USDⓈ-M Perpetual Futures Guide (Web)

2023-08-22 10:04:351. Activate Futures Trade

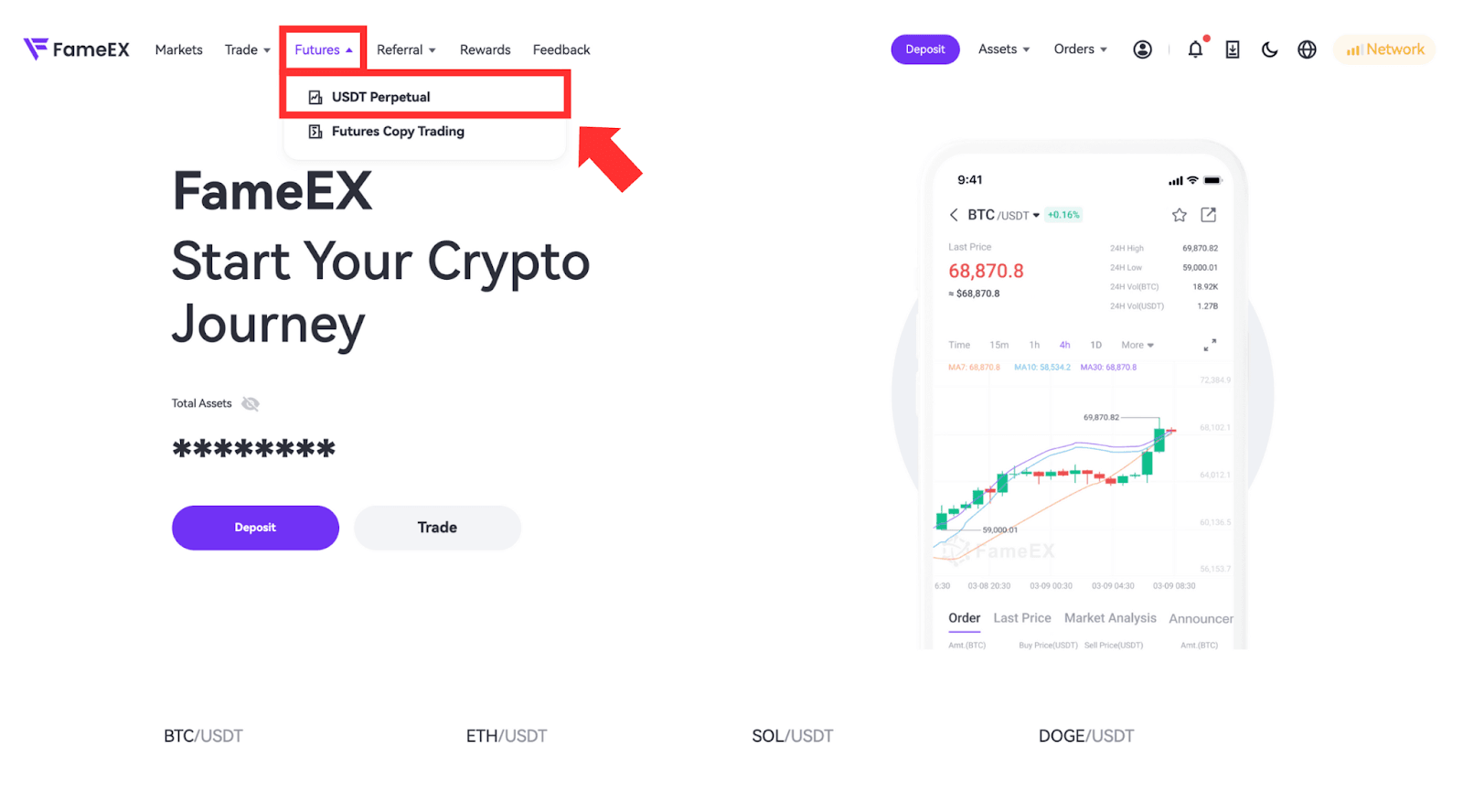

Log in to your FameEX account, click ‘Futures’ in the top, and you’ll be directed to the FameEX USDT perpetual futures section.

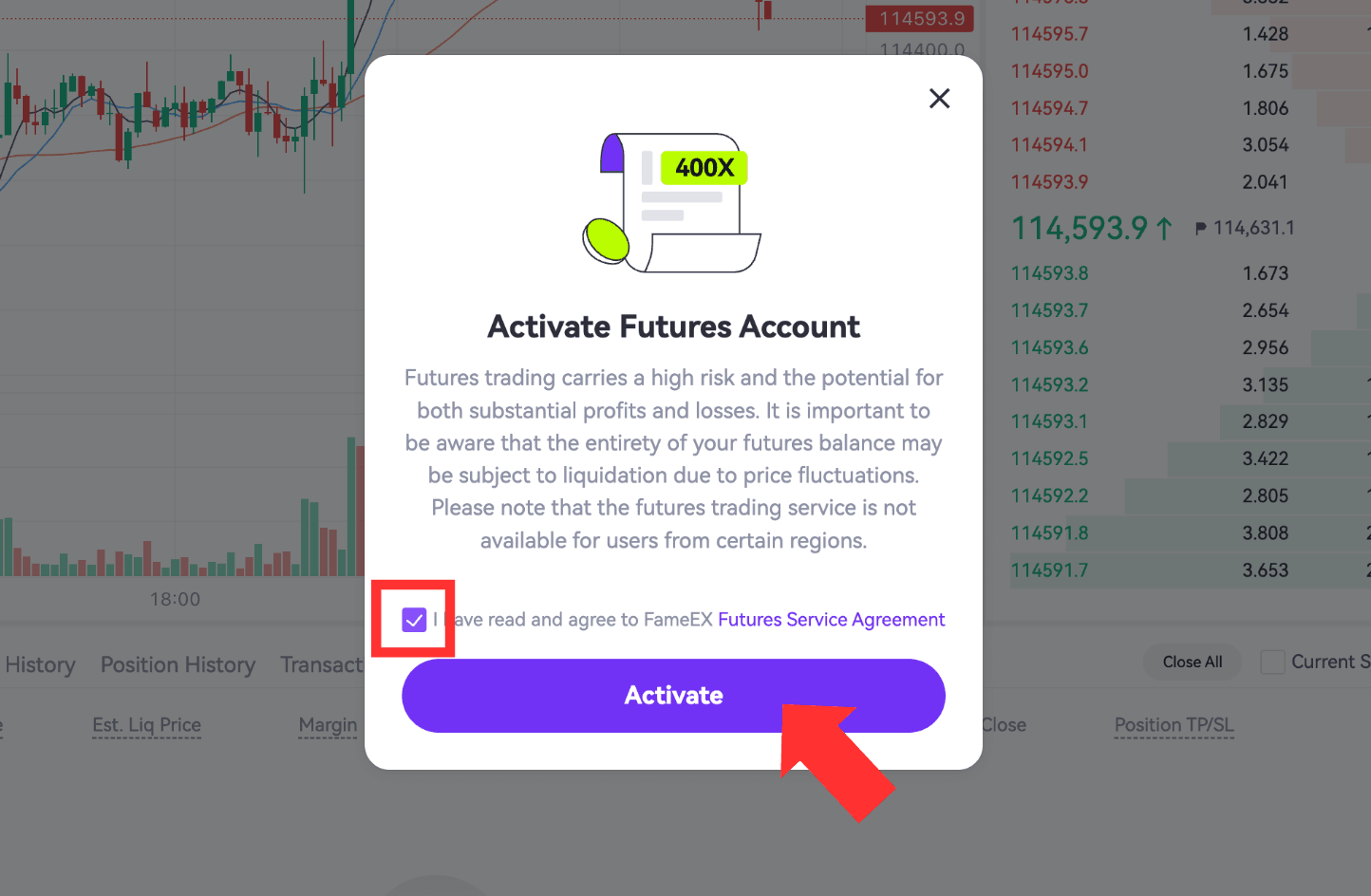

If you have not yet activated futures trading, carefully read the FameEX Futures Service Agreement, check the box to agree, and click 'Activate'.

