How to Choose A Trusted Crypto Exchange: A Guide for New Investors in 2024

2024-11-07 13:06:40The rise of cryptocurrency has been nothing short of extraordinary. With this digital revolution, a new era of investment has taken the world by storm, and naturally, there is an increasing demand for understanding how to choose a cryptocurrency exchange. Let's explore the intricacies of the crypto world and find out how to pick a crypto exchange that's right for you.

Understanding the Basics: What is a Crypto Exchange?

A crypto exchange, or cryptocurrency exchange, is a digital platform where users can buy, sell, or trade a variety of cryptocurrencies, such as Bitcoin, Ethereum. These exchanges function much like traditional stock exchanges, but deal exclusively in digital assets. Depending on the platform, they may offer spot trading, futures trading, and other financial products. Crypto exchanges can be centralized (managed by a single corporate) or decentralized (run on blockchain without intermediaries). They play a pivotal role in the cryptocurrency ecosystem, providing liquidity, price discovery, and a marketplace for enthusiasts and investors.

How Do Crypto Exchanges Work: The Behind the Scenes

Exchanges are the middlemen that facilitate trading by setting up orders, processing transactions, and ensuring seamless trading experiences. When you decide to buy or sell a cryptocurrency, the exchange matches your order with a suitable counterpart.

Types of Crypto Exchanges: Centralized vs. Decentralized

In the dynamic world of cryptocurrency, exchanges play a pivotal role by providing a platform for users to trade their digital assets. Broadly, crypto exchanges can be categorized into two main types: Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). Here's a brief overview of both:

Centralized Exchanges (CEX)

Centralized exchanges are platforms operated by centralized entities, much like traditional banks. Users entrust their funds to the exchange, which acts as an intermediary during transactions. These types of CEXs can be found in the market, such as Binance, Coinbase, Bybit, OKX, and FameEX, which provide services through their self-built platforms.

Pros of CEX:

・Speed & Efficiency: Transactions are generally faster due to off-chain order matching.

・User-Friendly: Many CEXs offer intuitive interfaces, making them ideal for beginners.

・High Liquidity: Popular CEXs like Binance, with a 50% market cap, often have high trading volumes, ensuring easy trade execution. However, exchanges like FameEX can offer more competitive order depth and arbitrage opportunities for some transactions.

Cons of CEX:

・Security Concerns: Centralized points of failure make them susceptible to hacks.

・Control: Users don't have full control of their funds; the exchange does.

・Regulation: Can be subject to government regulations, potentially affecting withdrawals and operations.

Decentralized Exchanges (DEX)

Decentralized exchanges operate without a central authority. They facilitate peer-to-peer trading directly between users, using smart contracts and blockchain technology. There are several famous DEX platforms, such as Uniswap, which is based on the Ethereum blockchain. SushiSwap, which began as a fork of Uniswap, has carved its niche by introducing distinct features and functionalities. Balancer is another notable DEX that offers automated portfolio management while allowing users to provide liquidity. It's especially notable for generalizing the concept of an Automated Market Maker (AMM) and can accommodate multiple tokens within its liquidity pool. Meanwhile, Curve Finance, tailored for stablecoin trading, stands out by offering minimal fees and slippage due to its specialized architecture.

Pros of DEX:

・Control & Security: Users retain control of their private keys, reducing the risk of large-scale hacks.

・Censorship Resistant: Less vulnerable to governmental regulations or shutdowns.

・Privacy: Often do not require KYC (Know Your Customer) procedures.

Cons of DEX:

・Liquidity: Historically, DEXs had lower liquidity, though this is changing with the rise of DeFi.

・User Experience: Can be less intuitive, especially for new users.

・Transaction Speeds: On-chain settlement can make trades slower, especially during network congestion.

The choice between CEX and DEX depends on the user's priorities. While CEXs offer a familiar and often user-friendly experience, DEXs provide more security and autonomy. As the crypto landscape evolves, hybrid solutions and advancements might offer a blend of both worlds.

Understanding the Crypto Market: Where Does Exchange Fit In?

