Lowest Transaction Fee Cryptocurrency Guide for Smart Traders

2025-09-12 09:19:05

Smart traders want to pay the lowest transaction fee cryptocurrency. This helps them keep more profit. In April 2024, Bitcoin’s average fee went up to $91.89. This happened after the halving event. Ethereum’s average fee went down by over 54% in the last year. Now, it is at 0.4309. Transaction fees and spreads can change how much traders earn or lose. These costs depend on trading style, asset liquidity, and fee structures. Traders should compare exchange and wallet fees. This helps them make better choices and avoid losing money to high costs.

Key Takeaways

- Smart traders keep more money by picking cryptocurrencies with low fees like Bitcoin, Ethereum, Nano, and Ripple. They do not spend much on fees.

- It is important to compare exchange fees. Find platforms with low maker and taker fees. This helps you earn more money.

- Using native tokens for trades can give big discounts on fees. Always check for new deals and offers.

- If you withdraw coins when the network is not busy, you pay less. Try not to take out coins during busy times.

- Choose wallets that do not charge platform fees. You only pay network fees when you send coins. This saves you money.

Lowest Fees Overview

Lowest Transaction Fee Cryptocurrency

Many traders search for the lowest transaction fee cryptocurrency to save money. Recent data shows that Bitcoin and Ethereum now offer some of the lowest fees in the market. Bitcoin fees have dropped to their lowest levels since 2011. Ethereum’s fees also fell sharply over the past year. These changes help traders keep more of their profits.

Some cryptocurrencies use special technology to lower costs. Nano uses Directed Acyclic Graph (DAG) technology. This system does not need miners, so users pay almost no fees. Ripple uses a consensus method called RPCA. This method allows fast and cheap transactions. Bitcoin Cash increases block size, which helps the network handle more trades at once. Stellar uses an efficient protocol that keeps costs low.

Network congestion affects fees. When fewer people use the network, fees go down. Timing matters. Traders who send coins during quiet periods often pay the lowest fees. Smart traders watch the network and choose the best time to move their money.

The lowest transaction fee cryptocurrency changes over time. Traders should check fee data often. They can choose coins like Bitcoin, Ethereum, Nano, Ripple, or Stellar to get the lowest fees. Each coin has strengths. Some work better for trading, while others suit transfers.

