What Steps Should Beginners Take to Invest in Cryptocurrency

2025-09-22 11:05:23

Many people want to know how to invest in cryptocurrency for beginners. Right now, about 13% of people online own cryptocurrency, which means over 700 million people have used it. Beginners sometimes make mistakes; they might spend too much money or forget to keep their accounts safe. Some even get tricked by scams. However, they can avoid these problems by starting with a small amount and choosing a safe crypto platform. It is important to learn the basics first, as understanding how to invest in cryptocurrency for beginners allows them to take things one step at a time, helping them feel more confident about investing.

Key Takeaways

- Begin with a small amount to lower your risk. Putting in $100 or less helps you learn and not lose much money.

- Pick a safe place to buy and sell cryptocurrency. Make sure it has good security, is easy to use, and does not charge high fees.

- Make a safe account with a strong password and two-factor authentication. This keeps your money safe from hackers.

- Keep up with news and trends in the market. Check your investments often and learn from trusted places to make smart choices.

- Watch out for scams. Only use money you can lose and stay away from deals that look too good to be real.

What Is Cryptocurrency?

Cryptocurrency Basics

Many people wonder what cryptocurrency means. It is a kind of digital money. You can use it to pay for things online or save it for later. Cryptocurrency is not like regular money. It does not need banks or governments to work. It uses computer networks called blockchains. These networks record every transaction. This makes cheating very hard. Cryptocurrency started small but is now important in finance. People use it for payments, banking, and sending money to other countries.

To understand crypto basics, you need to know how digital coins work. They are not real coins you can touch. They do not have value by themselves. Their price depends on what people want to pay. Bitcoin was the first and is still the best known. Ether is another big coin and works with Ethereum.

Here is a table that shows how financial groups explain different cryptocurrencies:

| Type of Cryptocurrency | Description |

|---|---|

| Digital/Virtual Currency | Electronic money used like normal cash |

| Altcoins | Coins made from bitcoin tech but changed for new jobs |

| Stablecoins | Digital coins tied to real money or things to keep their price steady |

| Central Bank Digital Currency | Digital money run by a central bank, like regular cash |

Types of Cryptocurrencies

Most people have heard of bitcoin. But there are thousands of other coins too. Ether is the second biggest and helps run Ethereum. Some coins, like Tether and USD Coin, are stablecoins. They try to stay close to the dollar’s value. Other coins, like Binance Coin and Solana, help run big crypto networks or exchanges.

Here are some of the most well-known cryptocurrencies by size:

- Bitcoin

- Ethereum (ether)

- Tether

- USD Coin

- Binance Coin

- Ripple

- Cardano

- Solana

- Polkadot

How to Learn About Crypto

Anyone can learn about crypto in many ways. You can read news, watch videos, or take online classes. Good websites like CoinDesk, U.Today, and Decrypt have easy guides and news. Forums like Reddit and social media like Twitter let people share tips and updates. If you want to know how to learn about crypto, sites like Binance Academy, Coinbase Learn, and Kraken Learn have lessons for beginners. These tools help anyone start learning about cryptocurrency and bitcoin, even if they are new.

How to Invest in Cryptocurrency for Beginners

Choose a Broker or Exchange

People want to know what to think about before buying crypto. The first thing beginners should do is pick where to buy and sell. They can use a broker or an exchange. Brokers follow what customers say and make things easy. This is good for people who are new. Exchanges match buyers and sellers. They have more tools for people who want to trade a lot. Beginners often like brokers because they are simple. Exchanges are better for people who want to trade often or look at prices.

Here is a table that shows the main differences:

| Feature | Cryptocurrency Exchange | Cryptocurrency Broker |

|---|---|---|

| Matching Mechanism | Pairs buyers with sellers using a central limit order book | Acts on customer instructions based on market conditions |

| User Experience | More suitable for advanced traders with tools for analysis | More beginner-friendly and simpler for casual investors |

| Cost Structure | Potentially lower fees for high-volume traders | Generally cheaper for small transactions |

| Trading Style | Better for day trading and fast transactions | Ideal for incremental portfolio building |

When picking a platform, beginners should check if it has popular coins. These include bitcoin and ether. They should also look for strong security, easy design, and low fees. Many people want to know what to look for when buying crypto. Here is another table with important things to check:

| Factor | Description |

|---|---|

| Security Measures | Look for exchanges with robust security, including cold storage and insurance for funds. |

| User Interface and Experience | A clean, easy-to-use interface is crucial for beginners, along with educational resources. |

| Supported Cryptocurrencies | Choose exchanges that offer a variety of cryptocurrencies to diversify investments. |

| Fees and Charges | Be aware of different fee structures, including maker/taker fees and withdrawal fees. |

| Liquidity | High liquidity ensures quick buying/selling without significant price changes. |

Tip: Beginners should make sure the platform has the coins they want. They should read reviews and compare fees before joining.

