FameEX Weekly Market Trend | June 21, 2023

2023-06-21 09:11:55

1. Market Trend

Between June 19 and June 20, the BTC price fluctuated between $26,255.85 and $27,179.03, with a volatility of 3.51%. According to the 1-hour candle chart, in the past two days, the BTC price movement has shown increased upper and lower wicks. Specifically, a significant observation was the clustering of these wicks around the 7-day moving average. The majority of the closing prices of the upper and lower wicks concluded near the average, with the lowest point above $26,000. This indicates a strong signal (filtering out unstable coin holders without causing any disruption to the market structure as a whole). The analysis from the previous market report, along with the current trend, validates the bullish outlook, maintaining the stop-loss level at $25,000. In terms of news, positive developments regarding liquidity policies and exchange compliance have emerged, further supporting the bullish sentiment in the market. Therefore, it is recommended to enter long positions. (please bear in mind that this is an individual opinion and does not constitute investment advice).

Source: BTCUSDT | Binance Spot

Between June 19 and June 20, the price of ETH/BTC fluctuated within a range of 0.06398 to 0.06562, showing a 2.56% fluctuation. Looking at the hourly candlestick chart, The ETH/BTC trend has remained weak, hitting new lows over and over again. The 7-day moving average has become the primary resistance level suppressing the coin’s price. Recently, the price has moved away from this cryptocurrency, indicating an independent downward trend. Therefore, it is advisable to primarily adopt a wait-and-see approach.

Based on overall analysis, the market recently has shown signs of recovery, with bullish sentiment prevailing. BTC has consecutively broken through significant resistance levels. The focal point now revolves around the price’s capacity to remain above the previously breached resistance levels. If the price successfully stabilizes, it will likely gain further upward momentum. However, if the price retraces, it is prudent to avoid impulsive buying during the dip. It is recommended to adopt a cautious approach and carefully observe the retracement situation before conducting a detailed analysis.

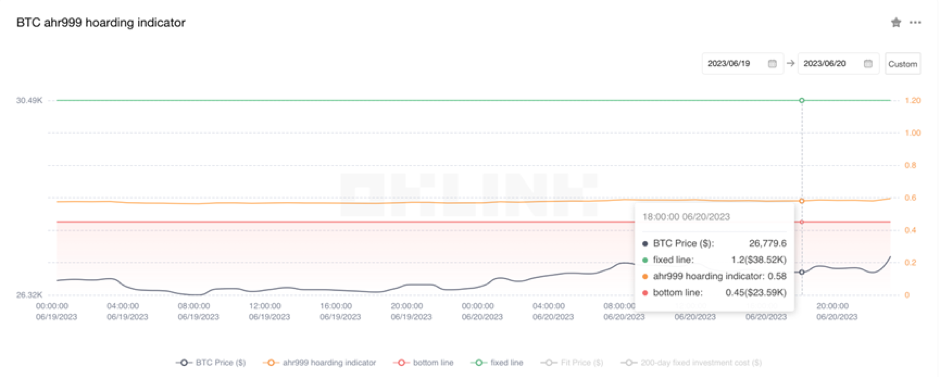

The Bitcoin Ahr999 index of 0.59 is above the buying-the-dip level ($23,590) but below the DCA level ($38,520). It is viable to purchase popular coins through DCA.

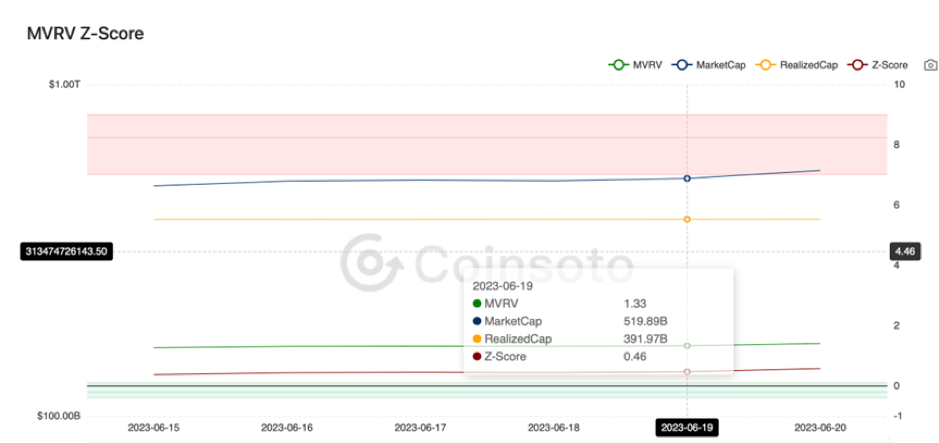

From the perspective of MVRV Z-Score, the value is 0.46. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buying-the-dip range (-0.44-0.14).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