The cryptocurrency market is a rapidly evolving digital financial landscape. At its core, it comprises digital assets or "cryptocurrencies" that represent a new form of currency, asset, or utility. One of the crucial components of this ecosystem is the cryptocurrency exchange. Exchanges are pivotal to the crypto ecosystem. They determine prices based on supply and demand mechanics and act as gatekeepers for liquidity, allowing smooth trading operations.

Why Is It Crucial to Pick the Right Crypto Exchange?

A credible exchange can provide investors with peace of mind, ensuring that their funds are safe and their trades are executed fairly. Picking the right crypto exchange is paramount for both seasoned and new investors. The right choice ensures optimal security for your funds, offers superior liquidity for smoother trades, and provides competitive fees. Furthermore, a user-friendly interface, a wide range of available assets, and robust customer support can make all the difference in one's trading experience. With factors like geographical restrictions, trustworthiness, regulatory compliance, and additional features also in play, the decision of selecting an exchange becomes central to one's crypto journey.

Importance of Choosing a Credible Crypto Exchange

The cryptocurrency landscape is vast and ever-evolving, making the choice of a credible exchange instrumental to an investor's success. A trustworthy platform not only guarantees the safety and security of your assets but also ensures smoother trading with adequate liquidity. With the right exchange such as FameEX, investors can take advantage of competitive fees, an intuitive user interface, and a wide array of available assets, all backed by prompt customer support. In addition, regulatory compliance and a strong reputation are indicators of an exchange's commitment to protecting its user base. Given the critical role exchanges play in the crypto ecosystem, selecting a reputable one is synonymous with fostering a robust and rewarding investment journey.

Risks Associated With Choosing the Wrong Crypto Exchange

Choosing the wrong platform can lead to potential security risks, higher fees, or even loss of investment due to hacks or fraudulent activities. Opting for the wrong crypto exchange can be a precarious move, fraught with a myriad of risks. Foremost among these is the potential compromise of asset security, as inadequately protected platforms can become easy targets for hacks and cyber-attacks. Low liquidity on such platforms can result in significant price slippage, adversely affecting trade profitability. Hidden fees or exorbitant charges can erode returns, while a clunky user interface can hamper trading efficiency. Moreover, exchanges with a tarnished reputation or lack of regulatory oversight can expose users to fraudulent activities or unforeseen legal complications. In essence, a poor choice in exchange can not only jeopardize one's investments but also undermine the very essence of the crypto trading experience.

Key Factors to Consider When Selecting a Crypto Exchange

Always research reviews, news, and feedback from other traders. High trust scores and a long-standing reputation often signify reliability. When selecting a crypto exchange, it's imperative to consider a variety of key factors to ensure security, efficiency, and a seamless trading experience. These factors include the platform's security measures, transaction fees, supported cryptocurrencies, liquidity, user interface, and customer support. Your choice will greatly influence not only your trading journey but also the safety of your investments.

Reputation Matters: How to Evaluate an Exchange’s Credibility?

In the rapidly evolving world of cryptocurrency, the reputation of an exchange is paramount to ensuring both the safety of your investments and a trustworthy trading environment. Now, there are several trustworthy listing platforms where you can find information about each exchange, such as CoinMarketCap, CoinGecko, Coinpaprika, etc. FameEX is listed on the aforementioned platforms and is proud to be ranked among the top 50 CEX platforms.

Evaluating an exchange's credibility isn't just about looking at its size or how long it's been in operation, but also delving deeper into several important indicators:

・User Reviews & Feedback: Sites like above mentioned or Trustpilot, Reddit, and various crypto forums are great places to start. While every platform will have its detractors, consistent negative feedback or reports of suspicious activity should raise red flags.

・Regulatory Compliance: Ensure the exchange follows regulatory standards set by leading countries. An exchange that is compliant demonstrates a commitment to adhering to legal standards and operating transparently.

・History of Security Breaches: Look into whether the platform has experienced any hacks or security breaches in the past. Even more important is how they responded: did they compensate affected users, improve their security infrastructure, and communicate transparently?

・Partnerships and Collaborations: Associating with reputable banks, financial institutions, or other well-known organizations often indicates that an exchange is trustworthy and has been vetted by other industry players.

・Media Coverage: Positive coverage by respected media outlets and industry publications can provide further insights into an exchange's credibility and standing in the community.

