FameEX Daily Market Trend | BTC Recovers Through Short Liquidations as ETH Diverges From Fundamentals

2025-12-10 07:22:21

After an extended period of structural adjustment, market sentiment has rebounded from Extreme Fear to Fear, with price action and leverage positioning beginning to show more directional rebalancing. Supported by forced short covering and a rebound in futures open interest, BTC has re-tested levels above $94K, while ETH exhibits a structural divergence between cooling base-layer fees and DEX activity versus continued support from its Layer-2 ecosystem and upgrade expectations. On the macro front, the Federal Reserve is now widely expected to initiate a 0.25% rate cut this week, regulatory clarity continues to improve, and the ongoing expansion of RWA and compliant products suggests the current drawdown resembles a leverage and liquidity reset rather than the end of the broader bull cycle.

1. Market Summary

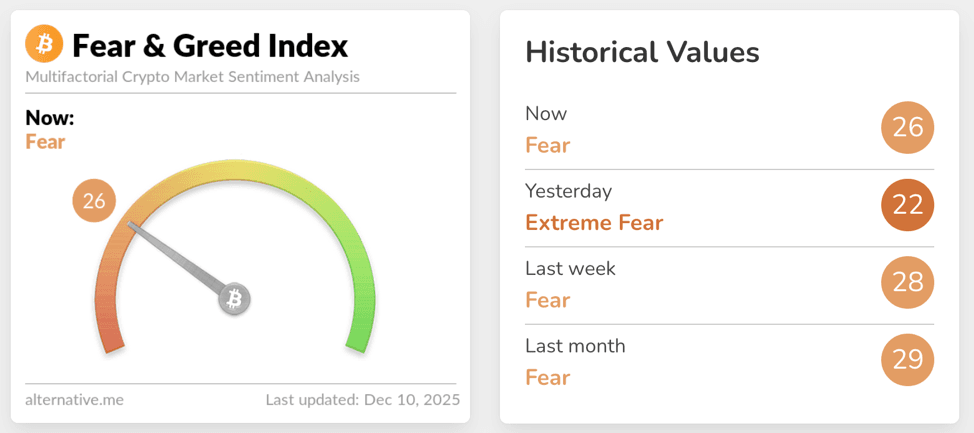

- The Fear & Greed Index rebounded from 22 (Extreme Fear) yesterday to 26 (Fear) today, indicating sentiment remains cautious but has moved away from extreme levels.

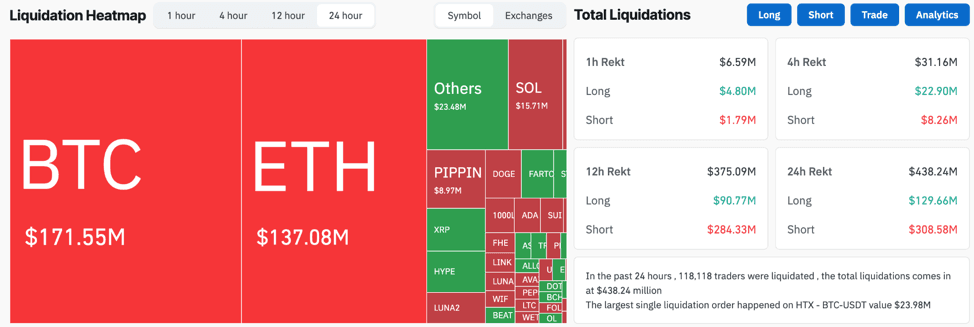

- Total market liquidations over the past 24 hours reached approximately $438 million, with short liquidations accounting for roughly $309 million, primarily concentrated in BTC and ETH.

