FameEX Today’s Crypto News Recap | January 30, 2026

2026-01-30 05:33:44

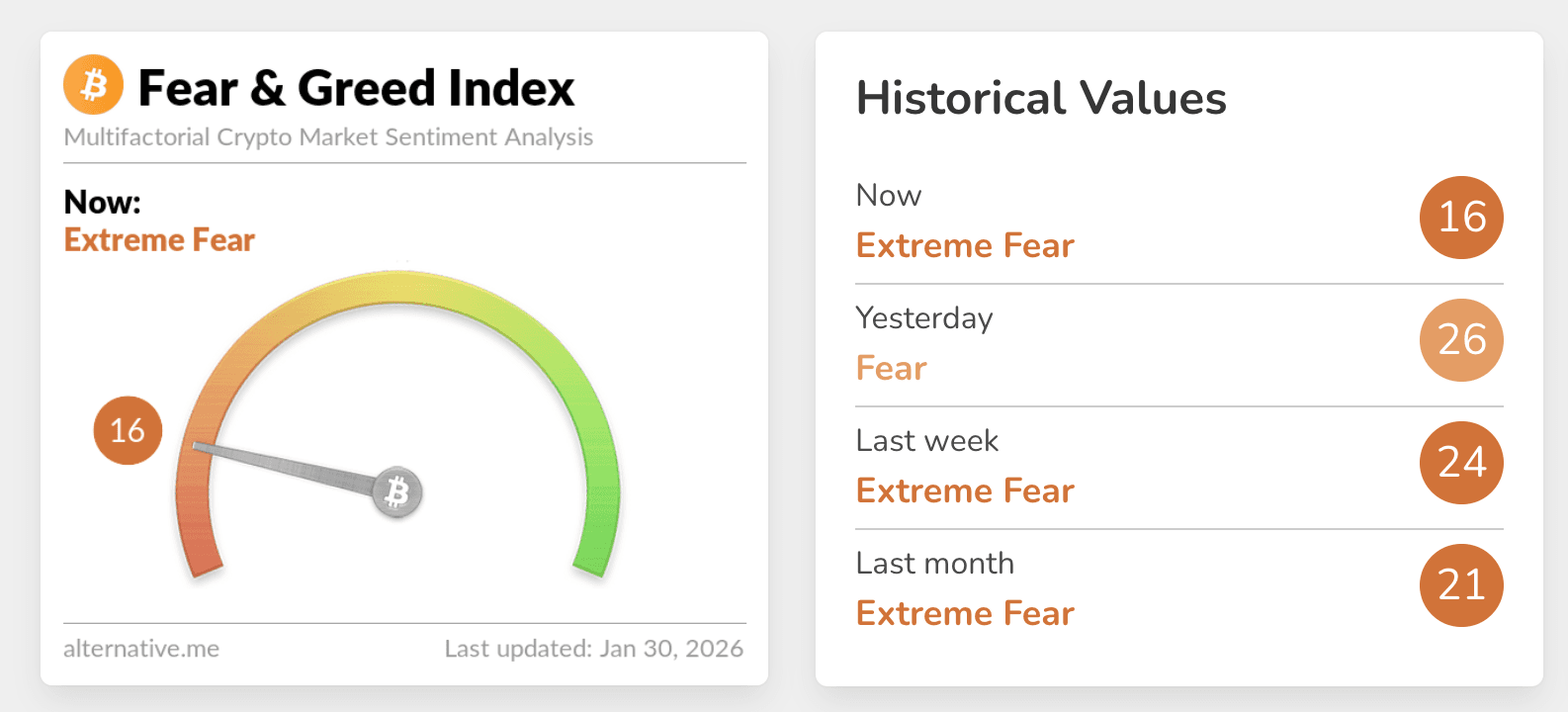

Europe launched a staked Solana ETP, expanding regulated access to blockchain yield. Crypto markets stabilized after futures deleveraging, with sentiment in Extreme Fear as BTC and ETH consolidated. Following an aggressive futures-led deleveraging phase, crypto markets saw a brief price stabilization, but overall conditions remain defensive, with limited evidence of a renewed expansion in risk appetite. The latest rebound appears driven mainly by the release of liquidation pressure and short-term covering, rather than by sustained spot buying or a structural rebuilding of demand. Capital flows continue to favor caution, as market participants prioritize margin management and exposure control. At the same time, the concentration of liquidation clusters in derivatives markets has made prices more sensitive to marginal moves, increasing the likelihood of cascading liquidity reactions. Ongoing macroeconomic and political uncertainty further constrains upside participation, keeping the market environment closer to consolidation and stabilization than to a genuine recovery.

Crypto Markets Overview

The Crypto Fear & Greed Index is at 16, holding in Extreme Fear and signaling that the market’s emotional state remains dominated by capital preservation rather than expansion. In this environment, Bitcoin continued to function as the market anchor. Liquidity and attention gravitated toward BTC as participants reduced exposure across higher-beta segments, using BTC as the primary defensive allocation within crypto. Ether’s performance remained structurally constrained because its derivatives market has shown heightened liquidation reflexivity. Small price changes can trigger forced flows that amplify moves, which in turn discourages discretionary re-risking. Altcoin activity was therefore selective and narrative-driven, with flows clustering around infrastructure and settlement rails rather than broad speculative breadth. This is consistent with a consolidation regime where positioning, margin dynamics, and liquidity conditions dictate intraday structure more than organic demand.

Source: Alternative

BTC Dropped to $83K but Follow-Through Remains Limited

