FameEX Daily Market Trend | BTC Sideways and ETH in Focus Amid Fed Rate Cut and Regulatory Shifts

2025-12-05 07:05:58

With the Fear & Greed Index holding at 28 in the “Fear” zone, it moderately recovered from last week’s “Extreme Fear”. BTC, after a roughly 30% retracement from its peak, has begun forming a new high-range consolidation between $85,000–$95,000. At the same time, ETH continues to outperform BTC, supported by significant spot ETF inflows and strengthening technical structure, positioning it as the core beneficiary of the current rotation. Thinner year-end liquidity, shifting macro rate expectations, and accelerating regulatory developments have created an environment defined more by structural repricing and cross-asset rotation than by a unidirectional trend.

1. Market Summary

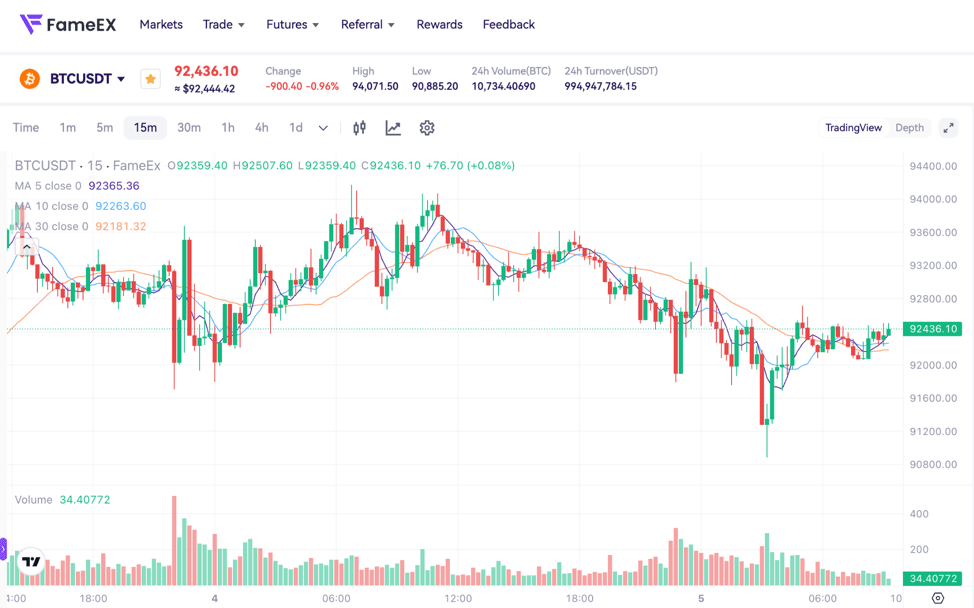

- BTC retreated from this week’s high back toward the $92,000 area yet continued to hold above the $85,000 support. Markets are increasingly accepting the $85,000–$95,000 range as the near-term structure, with price action characterized by high-level consolidation and volatility compression.

- ETH remained firmly above $3,100, supported by approximately 360 million dollars in net inflows into spot ETH ETFs over the past two weeks which roughly triple BTC’s 120 million dollars. The breakout above the $3,200 twenty-day high further reinforces ETH’s relative strength and rotation narrative.

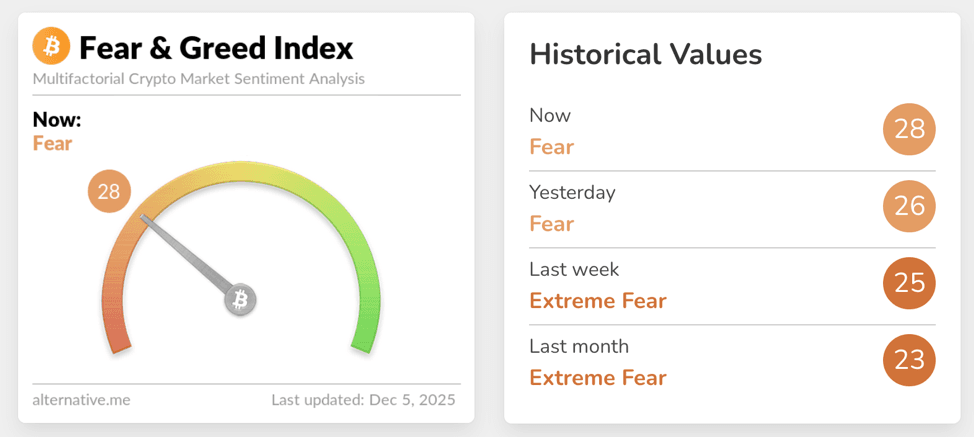

- The Fear & Greed Index climbed from last week’s “Extreme Fear” 25 and last month’s 23 to the current 28. Sentiment remains defensive but has begun to recover from extreme levels, reflecting a cautious “selective accumulation” stance.