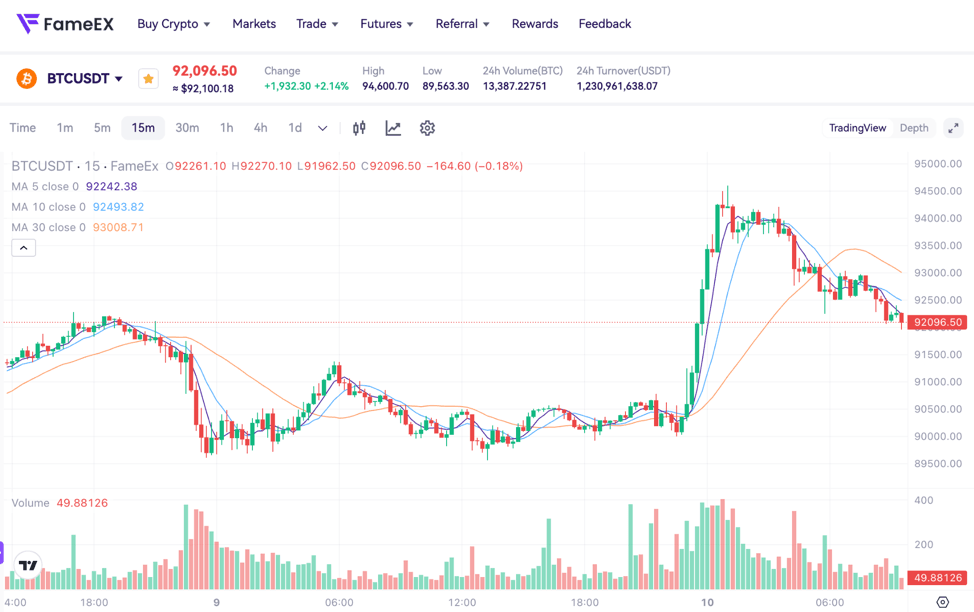

- BTC rallied intraday from around $89.6K to near $94.6K, with total market capitalization approaching $1.97 trillion and futures open interest rebounding to approximately $596.9 billion.

- ETH rebounded toward $3.4K, but 30-day network fees declined by approximately 62%, while base-layer DEX volumes and DeFi revenues fell to multi-month lows, signaling cooling mainnet demand.

- On the macro side, CME FedWatch shows an approximately 87.6% probability of a 25-basis-point rate cut this week, while regulatory signals from the SEC and CFTC point toward innovation exemptions and pilot programs, alongside growing institutional demand for RWA and compliant ETPs, forming a medium-term structural tailwind.

2. Market Sentiment & Emotion Indicators

The Fear & Greed Index rose to 26 today, moving back into the Fear zone from Extreme Fear yesterday. This shift suggests that the emotional extremes triggered by weakening ETF flows, futures deleveraging, and macro uncertainty are gradually easing. Historically, the index stood at 28 last week and 29 last month, indicating that the psychological impact of this correction has been more pronounced than the magnitude of the price adjustment itself. Discussions around BTC exposure that exists only on balance sheets or through contracts without actual onchain settlement, price manipulation concerns, and structural sell pressure have intensified, prompting investors to favor onchain self-custody and long-term holding as a hedge against trust risks. In the near term, sentiment remains well below greedy levels, but the fear premium is steadily being absorbed.

Source: Alternative

From a leverage perspective, total liquidations over the past 24 hours amounted to approximately $438 million, with short liquidations of about $309 million significantly exceeding long liquidations of roughly $130 million. This indicates that as BTC pushed through $94K, overly crowded downside positioning became the primary source of forced unwinds. Liquidation heatmaps show BTC accounting for approximately $172 million in daily liquidations and ETH around $137 million, while other major and long-tail assets represented only a small share. Structurally, this reflects indicator-asset-driven directional liquidations rather than a broad-based risk asset capitulation. Over the same period, an early BTC whale address added approximately 50 million in USDC margin to a decentralized perpetuals platform, expanding a 5X leveraged ETH long position to roughly 80,985 ETH, with a notional value of approximately $2.687 billion and unrealized gains near $16.9 million, signaling that high-net-worth and professional capital has begun selectively adding longer-term leveraged exposure near key support levels following the most intense phase of the drawdown.