While the allure of low fees or exclusive coin listings might be tempting, never underestimate the importance of reputation when choosing a crypto exchange. Your digital assets are valuable, and ensuring they're in safe hands should always be a top priority.

Fees and Charges: Understanding Crypto Exchange Fees

Different exchanges have varying fee structures. Look for transparent fee policies and compare rates to ensure you're getting a fair deal. These fee charges play a pivotal role in determining the actual cost of buying, selling, or trading digital assets. FameEX values transparency and displays its fee list on the website for all users to see and access.

Here's a breakdown of the types of fees you might encounter and why they matter:

・Trading Fees: These are the most common types of fee, charged for buying and selling cryptocurrencies on an exchange. Typically presented as a percentage of the trade's value, different exchanges will have varying fee structures. Some might offer tiered fees, rewarding higher trading volumes with lower rates.

・Deposit & Withdrawal Fees: Exchanges might charge you for depositing or withdrawing funds. While deposits are often free, withdrawals can come with a fee, especially when transferring to an external wallet. It's essential to be aware of these, as they can vary widely between exchanges.

・Spread Costs: This refers to the difference between the buying price (ask) and selling price (bid) of a cryptocurrency. While not a direct fee, it does represent a hidden cost of trading.

・Inactivity Fees: Some exchanges charge a fee if an account remains inactive for a specified period. While not common, it's crucial to be aware of any potential costs associated with account dormancy.

・Network Fees: When transferring a cryptocurrency, a network fee or "gas fee" might apply, especially during periods of high network congestion. While this fee goes to cryptocurrency miners or validators, not the exchange, it's still a cost to consider.

When choosing a crypto exchange, it's not just about finding the lowest fees. It's about understanding the entire fee structure and how it aligns with your trading habits and investment strategy. Always read the fine print, compare multiple platforms, and factor in all potential costs to make an informed decision.

User-Friendliness and Customer Support: Choosing the Best Crypto Exchange for Beginners

For those new to crypto, an intuitive interface and responsive customer support are essential. The design and usability of an exchange's platform, coupled with the quality of its customer support, can make all the difference in ensuring a smooth initiation into the crypto realm. Before trading, you may test the platform's features and ensure they offer adequate help resources. Here's how to evaluate these vital aspects:

・Intuitive Interface: For someone new to the crypto scene, the user interface (UI) can play a decisive role. An intuitive UI that's easy to navigate ensures that users can find what they're looking for without getting lost in technical jargon or complicated menus. Icons should be clearly labeled, and the layout should facilitate a straightforward trading process.

・Onboarding and Tutorials: An ideal exchange for beginners offers comprehensive onboarding processes, including tutorials, explainer videos, and FAQs. These resources can guide newcomers step-by-step, demystifying complex concepts and helping them start trading with confidence. FameEX offers a dedicated support center as well as comprehensive research and novice guides for new users. Whether they have questions about the platform or macro-level topics, these resources help users easily grasp the concepts of cryptocurrency.

・Demo or Practice Modes: Some exchanges provide a sandbox or demo mode, allowing users to practice trading with virtual funds. This is an invaluable feature for beginners, helping them get a feel for the platform without risking real money. While using FameEX, they offer a demo mode for options trading with 100,000 USDT to encourage users to try out this new product.

・Mobile App Availability: In our on-the-go world, having access to a well-designed mobile app can be crucial. It should offer a seamless experience, mirroring the desktop platform's functionalities and ensuring trades and account management can be handled from anywhere.

・Effective Customer Support: Beginners will inevitably have questions or face challenges. The availability of a responsive customer support team becomes essential. Look for platforms offering multiple support channels like live chat, email, and phone support. Quick response times and a knowledgeable support team can greatly enhance the user experience. At FameEX, we offer 24/7 customer support through all channels.

・Community and Forums: Some exchanges boast active communities, often on platforms like Discord or Telegram. These communities can be a treasure trove of information, where beginners can learn from more experienced traders, ask questions, and get a sense of the broader ecosystem.

The best crypto exchange for beginners blends a mix of user-friendly design, educational resources, robust customer support, and a supportive community. As the crypto landscape evolves, these foundational aspects remain critical in helping newcomers transition from novices to seasoned traders seamlessly.

