity environment for Solana NFTs. The aggregator side pulls together orders and listings from multiple marketplaces across the Solana ecosystem, giving users access to a broad range of collections and best-available prices through a single interface. This helps solve the fragmentation problem common in NFT markets, where liquidity is scattered and pricing can vary significantly between platforms.

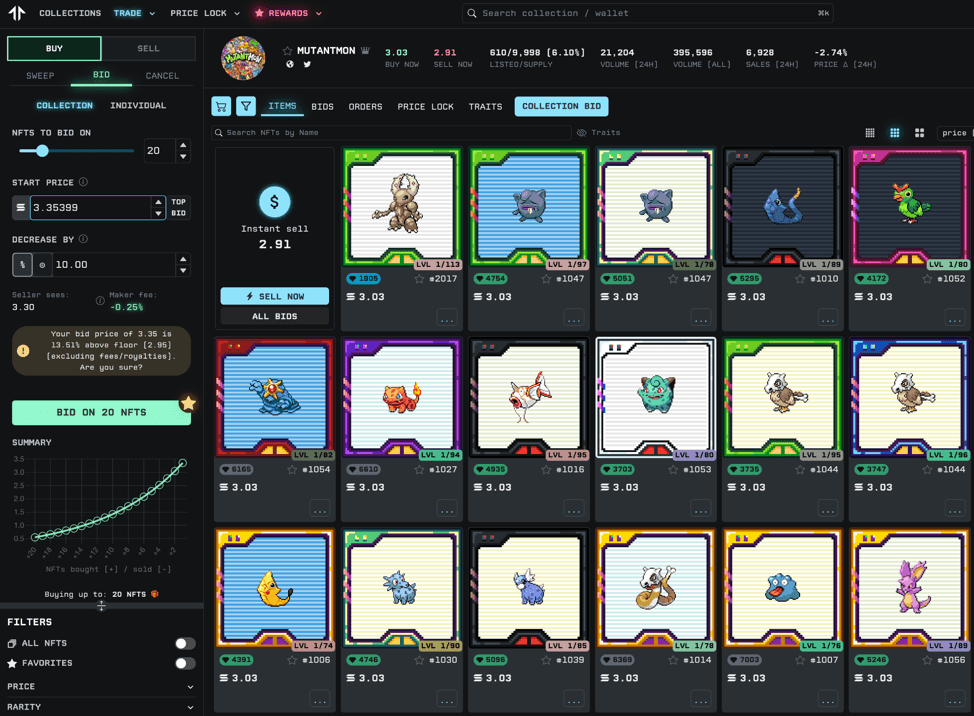

The AMM component introduces more advanced liquidity provision and trading mechanics. Instead of relying only on traditional listing-based markets, Tensor supports features such as bonding curve-based orders, collection-wide bids, and programmable liquidity pools. These tools allow traders to quote two-sided markets for entire collections, provide instant sell-side liquidity, and structure orders that automatically adjust as trades occur. For sellers, this means the ability to exit positions quickly without waiting for a specific buyer, reducing the risk of being undercut by competing listings. For buyers, it enables strategies like laddered bids and trait-specific targeting, where they can systematically acquire NFTs with certain attributes or rarities.

On top of this, Tensor’s bidding system allows users to place sophisticated limit orders across collections or traits, with options to automatically lower or raise prices as executions take place. This kind of dynamic order logic brings NFT trading closer to the experience of trading fungible assets, where order books, algorithms, and market-making strategies are standard. The end result is a marketplace infrastructure where NFTs can be traded with greater speed, depth, and precision than on traditional, purely listing-based platforms.

TNSR underpins the governance and economic flows behind these protocols. A portion of protocol fees generated by the Tensor marketplace and related products accrues to a treasury controlled by TNSR holders, creating a direct link between platform usage and on-chain resources that can be deployed through governance. In recent governance upgrades, the Tensor Foundation has moved to strengthen this connection by centralizing marketplace fees into the TNSR treasury and adjusting team allocations and lock-up schedules, aiming to better align long-term incentives between core contributors, users, and token holders.

Bidding systems on Tensor, Source: Tensor website

TNSR (Tensor) market price & tokenomics

The total supply of TNSR tokens is capped at 1 billion, with a significant portion earmarked for community incentives. Approximately 55% of the total supply is dedicated to the Tensor community through mechanisms like airdrops, grants, and liquidity provisioning programs. Seasonal reward programs and special events, such as the release of treasure boxes containing TNSR tokens, play a critical role in engaging and rewarding active community members.

TNSR’s Distribution, Source: TNSR whitepaper

The remaining supply is divided between core contributors, early investors, and reserves for future development. Team and investor allocations are generally subject to multi-year vesting and lock-up schedules, which are designed to align insiders with the platform’s long-term growth rather than short-term price movements. Over time, Tensor’s governance has also introduced adjustments such as burning a portion of unvested tokens and extending lock-ups for certain allocations, with the goal of reducing potential future sell pressure and signaling a commitment to long-term value creation.

Why do you invest in TNSR (Tensor)?

Investing in TNSR is essentially a way to gain exposure to Tensor’s role as a key piece of NFT trading infrastructure on Solana. Rather than simply tracking the price of an NFT collection or a general Solana index, TNSR offers access to the governance and fee flows of a platform that aims to be the default venue for active NFT traders. If you believe that NFTs will continue to evolve toward more liquid, trading-oriented use cases—and that Solana will remain one of the main ecosystems for high-throughput, low-fee activity—then TNSR represents a focused bet on that thesis.

The governance aspect is a major part of the investment appeal. By holding TNSR, investors can participate in decisions around protocol upgrades, fee structures, incentive programs, and treasury allocations. Instead of relying solely on an off-chain team, the community has the potential to influence how resources are deployed, which verticals to prioritize, and how to respond to competitive pressures. This is particularly relevant in fast-moving NFT markets, where new products (such as AMM pools, lending markets, or social trading layers) can rapidly change the landscape, and flexible governance can be a significant advantage.

Another reason some investors consider TNSR is its position at the intersection of several powerful narratives: Solana’s growth as a high-performance chain, the financialization of NFTs, and the broader shift toward protocol-owned liquidity and fee-generating treasuries. TNSR sits at the center of this intersection as the token that coordinates Tensor’s community, captures protocol value via the treasury, and signals the long-term commitment of the team and ecosystem. For those who are comfortable with volatility and looking for exposure beyond large-cap layer-1 tokens, TNSR can be seen as a higher-risk, higher-upside way to participate in the growth of Solana’s NFT and trading infrastructure.

Is TNSR (Tensor) a good investment?

The potential for TNSR as an investment hinges on several factors, including its utility, community engagement, and the growth trajectory of the Tensor platform. Given its central role in governance and operations within Tensor, coupled with the platform’s market dominance and innovative features, TNSR presents itself as a compelling investment opportunity for those looking to engage with advanced NFT trading and decentralized governance.

TNSR may be best suited for those who have a strong understanding of Solana, follow developments in the NFT and DeFi ecosystems closely, and are willing to actively manage their exposure. For such investors, TNSR can serve as a targeted play on the continued maturation of NFT trading infrastructure and community-led governance around a major Solana protocol. For others, especially those seeking lower-risk or more predictable assets, TNSR might be more appropriate as a small, speculative component of a diversified portfolio rather than a core holding. As with any digital asset, thorough research and disciplined risk management are essential.

Find out more about TNSR (Tensor):

- Homepage

- Explorer: Solscan

- Whitepaper