FameEX Weekly Market Trend | October 7, 2023

2023-10-08 09:35:55

1. Market Trend

From Sept. 28 to Oct. 6, the BTC price fluctuated between $26,112.06 and $28,580.00, with a volatility of 9.45%. The prior analysis said that BTC could form a new trading range, with BTC briefly surging to $26,800 on Sept. 27 but retracing to $26,100 without falling below this level. It also stressed the importance of $26,000 (a break below $25,000 could trigger a new bear market starting from $25,000) with $25,000 as an exit point. On Sept. 29, BTC surged past $27,000 without a sharp pullback, maintaining stability around that level. This breakout differed from prior patterns (no rapid retracement after a swift surge and a noticeable increase in trading volume). As previously noted, BTC’s trend change requires a rapid high-volume surge to breach resistance levels. At 6:00 a.m. on Oct. 2, BTC swiftly surged 3 points in 5 minutes, backed by significant volume, breaking the crucial psychological barrier at $28,000. This event bolstered uptrend factors and stabilized the upward momentum. Currently, BTC’s price has hit the important 99-day MA at $28,200 on the daily chart, a highly significant development. The 99-day MA will play two roles in the short term, directly impacting BTC’s future development:

1. The right shoulder vertex in the entire daily chart structure

2. The starting point of a new uptrend (third major wave) since the retracement from the previous high of $31,000

Hence, the crucial support level now stands at approximately $28,200. Traders can opt for a cautious strategy by waiting for BTC to breach the daily chart’s 99-day MA and stabilize before entering, with the break below MA serving as an exit signal.

Source: BTCUSDT | Binance Spot

Between Sept. 28 and Oct. 6, the price of ETH/BTC fluctuated within a range of 0.05855-0.06257, showing a 6.87% fluctuation. The current ETH/BTC trend is extremely bearish, with all levels of moving averages in a bearish alignment. The price is at its lowest point in over a year, and the bearish trend is evident, overpowering any bullish sentiment. There are no signs of a rebound, and the trading volume for the downtrend far exceeds that of the uptrend. It is advisable to stay away from such cryptocurrency at the moment.

Based on overall analysis, the market has seen significant improvements in trading volume, activity, and capital inflow. This is attributed to the confidence instilled in most investors by the current trend of BTC, and many altcoins have reached a state where further declines are unlikely. In this scenario, following the upward movement of BTC can generate a strong profit effect (OP, ARB, CRV, etc.), leading to more capital involvement. BTC is once again facing a new challenge (whether it can break and stabilize at $28,200). The previous uptrend can be understood as halting the decline, while the new one can be seen as a shift from defense to offense. If BTC successfully challenges again, it will likely usher in a bullish market trend in the short term.

The Bitcoin Ahr999 index of 0.45 is between the buy-the-dip level ($27,550) and the DCA level ($45,000). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

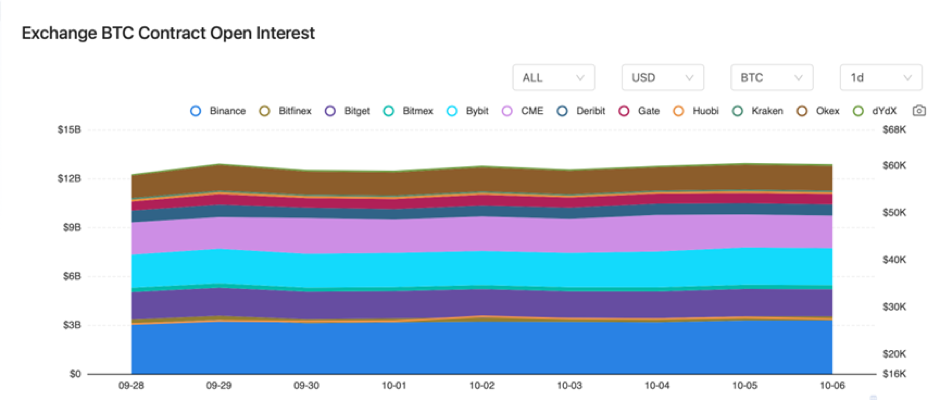

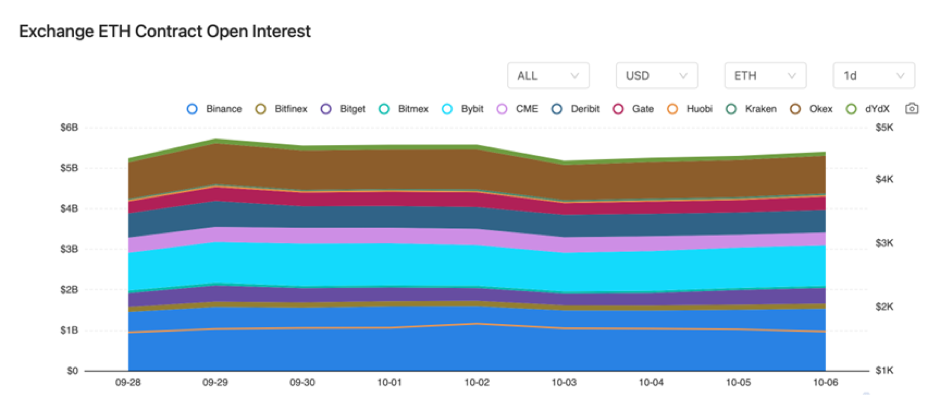

There were slight climbs in the BTC and ETH contract interest from major exchanges, with changes not being significant.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On October 1, Bloomberg analysts suggested that nine Ethereum futures ETFs might be approved simultaneously next Monday.

2) On October 1, Biden signed a short-term spending bill to avert a government shutdown in the United States.

3) On October 2, GSR Markets was conditionally granted a payment institution license in Singapore.

4) On October 2, the yield on the 10-year US Treasury bond rose to 4.689%, the highest level since 2007.

5) On October 3, the Governor of the Central Bank of Portugal stated that efforts to regulate cryptocurrencies by individual countries would not function properly without a global framework.

6) On October 3, the Federal Reserve’s Mester stated that the Fed might have reached or be close to the peak of its interest rate target.

7) On October 4, according to the Deputy Commissioner of Hong Kong Customs, Hong Kong Customs has no authority to regulate virtual currencies.

8) On October 4, the Temasek Group of Singapore would launch a $100 million venture capital fund by the end of the year, focusing on investments in the Web3 and digital asset sectors.

9) On October 5, the former Vice Chairman of the Federal Reserve indicated that the interest rate hike had come to an end.

10) On October 5, Optimism stated that approximately 230 million OP tokens, belonging to core contributors, are being transferred to institutional custodians.

11) On October 6, the United States added 336,000 jobs in September, surpassing the estimated 170,000.

12) On October 6, Komainu received approval from the UK FCA to provide cryptocurrency custody services.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.