Security Is Paramount: Choosing a Secure Crypto Exchange

The digital nature of cryptocurrencies makes them susceptible to a range of cyber threats. With cases of exchange hacks and breaches becoming headlines in the past, ensuring that your chosen platform prioritizes security cannot be overstated. Here's several factors to help you identify and choose the most secure crypto exchanges:

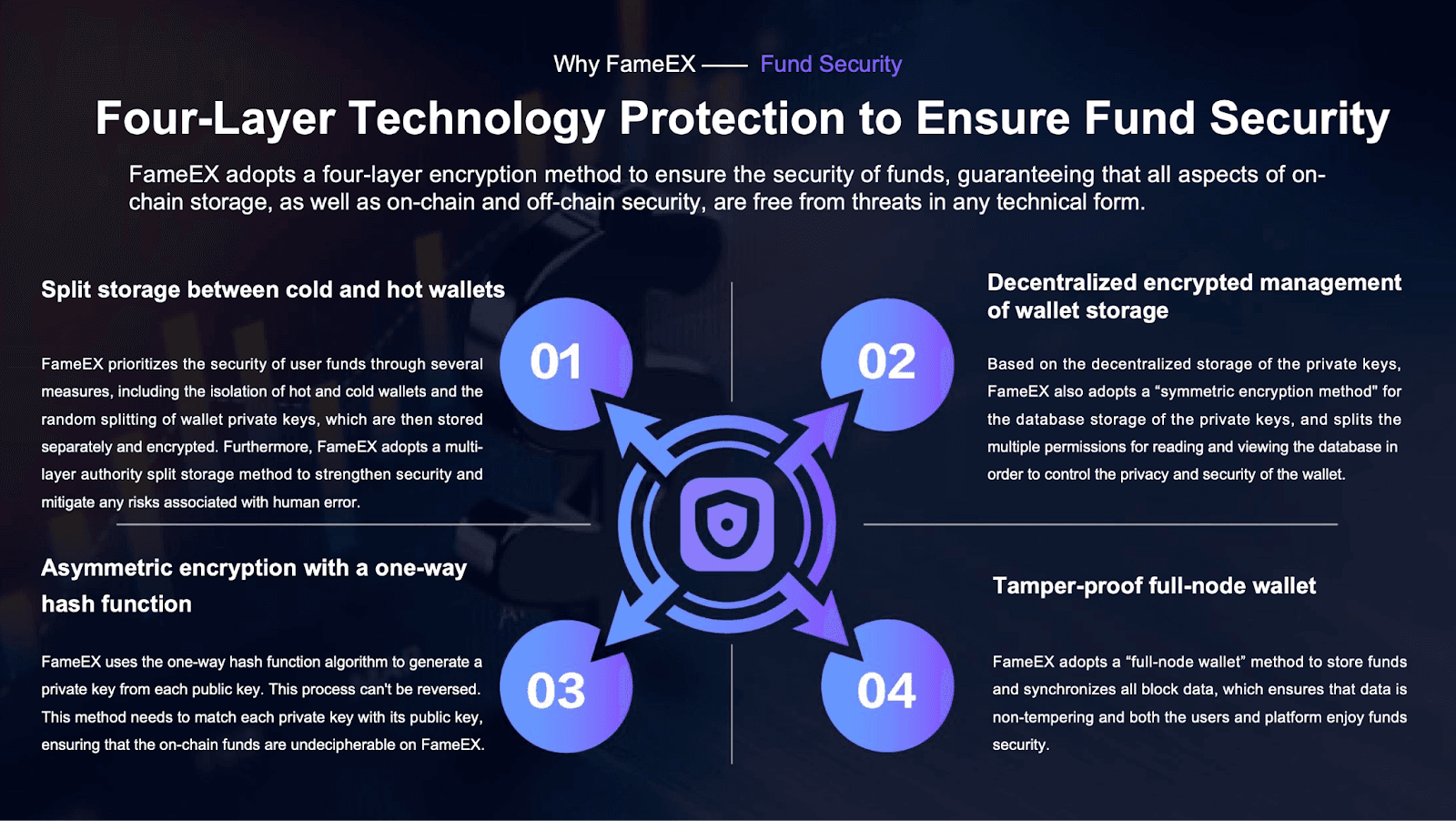

・Cold and Hot Wallets: Understand how an exchange manages its funds. A secure exchange will store a majority of its assets in cold wallets (offline storage) to protect them from online threats. Hot wallets (online storage) are more vulnerable, so their use should be limited to only the funds required for daily trading operations. FameEX places paramount importance on the safety of its users' funds by implementing robust security measures. These include segregating funds between hot and cold wallets and employing a method where wallet private keys are randomly divided, stored independently, and encrypted. Moreover, to bolster security and reduce potential human error risks, FameEX uses a multi-layered authority split storage technique.

・Encryption Protocols: Check if the exchange uses the latest encryption technologies to safeguard user data. SSL certificates, for instance, ensure that the data transmitted between your device and the exchange servers is encrypted and remains confidential. FameEX’s cutting-edge approach combines decentralized storage for private keys with advanced "symmetric encryption methods" for database storage. By implementing split permissions for database access, FameEX empowers you with unparalleled control over your wallet's privacy and security. Your assets deserve the utmost protection, and FameEX delivers it through innovative encryption techniques that redefine the standards of safeguarding digital assets.

・Regular Security Audits: Leading exchanges periodically undergo security audits conducted by third-party agencies. These audits assess the platform's vulnerability to attacks and suggest improvements. Opt for exchanges that transparently share these audit results with their users.

・Withdrawal Whitelists: This feature allows users to specify one or more trusted withdrawal addresses. If anyone tries to withdraw funds to an address outside of this whitelist, the transaction is denied, adding an extra security layer against unauthorized withdrawals.

・Insurance Funds: Some exchanges have insurance funds to compensate users in the event of a breach. While this doesn't prevent hacks, it does provide an assurance that users might recover some, if not all, of their lost funds. FameEX showcases its insurance fund on the website for user transparency.

