What Is Futures Premium? Understanding Crypto Market Trends Through Futures Market Term Structure

2025-12-09 06:46:11

In the crypto derivatives market, the ability to assess whether the BTC and ETH trend is healthy, whether leverage is becoming crowded, and whether price action is in a recovery phase or approaching overheating hinges largely on two structural indicators: Futures Premium and Futures Basis. In traditional finance, basis is considered foundational to interpreting futures markets. In crypto, where futures and perpetual swaps consistently generate more volume than spot, the long-short balance of the market is increasingly shaped by leveraged capital. As a result, price is never just how much one BTC costs, but rather a reflection of how many participants are willing to take leveraged exposure, absorb funding costs, and pay a premium for future positioning. Futures premium is the metric that quantifies this collective market willingness.

1. Futures Premium and Futures Basis: From Formula to Market Structure

In futures markets, the relationship between futures prices and spot prices forms the backbone of how traders interpret leverage, risk appetite, and structural trends. This relationship is expressed through what the industry calls futures basis, a measure of how much more or less the market is willing to pay for future exposure compared with holding spot today. Whether the basis is positive or negative provides valuable insight into how traders perceive upcoming risks, funding conditions, and expected price direction. Only after understanding this context does the definition become intuitive that the basis represents the difference between a dated futures contract and the current spot price. It can appear as a premium when futures trade above spot, or a discount when they trade below it.

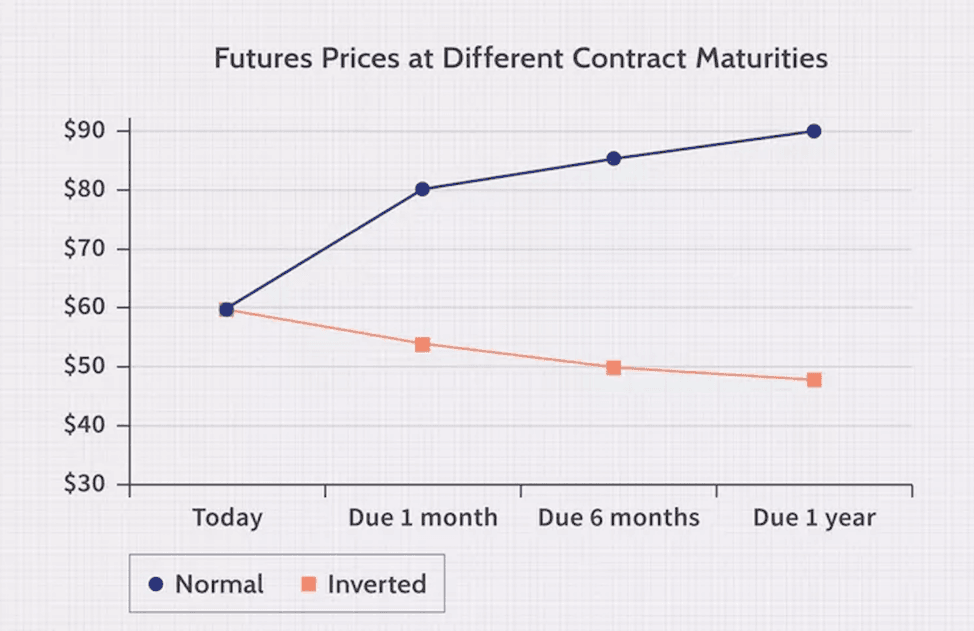

In traditional commodities and financial derivatives, futures commonly trade at a premium because the futures price embeds interest rates, financing costs, storage, and insurance. This produces the familiar Contango structure—an upward-sloping curve that reflects the natural cost of carrying a position forward in time.

Typical Contango and Backwardation futures curves, source: Investpedia

Crypto markets operate without storage or physical delivery costs, so the drivers of basis differ. Instead, capital costs, leverage demand, and market risk compensation become the dominant forces shaping futures premium. Analysts often observe the annualized basis, such as the annualized spread between BTC’s three-month futures and spot, to quantify how expensive it is to hold leveraged long exposure over time.

A key structural feature of basis is its convergence toward spot as contracts approach expiry. Because all futures settle against a spot index or reference price at maturity, a wide gap near expiry creates an attractive arbitrage opportunity. Traders can lock in low-risk returns through basis trades or cash-and-carry arbitrage, pushing futures and spot closer together. This convergence behavior is fundamental across all futures markets, and crypto is no exception.

2. Why Does Futures Premium Exist in Crypto? Three Structural Drivers

From a structural standpoint, futures premiums in crypto are shaped by the interaction of three key forces: leveraged long demand, capital costs, and market-priced risk premia. Understanding how these elements reinforce or offset one another is essential for distinguishing a healthy bullish environment from one driven by excessive leverage buildup.

