What Is a Bitcoin Spot ETF? And How Can Investors Buy It?

2024-01-12 12:58:55

Key points:

A Bitcoin Spot ETF refers to an exchange-traded fund that directly holds Bitcoin, allowing its shares to be traded on a stock market.

On January 10 in the U.S. time zone, the U.S. Securities and Exchange Commission officially granted approval to 11 Bitcoin Spot ETFs, allowing users to begin trading these ETFs on the market.

On January 10th in the US time zone, the SEC officially approved proposals for 11 Bitcoin spot ETFs, and users can now begin trading these Bitcoin spot ETFs in the market. So, what exactly is a Bitcoin spot ETF, and why is the market eagerly anticipating its approval? Furthermore, once the Bitcoin spot ETF is approved, how can retail investors go about purchasing it? For an in-depth guide on investing in Bitcoin spot ETFs, please read this article to find out more.

1. What is the ETF?

ETFs, short for Exchange Traded Funds, are also known as exchange-traded open index funds. Essentially, ETFs are index funds that are tradable on stock exchanges, similar to individual stocks. These funds generally show price correlation with stocks and bonds and are actively traded on financial exchanges. ETFs can be bought and sold freely in the secondary market, facilitating an easier investment environment and prompt withdrawal for retail investors. They combine the attributes of mutual funds and stocks, providing a diversified investment portfolio along with the flexibility and liquidity that are typically associated with stocks.

Typically managed by fund management companies, ETFs are pooled investments similar to mutual funds. However, unlike mutual funds, ETFs trade on stock exchanges like stocks or bonds and track specific indexes, sectors, or asset classes, such as gold. They often encompass a diverse range of stocks, meticulously curated for each ETF. This approach offers a cost-effective and efficient investment method, enabling investors to conveniently target specific industries, markets, or asset classes. Therefore, ETFs have surged in popularity among both retail and institutional investors as innovative investment tools thanks to ETFs' accessibility and diversified nature.

2. What is the Bitcoin Spot ETF?

An ETF (Exchange-Traded Fund) by definition implies that a Bitcoin spot ETF would be a publicly traded fund primarily invested in Bitcoin. Numerous cryptocurrency exchanges currently offer investment opportunities in Bitcoin spots. However, for the traditional investment management industry, which manages trillions of dollars in assets, directly investing in or purchasing Bitcoin on the market often isn't feasible. This hesitancy is due not only to concerns over fund safety but also because of the strict regulatory rules that most investment companies must adhere to when dealing with these trading platforms or exchanges.

Therefore, if major fund management companies wish to invest in Bitcoin, they must do so prudently and in compliance with traditional finance regulations. This is the primary reason why major asset management companies are applying for Bitcoin spot ETFs. A Bitcoin spot ETF provides a legal, reasonable, transparent, regulated, and safe investment avenue for asset management companies globally. It facilitates the investment of a substantial amount of traditional financial products in Bitcoin. This aspect is also a key selling point in the current applications for a Bitcoin spot ETF.

Investing in Bitcoin through a Bitcoin spot ETF tends to carry lower investment risks compared to other methods. However, it's important to note that it adheres to traditional investment rules, and typically, the investment returns are lower than those gained from directly buying the Bitcoin spot on a cryptocurrency exchange. As for retail investors, especially those with smaller capital, buying Bitcoin directly from cryptocurrency exchanges is likely to yield better returns, in contrast to institutional or whale investors who might prefer the ETF route.

>> Click here to buy Bitcoin directly <<

3. What Is the Difference Between a Bitcoin Spot ETF and a Traditional ETF?

The primary distinction between Bitcoin Spot ETFs and traditional ETFs lies in the types of assets they target. Bitcoin Spot ETFs concentrate on investing directly in Bitcoin, as opposed to stocks, bonds, or other traditional assets. Therefore, the performance of Bitcoin Spot ETFs is directly influenced by the price fluctuations in the Bitcoin market. In contrast, traditional ETFs typically track the performance of a specific stock index, industry, commodity, or other asset class. Therefore, while Bitcoin Spot ETFs provide a focused approach to investing in cryptocurrency, traditional ETFs offer broader exposure to a variety of market sectors and investment opportunities.