・History and Track Record: As the saying goes, "Past behavior is the best predictor of future behavior." Research if the exchange has a history of security breaches and, more importantly, how they responded to them. An exchange that has continuously evolved and bolstered its security after a setback is more trustworthy than one that remains complacent.

・DDoS Protection: Distributed Denial of Service (DDoS) attacks aim to overwhelm a network with traffic, causing interruptions in service. Ensure your chosen platform has robust DDoS protection mechanisms in place.

・User Education: An exchange's commitment to user security often extends beyond its technical measures. Platforms that regularly educate users about phishing threats, safe browsing practices, and more, highlight a comprehensive approach to security.

In the realm of digital assets, your exchange's security measures are your first line of defense against potential threats. While no platform can offer a 100% guarantee against breaches, aligning with exchanges that consistently prioritize and update their security protocols ensures that your investments are as safe as they can be in the dynamic world of cryptocurrency.

Trading Volume: The Importance of Liquidity on an Exchange

Liquidity is a cornerstone of a robust and efficient marketplace. It plays a pivotal role in determining the viability and reliability of a crypto exchange. High trading volumes often indicate a healthy and liquid market. This allows for smoother trades without drastic price changes. Here's a breakdown of why trading volume and liquidity matter:

・Quick Trade Execution: High liquidity means that there's a substantial amount of trading activity on the exchange. This ensures that when you place an order, it gets matched and executed swiftly, preventing potential slippage and guaranteeing timely transactions.

・Price Stability: In a highly liquid market, significant trades won't dramatically swing prices, ensuring that the cryptocurrency price remains stable. This stability protects traders from erratic price fluctuations, which might result from low-volume trading.

・Accurate Price Reflection: The price of any asset, including cryptocurrencies, is a direct reflection of its demand and supply. Higher trading volumes ensure that the asset's price more accurately mirrors its genuine market value, offering a truer depiction of its worth.

・Enhanced Trustworthiness: An exchange with significant trading volume indicates a high level of trader trust. It suggests that many participants believe the platform is reliable and secure, further cementing its reputation in the market.

・Diverse Trading Pairs: High liquidity often means that the exchange offers a variety of cryptocurrency pairs to trade. This diversity offers traders the flexibility to diversify their portfolios, explore different assets, and employ varied trading strategies.