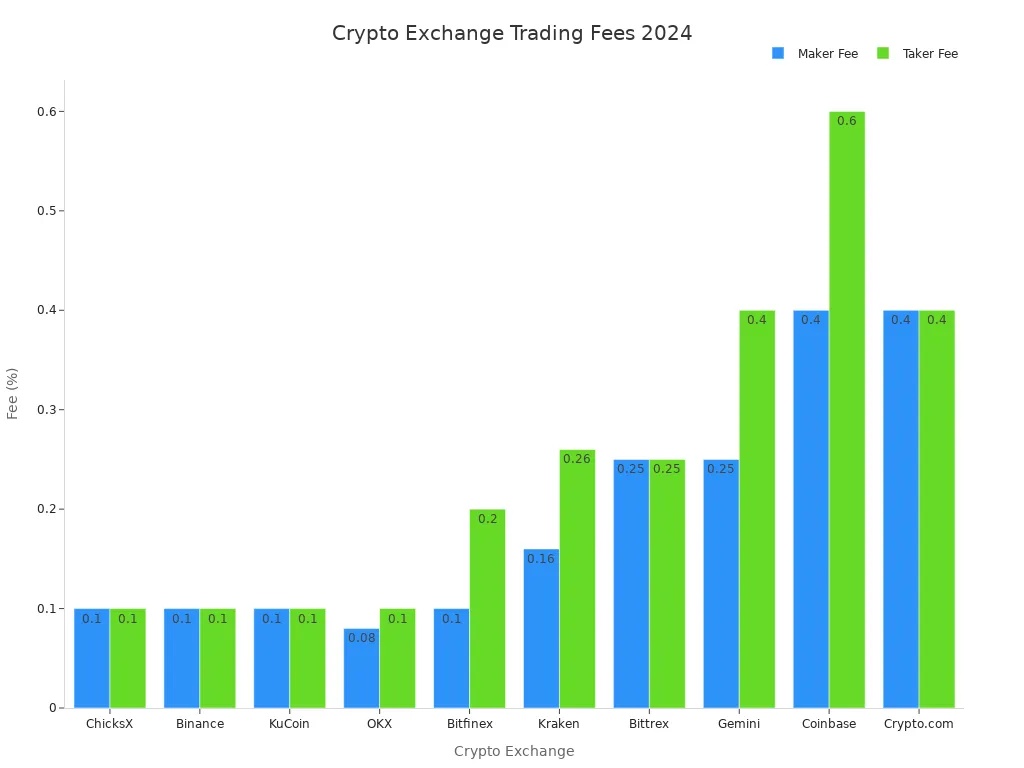

Crypto Exchange with Lowest Fees

Choosing the right exchange helps traders find the lowest fees. Exchanges set different rates for trading, deposits, and withdrawals. The table below shows the main exchanges and their fees in 2024.

| Crypto Exchange | Maker Fee | Taker Fee | Withdrawal (BTC) | Fiat Deposit |

|---|---|---|---|---|

| ChicksX | 0.1% | 0.1% | $5 | 0.5% |

| Binance | 0.1% | 0.1% | $15-25 | 1-4% |

| KuCoin | 0.1% | 0.1% | $20 | 2-3% |

| OKX | 0.08% | 0.1% | $10-15 | 2-3% |

| Bitfinex | 0.1% | 0.2% | $15-20 | 1-3% |

| Kraken | 0.16% | 0.26% | $10 | 0-3.75% |

| Bittrex | 0.25% | 0.25% | $25 | 3% |

| Gemini | 0.25% | 0.40% | Free (10/mo) | 0-3.49% |

| Coinbase | 0.40% | 0.60% | $25+ | 1.49-3.99% |

| Crypto.com | 0.40% | 0.40% | $20-50 | 2.99% |

ChicksX, Binance, KuCoin, and OKX offer the lowest fees for trading. OKX has the lowest maker fee at 0.08%. ChicksX charges only $5 for Bitcoin withdrawals, which is the lowest among top exchanges. Binance and KuCoin also keep trading fees low, but their withdrawal costs are higher.

Traders should compare exchanges before choosing where to trade. Some exchanges offer lower fees for users who trade large volumes. Others give discounts for using their native tokens. Smart traders look for the lowest transaction fee cryptocurrency and the lowest fees on exchanges. This helps them keep more profit and avoid high costs.

Tip: Traders can save money by picking exchanges with low maker and taker fees. They should also check withdrawal and deposit costs before moving funds.

Trading Fees Breakdown

Maker and Taker Fees

Crypto exchanges charge users with maker and taker fees. Makers help the market by placing limit orders. Takers fill orders that are already there. Most exchanges give makers lower fees than takers. This helps keep the market busy.

The table below shows common maker and taker fee ranges for top exchanges:

| Exchange | Maker Fee Range | Taker Fee Range |

|---|---|---|

| Kraken | 0.00% to 0.26% | 0.10% to 0.26% |

| Gemini | 0.00% to 0.20% | 0.03% to 0.40% |

| Coinbase | 0.00% to 0.40% | 0.05% to 0.60% |

| Bitstamp | 0.00% to 0.50% | 0.03% to 0.50% |

People who trade a lot care about trading fees. They can pay less by picking exchanges with better rates. They can also act as makers instead of takers.

- Makers pay less because they help the exchange work well.

- Takers pay more since they use up the market’s liquidity.

- Smart traders look at these fees and change how they trade to save money.

Tip: If traders learn about maker and taker fees, they can pay less and keep more profit.