4. Why Do the Crypto Markets Expect the Bitcoin Spot ETF to Be Approved?

Following almost two years of instability, marked by a significant decline in Bitcoin's value and the collapse of numerous cryptocurrency companies, the declaration made on Wednesday, January 10 is expected to be positively received by many cryptocurrency market investors. For several months, market participants have been eagerly awaiting regulatory approval, and this anticipation has contributed to a remarkable increase of approximately 70% in Bitcoin's price since October 2023. This surge is largely attributed to the belief among crypto investors that the widespread adoption of Bitcoin ETFs would boost the demand for the digital currency. Here are several scenarios people might expect following the Bitcoin spot ETFs’ approval.

There will be massive inflows of traditional capital into the crypto market: The approval of the Bitcoin spot ETF signifies the integration of substantial funds from the traditional financial market into the crypto market. This implies that there might be further tailwinds for the coming of the crypto bull market.

It indicates that Bitcoin will become compliant: Currently, the regulations for the crypto market are not fully developed, and there are some shortcomings in crypto supervision. The introduction of Bitcoin spot ETF products suggests that cryptocurrencies are on the verge of entering a traditional finance trading market with more comprehensive mechanisms and mature rules. This advancement will significantly diminish trading risks for investors and provide a mature investment approach for Bitcoin to traditional investors.

5. Which Bitcoin Spot ETF Applications Have Been Approved?

Only financial institutions with adequate compliance capabilities and experience in managing crypto assets are qualified to issue Bitcoin Spot ETFs. Typically, the entities issuing Bitcoin Spot ETFs are financial institutions like fund companies or investment management firms. These institutions must obtain approval from relevant financial regulatory agencies and adhere to stringent regulatory standards. These standards include many aspects such as transparency, asset custody, risk management, and investor protection.

In various countries and regions, the issuance of Bitcoin Spot ETFs must also align with local regulations and guidelines. Notably, 11 financial institutions have recently garnered significant attention for their approval to issue Bitcoin Spot ETF products in the U.S. These institutions include Ark Invest, BlackRock, Grayscale, Invesco, Bitwise, WisdomTree, Valkyrie, and Fidelity. Investors can access and purchase these Bitcoin Spot ETF products through corresponding banks or brokerage companies on various platforms. The U.S. SEC approved 11 Bitcoin spot ETFs and the following products are listed below:

ARK 21Shares Bitcoin ETF (ARKB)

Blackrock's iShares Bitcoin Trust (IBIT)

Grayscale Bitcoin Trust (GBTC)

Invesco Galaxy Bitcoin ETF (BTCO)

Bitwise Bitcoin ETF (BITB)

WisdomTree Bitcoin Fund (BTCW)

Valkyrie Bitcoin Fund (BRRR)

Fidelity Wise Origin Bitcoin Trust (FBTC)

VanEck Bitcoin Trust (HODL)

Franklin Bitcoin ETF (EZBC)

Hashdex Bitcoin ETF (DEFI)