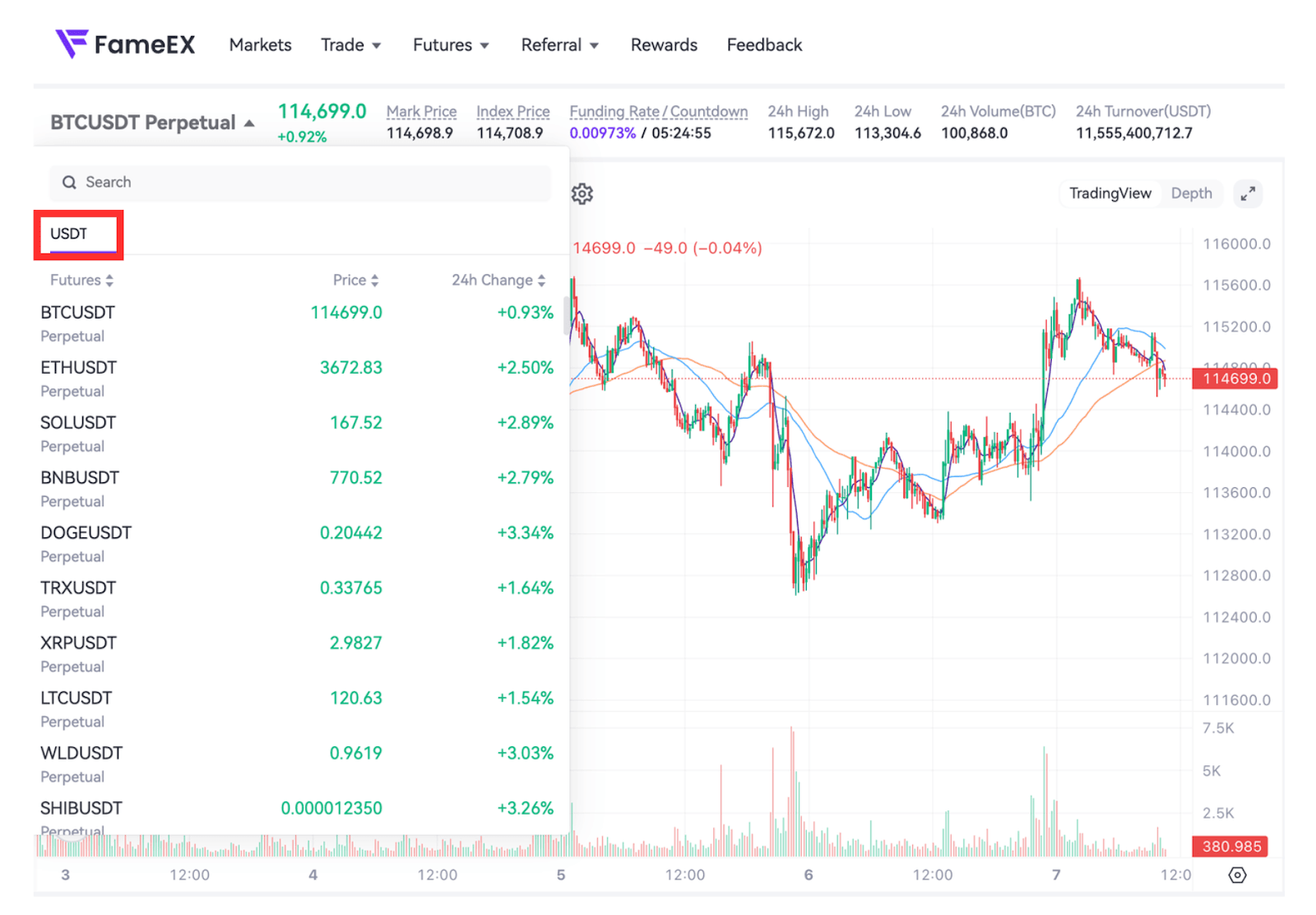

2. Select the Futures Trading Zone

Currently, FameEX only supports USDT perpetual futures trading with a single-currency margin mode. In this mode, you can open both cross margin and isolated margin positions.

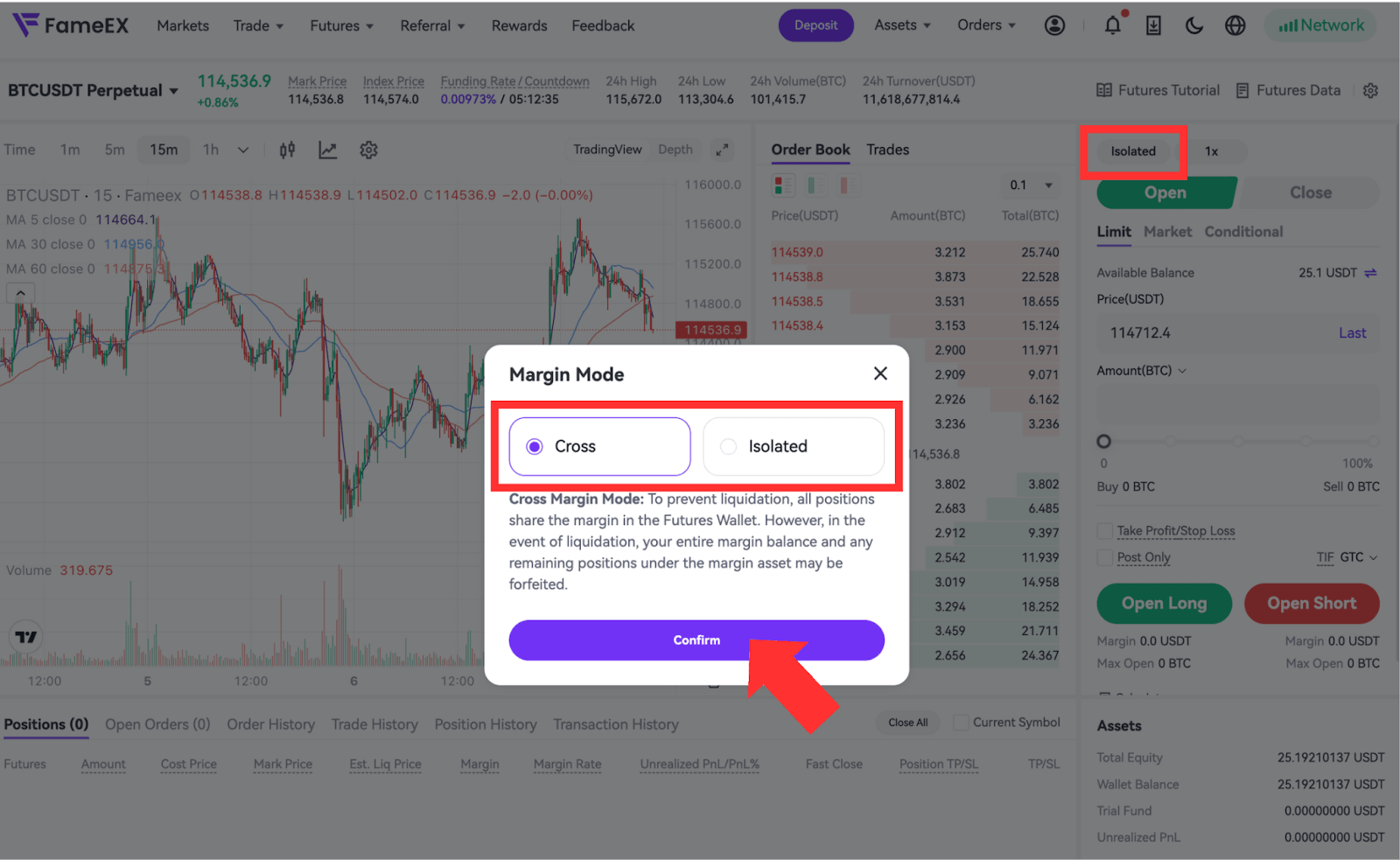

3. Select Position Mode

FameEX supports two position modes: Cross and Isolated. Click 'Cross' or 'Isolated' on the right side of the page to switch between these modes.