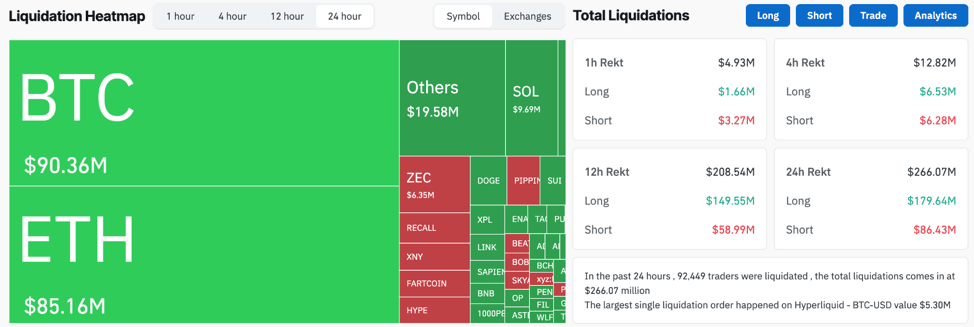

- Roughly 92,000 traders were liquidated in the past 24 hours, totaling approximately 266 million dollars in liquidations—BTC around 90 million dollars and ETH around 85 million dollars. The long-to-short liquidation ratio of roughly 1:0.5 indicates that leveraged longs continue to experience periodic de-risking near the upper boundary of the range.

- Macro focus remains on the Federal Reserve’s December meeting, where markets are pricing an 87% probability of a 25-basis-point rate cut, alongside the Bank of Japan’s key decision regarding yen carry dynamics. Additionally, the CFTC’s approval of spot crypto trading on regulated futures exchanges, the EU’s proposed expansion of ESMA authority, and Ethereum’s Fusaka upgrade together form a new structural backdrop for the medium-term policy environment.

2. Market Sentiment / Emotion Indicators

The Fear & Greed Index currently sits at 28 in the “Fear” zone, slightly above yesterday’s 26 and meaningfully above last week’s and last month’s “Extreme Fear” readings of 25 and 23. This gradual improvement from extreme pessimism suggests that the market has completed the initial phase of rapid deleveraging and emotional capitulation, though confidence in a renewed unilateral uptrend remains insufficient. Investors appear less inclined to panic-sell but remain hesitant to re-lever, preferring spot and low-leverage positioning near key supports while maintaining caution toward macro and regulatory uncertainties.

Source: Alternative

Liquidation data show that approximately 266 million dollars of liquidations over the past 24 hours were concentrated mostly in BTC and ETH, together comprising the majority of the market. Long liquidations around 180 million dollars significantly exceeded shorts at roughly 86 million dollars, indicating that leveraged longs chasing the rebound continue to face overhead pressure. Coinglass liquidation heatmaps show that if BTC breaks above $96,829, cumulative short liquidation pressure on major platforms would reach roughly 2.024 billion dollars, while a drop below $87,709 would trigger approximately 1.291 billion dollars in long liquidations. For ETH, short-side liquidation clusters around $3,297 total approximately 1.496 billion dollars, while long-side clusters below $2,988 amount to roughly 691 million dollars. This dual-sided concentration of liquidation clusters encourages short-term rangebound behavior and repeated tests of leverage boundaries rather than directional breakout conditions.

Source: Coinglass

At the macro level, year-end market thin liquidity combined with evolving rate-cut expectations keeps crypto highly correlated with broader risk assets. CME FedWatch indicates an 87% probability of a 25-basis-point cut in December, and a combined near 90% probability of cumulative 25–50 basis points of cuts by January, supporting a more accommodative backdrop for medium-term risk positioning. Meanwhile, institutions view the Bank of Japan’s upcoming rate decision as a key determinant of yen-funded carry flows, which influence global risk appetite and capital costs. The IMF and ECB have recently highlighted that dollar-denominated stablecoins may pose risks to monetary sovereignty and financial stability, urging the establishment of frameworks preventing them from functioning as de facto legal tender. Taken together with the U.S. progress on stablecoin legislation and the CFTC’s approval of spot crypto products on regulated exchanges, these developments outline a medium-term environment of stricter oversight paired with clearer regulatory pathways.