- Leveraged long demand: During strong market phases, traders and institutions prefer taking leveraged exposure through futures or perpetuals rather than buying spot. When leveraged long demand grows, buy-side pressure pushes futures above spot, resulting in a positive premium. This is especially visible during BTC or ETH price breakout phases.

- Capital cost and funding environment: Even without physical storage, capital has a price. Borrowing coins, collateral leverage, off-exchange financing, and stablecoin lending rates all influence the cost of holding long leverage. When interest rates rise, either in global markets or within crypto lending, futures embed a higher risk premium, lifting the futures premium. This is why BTC’s 3-month annualized basis in a healthy market often sits around 5–10%.

- Risk and volatility pricing: Futures premium also reflects uncertainty about future volatility. When traders anticipate higher volatility, event risk, or macro catalysts, they demand a higher premium for taking long futures exposure. When volatility compresses or confidence softens, premium naturally declines.

3. How to Identify Futures Premium Levels: From Neutral to Overheated

When reading futures premium, the key is not a single number but the zone it falls in, how long it stays there, and whether it moves in sync with the spot price.

1) Near-zero or slight positive premium (0–3%)

A futures premium that hovers near zero or only slightly positive usually reflects a derivatives market that has not yet committed meaningful leverage, even if spot prices are beginning to recover. In these environments, traders typically prefer direct spot exposure rather than paying to extend positions through dated futures, and any early uptrend tends to be driven predominantly by spot flows and low-leverage participants. This structure often appears in post-liquidation stabilization phases or during early-cycle accumulation, where uncertainty still suppresses aggressive leveraged activity. Because leverage is light, the market carries relatively little embedded liquidation risk, making these recoveries slower, steadier, and structurally more resilient.

2) Moderate premium (5–10%)

When the premium rises into the mid-range, it usually signals the return of a healthier Contango structure, where the market is willing to pay a moderate cost for forward exposure. Leverage becomes active but remains well-distributed rather than crowded, and both spot and derivatives flows begin reinforcing one another. This is the structural regime most conducive to durable trend formation: the market expresses confidence through its willingness to pay a reasonable premium, yet speculative pressure has not reached levels that distort price discovery or elevate liquidation sensitivity. Many sustained bullish phases spend extended periods in this range because it reflects a balanced interaction between conviction and risk management.

3) Elevated premium (15–20% or higher)

Premiums that escalate toward 15% to 20% or higher indicate a very different environment, one characterized by crowded leverage, directional chasing, and rising fragility beneath the surface. At these levels, a significant share of market exposure is leverage-dependent, margin buffers thin out, and the system becomes hypersensitive to even modest volatility spikes. A minor drawdown can rapidly cascade into large-scale liquidations as overextended long positions unwind. While elevated premiums often coincide with strong momentum on the surface, the underlying structure becomes increasingly unstable, and the likelihood of abrupt reversals grows materially.

Across all regimes, the basis fundamentally captures the market’s cost of leverage and its aggregate risk appetite. Higher premiums convey stronger conviction but also greater sensitivity to adverse price moves. Conversely, low premiums signal light leverage, reduced fragility, and conditions frequently associated with early-stage accumulation or post-cleansing rebuilds. Understanding how these ranges evolve provides valuable insight into whether a trend is strengthening, stabilizing, or entering a phase of structural vulnerability.

4. Futures Premium vs Funding Rate vs Futures Curve Structure

Many newcomers confuse futures premium, funding rates, and the futures curve structure, but each measures a different dimension.

- Futures Premium (Basis): The structural price difference between dated futures and spot, which is used to evaluate leverage demand and risk compensation over time.

Funding Rate: A short-term mechanism in perpetual swaps to anchor prices back to spot.

Positive funding = longs paying shorts → leveraged longs concentrated.

Negative funding = shorts paying longs.

- Futures Curve (Contango vs Backwardation): This shows the price structure across all maturities.

Contango → upward sloping, reflects moderate optimism.

Backwardation → downward sloping, often signaling short-term stress or supply imbalance.