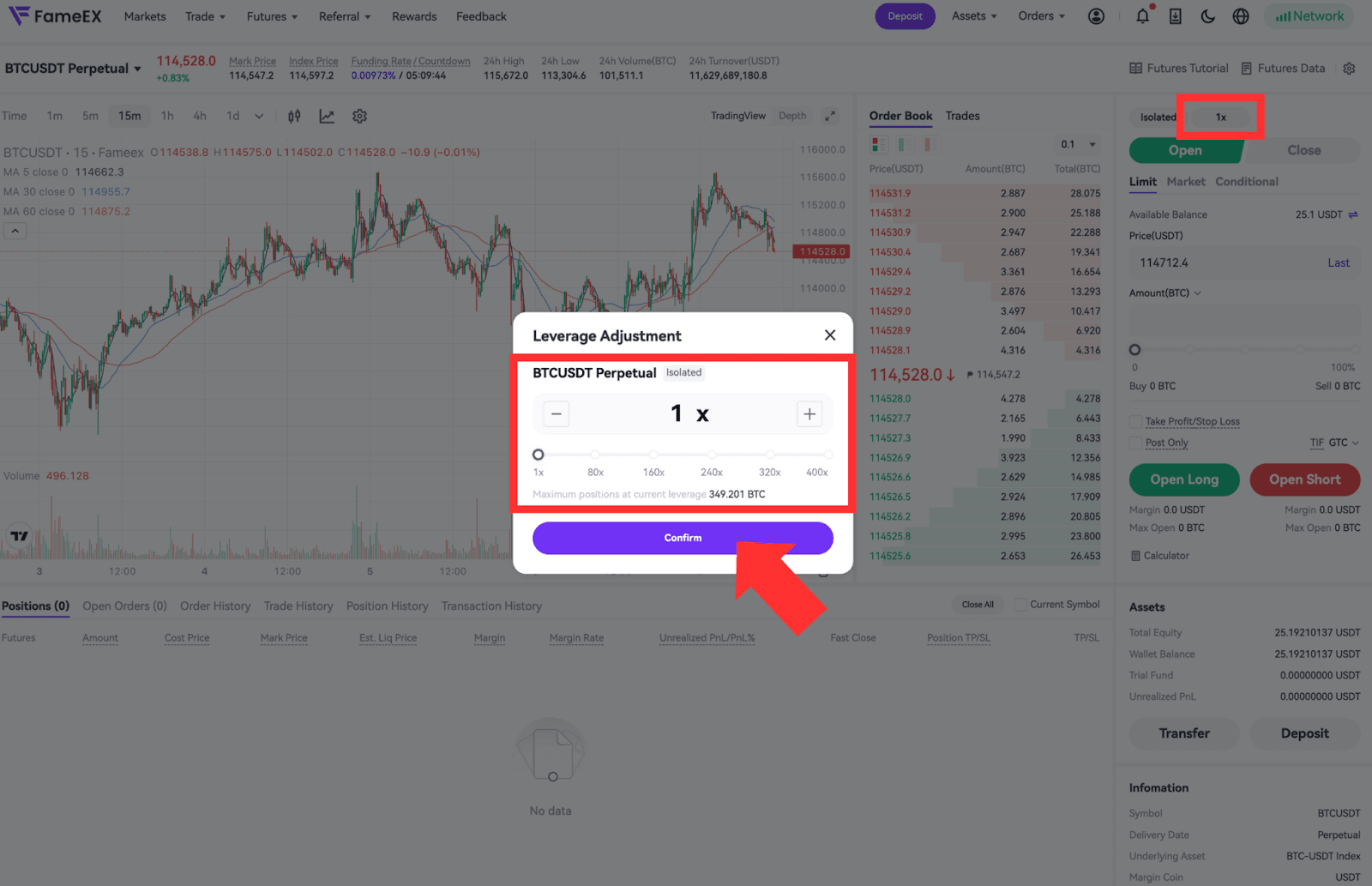

4. Adjust Leverage

Click the '1x' button on the right side of the page to adjust your preferred leverage level.

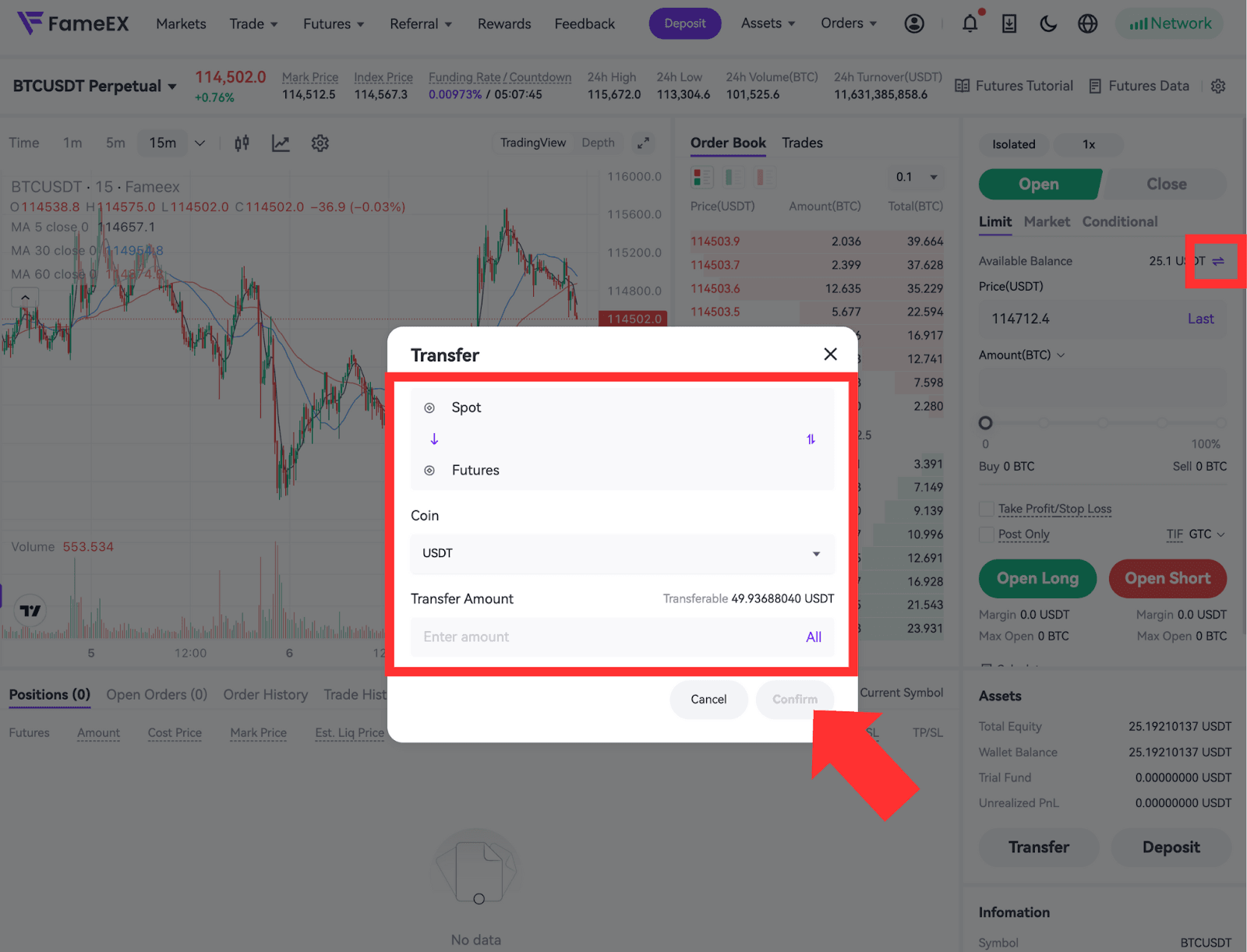

5. Transfer Funds

Users can use USDT as collateral margin. On the Futures interface, click the 'Transfer' icon near ‘Available Balance’, select the transfer direction, coin, and amount, review the details, and then click 'Confirm' to complete the transfer.