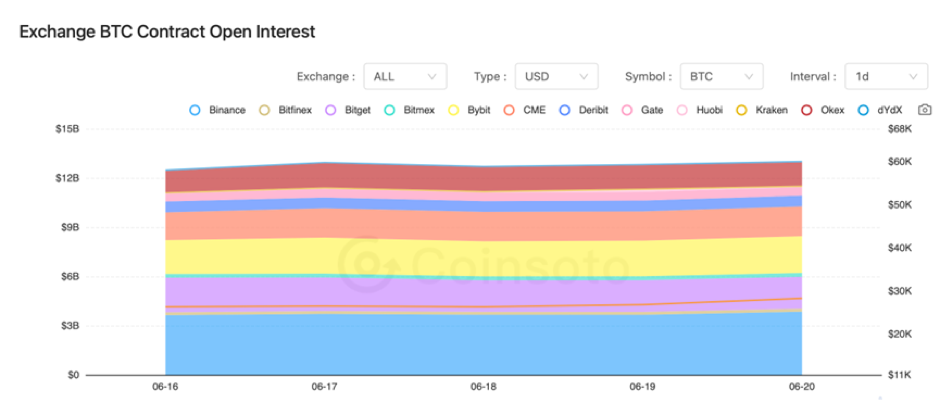

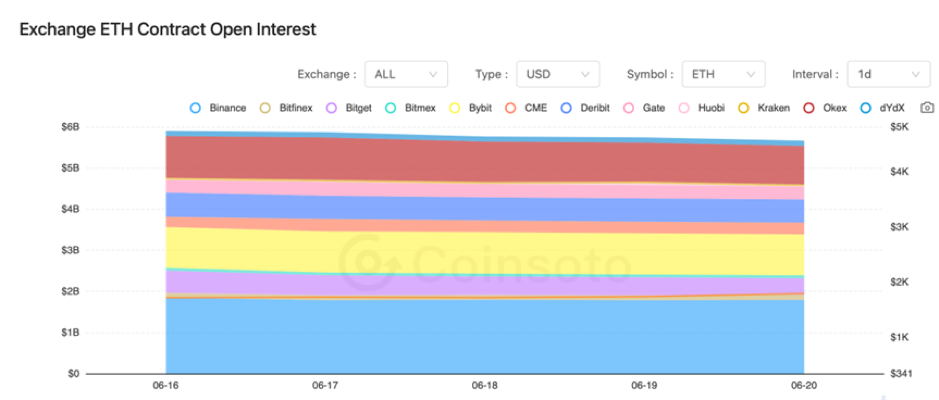

Between June 19 and June 20, the contract open interest of BTC and ETH from major exchanges basically remained unchanged.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On June 19, Tether’s market value dropped by nearly $500 million yesterday.

2) On June 19, Fidelity was reportedly considering acquiring Grayscale or applying for a Bitcoin spot ETF.

3) On June 19, Cobo Coo stated that 140 companies are applying for a virtual asset exchange license in Hong Kong.

4) On June 20, three unidentified Ethereum validators withdrew 72,000 ETH.

5) On June 20, after BlackRock applied for a Bitcoin spot ETF, GBTC surged over 12%.

6) On June 20, Mastercard submitted a new trademark application to introduce software for cryptocurrency and blockchain transactions.

7) On June 20, according to data, the average daily trading fees of GMX exceeded Uniswap in the past 7 days.

8) On June 20, EDX Markets, a cryptocurrency exchange supported by Citadel Securities, Fidelity, and Guggenheim Wealth Management, started executing trades.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.