Create and Secure Your Account

After choosing a broker or exchange, beginners need to make an account. Most places ask for an email, a password, and sometimes an ID. Beginners should use strong passwords and turn on two-factor authentication. This helps keep their account safe. Many exchanges use extra security like fingerprint scans and encryption.

Here are some security measures that help protect accounts:

| Security Measure | Description |

|---|---|

| Private Key Protection | Use encryption, secure storage, and hardware wallets to protect private keys. |

| Wallet Security | Implement strong passwords and multi-factor authentication (MFA) for wallet security. |

| Two Factor Authentication (2FA) | Add an extra layer of security to accounts with 2FA. |

| Secure Transactions | Verify recipient's wallet address and use transaction signing and encryption. |

| Network Security | Protect blockchain infrastructure with cryptographic algorithms and network monitoring. |

| Crypto Exchange Security | Use 2FA, AML, KYC procedures, and regular security audits for exchange security. |

| Data Encryption | Encrypt sensitive data in transit and at rest to prevent unauthorized access. |

| Strong Password Practices | Encourage the use of robust passwords and password managers. |

| Backup and Recovery | Regularly back up wallets and store backups securely. |

| User Education and Awareness | Educate users on best practices and common attack vectors. |

| Incident Response and Recovery | Have a plan for responding to security incidents and recovering lost funds. |

Big exchanges use more tools to keep accounts safe. They ask for hard passwords and multi-factor authentication. They update their systems a lot and use encryption. Some exchanges watch for strange actions and use AI to find threats. Others use fingerprints and other checks to see if a user is real.

Note: Beginners should never share their passwords or private keys. They should back up their wallet and learn about scams.

Start with a Small Investment

Many people want to know how to invest in cryptocurrency for beginners without losing too much. The best way is to start with a small amount. Beginners can try investing with $100 or less. This helps them learn how to buy and sell. They can watch prices and see how their money changes. Starting small means less worry if prices go down.

People can buy bitcoin, ether, or other coins. They should not put all their money in one coin. Spreading out money helps lower risk. Beginners should remember that prices can change fast. They should only use money they can lose.

Tip: Beginners should keep track of what they buy and sell. They can use apps or notes to record their trades.

Investing in cryptocurrency can seem hard at first. By picking a safe place, keeping their account safe, and starting small, beginners can feel better. They can learn step by step. Over time, they will know more about bitcoin, ether, and other coins. They will know what to look for when buying crypto and how to keep their money safe.

Make Your First Cryptocurrency Purchase

Select Your Coins

When people start with cryptocurrency, they ask what coins to buy. Most beginners pick coins that are popular. Some of the most common coins are:

- Bitcoin

- Ether (Ethereum)

- Tether (USDT)

- USD Coin (USDC)

- BNB

- Binance USD (BUSD)

- XRP

- Cardano (ADA)

- Solana (SOL)

- Dogecoin (DOGE)

People buy cryptocurrency in different ways. They look at exchanges like Binance or Coinbase for new coins. Data sites like CoinMarketCap and CoinGecko show prices and trading amounts. Social media like Discord and Telegram help people find new coins fast. Some use tools like Kryptview and BSCCheck to compare coins and pick good ones.

Tip: Beginners should check coins using many sources before buying.

Place Your First Trade

After picking a coin, the next step is to buy it. Here is what happens on big exchanges:

- Make an account on a crypto exchange.

- Prove who you are by uploading documents.

- Add money with a bank card, wire, or crypto.

- Pick the coin you want, like bitcoin or ether.

- Place a buy order and think about stop-loss or limit orders.

Most exchanges want users to sign up with an email. They ask for a strong password and two-factor authentication. Users add money with dollars or send crypto from another wallet. Knowing the ticker symbol helps avoid mistakes. Stop-loss and limit orders can protect your money if prices change fast.

Here is a table that shows normal fees on popular platforms:

| Platform | Fee Type | Fee Percentage |

|---|---|---|

| Binance | Maker | 0.019% - 0.38% |

| Taker | 0.095% - 0.57% | |

| Coinbase | Custom | Varies (e.g., $18.40 for $1,000) |

| Robinhood | Commission-free | 0% (inflated prices may apply) |

Understand Market Dynamics

The cryptocurrency market changes very fast. Prices go up and down for many reasons:

- Price discovery keeps happening, so values change as new people join.