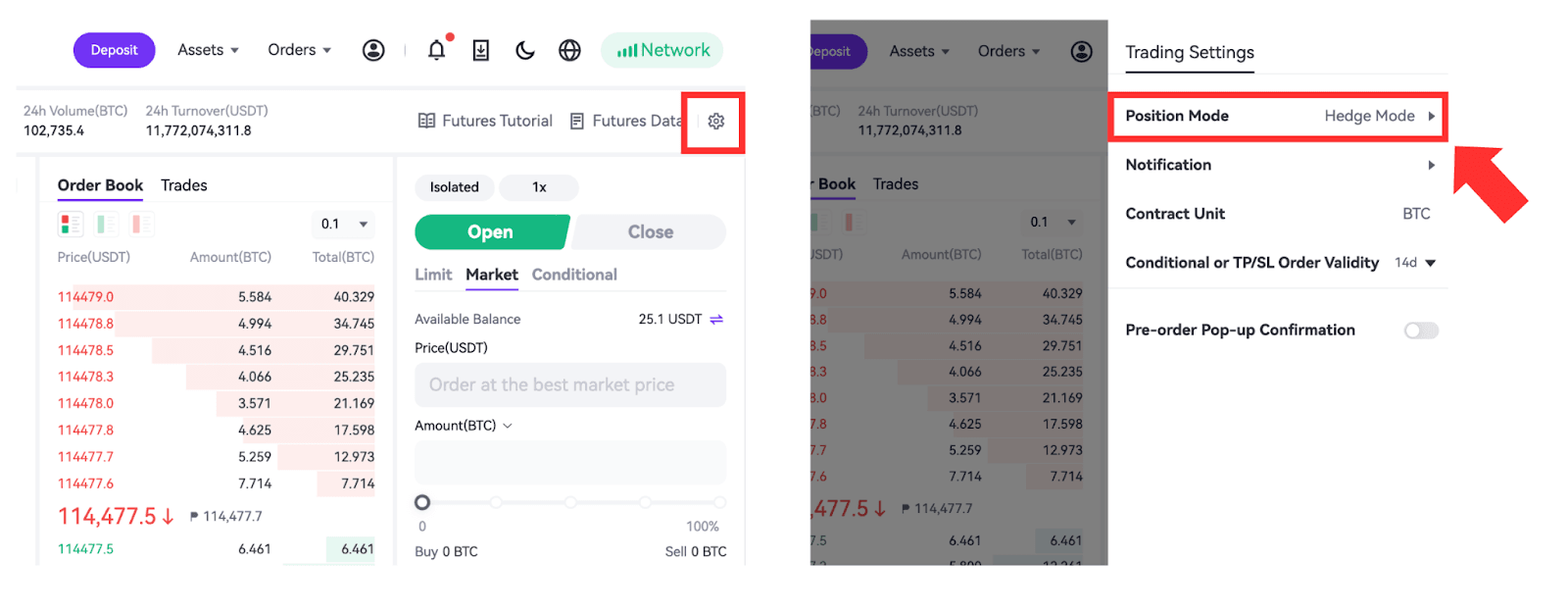

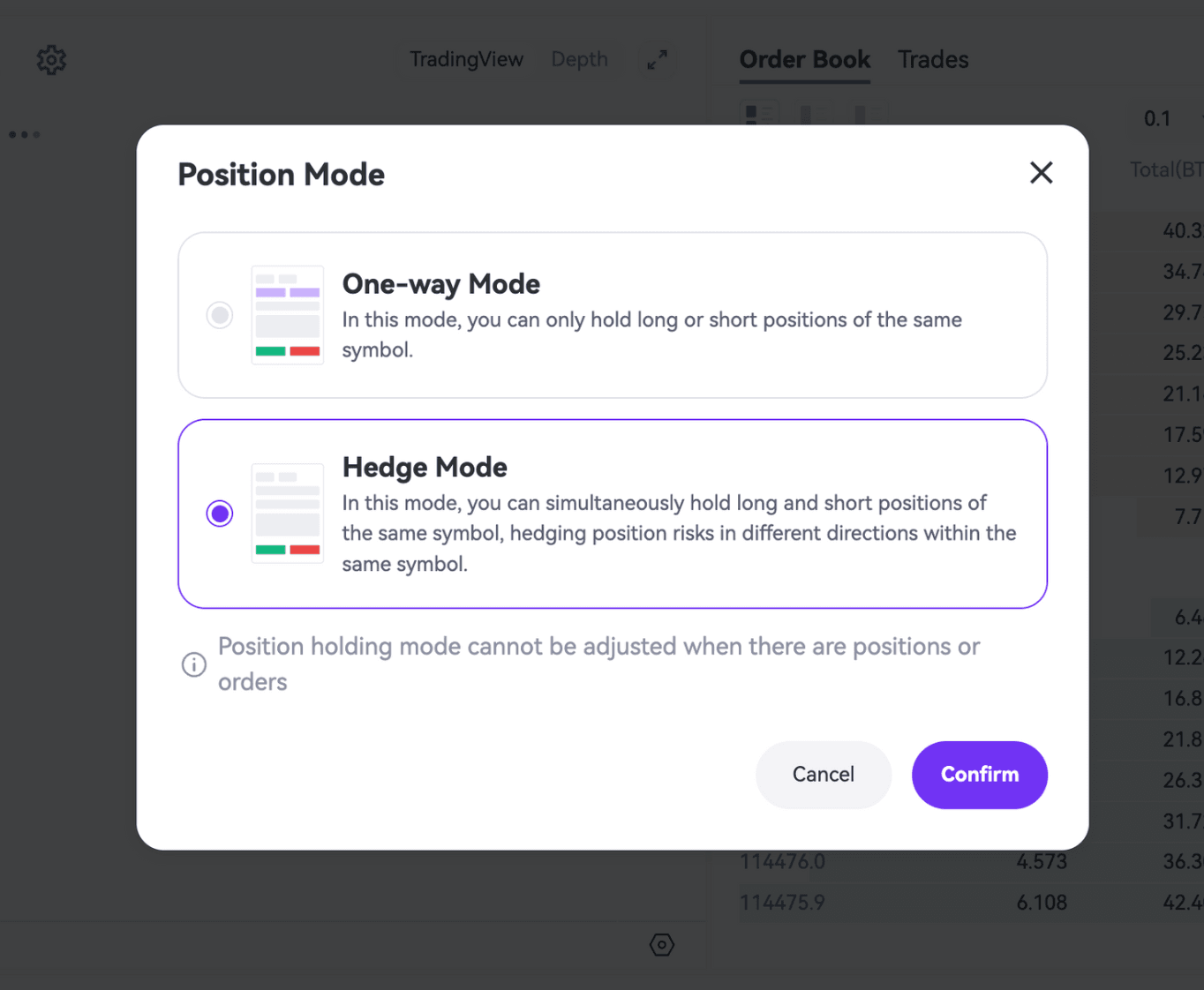

6. Select Position Mode

FameEX supports two position modes: One-way Mode and Hedge Mode. Click the 'Settings' button in the upper-right corner of the Futures interface, select 'Position Mode', and choose either 'One-Way Mode’ or 'Hedge Mode’.