3. BTC & ETH Technical Data

3.1 BTC Market

BTC briefly pushed above $94,000 earlier this week before retracing toward the $92,000 region during U.S. trading hours. This reflects both the absence of new macro catalysts and the typical year-end decline in liquidity and institutional participation. The $85,000 support formed earlier in the week remains intact, with multiple retests successfully absorbed, establishing a rising short-term floor. Without a major macro shock, BTC is increasingly likely to remain within the $85,000–$95,000 band over the next several weeks, with overhead supply driven by trapped longs and defending short positions.

Futures metrics show the global 8-hour BTC funding rate at approximately 0.0021%. Most major platforms remain slightly positive, though some have turned negative, indicating a neutral-to-marginally-long leverage structure—well below euphoric levels typical of prior bull cycles. Liquidation clusters around $96,829 on the upside and $87,709 on the downside form key boundaries for short-term positioning, favoring mean-reversion and range management rather than breakout-driven leverage deployment.

3.2 ETH Market

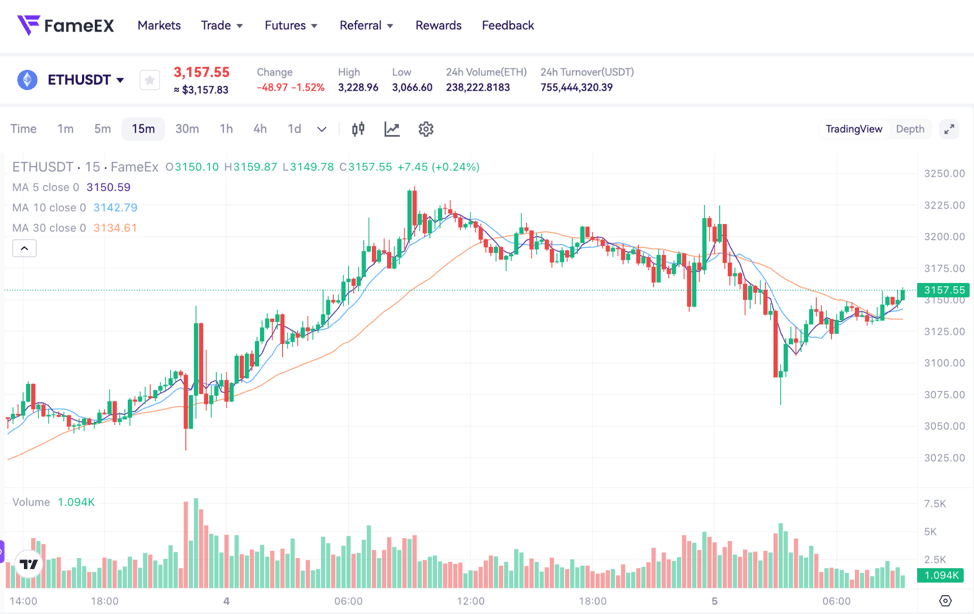

ETH continues to display a structurally superior profile relative to BTC, currently trading around $3,150–$3,160 and having broken above the $3,200 twenty-day high, confirming a high-time-frame structural breakout. Spot ETH ETFs have attracted roughly 360 million dollars of inflows over the past two weeks which is far exceeding BTC’s 120 million dollars. This indicates that institutional and long-term capital prefer ETH during this phase of structural adjustment. The Fusaka upgrade’s mainnet activation reinforces ETH’s role as a settlement-layer asset by improving data throughput and lowering L2 costs. On-chain NUPL around 0.22 suggests holders remain in modest profit without entering euphoric territory, a structure consistent with an early-stage medium-term uptrend.

ETH’s global 8-hour funding rate currently stands near 0.0027%, slightly above BTC, demonstrating stronger leverage appetite yet remaining well within sustainable bounds. If BTC can hold above $94,000 and secure a decisive close above $96,000, market consensus expects ETH to retest the $3,650 swing high, with potential to probe liquidity clusters above $3,900 should broader risk sentiment improve.