Withdrawal and Network Fees

Withdrawal and network fees matter when moving crypto out of an exchange. These fees depend on the coin and how the network works. The table below shows average withdrawal fees for some popular cryptocurrencies:

| Cryptocurrency | Withdrawal Fee | Network Fee |

|---|---|---|

| Bitcoin | 0.0006 BTC | Varies |

| Ethereum | N/A | N/A |

| Solana | N/A | N/A |

| Litecoin | N/A | N/A |

| Dogecoin | N/A | N/A |

| Cardano | N/A | N/A |

| Monero | N/A | N/A |

| Toncoin | N/A | N/A |

| Exodus Swap | 0.5-2% | N/A |

When lots of people use the network, fees can go up. If blocks are full, fees rise. If blocks are empty, fees can drop, but this may hurt security. Some experts want to change blockchain rules to keep fees steady and make transactions faster.

Note: Traders should look at withdrawal and network fees before moving their crypto. Picking the right time can help them avoid high fees when the network is busy.

Crypto Exchange Comparison

Fee Structures

When you compare crypto exchanges, you need to look at their fees. Each exchange has its own rules for trading, deposits, and withdrawals. The main fees are trading, deposit, and withdrawal fees. Trading fees use the maker and taker model. Makers place limit orders and add liquidity. Takers fill those orders and remove liquidity. Most exchanges give makers lower fees.

Deposit fees can be high, especially for fiat money. Some exchanges charge 3-5% for fiat deposits. Wire transfers and SEPA payments may have set fees. Withdrawal fees change based on the method and currency. Some exchanges let you use ACH for free and have low SEPA withdrawal fees. This is good for people in the US and Europe.

The table below compares spot trading and withdrawal fees for Coinbase, Kraken, and Bitvavo:

| Feature | Coinbase | Kraken | Bitvavo |

|---|---|---|---|

| Spot Fees (Maker/Taker) | 0.40% / 0.60% | 0.16% / 0.26% | 0.10% / 0.25% |

Note: Lower spot trading fees help traders keep more profit, especially when trading often.

Fiat deposit and withdrawal fees are important too. Many exchanges let you use ACH for free, but wire transfers can cost $10 to $25. SEPA deposits are cheap, sometimes only €0.15. Swift withdrawals in GBP may cost £1. These differences show why it is smart to compare exchanges.

- Fiat Deposit Fees:

- ACH: Free

- Wire (USD): $10 USD

- SEPA (EUR): €0.15 EUR

- Swift (GBP): Free

- Fiat Withdrawal Fees:

- ACH: Free

- Wire (USD): $25 USD

- SEPA (EUR): Free

- Swift (GBP): £1 GBP

Exchanges also make money from the spread. This is the gap between buy and sell prices. Some platforms charge funding rates for derivatives. But spot trading fees are the most important for most users. New rules, like the SEC allowing in-kind creations, have helped lower trading costs on some platforms.