If you choose Hedge Mode, proceed to step 7. If you select One-way Mode, scroll down to step 9.

7. Place Open Orders (Hedge Mode)

Hedge mode means that you can simultaneously hold long and short positions of the same symbol, where profits and losses do not offset each other. In this mode, you can hedge position risks in different directions within the same symbol. When you anticipate a bullish market, select ‘Open Long’, and when you expect a bearish market, choose ‘Open Short’. You can place open orders at Limit, Market, Trigger, or Post Only (USDT perpetual is used as an example below).

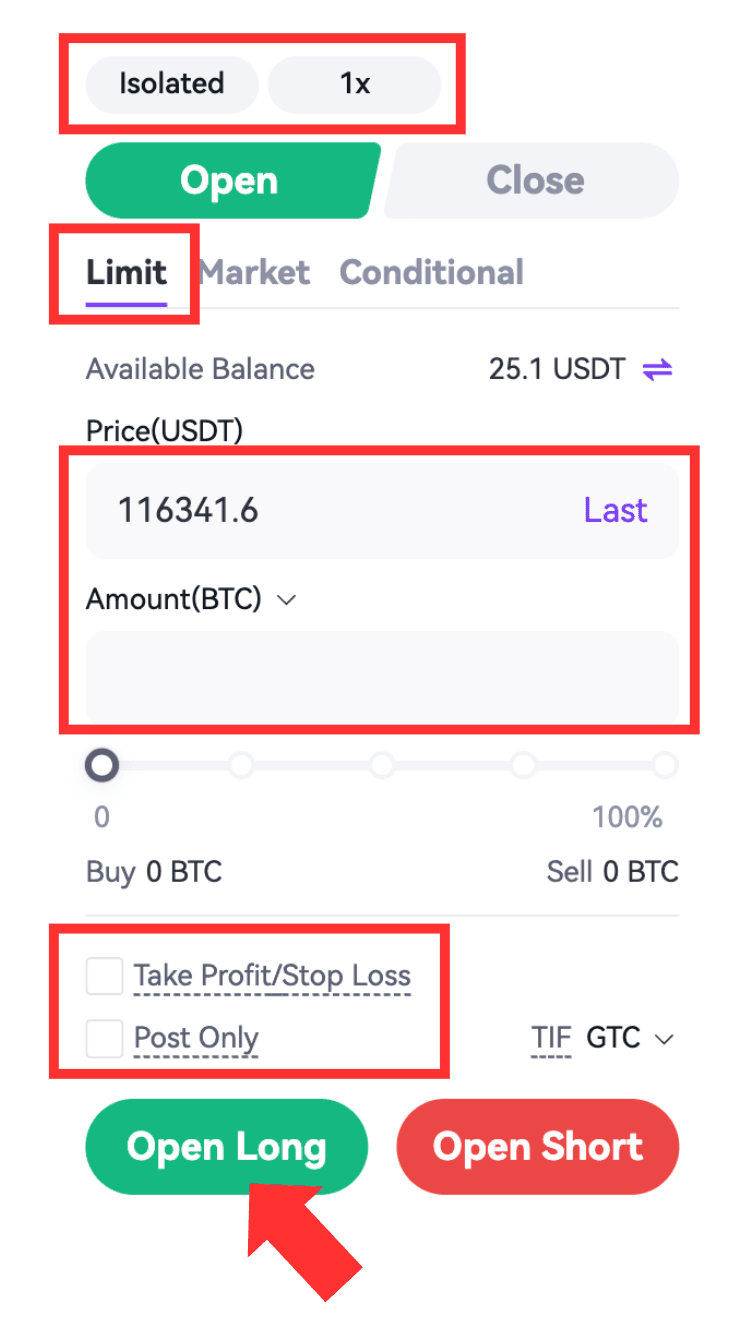

7.1 Limit (Open Long): Click ‘Open’ on the trading page, select Limit order, and enter Price and Amount. In addition, you can select TP/SL and Post Only type. Once you have confirmed the details, tap ‘Open Long’. After placing an order, the limit order will only be executed when the opposing orders in the market match the specified price range.

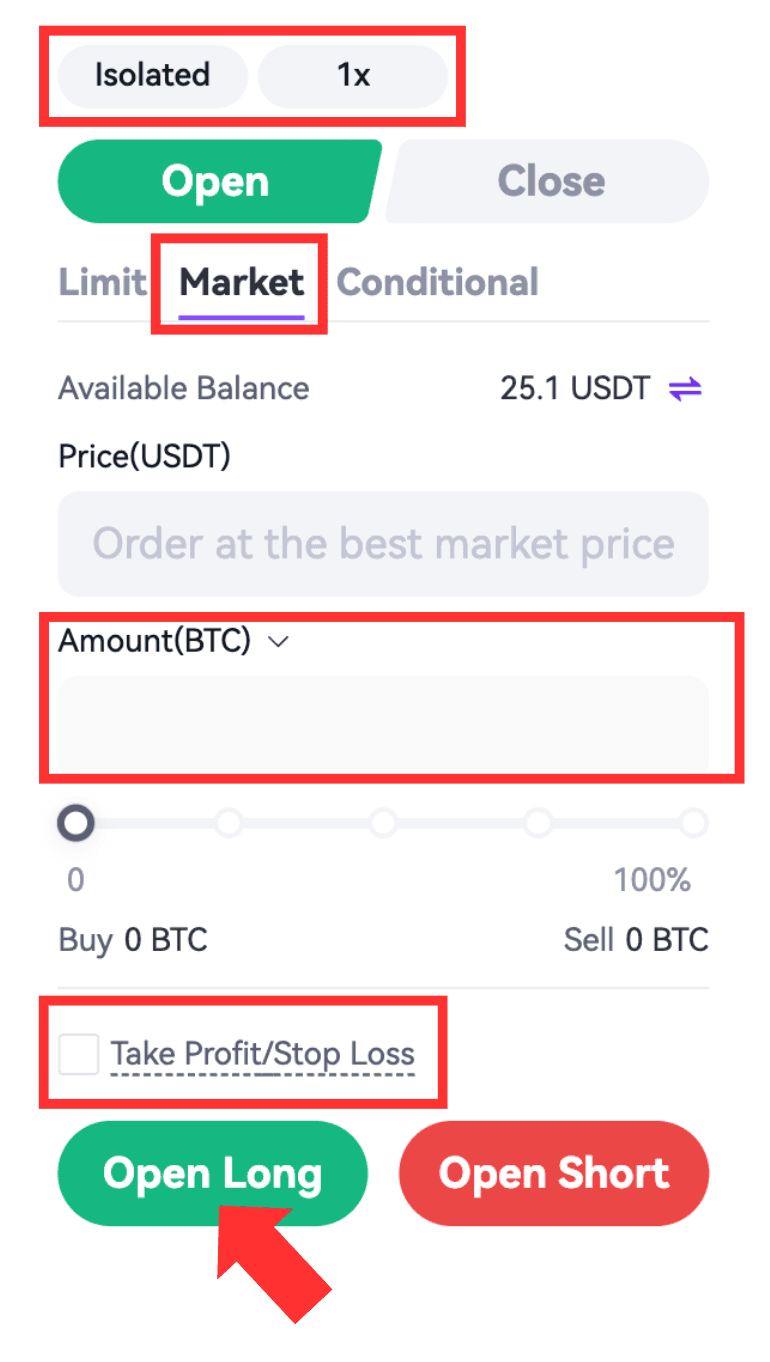

7.2 Market (Open Long): Click ‘Open’ on the trading page, select Market order, and enter the Amount. In addition, you can select TP/SL. Once you have confirmed the details, tap ‘Open Long’. After placing an order, the market order will be executed at the best price in the current market.