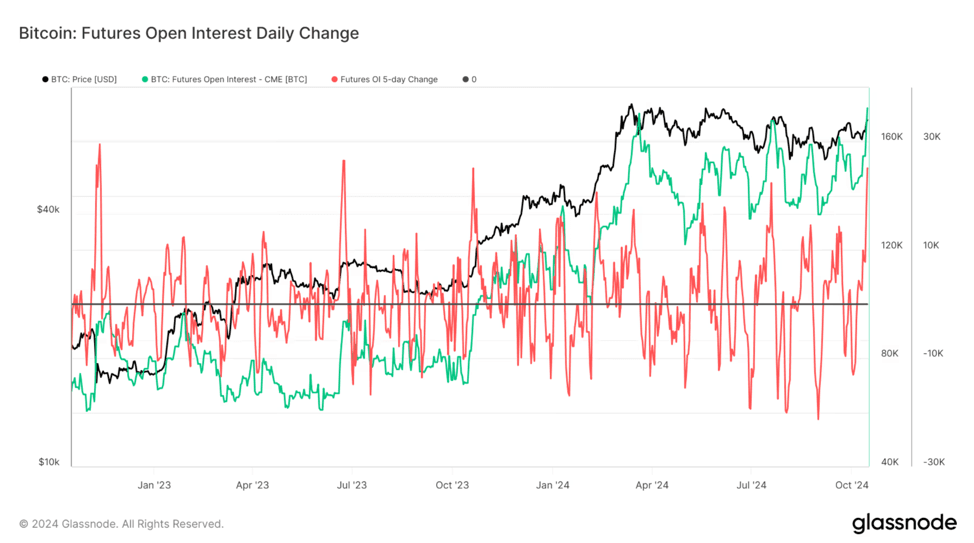

When basis, funding, and curve slope all lean bullish, spot and derivatives flows are mutually reinforcing, but the risk of overcrowding rises. When the basis is healthy but funding is neutral, uptrends tend to be more stable. When both surge together, overheating becomes the primary risk. Open interest (OI) is a critical supplementary indicator. Elevated OI combined with high basis and high funding often marks the most fragile phase of a leveraged uptrend.

CME Bitcoin Futures Open Interest trend (2024–2025), source: Glassnode

5. How to Use Futures Premium in Trading and Risk Management?

Futures premiums have significant practical value because they help traders evaluate trend strength, leverage density, and overall market risk.

- When BTC or ETH prices rise, but the futures premium remains suppressed, it signals that leverage has not yet followed the move. In this scenario, the market is still operating in a spot-driven structure where price appreciation is supported mainly by unleveraged flows. Such environments tend to produce steadier, less fragile uptrends because the market carries relatively little embedded liquidation risk.

- When the premium begins to expand and moves higher in tandem with price, it suggests that the market is transitioning into a more balanced and healthier trend cycle. Leverage starts to align with spot demand, indicating that traders are increasingly willing to pay a forward cost to maintain long exposure. This alignment between spot and derivatives flows often leads to more coherent and sustainable momentum.

- However, when the premium accelerates into excessively high territory, the apparent strength of the trend can mask an underlying buildup of fragile leverage. At elevated premium levels, long positioning becomes increasingly dependent on borrowed capital, and even a modest downside move can trigger large-scale liquidations. For this reason, traders typically reduce leverage, widen stop levels, or adopt partial hedges whenever the market enters a high-premium regime to manage systemic risk.

For more advanced participants, futures premium also forms the foundation of cash-and-carry arbitrage. When the positive basis becomes sufficiently large, buying spot while shorting futures allows traders to lock in future returns with relatively low directional risk. This is an approach particularly attractive to institutional capital with lower risk tolerance. For most market participants, however, the essential principle remains straightforward: an elevated premium is a clear sign of crowded leverage and an early warning of rising structural vulnerability.

Conclusion

Futures premiums quantify the additional cost the market is willing to pay to hold long exposure, making them one of the most essential indicators for assessing leverage dynamics in crypto markets. When premiums remain within a reasonable range, the underlying structure tends to be healthier, with leverage distributed more evenly across participants. But when premiums expand rapidly, it often signals accelerating leverage buildup and a growing fragility beneath the surface. Understanding the movement of futures premiums is effectively understanding the heat of market leverage, and it allows traders to gauge, with far greater accuracy, whether a prevailing trend has genuine continuation potential or is becoming structurally vulnerable.

FAQ

Q1: Does a high futures premium guarantee that prices will rise?

No. A high premium simply means leveraged long positions are aggressive. It does not ensure upward continuation. In fact, when leverage becomes more in demand, the market turns more fragile. If price pulls back even slightly, those leveraged positions can trigger liquidation cascades, accelerating the downturn instead of supporting the rally.

Q2: Does a low premium mean the market is weak?

Not necessarily. A low premium often appears when spot buyers lead the market and leverage has not yet re-entered. Many strong and sustainable rallies actually start in these low-basis environments, where the market structure is cleaner and less vulnerable to forced selling.

Q3: Which is more important: futures premium or funding rate?

They measure different aspects of market behavior. Futures premium reflects the structural leverage, indicating how much the market is willing to pay for forward exposure. Funding rates capture short-term leverage pressure in perpetual swaps. Professionals monitor both, because relying on one alone can lead to misreading overall market conditions.

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. For more information, please refer to here. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.