FameEX Daily Market Trend | BTC Reclaims $90K, ETH Open Interest Expands and RWA Narrative Rises

2025-11-27 07:13:41

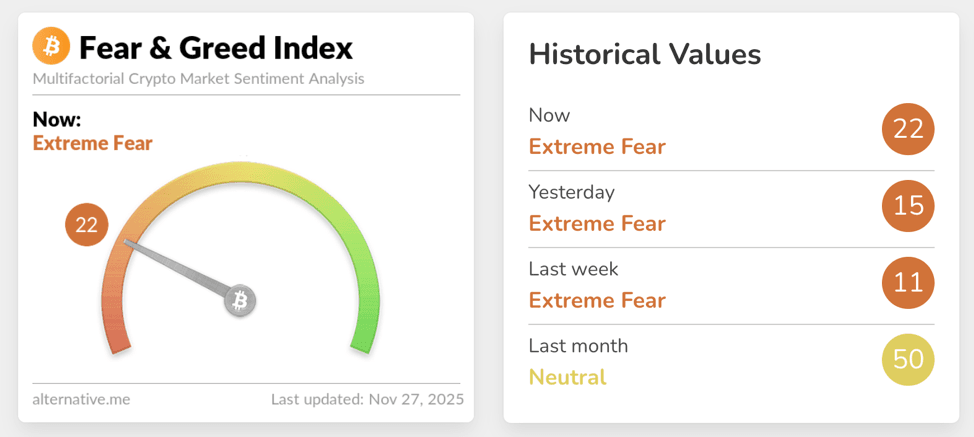

After nearly a month of staged pullbacks, BTC has closed back above $90K today, while ETH has held the key $3K zone, with the market showing a mild recovery within an “Extreme Fear” regime. The Fear & Greed Index has rebounded from 15 yesterday to 22 today, indicating sentiment remains clearly cold, but the downside momentum is gradually fading, with attention shifting toward refined positioning around liquidation bands and position structures. On the macro front, the institutionalization of stablecoins and RWA tokenization, combined with the expansion of ETF options position limits, is quietly reshaping capital flows between crypto assets and traditional finance, laying the groundwork for the next shift in risk appetite.

1. Market Summary

- BTC traded in a consolidation range around $90.1K to $90.6K today, with modest gains over 24 hours and closing near $90.65K. This reclaims the psychologically important $90K level and extends the recent rebound structure from the $86K–$87K zone.

- ETH traded in a tight $3K–$3.05K band, with intraday gains of about 0.3%. At the same time, total ETH derivatives open interest increased by 5.11% over the past 24 hours to around $36.935B, indicating that leveraged capital is re-adding ETH exposure.

- The Fear & Greed Index rebounded from 15 yesterday to 22, remaining in the “Extreme Fear” range, but marginal sentiment has shifted from outright fear toward cautious dip-buying, suggesting an initial stabilization at the sentiment floor.

- At the institutional and macro level, Nasdaq ISE has filed with the SEC to raise the position limit for options on a major BTC spot ETF from 250K contracts to 1M contracts, signaling that Bitcoin ETFs are gradually entering the top tier of liquidity assets in traditional markets.

2. Market Sentiment / Emotion Indicators

Today’s market is defined by a rebalancing of positions rather than emotion, even as sentiment stays in Extreme Fear. The Fear & Greed Index still remains at 22, showing that sentiment has yet to escape a conservative regime and that traditional “FOMO chase-higher” flows are still extremely limited.

Source: Alternative

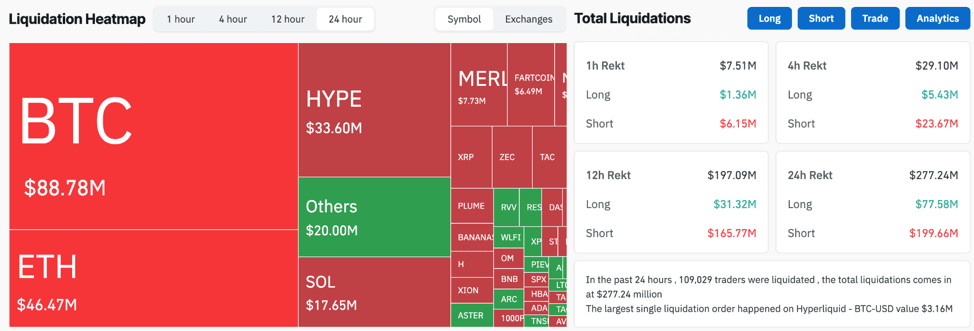

On the other hand, nearly $300M in liquidations across the market has been skewed toward shorts, indicating that aggressive bearish leveraged positions accumulated at lower levels are being steadily flushed out by upside price swings. Looking at the liquidation distribution, if BTC falls below roughly $85,669, cumulative long liquidation intensity on major CEXs could reach about $2.231B. Conversely, if BTC breaks above roughly $94,129, it would trigger around $843M in concentrated short liquidations. The market is thus forming a classic “two-sided liquidation corridor” between these price bands, where short-term volatility is more likely to manifest as leverage redistribution within the range rather than a directional, trend-driven move.