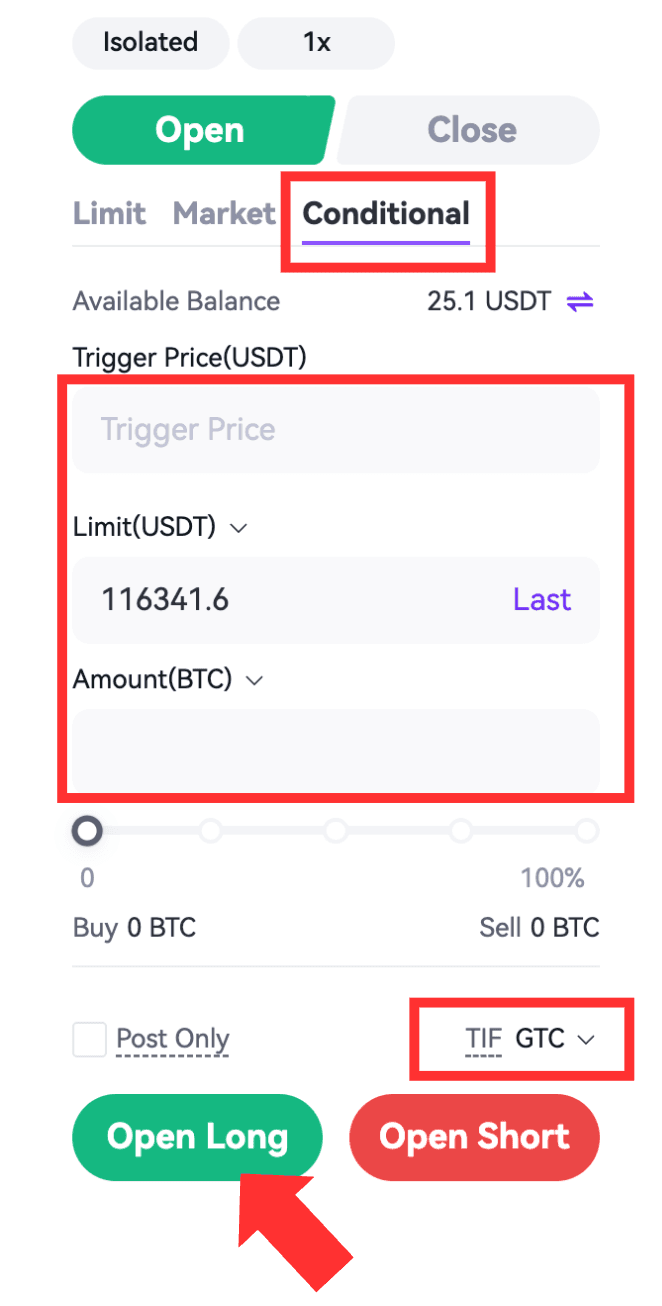

7.3 Conditional (Open Long): Click ‘Open’ on the trading page, select Conditional, and enter Trigger Price, Order Price in Limit or Market, and Amount. In addition, you can select the TIF type. Once you have confirmed the details, tap ‘Open Long’. After placing an order, the trigger order will be placed if the market price reaches the trigger condition.

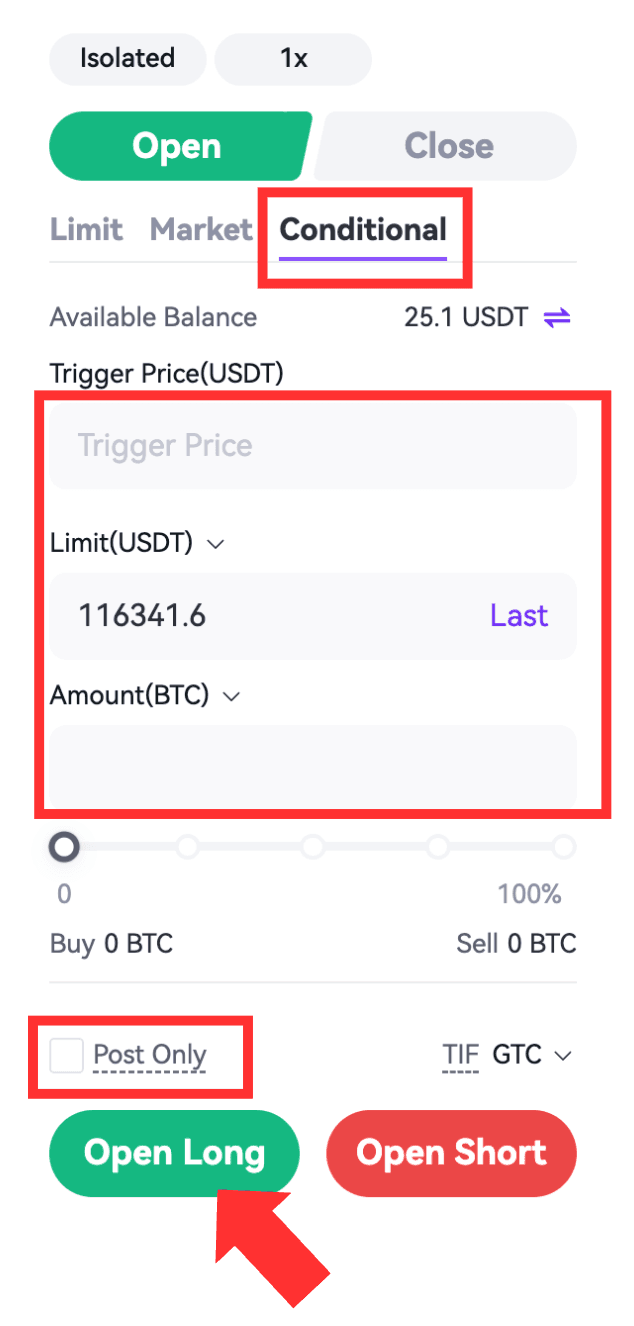

7.4 Post Only (Open Long): Click ‘Open’ on the trading page, select Post Only, and enter Price and Amount. In addition, you can select the TIF type. Once you have confirmed the details, tap ‘Open Long’. After placing an order, the post-only order will be added to the order book and not executed in the market immediately. By placing a post-only order, if the order matches with an existing order, it will be canceled, ensuring that you will always act as a Maker.

Note: When you open a position with a Take Profit (TP) or Stop Loss (SL) order, the system will automatically place the TP/SL order once the initial order is fully executed. You can choose to set either a TP or SL order individually, or set both simultaneously.