- The market is still growing, so small coins can be very jumpy.

- Supply and demand matter a lot. For example, bitcoin has a set supply, so big changes in demand move prices quickly.

- What investors feel is important. News and social media can make prices swing fast.

Short-term price moves depend on things like Google trends, how many coins exist, how people feel, and the S&P500 index. If a company or big investor uses crypto, prices can go up. Bad news can make prices drop. For example, when Tesla took bitcoin, its price went up. When Tesla stopped, the price went down.

Note: Beginners should watch the market and see how news and trends change prices before spending a lot.

Store and Protect Your Crypto

Create a Secure Wallet

Every beginner needs a secure wallet to keep crypto safe. Cold wallets are the best for new users. These wallets keep private keys offline. This keeps them away from hackers and online dangers. Cold wallets are easy to use and set up. Many people pick hardware wallets like Ledger or Trezor. These give strong protection for bitcoin, ether, and other coins. Paper wallets can also store coins offline. Users must keep paper wallets in a safe spot.

Here’s a quick look at how hardware wallets compare to software wallets:

| Aspect | Hardware Wallets | Software Wallets |

|---|---|---|

| Nature of Storage | Offline (Cold Storage) | Online (Hot Storage) |

| Connection to Internet | Rarely connected | Always connected |

| Risk of Online Attacks | Low | Higher |

Transfer and Store Safely

When moving or storing cryptocurrency, people should be careful. Picking the right wallet is important. Hot wallets are easy to use but less safe. Cold wallets are safer because they keep keys offline. Hardware wallets lower the risk of online attacks. Some use paper wallets for bitcoin or ether. They make more than one copy and store them safely.

Other smart moves include:

- Use strong and different passwords with a password manager.

- Turn on two-factor authentication for all crypto accounts.

- Back up wallets and keep backups in safe places.

- Update software to stop new threats.

- Never share private keys or keep them online.

Security Tips

Crypto owners face many dangers. Hackers and scams try to steal private keys. Social engineering tricks people into giving away secrets. Sometimes, smart contracts have bugs that let attackers steal money. Even people inside a company can cause trouble. Rug pulls happen when developers take investor money and leave.

To stay safe, users should:

- Watch out for fake emails and websites.

- Keep only a small amount in hot wallets.

- Use safe internet and antivirus software.

- Make sure loved ones can get their crypto in emergencies.

Tip: Learning about new security risks helps protect bitcoin, ether, and other coins.

Learn and Manage Risks

Monitor Investments

It is important to watch your crypto investments often. Beginners can use apps or websites to see prices and how their coins are doing. Many people learn from trusted news and updates about the market. They follow good sources to avoid mistakes. Here are some easy ways to keep learning:

- Look for trusted and smart sources. Good information helps you not make mistakes.

- Learn the basics first. Knowing about blockchain and mining helps you understand the market.

- Know how things work. Learning how to buy, sell, and handle risks helps you make better choices.

Tip: Crypto prices change fast. Checking your investments often helps you act quickly and keep your money safe.