・Mitigated Manipulation Risks: In low-liquidity markets, there's a heightened risk of price manipulation, where individual traders or groups can artificially inflate or deflate prices for personal gain. High trading volumes make such manipulations harder and less likely.

・Better Analysis and Predictions: A steady flow of trading volume provides a wealth of data for technical analysis. Patterns and trends become more discernible, aiding traders in making informed decisions based on historical data.

The trading volume is not just a mere number; it's an indicator of an exchange's health, reputation, and efficacy. When selecting a crypto exchange, ensuring it boasts high liquidity can safeguard your trades, offer better prices, and generally provide a more favorable and reliable trading environment.

Supported Cryptocurrencies: Check the Number of Coins You Can Trade

Some exchanges offer hundreds of coins, while others focus on the main players. Cryptocurrency markets are vibrant ecosystems teeming with a diverse range of digital assets. From the renowned Bitcoin and Ethereum to the rising stars and niche tokens, there's a vast world of opportunities awaiting traders. Hence, when choosing a crypto exchange, one of the foremost considerations should be the variety of supported cryptocurrencies. Let's delve into why this is paramount and what to look out for:

・Diverse Portfolio: An exchange with a wide array of supported cryptocurrencies allows traders to diversify their portfolio. Diversification can mitigate risks, as the performance of individual assets doesn't overly influence the entire portfolio.

・Emerging Opportunities: While everyone knows about the major cryptocurrencies, many emerging tokens have the potential for significant returns. An exchange that frequently adds new coins provides traders the chance to invest early in promising projects.

・Trading Pairs and Flexibility: With a variety of coins comes a myriad of trading pairs. This flexibility lets traders switch between different cryptocurrencies easily, without the need to revert to fiat currencies or major coins like Bitcoin as intermediaries.