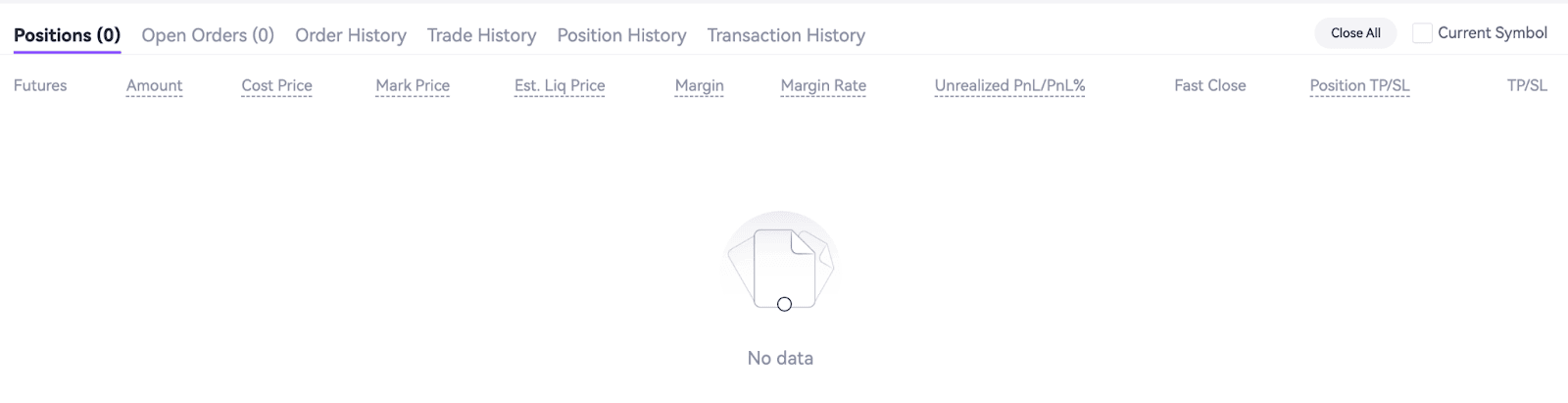

8. Check Your Positions

After placing your order, executed positions will appear under current ‘Positions'. Unfilled orders will show under 'Open Orders', where they can be canceled if not yet matched. You can also view 'Order History', 'Trade History', ‘Position History’, and 'Transaction History’' from this interface.

9. Place Close Orders (Hedge Mode)

When placing a close order under the hedge mode, you have multiple order types to choose from, including Limit, Market, Conditional, or Post Only. Moreover, you can tap ‘Close’, ‘Quick Close’ and ‘Close All’ under the Positions section to close your positions.

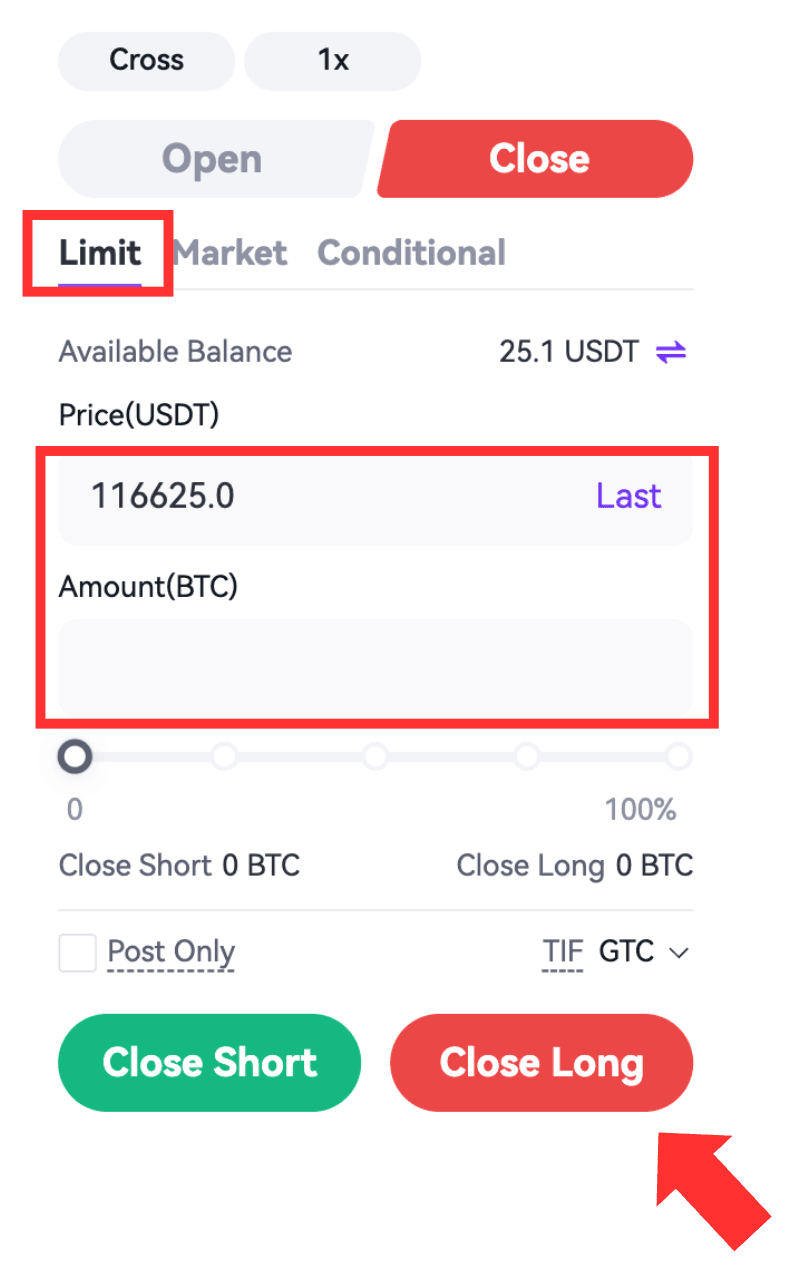

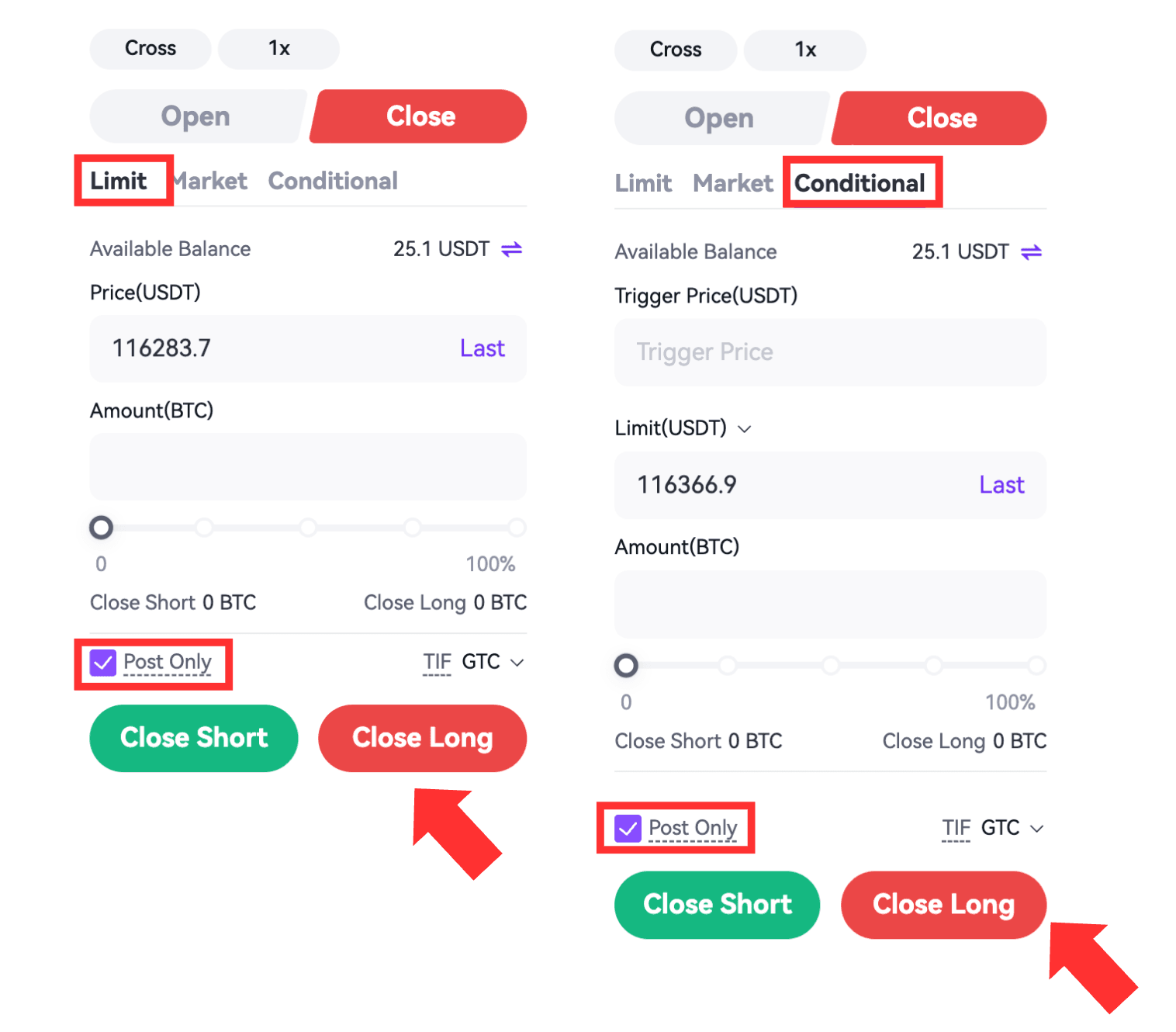

9.1 Limit (Close Long): Click ‘Close’ on the trading page, select Limit, and enter Price and Amount. Then, click ‘Close Long’.

