FameEX Weekly Market Trend | January 25, 2024

2024-01-25 11:10:05

1. Market Trend

From Jan. 22 to Jan. 24, the BTC price swung from $38,555.00 to $41,811.10, with a volatility of 8.45%. The earlier analysis stated that if the market approaches $40,500 without strong long resistance, there’s a high chance of it not recovering and dropping below $40,000. A significant rebound is anticipated if it falls below $40,000. However, if the rebound fails to surpass and stabilize above $43,000, the price is likely to gradually decline until breaking above $43,000 with increased volume, potentially signaling a reversal in the bearish trend. Recently, BTC turned downward again, with the second pass through $40,500 lacking strong bullish resistance. BTC eventually dropped below $40,000, hitting a low of around $38,555 and stabilizing. Notably, as BTC declined to around $38,500 and rebounded, trading volume consistently increased without consolidation after the drop, showing a gradual recovery in the downward trend, fluctuating around $40,000. This suggests the decline is not deliberately caused by major players but rather a benign competition between long and short positions in the market. (Grayscale’s GBTC has been continuously sold by users seeking lower-fee ETF fund products, forcing Grayscale to sell BTC for cash to manage the fund pressure from GBTC sales.)

In this situation, it won’t fundamentally disrupt the larger cycle’s upward structure and undermine confidence in the upward trend. Hence, it’s advised to gradually increase positions after BTC stabilizes above $40,000, leaving room for adjustments. Further increases can be considered after stabilizing above $43,000. For short positions, focus on short-term trading after BTC stabilizes.

Source: BTCUSDT | Binance Spot

Between Jan. 22 and Jan. 24, the price of ETH/BTC fluctuated within a range of 0.05572-0.05942, showing a 6.64% fluctuation. The earlier mention of entering near 0.05800 is currently on hold due to the current BTC trend. The plan to enter has been paused, and a watchful, empty position strategy has been adopted. In recent days, ETH/BTC has exhibited more pronounced weakness compared to the overall market, consistently declining without any rebound signals. On the 1-hour chart, it has formed a clear downward channel. Whether this trend will persist on larger timeframes remains to be seen. For now, there’s no need to pay too much attention to this currency. Entry will be considered opportunistically once rebound signals emerge.

Based on the overall analysis, the current market is experiencing a weak rebound after a significant decline, with BTC bouncing approximately $2,000 from its lowest point near $38,500 and then hovering around $40,000. Whether the market will see a continuation of the upward trend depends on the strength of BTC’s rebound in the coming days. Likely, BTC will not consolidate in the short term, exhibiting some volatility, as detailed in the previous analysis of BTC. Recently, apart from Grayscale consistently experiencing fund outflows, most other ETF funds have seen a net inflow of funds. This sets a foundation for the future trend. The recent overall market decline did not trigger widespread consecutive declines in other cryptocurrencies. Apart from the day BTC dropped to $38,550, most cryptos have demonstrated certain resistance and rebound capabilities. Therefore, considering the previous analysis of BTC, investors can still strategically select high-quality assets within the overall market for potential entry points.

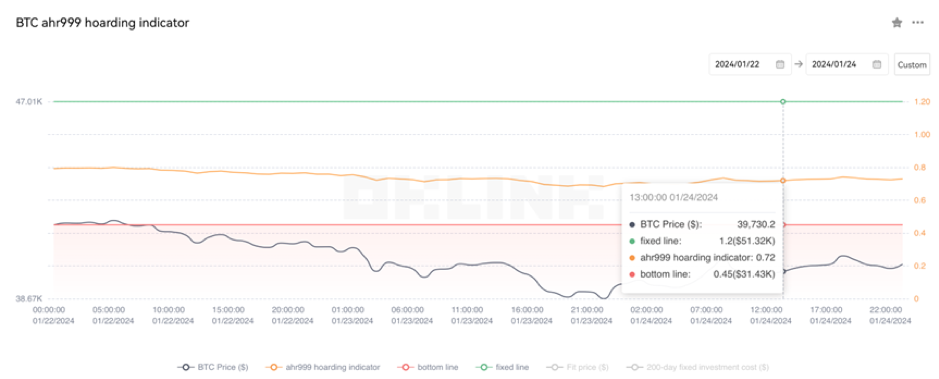

The Bitcoin Ahr999 index of 0.73 is between the buy-the-dip level ($31,430) and the DCA level ($51,320). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