Source: Coinglass

Macro and regulatory developments provide an additional layer of support to the current structure. CME FedWatch indicates a roughly 87.6% probability of a 25-basis-point rate cut this week, with the likelihood of cumulative cuts by January remaining near seventy percent, substantially reducing concerns around renewed policy tightening. JPMorgan and other major institutions broadly argue that the traditional four-year halving cycle logic characterized by 80% drawdowns has been weakened by ETF participation and institutional capital, with the current correction resembling a mid-cycle repricing rather than structural deterioration. On the regulatory front, the new SEC chair has advanced innovation exemptions and token classification frameworks, while the CFTC has launched pilot programs allowing BTC, ETH, and USDC to be used as margin collateral. Combined with Senate progress on market structure legislation, the overall policy tone appears meaningfully softer than the prior era of regulation-by-enforcement, supporting medium- to long-term risk appetite recovery.

3. BTC & ETH Technical Data

3.1 BTC Market

From a price perspective, BTC is rebounding over the past 24 hours from a low around $89.6K to a high near $94.6K, representing a short-term gain of approximately 4%–5% and breaking out of the narrow consolidation seen in prior sessions. However, it’s back to 92K now. Futures open interest rebounded to approximately $596.9 billion, up about 3.19% over 24 hours, alongside liquidations totaling roughly $157 million, indicating that leverage positioning is transitioning from forced reduction toward gradual rebuilding. Notably, short liquidations significantly exceeded long liquidations during this rebound, suggesting price strength was driven more by forced covering and risk management than by an aggressive, funding-driven FOMO bid. On the spot side, large institutional purchases exceeding 10,000 BTC in a single day failed to materially lift prices, reigniting debate around balance-sheet pricing and off-market hedging structures. However, given BTC’s roughly $1.9 trillion market capitalization, its depth remains sufficient to absorb such flows, reflecting hedging between ETFs and derivatives rather than a lack of directional spot demand. Overall, if BTC can hold the $90K–$92K support zone, it would support continued inventory accumulation ahead of the next trend selection phase.

3.2 ETH Market

ETH continues to display a structural divergence between price action and onchain fundamentals. Price-wise, ETH rebounded to approximately $3.29K after weaker employment data reinforced rate-cut expectations, reaching a three-week high near $3.4K on Tuesday and posting a weekly gain of about 11.2%. However, Nansen data shows Ethereum’s 30-day network fees declined by approximately 62%, far exceeding the roughly 22% pullback observed across Tron, Solana, and HyperEVM. Over the same period, base-layer DEX volumes fell from around $23.6 billion to approximately $13.4 billion, while DeFi protocol revenues dropped to about $12.3 million, marking a five-month low and signaling a pronounced cooling in base-layer activity and high-yield strategies. Several core DeFi protocols, including Pendle, Athena, Morpho, and Spark, also saw TVL decline from roughly $100 billion two months ago to around $76 billion, indicating that risk capital remains cautious ahead of fully realized rate easing. In contrast, Layer-2 activity presents a markedly different picture, with Base transaction counts rising over 100% month-over-month and Polygon recording growth exceeding 80%, highlighting Ethereum’s structural advantage in L2 fee and incentive design as usage and liquidity migrate off the base layer. Following the Fusaka upgrade in early December, improvements in rollup data availability and cost efficiency have driven overall fee compression, weighing on short-term mainnet revenues while laying groundwork for medium-term scalability and DeFi growth. In derivatives markets, ETH perpetual funding rates remain near 9% annualized, squarely within a neutral range, with balanced long-short positioning and no signs of one-sided squeezes or extreme leverage, reinforcing the view that ETH is in a transitional phase where fundamentals have cooled temporarily while technical and upgrade narratives support the medium-term outlook.