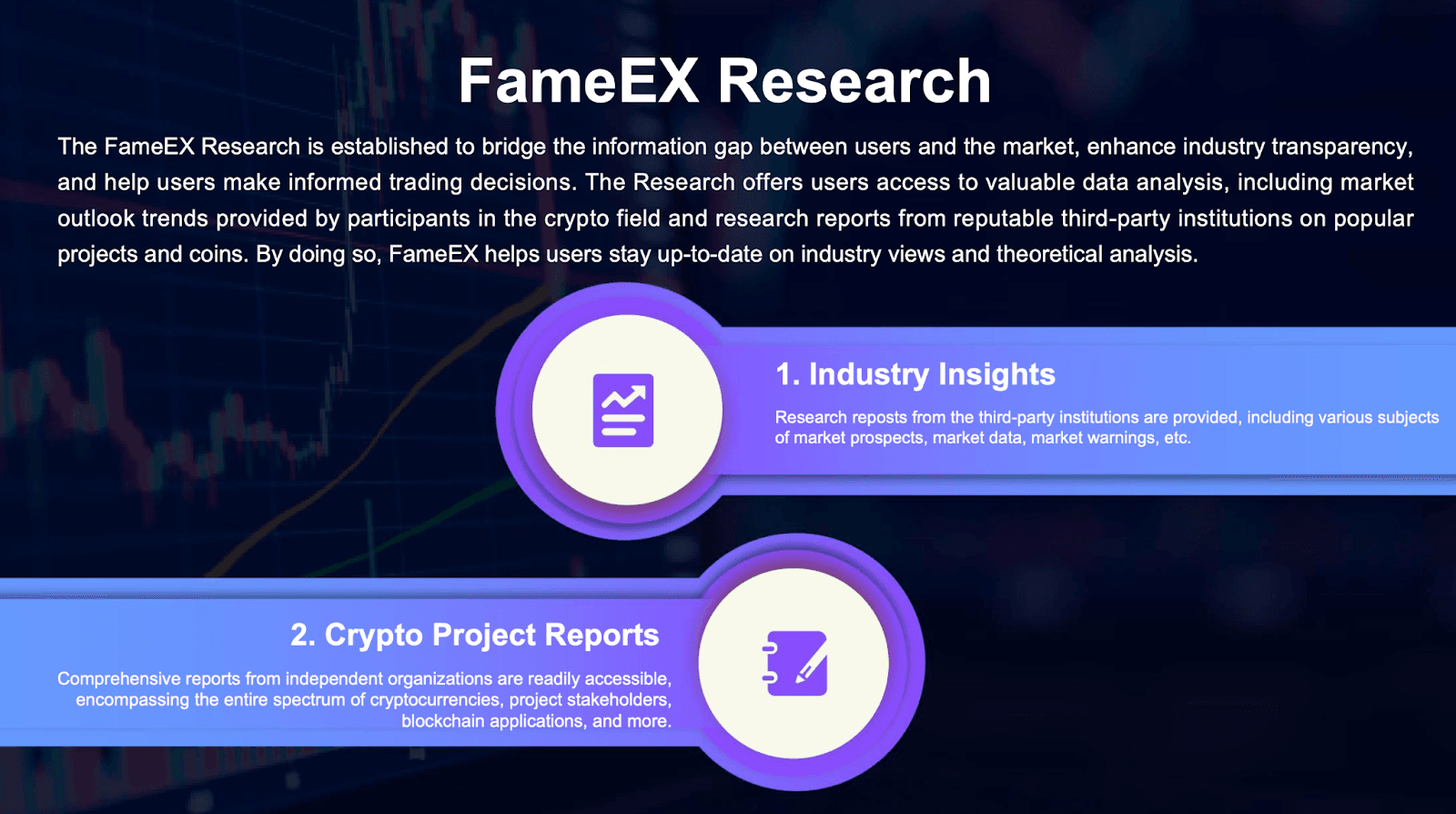

・Enhanced Research and Analysis: More supported coins mean more data points and market behaviors to analyze. This wealth of information can be invaluable for traders looking to understand market dynamics and emerging trends. On FameEX, you can access all token research articles before diving into investing. Read our guides and research for a more comprehensive understanding.

・Market Sentiment Indicator: An exchange that actively adds new coins indicates that it's in tune with the evolving market landscape. It suggests that the platform is responsive to community demand and keen on providing the latest trading opportunities.

・Safety and Due Diligence: While a vast array of coins is a plus, it's crucial that the exchange conducts thorough due diligence before listing new tokens. Platforms should prioritize user safety by ensuring that they only support legitimate and non-fraudulent projects. FameEX conducts comprehensive assessments before listing any coin, ensuring that only premium and promising ones make the cut. These thorough evaluations encompass aspects such as code audits, token issuance, technical innovation, brand management, the original intention behind the project, and its potential for future development.

In essence, while the number of supported cryptocurrencies is a reflection of an exchange's versatility, it's also a testament to its adaptability and alignment with market demands. Traders should seek platforms that offer a balanced mix of established coins and emerging tokens, all while ensuring a secure and thorough vetting process. This approach ensures both the promise of potential returns and the assurance of safety.

What Are Some of the Best Crypto Exchanges for Beginners in 2024?

In 2024, as the world of cryptocurrencies continues its meteoric rise, several exchanges stand out for their user-friendliness, robust security measures, and comprehensive educational resources tailored for newcomers. These platforms prioritize intuitive interfaces, easy onboarding processes, and provide ample support to help beginners navigate the often complex realm of digital assets. Let's dive into the top crypto exchanges that have made a mark this year for those taking their first steps in the cryptocurrency space.

Tips for Selecting a Reliable Crypto Exchange from Experts

Experts in the crypto community emphasize the significance of stringent security features. Prioritize platforms that have a proven track record, fortified by measures like cold wallet storage and insurance funds. Additionally, regulatory adherence is not just a checkbox; it's a testament to the exchange's commitment to safeguarding user interests. As a potential investor, don't underestimate the value of peer reviews. They offer genuine insights into user experience, platform responsiveness, and potential pitfalls. Moreover, an often-overlooked aspect is the platform's fee structure; ensure transparency to avoid unforeseen charges. Overall, consider the platform's liquidity and quality of customer support, as these can greatly influence trading experience and prompt issue resolution.