6. Where Can I Purchase a Bitcoin Spot ETF?

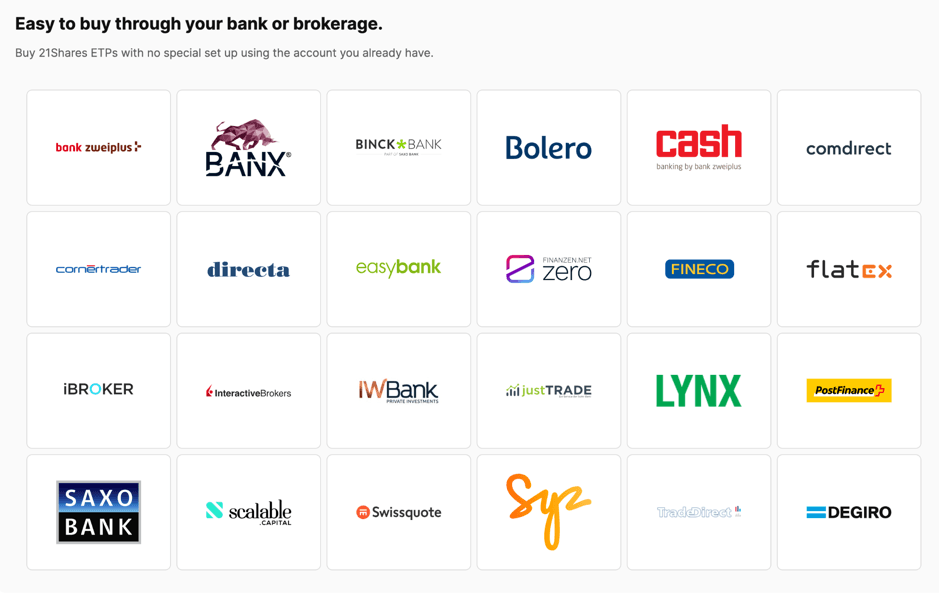

When it comes to investing in cryptocurrencies, Bitcoin Spot ETFs have emerged as a popular and accessible option for many investors now. This type of ETF tracks the actual price of Bitcoin, providing a more direct exposure to the cryptocurrency's performance compared to other types of Bitcoin-related investments. Here are several ways for investors to easily purchase stocks through banks or brokerages.

Image Source: 21Shares

Only institutions with the appropriate licenses and adherence to strict regulations are authorized to issue Bitcoin spot ETF products. Once financial institutions receive approval to launch these products, other financial services companies such as securities brokers, investment advisory firms, banks, and other authorized platforms will manage their sales. These companies must possess the necessary qualifications and comply with the financial regulatory standards of their respective countries or regions. Additionally, they are required to hold the appropriate licenses and qualifications for selling such financial products. It is also imperative for these service companies to provide investors with transparent information, including details about product features, associated risks, and potential returns. This ensures that investors can make well-informed decisions.

Usually, retail investors should first set up an account with a relevant financial services company. It is crucial for investors to verify the company's requirements and the supervisory authority of the platform. This step is essential to ascertain the legality of the products offered and to protect themselves from potential fraud.

7. How Can Retail Investors Buy Bitcoin Spot ETFs?

Before diving into the specifics of opening your account, it's crucial to understand the landscape of Bitcoin spot ETFs for retail investors. Bitcoin spot ETFs offer a direct investment in the cryptocurrency without the complexities of managing digital wallets or navigating the intricacies of the crypto market. This investment option is increasingly accessible, but its availability and the process to invest can vary based on your geographic location and compliance with local financial regulations.