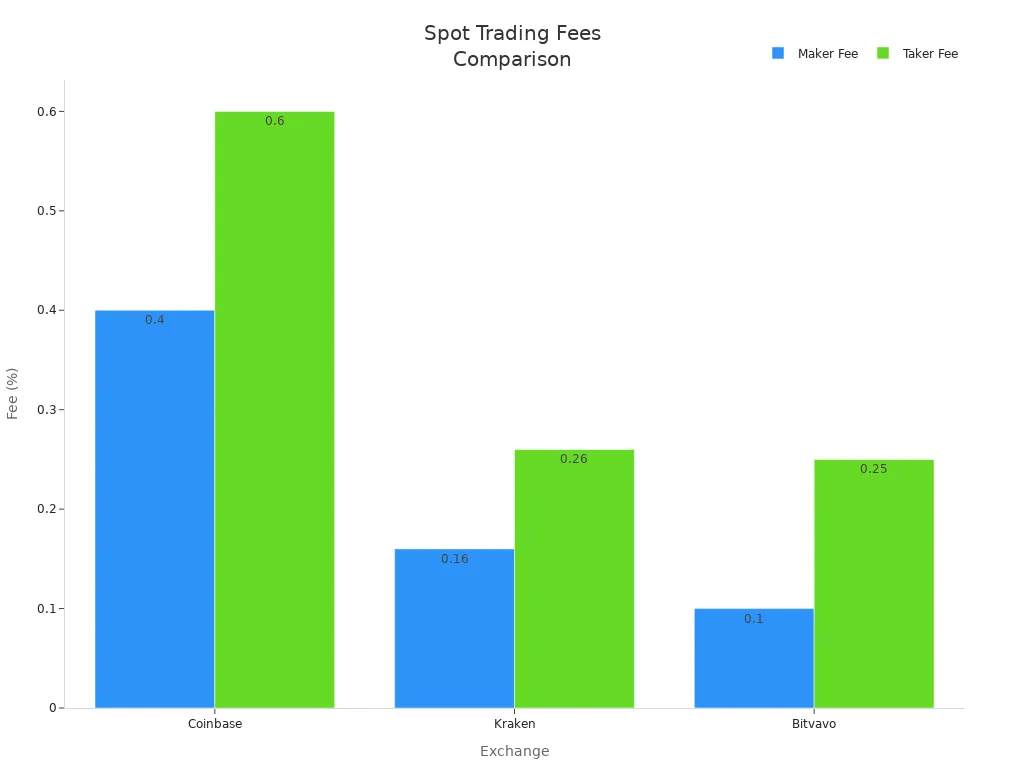

Spot Trading Fees

Spot trading fees are a big part of comparing exchanges. These fees decide how much you pay when you buy or sell coins. The average spot trading fee is about 0.1% per trade. Some exchanges have even lower fees for big traders or users of native tokens.

The chart below compares maker and taker spot trading fees for Coinbase, Kraken, and Bitvavo:

Bitvavo has the lowest spot trading fees of these three. Kraken also has good rates, especially for makers. Coinbase charges higher spot trading fees, which can add up for active traders.

Looking at more exchanges, Binance and Binance.US offer spot trading fees as low as 0.10%. Crypto.com goes even lower, starting at 0.075% with more discounts for VIPs. Robinhood says it has zero commission, but spreads can be wide. Bitstamp uses a tiered system, with 0% for low volume and lower rates for higher volume.

| Exchange | Spot Trading Fee | Additional Notes |

|---|---|---|

| Binance | 0.10% | Lower fees with BNB payment or high volume |

| Binance.US | 0.10% | Zero-commission on specific pairs |

| Robinhood | 0% | Commission-free, but spreads apply |

| Crypto.com | 0.075% | Further discounts through VIP programs |

| Bitstamp | Tiered system | 0% for low volume, lower for higher volume |

| BYDFi, OKX, Gate.io, MEXC | 0.1% or less | Token-based or VIP discounts available |

Some exchanges give lower spot trading fees to high-volume traders. KuCoin starts at 0.10% and goes lower for VIPs or KCS token users. Bitfinex starts at 0.10% for makers and 0.20% for takers, with discounts for big trades or LEO token holders. Kraken has 0.16% maker and 0.26% taker fees, which drop for people who trade more.

- KuCoin: 0.10% to start, lower for high volume or KCS token users.

- Bitfinex: 0.10% maker, 0.20% taker, discounts for LEO token holders.

- Binance US: 0.1% maker/taker, extra discounts for BNB holders.

- Crypto.com: 0.075% for VIPs.

Each exchange has its own strengths. Kraken supports over 200 cryptocurrencies and has advanced tools. Binance US lets you trade many coins and use different payment methods. KuCoin has lots of trading options and promotions. Bitfinex is made for big traders and has advanced features.

Tip: Traders should check the fee structure and spot trading fees before picking an exchange. Comparing exchanges helps users find the best value and avoid hidden costs.

A smart trader looks at all the fees before choosing an exchange. Comparing these details helps users keep more profit and avoid surprises.