Source: Coinglass

There are two additional structural shifts worth monitoring. First, Glassnode has highlighted a “strong negative correlation” over the past two years between BTC price and net USDT flows to exchanges. During frothy topping phases, USDT typically sees net outflows of $100M–$200M per day from exchanges, corresponding to large-scale profit-taking, whereas the combination of recent price pullbacks and a turn back to positive stablecoin flows suggests that risk capital is re-accumulating exposure. Second, the BIS has flagged the rapid expansion of on-chain money market funds as a source of risk. These tokenized products, backed by US Treasuries and other short-term instruments yet circulating on-chain, offer stablecoin-like convenience and yields but are constrained by permissioned wallets, concentrated holder bases, and traditional settlement cycles. Under stress, they may amplify liquidity tightening and redemption pressure, with the structural mismatch between “on-chain transfer” and “off-chain settlement” becoming a new source of systemic risk.

Against this backdrop, institutional flows and macro-regulatory signals become particularly important. For example, the Nasdaq ISE proposal to quadruple the position limit for options on a BTC spot ETF to 1M contracts is essentially designed to allow more institutions to scale hedging and arbitrage trades within a compliant framework, embedding Bitcoin more deeply into the architecture of traditional derivatives and risk management. At the same time, Bolivia has announced plans to integrate stablecoins and crypto assets into its domestic financial system, allowing banks to custody crypto for clients and use it in savings and lending products, underscoring how, under pressures of high inflation and currency depreciation, emerging markets are gradually building institutional demand for crypto assets.

3. BTC & ETH Technical Data

3.1 BTC Market

BTC stabilized above $90K today, with prices having recovered from the $85K–$88K zone in recent sessions and completing a short-term “probe-lower and pullback” around prior lows. Looking at recent price history, BTC first saw a high-volume selloff from just above $80K last week, then gradually built support around $85K, and has now closed back above $90K, with daily gains in the roughly 0.2–3% range. This reflects a weakening of bearish momentum after consecutive pullbacks, with the long/short balance tilting modestly back toward the long side. In parallel with price, the liquidation and leverage structure is also notable. Over the past 24 hours, BTC short liquidations of around $80.5M significantly exceeded long liquidations of roughly $19.61M, indicating that the recent rebound is more about “technically compressing” previously overcrowded bearish positioning than the start of a new, fully fledged trend-upcycle.

It is worth highlighting that Coinglass liquidation distribution data shows that, if BTC once again breaks below roughly $85,669, long positions on major CEX derivatives platforms will face potential liquidation pressure totaling more than $2.2B. If the market continues higher and breaks above around $94,129, then roughly $843M in short liquidations could be triggered in the opposite direction. This highly concentrated liquidation band above and below spot often implies a greater likelihood of “false breakouts followed by swift reversals” in the short term, flushing out leveraged chase-flows that have not adequately accounted for risk bandwidth.

3.2 ETH Market

Compared with BTC’s structure, the defining feature of ETH today is that “price is holding the key $3K level while leveraged positioning continues to expand.” On-chain and derivatives data show that total ETH open interest has risen by 5.11% over the past 24 hours to about $36.935B. The three largest derivatives platforms each hold ETH OI in the tens of billions, at around $7.453B, $2.143B, and $2.659B respectively, indicating that both centralized and decentralized derivatives venues are seeing leverage added at these levels. Meanwhile, whale behavior on-chain reflects a hybrid structure of “high-leverage longs combined with spot/stablecoin rebalancing.” One closely watched “1011 short-side insider whale” currently holds 15,000 ETH in 5X leveraged long positions with unrealized gains of roughly $1.139M. Another whale has added 4,234 ETH using about 12.82M DAI, bringing cumulative deployment to around 16.08M DAI at an average entry of $3,010 for 5,343 ETH, while still retaining approximately 55M DAI as dry powder for potential further scaling.

This implies that, on one hand, ETH is gradually building a “leveraged consensus support zone” around $3K, and as long as price does not break sharply lower, longer-horizon capital is inclined to view this range as an attractive entry area from a risk-reward perspective. On the other hand, the expansion of leverage and concentration of positions also increases the “fragility” of future volatility. Any disappointment in macro conditions or Ethereum-specific narratives, such as targeted gas adjustment roadmaps or the pace of L2 ecosystem expansion, could force a significant repricing of the currently crowded leveraged long structure. From a trader behavior standpoint, the prevailing ETH strategy is closer to “leveraging beta exposure at key support” rather than slow-paced, value-driven accumulation, making it essential for risk management to closely track liquidation bands and orderbook depth dynamics.