Bitcoin’s move through the $83K region unfolded as a liquidity event rather than a clean directional break, with follow-through constrained by leverage cleanup and a lack of sustained spot absorption. Over the past 24 hours, total liquidations reached USD 1.78 billion, including USD 1.674 billion in long liquidations. This is an imbalance that points to crowded long exposure being forcibly reduced rather than a two-sided re-pricing process. BTC liquidations were also significant, with BTC long liquidations at USD 811 million and BTC short liquidations at USD 22.769 million, indicating that the bulk of the unwind occurred on the long side. Key liquidation-intensity levels remain well-defined. Downside sensitivity clusters around $80,117, while upside pressure is mapped near $88,477. This keeps BTC structurally boxed inside a leverage-defined range. In practical terms, this means price action is likely to remain reactive to liquidity pockets rather than showing persistent “chasing” behavior that would typically accompany a healthier recovery phase.

ETH Slips Below $2,700 as Liquidation Ladders Dominate Price Formation

Ether fell below the $2,700 level, trading down to $2,699.98 as price action was driven primarily by derivatives-led liquidations rather than spot-driven selling. Over the past 24 hours, ETH long liquidations reached USD 407 million, far exceeding USD 23.9 million in short liquidations, indicating a one-sided leverage unwind. Liquidation intensity remains tightly clustered, with downside sensitivity near $2,665 linked to approximately USD 738 million in potential long liquidations, while upside pressure near $2,941 corresponds to around USD 1.29 billion in short liquidation exposure. This stacked liquidation structure has made ETH highly reactive to marginal price moves, reinforcing flow-driven volatility. As leverage adjustments continue to dominate trading behavior, ETH’s intraday performance remains constrained, reflecting stabilization through deleveraging rather than directional conviction.

Key News Highlights:

Institutional Tokenization Activity Expands on Avalanche

Avalanche’s tokenized real-world asset footprint expanded meaningfully in Q4, with tokenized RWA TVL exceeding USD 1.3 billion, highlighting steady institutional experimentation in on-chain issuance, settlement, and securitized structures. BlackRock’s USD 500 million BUIDL launch acted as a focal catalyst for tokenized money-market style rails, while additional partnerships around tokenized loan securitization and index products reinforced a theme. Institutions are increasingly using public-chain infrastructure as a programmable ledger, even if they are not directly expressing that adoption through the L1 token in the short term. The market relevance lies in the growing separation between network utility metrics and token performance, a dynamic that can shape how participants price L1 exposure, especially in a regime where macro uncertainty keeps risk budgets tight and investors prefer “usage growth” narratives over pure momentum.