Wallet Fees

Zero-Fee Wallets

Many traders want wallets with low fees. Some wallets charge no platform fees and only require users to pay network fees. Exodus, Trust Wallet, Electrum, Mycelium, Coinomi, and BRD all offer zero platform fees. MetaMask charges only network fees but adds a small fee for swaps. The table below shows how these wallets compare:

| Wallet Name | Transaction Fees | Notes |

|---|---|---|

| MetaMask | Only network fees | Charges 0.875% for swaps |

| Exodus | No fees | Only network fees apply |

| Trust Wallet | No platform fees | Only network gas fee |

| Electrum | No fees | Only network fees apply |

| Mycelium | No fees | Only network fees apply |

| Coinomi | No fees | Only network fees apply |

| BRD | No fees | Only network fees apply |

Traders who use these wallets can avoid high deposit fees. They only pay the network fee when sending coins. This helps them keep more profit and reduce trading costs. Many users choose wallets with low fees to save money on every transaction.

Tip: Picking a wallet with zero platform fees means users only pay the network fee, which is often much lower than exchange withdrawal or deposit fees.

On-Chain vs. Off-Chain

Wallet fees depend on how users transfer their coins. On-chain transfers record every transaction on the blockchain. These transfers often have higher fees, especially when the network is busy. Off-chain transfers use payment channels or networks like Lightning. These methods process transactions outside the blockchain and record only the final balance on-chain.

| Method | Fee Range |

|---|---|

| On-Chain | $1-50+ depending on congestion |

| Off-Chain | $0.01-0.50 typically |

| Method | Fee Type |

|---|---|

| On-Chain | Higher fees |

| Off-Chain | Lower or no fees |

Some wallets support off-chain transfers. They use the Lightning Network for Bitcoin. This allows instant transactions with minimal fees. Off-chain transfers help traders avoid high deposit fees and keep costs low. Instant transactions also make trading faster and cheaper.

- Off-chain transfers support low fees and quick payments.

- On-chain transfers may cost more during busy periods.

- Traders who want low fees should look for wallets that support off-chain methods.

Wallet fees play a big role in trading costs. Smart traders compare deposit fees and choose wallets with low fees. They also check if a wallet supports off-chain transfers to save even more.

Minimize Fees

Use Native Tokens

Many exchanges give discounts if you use native tokens for fees. Binance users who pay with BNB get big fee cuts. OKX lets users save up to 40% by paying with OKB. BMX holders on some platforms get 25% off transaction fees. These deals help traders keep more money.

| Exchange | Native Token | Fee Discount |

|---|---|---|

| Binance | BNB | Significant |

| OKX | OKB | Up to 40% |

Traders can use limit orders instead of market orders. Limit orders help them skip taker fees, which are higher. Some exchanges have special deals like fee-free trading or bonuses for using native tokens. Checking the promotions page often can help traders find new ways to save.

Tip: Using native tokens and limit orders can lower trading costs. Traders should look for special events and bonuses to save more.

Timing Withdrawals

When you withdraw matters for network fees. Lower fees happen when the network is not busy. If fewer people use the blockchain, miners process transactions faster and charge less. When many people use it, fees go up because miners pick higher-paying transactions first. A busy mempool means longer waits and higher costs.

Traders who withdraw on weekends may see lower gas prices. They can save money by picking quiet times for their transactions. Good ways to lower withdrawal fees include:

- Learning about exchange fees, spreads, and blockchain withdrawal fees.

- Trying out trades to compare total costs on different platforms.

- Picking exchanges with many fiat on/off ramps to avoid delays and extra costs.

- Asking about cut-off times and FX spread rules to avoid surprise charges.

- Making sure client funds are kept in separate accounts for better tracking.

Note: Smart traders plan withdrawals when the network is quiet and check exchange rules. This helps them avoid high fees and keep more of their money.

Beyond Fees

Security vs. Cost

Smart traders know low fees are good, but safety is also important. Strong security on exchanges and wallets keeps users safe from fraud and theft. Features like encryption and fingerprint logins help protect accounts. These tools can also lower transaction fees by stopping fraud.