4. Trending Tokens

- PLUME (Plume)

Plume positions itself as a modular Layer 2 focused on RWAfi, providing a “one-stop” tokenization and composable DeFi stack for a wide range of real-world assets through an EVM-compatible environment and native tokenization infrastructure. Recently, Plume announced a deep partnership with tokenization specialist Securitize, which delivers tokenization solutions, including products backed by US Treasuries and institutional-grade trusts for multiple large asset managers and Wall Street funds. Under this collaboration, Securitize’s compliant tokenized funds will be integrated into Plume’s Nest staking protocol, enabling more than 280K RWA investors to supply liquidity, loop into lending markets, and amplify yields within a regulated framework on a single RWA-dedicated chain. At the same time, Bitcoin-focused platforms such as Solv plan to deploy multi-million-dollar allocations into Plume’s RWA vaults, further reinforcing the intersection of BTC yield & RWA collateral.

- VOOI (vooi)

VOOI has evolved from a front-end trading interface for a single perpetual DEX into a Trading SuperApp that aggregates 7+ perpetual protocols across 10 chains, with roughly $21B in cumulative trading volume and a user base of more than 180K traders. Its core lies in chain and account abstraction, wrapping liquidity and matching depth from multiple L1/L2 networks and perpetual protocols into a single interface to deliver a unified leveraged trading experience. In VOOI’s recently announced tokenomics, $VOOI assumes both governance and utility roles, being used for protocol governance, trading fee discounts, yield product enhancement, active trader incentives, and early access to new features. Token distribution is structured through multiple pools with punitive cliffs and linear vesting, in an attempt to build long-term alignment among the community, contributors, and early capital. In an environment where perpetual DEX liquidity is highly fragmented, if order flow and depth continue to consolidate into a few aggregator front ends, the governance token may increasingly represent the claim on trading flow and protocol fee accrual.

- TRUST (Intuition)

Intuition focuses on building infrastructure that allows users to create “verifiable claims” and “relationship graphs” around any subject, delivered as both a base protocol and middleware, so developers can embed these proofs and knowledge graphs directly into their own applications. Signals from the recent Devcon sidelines suggest the team has already engaged with multiple protocols and application partners, while actively recruiting more developers and expanding the ecosystem. Intuition’s core value lies in the fact that, in an environment where regulators increasingly emphasize transparency, such as UK authorities piloting standardized disclosure templates and emerging markets moving to incorporate stablecoins into formal financial systems, verifiable identity and relationship data will become a key bridge between compliance requirements and open financial applications. For protocols aiming to meet KYC, suitability, and disclosure obligations without sacrificing openness, infrastructure like Intuition provides a critical starting point for the future of compliant DeFi.

5. Today Token Unlocks

- $TICO: Unlocking 471.88 million tokens, with 22.06% of the circulating supply as the largest unlock today.

- $WAL: Unlocking 17.50 million tokens, with 1.16% of the circulating supply.

6. Conclusion

The market remains in a repair phase within the Extreme Fear band, but the core driver has shifted from pure price swings toward the interaction between leverage structure and institutional capital allocation. On one side, BTC’s return above $90K and ETH’s hold of the $3K level, together with a short-heavy liquidation profile, show that previously over-extended bearish leverage is being unwound in an orderly fashion. The potential liquidation clusters above $85.7K and $94.1K provide fuel for short-term range trading, making sharp moves between breakouts and reversals more likely. On the other side, the expansion of ETF options limits, RWA tokenization nearing $9B in scale, and emerging markets integrating stablecoins and crypto into domestic financial systems all indicate that crypto assets are being embedded more deeply into global financial and capital market infrastructure. This not only offers structural support for long-term valuation and demand but also implies that future volatility will be more tightly coupled with interest rates, liquidity conditions, and regulatory cycles.

For traders, the current environment is better suited to a focus on risk-bandwidth management and structural events rather than attempting to call large one-way moves over short horizons. Within the $85K–$95K range for BTC and the $2.8K–$3.2K range for ETH, managing leverage and distance to liquidation levels is more important than simply debating price targets. On the narrative front, medium- to long-term themes such as RWAfi, perpetual aggregators, and decentralized identity offer structural opportunities that are relatively less dependent on short-term noise. Overall, the market has not yet entered a new “Greed cycle,” and is instead in a regime of position redistribution at the edge of fear, driven primarily by institutions and high-sensitivity traders. In such an environment, discipline, liquidity, and structural understanding often matter more than directional calls in determining the eventual distribution of P&L.

Disclaimer: The information provided in this section is for reference only and does not represent any investment advice or the official views of FameEX.