Federal Reserve Chair Nomination Raises Policy Uncertainty Across Risk Markets

Prediction markets priced a 95% probability that Kevin Warsh will be named the next Federal Reserve Chair, injecting policy-path uncertainty into broader risk sentiment. For crypto, the transmission mechanism is not about a single announcement’s direction, but about liquidity expectations: when markets perceive a higher probability of a more hawkish or less accommodation-friendly policy framework, risk assets tend to shift toward defensive positioning, tighter leverage, and reduced duration. This backdrop aligns with the day’s observed structure. This limited follow-through after sharp moves, elevated sensitivity to liquidation levels, and a preference for stability over expansion.

Europe Launches Staked Solana ETP, Integrating Blockchain Yield Mechanisms Within a Regulated Framework

European markets have recently introduced a Solana exchange-traded product (ETP) that incorporates Jito’s liquid staking mechanism, allowing investors to gain exposure to Solana’s proof-of-stake (PoS) assets through a listed product in traditional financial markets while embedding staking-derived yields into the product structure. The defining feature of this ETP is its ability to translate a native blockchain staking process into a regulated, exchange-listed investment vehicle, enabling institutional investors to access the underlying assets and associated yield without directly engaging in on-chain operations. By contrast, the U.S. market continues to take a more cautious regulatory stance toward liquid staking products, highlighting differences across jurisdictions in the design and approval of crypto-related financial instruments. This development illustrates how blockchain-native mechanisms are increasingly being incorporated into institutional investment channels through structures that align more closely with established financial frameworks.

Trending Tokens:

- $USAT (USA₮)

USA₮ drew attention as a U.S. dollar stablecoin positioned explicitly around internet-native settlement and everyday payments rather than exchange-centric trading activity. Issued by Anchorage Digital Bank, the project emphasizes a compliance-forward framing and a 1:1 redeemability narrative, directing market focus toward institutional issuance structure and reserve credibility. The recent availability via a major on-ramp strengthens the “distribution rail” storyline that stablecoins increasingly compete on access, settlement speed, and integrations rather than on yield or incentives.

- $LINEA (Linea)

Linea remained in focus as its Exponent program continued to channel measurable on-chain activity toward verified-user transactions, framing growth through usage rather than promotional signaling. As a zk-rollup operated by ConsenSys, Linea’s positioning centers on compatibility with Ethereum tooling while lowering execution costs, but the program’s deeper market significance lies in its economic design. Activity is linked to a dual-burn mechanism that connects network usage to value accrual for ETH and LINEA. This pushes the rollup discussion beyond “cheap fees” into monetization and sustainability. In a consolidation market, investors often prefer narratives where value capture is structurally tied to usage, because it reduces reliance on momentum and speculative beta. The Exponent structure also spotlights competition for builders and distribution, which is increasingly the real battleground among rollups.

- $BREV (Brevis)

Brevis drew attention following the ProverNet mainnet launch and the activation of BREV staking, marking a tangible milestone for decentralized ZK proof generation markets. Its core value proposition is infrastructure: enabling dApps to compute and verify arbitrary cross-chain data in a trust-minimized way, which can support data-driven DeFi, zkBridges, identity primitives, and user acquisition workflows that require verifiable computation. From a market-structure perspective, ZK proof marketplaces are increasingly discussed as “compute liquidity” layers, where proof generation becomes an on-chain service with pricing and capacity dynamics. The opening of staking and related participation mechanics signals a transition from concept to operational network, which matters in a year where infrastructure narratives are favored over purely speculative memes. Protocols with clear utility framing often attract attention because their demand is linked to application usage rather than sentiment alone.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.