A Review of Popular Crypto Exchanges for Beginners

The cryptocurrency ecosystem in 2024 is teeming with platforms, but some have emerged as particularly conducive for novices. Coinbase, with its uncluttered interface and robust educational arm, is often the first choice for new entrants. Binance strikes a balance by offering a vast crypto palette while retaining an intuitive user interface, making it a crowd favorite. Kraken's reputation for stellar security measures and user-focused resources makes it a trustworthy option for beginners. Lastly, FameEX's unwavering focus on security and compliance establishes it as a dependable platform for newcomers to the crypto world. Additionally, it offers numerous AI tools to assist traders in all aspects of investment.

The Easiest Crypto Exchanges to Start Your Crypto Journey

For many, the world of cryptocurrency can seem daunting. Hence, ease of use becomes a pivotal factor when choosing an exchange. Coinbase, with its beginner-centric approach, offers an effortlessly navigable experience, further enhanced by its mobile-friendly application. Binance Lite is the epitome of simplicity, catering to those who desire no-frills trading. FameEX's long standing reputation is built on its straightforward trading system and tools, which makes it an ideal platform for beginners. Moreover, FameEX goes beyond being just an exchange by allowing users to earn sign-up bonuses from a monthly pool of 1000 USDT, offering a comprehensive platform for those embarking on their crypto journey.

Conclusion

In 2024, as the crypto landscape continues to evolve rapidly, choosing a trustworthy crypto exchange remains paramount for new investors. Navigating this intricate world requires diligence, research, and a keen understanding of individual needs. While technology, security measures, and regulations have come a long way, the onus still lies with investors to prioritize their safety and financial goals. By carefully evaluating factors like fee structures, security protocols, user reviews, regulatory compliance, and the overall reputation of an exchange, investors can ensure they're making informed decisions in a volatile market. As with all investment ventures, the foundational rule remains: invest the time before investing your money.

FAQ About How to Choose a Crypto Exchange

Q: Are There Factors to Consider Before Choosing a Crypto Exchange Platform?

A: Absolutely. When choosing a crypto exchange platform, it's essential to prioritize several key factors. Firstly, security should be at the forefront of your considerations; select platforms known for strong measures like cold storage, and solid encryption practices. The reputation of an exchange is equally crucial; delve into user reviews, its operational history, and its customer support track record to gauge trustworthiness. The platform's user interface and experience can significantly impact your trading efficiency, so an intuitive and responsive design is beneficial. Also, ensure the exchange supports the specific cryptocurrencies you're interested in, and assess its liquidity, which affects the ease of executing trades. It's vital to be aware of any fees associated with trading, deposits, or withdrawals, and compare these costs across platforms. Another important aspect is the regulatory environment; platforms compliant with relevant regulations in your jurisdiction offer an added layer of protection. Lastly, reliable customer support can be a lifesaver in times of technical difficulties, and additional trading tools or educational resources can further enhance your trading experience. Always conduct thorough research to ensure your chosen platform aligns with your individual needs and trading objectives.

Q: What Is the Easiest Crypto Exchange to Use?

A: Beginners may find platforms like Coinbase and Binance appealing because of their ease of use and educational resources. Meanwhile, newer platforms like FameEX also promise user-friendly experiences, as well as derivative tools and potential arbitrage opportunities for traders. It's recommended to research and possibly try a few platforms to determine which one feels easiest for personal use. Always ensure you prioritize security and regulatory compliance when choosing an exchange.

Q: What Is the Best Crypto Exchange for Beginners?

A: The "best" crypto exchange for beginners often depends on individual needs, location, and investment goals. Platforms like Coinbase, Binance, and FameEX are among the most user-friendly and popular exchanges for novices. They offer intuitive interfaces, educational resources, and strong security features. Before choosing an exchange, beginners should consider factors like ease of use, fees, security, available assets, and user reviews. It's always advisable to conduct personal research and perhaps consult with a financial advisor.

Q: What Are the Two Main Types of Crypto Exchanges?

A: The two main types of crypto exchanges are centralized exchanges (CEX) and decentralized exchanges (DEX). Centralized exchanges, like Coinbase, Binance, and FameEX, are managed by centralized entities, requiring users to create accounts to trade. They often provide a user-friendly interface, high trading volume, and strong security measures. In contrast, decentralized exchanges, like Uniswap and Sushiswap, operate without a central authority and allow users to trade directly from their personal wallets. DEXs offer more privacy and can prevent single points of failure, but might be less intuitive for newcomers.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.