4. Trending Tokens

- WET (HumidiFi)

The $WET token issued by HumidiFi has recently become one of the most notable liquidity assets within the Solana ecosystem, driven by the narrative of an “active-liquidity DEX” built on institutional-grade market-making logic. Unlike traditional passive-curve AMMs, HumidiFi utilizes proprietary on-chain quoting systems and predictive pricing oracles that dynamically adjust inventory and quotes based on real-time market conditions, resulting in tighter spreads and lower slippage for equivalent capital. Since launching in June 2025, HumidiFi has recorded multiple days exceeding 1 billion dollars in trading volume and now accounts for more than 30% of Solana’s spot activity, increasingly recognized as the liquidity venue for on-chain professional traders. The $WET token is distributed via Jupiter’s decentralized token formation mechanism, allocating shares to Wetlist participants, JUP stakers, and public buyers. With staking rewards and fee-rebate utilities expected post-TGE, $WET functions more as a utility credential for the liquidity engine than a short-term speculative instrument. Near-term price volatility and redistribution are inevitable, but the long-term question remains whether HumidiFi can sustainably attract sophisticated market makers and aggregator routing as key determinants of value and narrative durability.

- COTI (COTI)

COTI, an enterprise-grade fintech infrastructure platform, originally focused on payments and digital currency issuance, powered by a multi-DAG, machine-learning-based Trustchain consensus optimized for high throughput and low-cost transactions. More recently, it has gained renewed attention due to its privacy-layer solution recognized by the Ethereum community. An Ethereum-endorsed privacy thread highlighted COTI as one of the key protocols enabling “programmable privacy” through Garbled Circuits. This is critical for enterprise use cases requiring confidentiality of pricing models, customer data, and contract terms. Pure private transfers are insufficient for enterprise-scale adoption; instead, the ability to execute complex financial workflows on-chain while maintaining commercial secrecy is decisive. With COTI’s privacy layer already deployed in real-world scenarios, its narrative aligns more with infrastructure and enterprise services than simple payments. If Ethereum advances meaningfully on privacy and enterprise adoption in 2026, COTI stands to benefit, though competition from ZK-based and modular privacy frameworks will intensify, making its balance between technology, compliance, and ecosystem development central to sustaining future positioning.

- LDO (Lido)

Lido’s recent launch of the stRATEGY Vault further strengthens its strategic presence within ETH liquid staking and DeFi yield aggregation, adding a new dimension to the LDO narrative. The stRATEGY Vault allows users to deposit ETH, WETH, or wstETH in a single step and receive strETH, representing diversified exposure across DeFi strategies allocated through the Mellow Core Vault system including Aave, Ethena, and Uniswap in order to dynamic rebalancing based on market conditions. This “single-deposit, multi-strategy exposure” model lowers the barrier for participating in complex DeFi strategies while elevating stETH from a staking yield instrument to a broader yield-curve management asset. To incentivize early adoption, strETH holders earn Mellow Points based on size and duration, with triple accrual in the first four weeks. Fees include a 1% annual management charge and a 10% performance fee embedded directly in strETH pricing. For LDO holders, the Vault enhances stETH’s role as the “yield hub asset” for Ethereum, indirectly supporting higher TVL and network effects. However, this also exposes Lido to greater scrutiny regarding risk management, validator decentralization, and regulatory oversight. Those factors that will materially influence LDO’s valuation profile.

5. Today Token Unlocks

- $ENA: Unlocking 171.88 million tokens, with 2.32% of circulating supply as the largest unlock today.

- $XION: Unlocking 43.16 million tokens, with 97.90% of circulating supply.

6. Conclusion

Overall, the crypto market currently reflects a structure of sentiment recovering from extreme fear but not yet optimistic, embodied by BTC’s consolidation within the $85,000–$95,000 range and ETH’s structural outperformance. Liquidation heatmaps show sizable liquidation clusters on both sides of the range, suggesting that price action is more likely to oscillate within boundaries. It’s better to wait for time rather than direction to reset leverage or rather than initiating breakout-driven cascades. Funding rates and open interest remain within healthy ranges, indicating that leverage has re-entered the market without approaching overheated conditions. Spot ETF flows further reinforce institutional preference for ETH as a beneficiary of settlement-layer upgrades and emerging DeFi yield infrastructure.

Macro drivers, including the Federal Reserve and Bank of Japan’s rate paths, alongside accelerating regulatory frameworks for stablecoins and tokenization, are poised to reshape crypto’s role within global capital markets over a longer horizon. In this environment, a strategy grounded in selective allocation within structural rebalancing appears most appropriate. Watching out for BTC’s range and liquidation boundaries, capturing ETH’s relative strength and targeted DeFi/infrastructure themes, and maintaining disciplined leverage and risk management in a low-liquidity setting ahead of potential medium-term trends into 2026.

Disclaimer: The information provided in this section is for reference only and does not represent any investment advice or the official views of FameEX.