Taxes and Regulations

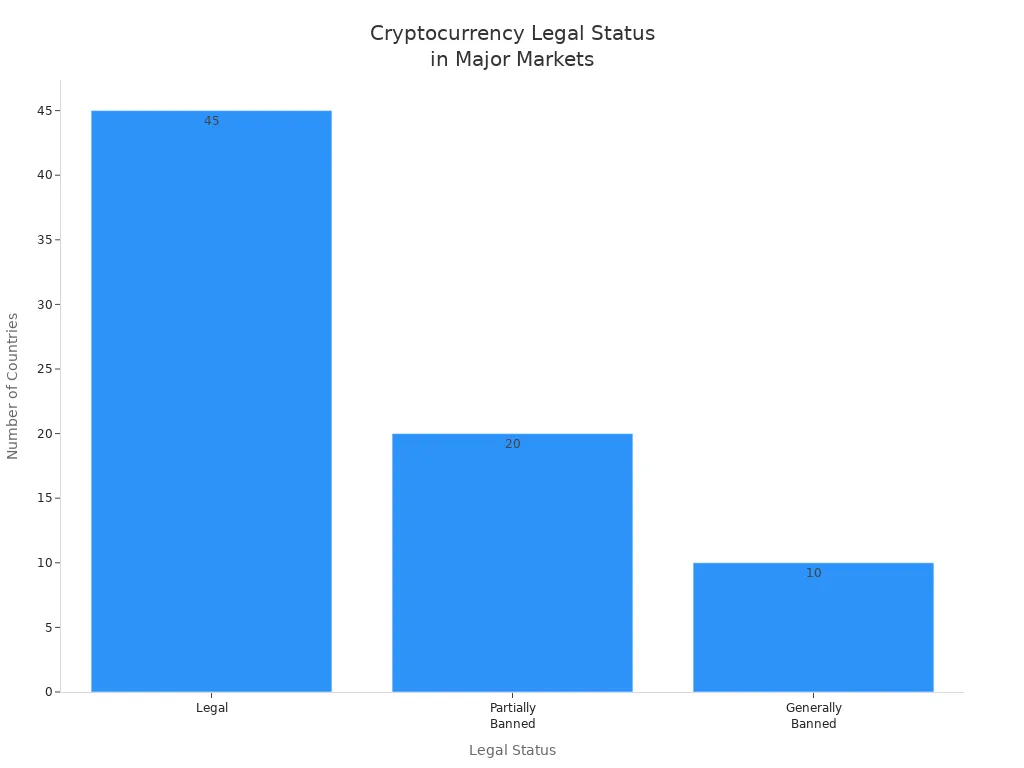

Crypto has tax rules and laws that can change. In the U.S., these rules can be hard to understand. Some states have different rules, and federal laws can mix in. Here is a table that shows how countries treat crypto:

| Legal Status | Number of Countries |

|---|---|

| Legal | 45 |

| Partially Banned | 20 |

| Generally Banned | 10 |

People in the U.S. must tell the government if they make or lose money with crypto. The table below shows when you have to pay taxes:

| Tax Event | Description |

|---|---|

| Selling Crypto for Fiat | Tell if you made or lost money when you sell. |

| Buying Goods and Services | Tell if you made or lost money when you buy things. |

| Trading One Crypto for Another | Figure out if you made or lost money when you trade. |

| Receiving Cryptocurrency as Salary | Count it as income; later gains or losses are capital gains. |

| Staking Rewards | Count as income at the value when you get it. |

| Mining Rewards | Count as income at the value when you get it; miners can subtract costs. |

Note: Rules can change. Learn about new laws and ask a tax expert if you are not sure.

Avoid Scams

Scammers try to trick beginners in crypto every day. They may promise free money or make big claims with no proof. Some pretend to be real companies and steal coins. Here are scams to watch out for:

- Rug pulls: Creators make a token, raise the price, then run away.

- Pump and dumps: Scammers talk up a coin, then sell and leave others with losses.

- Fake apps: Apps that look real but steal your money.

- Giveaway scams: Promises of free money if you follow steps.

- Impersonation scams: Scammers pretend to be real people or companies.

Other tricks are fake exchanges, phishing emails, and Ponzi schemes. To stay safe, you should:

- Only invest what you can lose.

- Be careful with offers that sound too good or pyramid schemes.

- Change your passwords often and use cold wallets for your coins.

- Take time to learn about crypto and stick to simple steps.

- Do your own research and avoid coins that seem too perfect.

Stay careful and keep learning. Scammers always try new tricks in crypto.

Beginners can start investing in cryptocurrency by following a few simple steps. They pick a safe platform, create a secure account, and begin with a small amount. They watch out for fees and keep their coins in a secure wallet. The market moves quickly, so they stay alert and learn from trusted sources.

Here are the most important things to remember:

- Start small to manage risk and avoid big losses.

- Watch for fees on different exchanges.

- Use secure storage for your coins.

- Get ready for price swings and speculation.

- Stay alert for scams and fake offers.

He should always learn more about crypto and only invest what he can afford to lose. They can read news, join online groups, and ask questions to stay informed.

FAQ

What is the safest way for a beginner to store cryptocurrency?

Most beginners pick hardware wallets for safety. These wallets keep coins offline. This helps stop hackers and scams. Some people use paper wallets too. Always back up wallet info. Never share your private keys with anyone.

What should someone do if they lose access to their crypto wallet?

He should look for backup phrases or recovery keys. Most wallets give a recovery phrase when you set them up. If he wrote it down, he can get his wallet back. Without this, getting coins back is almost impossible.

What fees can beginners expect when buying cryptocurrency?

Exchanges charge different fees for trades. Some take a small percent each time you buy or sell. Others add fees when you take out or put in money. Beginners should check the fee chart before buying. Comparing platforms can help save money.

What are the signs of a crypto scam?

Scams promise big returns very fast. Fake websites or apps may ask for private keys. Some scammers pretend to be famous people. If something sounds too good, it is likely a scam. Always check carefully before sending money.