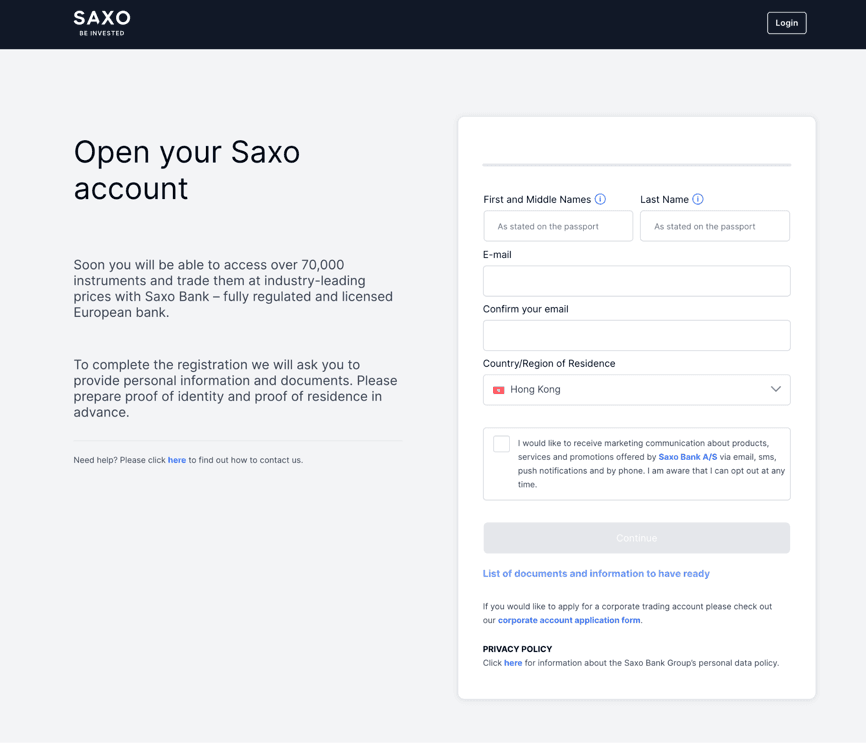

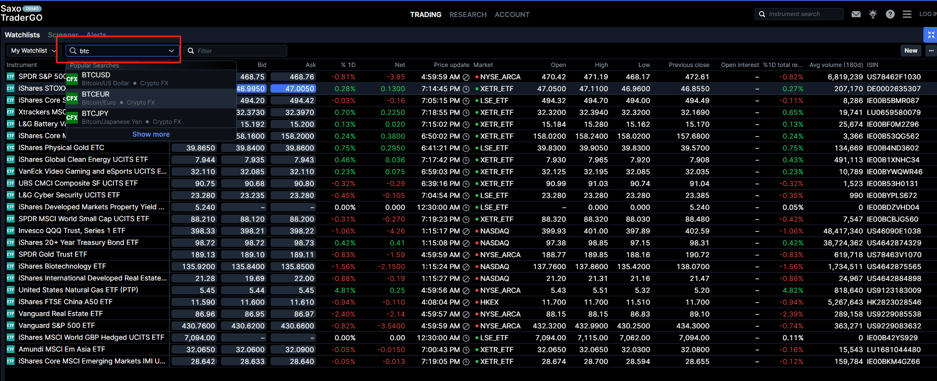

7.1 Open Your Account

Retail investors have various options for setting up an account to purchase Bitcoin spot ETFs, depending on their location and local compliance policies. In the United States, platforms like Robinhood or Charles Schwab can be utilized to gain access to Bitcoin spot ETF investments.

Image Source: Saxo Bank

To purchase Bitcoin spot ETF products, it is necessary to have an account with a relevant institution, such as SAXO Bank. Users who do not have an account can apply online to open either a stock account or a securities investment fund account through the stock exchange's app. Alternatively, they can visit the business firms of the stock exchange company to apply for a stock account in person. Once the account is opened, they can deposit the funds they wish to invest into this securities account.

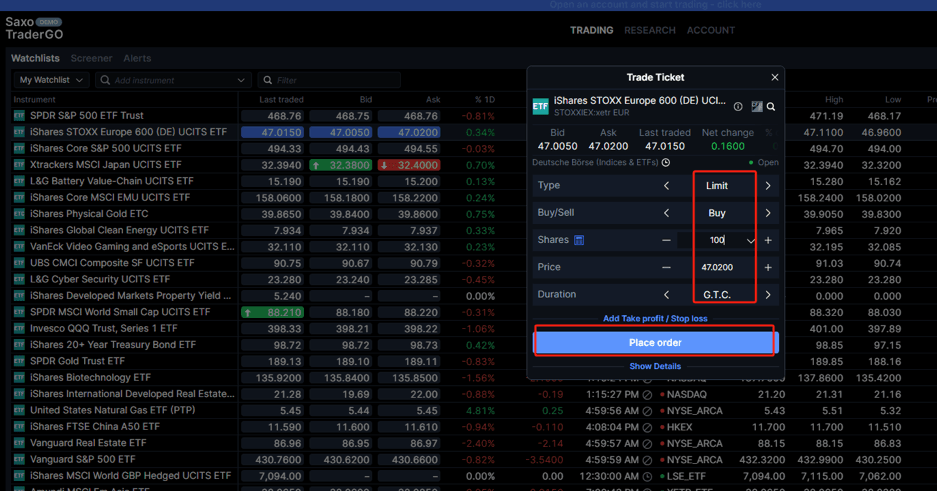

7.2 How to Trade the Bitcoin Spot ETFs?

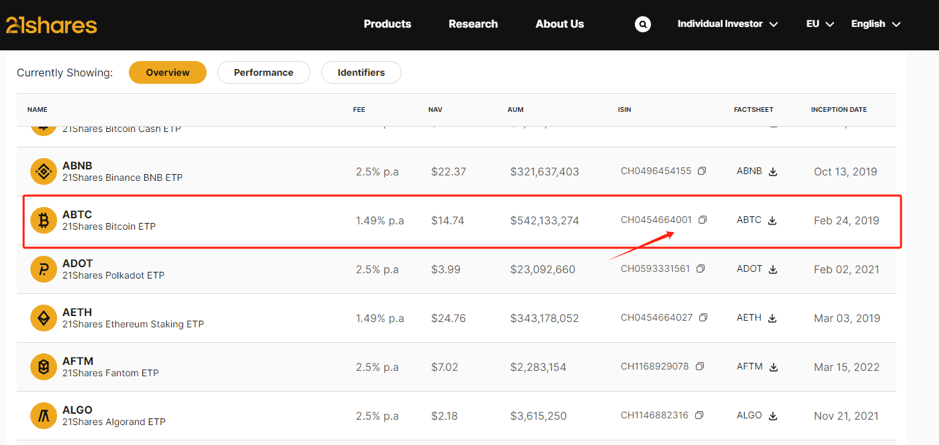

Image Source: 21Shares

Locate the ISIN code for the specified Bitcoin spot ETF product on the official website of the approved ETFs, and copy it.