- Digital wallets with strong security usually cost less than old payment ways.

- Secure wallets help groups handle money better, especially for many payments.

- Lower fees from safe wallets help people who trade or send money a lot.

When picking a platform, traders should think about both price and safety. Some blockchains have low fees and can handle lots of trades, but their security is not the best. Others focus on keeping money safe, but this can mean higher fees. The table below shows how some popular platforms compare:

| Platform | Scalability | Security | Utility |

|---|---|---|---|

| Solana | High | Lower security | High growth potential |

| Avalanche | High | Lower security | High growth potential |

| Ethereum | Moderate | High security | Stable ecosystem support |

| BNB Chain | Moderate | Moderate security | Niche advantages |

| Cardano | Moderate | High security | Long-term development focus |

Traders need to find a balance between low fees and strong safety. If a platform is not safe, users could lose money, even if fees are cheap.

User Experience

User experience changes based on how much a platform charges. Exchanges with low fees often work faster and let you use more coins. Platforms with high fees can be slow and have fewer choices.

| Feature | Rise | Remote.com |

|---|---|---|

| Cost Structure | Flexible pricing | $599/month + 2% |

| Processing Speed | Instant | Multi-day delays |

| Crypto Features | 100+ coins | 3 options |

| Minimum Costs | No minimums | High base fees |

| User Experience | Streamlined and efficient | Cumbersome due to costs |

Traders who use platforms with flexible prices and fast service have an easier time. They can pick from many coins and do not pay big base fees. High-fee platforms can slow things down and give fewer options, which makes trading harder.

Tip: Smart traders pick exchanges with low fees and easy-to-use designs. A simple platform helps them trade fast and handle money without worry.

Smart traders choose the best cryptocurrency exchange by looking for low fees and strong features. The table below shows exchanges with the lowest trading fees in recent reports:

| Exchange | Trading Fee |

|---|---|

| Binance | 0.03% |

| Bybit | 0.03% |

| OKX | 0.03% |

| Deribit | 0.03% |

Wallets like Trust Wallet and Exodus also help users save money with zero platform fees. Traders must compare fee structures often because costs can change and affect profits. The best crypto exchange offers clear fees and easy access to many coins. To minimize costs, traders use these strategies:

- Place limit orders for lower maker fees.

- Hold native tokens for fee discounts.

- Batch transactions to reduce network fees.

- Pick the cheapest crypto exchange for withdrawals.

- Use VIP tiers for frequent trading.

- Watch for free trading promotions.

Reviewing trading habits and switching to lower-fee options helps traders keep more profit and reach their goals.

FAQ

What is the best way to find a no fee crypto exchange?

Traders can look online to compare different crypto trading platforms. They should search for exchanges that say they have zero fees or very low fees. Reading reviews helps people see if there are hidden costs. Reviews also show if there are withdrawal or wallet transfer fees.

How do withdrawal fees affect profits on a crypto trading platform?

Withdrawal fees take away some of the money traders get when they move funds from an exchange or crypto wallet. If withdrawal fees are high, traders make less profit. Smart traders pick exchanges with good fees and always check withdrawal fees before moving money.

Why do fees change on different exchanges?

Each exchange decides its own fee rules. Some exchanges have zero fees for some trades. Others charge more for withdrawals or deposits. Fees can change because of trading volume, coin type, or special deals. Traders should check for fee changes often.

Are wallet transfer fees different from exchange withdrawal fees?

Wallet transfer fees are charged when moving coins between crypto wallets. Exchange withdrawal fees happen when taking money out of a crypto trading platform. Both fees depend on the network and the platform used. Comparing these fees helps traders save money.

How can traders avoid high transaction fees?

Traders can use exchanges with zero or low fees. Doing transactions when the network is not busy helps lower costs. Using native tokens on a crypto trading platform can also cut fees. Checking wallet transfer and withdrawal fees before trading keeps costs down.