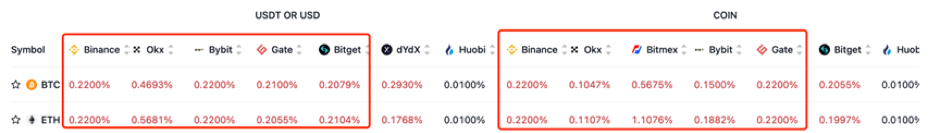

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

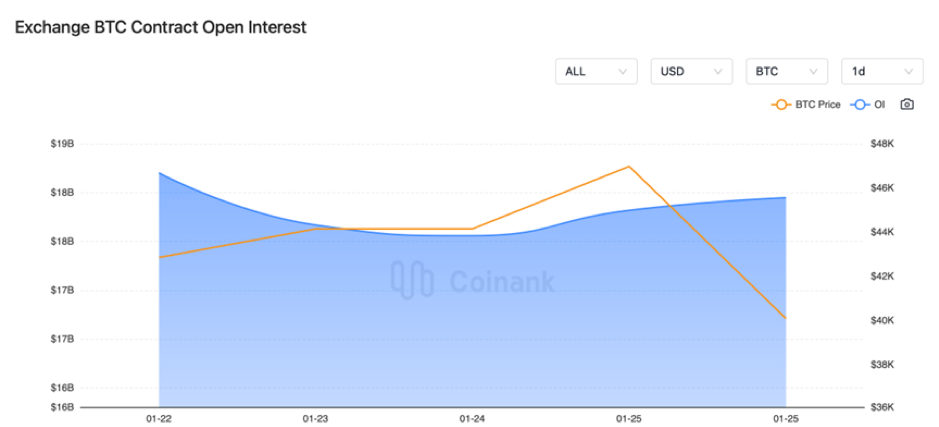

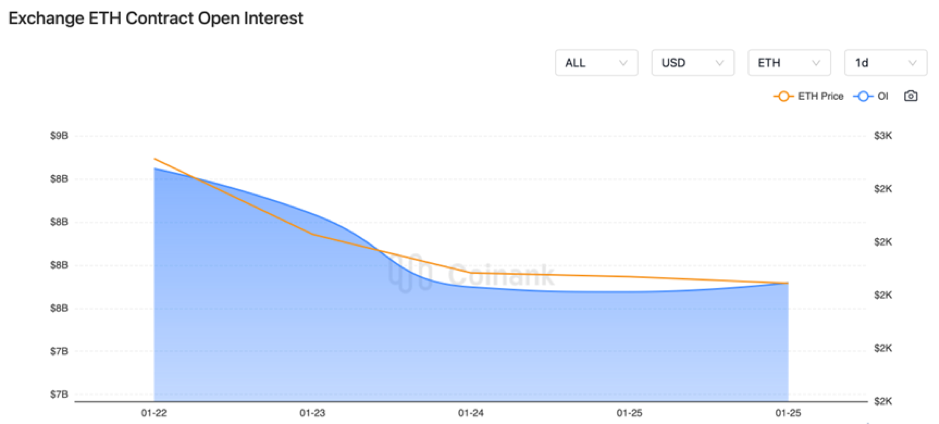

The BTC contract open interest declined but later rebounded to the original level, while the ETH contract open interest experienced a significant decrease.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On January 22, the number of global virtual asset users was reported to exceed 500 million, a 34% increase compared to the previous year.

2) On January 22, Canada sought public opinion on new regulations for funds investing in cryptocurrencies.

3) On January 22, BUSD market cap fell below 100 million USD.

4) On January 23, BlackRock’s Bitcoin ETF experienced its first-ever negative premium.

5) On January 23, Fidelity Bitcoin spot ETF trading volume surpassed BlackRock for two consecutive days.

6) On January 23, the Goldman Sachs Global Head of Trading Strategy predicted four interest rate cuts in the U.S. in 2024.

7) On January 24, Paul Chan Mo-po stated that Hong Kong, China will issue a second batch of tokenized green bonds.

8) On January 24, a U.S. SEC Commissioner believed that Ethereum spot ETF does not require court battles for approval.

9) On January 24, the People's Bank of China would reduce the reserve requirement ratio by 0.5 percentage points on February 5.

10) On January 24, Japanese lawmakers hoped to formulate new Web3 policies.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.