Image Source: Saxo Bank

During daily trading hours, retail investors can look up the specific ISIN code for Bitcoin spot ETF products on the SEC approval trading platform. They can then enter the number of shares they want to purchase and confirm their order. The process for redemption operations is similar.

Image Source: Saxo Bank

It is important to recognize that traditional financial firms are subject to numerous limitations, including restricted trading hours, constraints on price fluctuations, and specific timings for buying and selling. Recent information obtained from a financial institution's application reveals that the Bitcoin spot ETFs currently under consideration are limited to fiat transactions only. This means that during the redemption process, users receive fiat instead of actual Bitcoin. While this approach mitigates certain risks, it also introduces a significant inconvenience for trading. For those aiming to maintain long-term holdings in Bitcoin, the flexibility of 24/7 trading, the ability to deposit and withdraw at any time, and the use of both directional leverage and futures strategies are essential. These features underscore the unique appeal of trading in Bitcoin.

>> Click here to buy Bitcoin directly <<

Conclusion

Those platforms authorized to issue Bitcoin spot ETF products are financial institutions approved by the relevant government regulations. Meanwhile, those permitted to sell Bitcoin spot ETF products are financial investment service companies that possess the necessary qualifications. To date, the SEC has approved applications from 11 companies for the issuance of Bitcoin spot ETF products. Retail investors are advised to closely monitor the online progress of these Bitcoin Spot ETF Products offered by financial institutions. This proactive approach can enable them to make timely investment decisions and potentially achieve superior returns.

Bitcoin Spot ETF FAQs

Q: What is a Bitcoin Futures ETF?

A: Bitcoin Futures ETF is an exchange-traded open-end fund that invests in Bitcoin futures contracts, as opposed to direct investment in actual Bitcoins. This ETF is listed on traditional stock exchanges and allows investors to indirectly engage in the Bitcoin market by purchasing shares of the ETF. Unlike direct Bitcoin investments, the Bitcoin Futures ETF invests in futures traded on formal exchanges, which mitigates the storage and security risks typically associated with cryptocurrencies. It offers an alternative for investors seeking exposure to Bitcoin through traditional financial market platforms.

Q: What is an Ethereum Spot ETF?

A: The Ethereum Spot ETF is an exchange-traded fund that exclusively invests in actual Ethereum (ETH). Listed on traditional stock exchanges, it enables investors to gain exposure to Ethereum indirectly through the purchase of ETF shares, without the need for direct acquisition or management of the cryptocurrency. The value of this ETF is directly influenced by the price fluctuations in the Ethereum market, offering investors a relatively straightforward and secure method of Ethereum investment. It also reduces the risks linked with the direct purchase and custody of the cryptocurrency. The Ethereum Spot ETF appeals to those seeking to participate in the cryptocurrency market via traditional investment tools.

Q: What Is the Minimum Purchase Amount for a Bitcoin Spot ETF?

A: The minimum purchase amount for a Bitcoin Spot ETF varies based on the specific fund's regulations and the issuing entity. This detail is typically outlined in the ETF's prospectus or related documentation. For most investors, the entry for ETFs is generally low, often equivalent to the market price of a single ETF share (a few to several dollars), enabling flexible investment according to individual capacity and preferences. However, the exact minimum purchase amount can differ among funds and market conditions. Investors are advised to thoroughly review relevant documents or consult a professional financial advisor before investing.

Q: Why Invest in Bitcoin Spot ETF?

A: Bitcoin spot ETFs offer an efficient way for investors to gain exposure to Bitcoin's price through conventional brokerage accounts, providing a transparent and regulated option. They allow retail customers and traditional financial institutions to invest without using crypto exchanges, broadening access to digital assets. These ETFs are expected to have a dynamic and liquid market, supported by liquidity pools and major trading firms. They represent a significant advancement in establishing cryptocurrency as a tradable asset class.

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. For more information, please refer to here. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.