4. Trending Tokens

- $CLONE(Confidential Layer)

CLONE continues to attract attention ahead of its listing as the Confidential Layer narrative around multi-chain privacy and cross-chain infrastructure gains traction. Designed to facilitate asset transfers across EVM chains, Solana, Cosmos, Bitcoin, and privacy-focused blockchains, Confidential Layer seeks to balance regulatory transparency with privacy preservation, addressing institutional and high-net-worth demand for cross-chain asset mobility and confidentiality. The project has announced that $CLONE will begin trading on December 10, alongside staking rewards and exchange listings, driving positioning by capital seeking exposure to the next phase of privacy-plus-interoperability narratives. Relative to traditional bridge solutions, Confidential Layer emphasizes data confidentiality and flexible routing across heterogeneous environments. Should the protocol succeed in onboarding institutional-grade RWA or DeFi assets, CLONE’s potential for use-case expansion and protocol-level value capture could scale meaningfully.

- $VANRY(Vanar)

Market attention around VANRY has centered on the launch of myNeutron, a consumer-facing AI product introducing an onchain “memory layer” into Web3 workflows. myNeutron allows users to store links, articles, messages, PDFs, and notes as searchable knowledge seeds, organize them into bundles, and query their personal knowledge base using natural language, effectively combining knowledge management, AI assistance, and onchain identity and settlement. From a monetization standpoint, the product transitions from a free trial into a subscription model, with all subscription revenues converted into $VANRY for buybacks, partial burns, and distribution to stakers and the treasury, forming a closed-loop revenue-to-token value capture mechanism. This cash-flow-backed demand adds an additional investment dimension to VANRY beyond its NFT and metaverse roots, and sustained user growth and retention could provide a more resilient valuation floor.

- $USUAL(Usual)

USUAL sits at the intersection of DeFi and RWA narratives, with recent upgrades to its stablecoin and governance framework drawing increased attention. The protocol rolled out a new product suite spanning Savings, Alpha, and Bonds, offering simplified yield access through products such as $sUSD0 and $sEUR0, while introducing a Cash and Carry structure ($USD0a) to enhance returns via spot and derivatives strategies backed by compliant treasury assets. On the tokenomics side, the DAO approved a disinflation proposal that reduced maximum supply by approximately 25% and significantly lowered daily sell pressure, alongside ongoing buybacks and a reduction in borrowing rates from 5% to 1.5% APY, improving USUAL’s risk-reward profile as a governance and yield-bearing asset. As institutional participation continues to accelerate RWA adoption, protocols like USUAL that directly redistribute real-world yield to token holders are increasingly positioned as core representatives of compliant yield-bearing DeFi.

5. Today Token Unlocks

- $CGPT: Unlocking 7.68 million tokens, with 0.89% of circulating supply.

- $B3: Unlocking 567.00 million tokens, with 1.84% of circulating supply as the largest unlock today.

6. Conclusion

Today’s structure continues to resemble a mid-cycle structural rebalancing rather than a full trend reversal. Sentiment has rebounded from Extreme Fear, BTC remains supported above $90K amid concentrated short liquidations and recovering open interest without signs of systemic confidence collapse, and while ETH’s base-layer fees, DEX volumes, and DeFi revenues have cooled materially, Layer-2 usage and the Fusaka upgrade provide flexibility for medium-term demand recovery. On the macro side, the high probability of an impending rate-cut cycle, a regulatory shift toward innovation exemptions and pilot frameworks, and the steady expansion of RWA and compliant investment products have collectively strengthened the market’s underlying capital structure relative to prior cycles. For traders, the current environment favors structural observation and position recalibration, selectively engaging around key BTC support levels and ETH’s internal divergences, while monitoring L2, RWA, and high-quality protocol fundamentals to position ahead of the next trend acceleration.

Disclaimer: The information provided in this section is for reference only and does not represent any investment advice or the official views of FameEX.