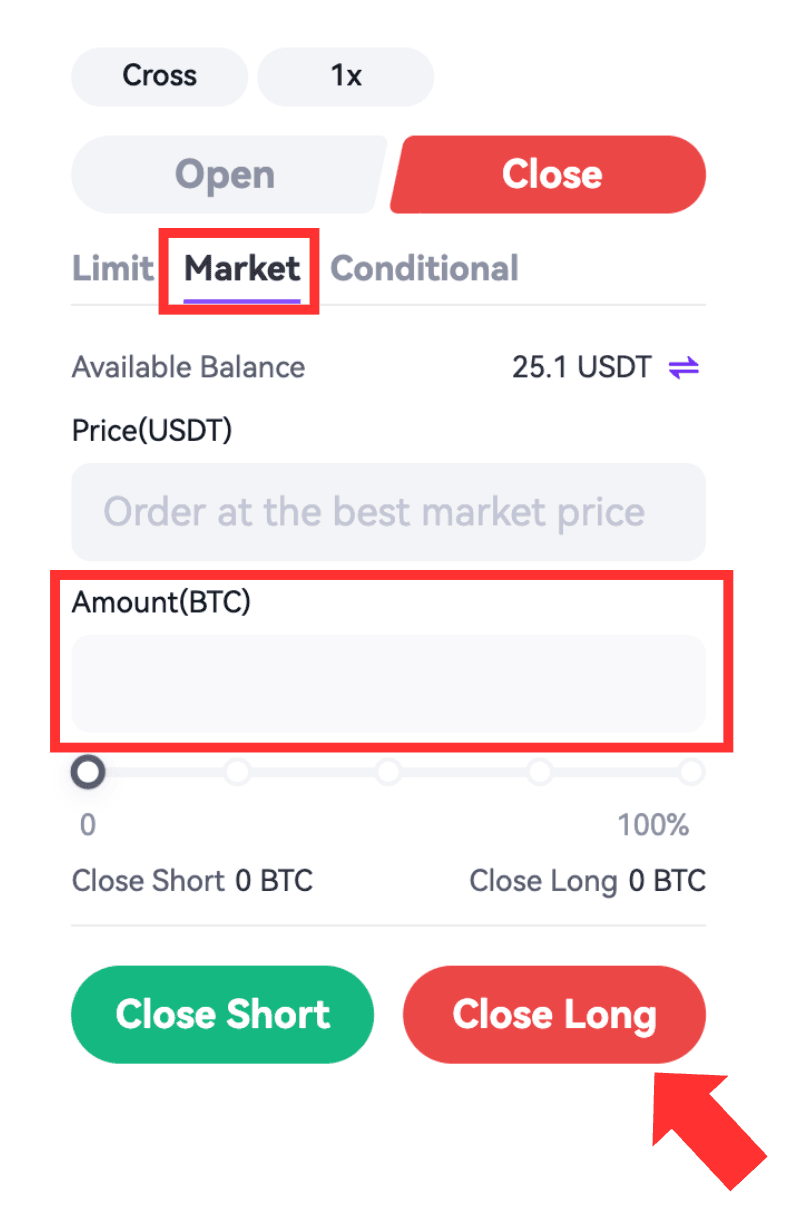

9.2 Market (Close Long): Click ‘Close’ on the trading page, select Market, and enter Amount. Then, click ‘Close Long’.

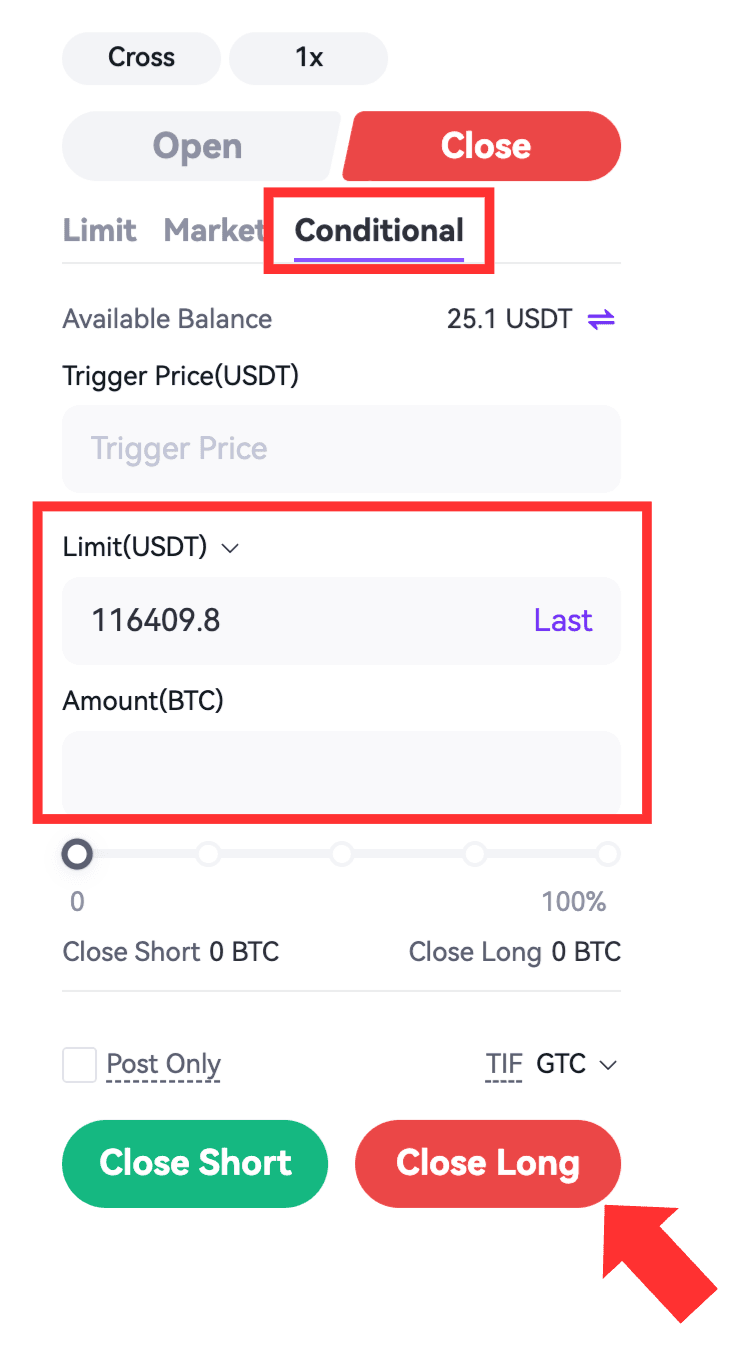

9.3 Conditional (Close Long): Click ‘Close’ on the trading page, select Conditional, and enter Trigger Price, Order Price in Limit or Market, and Amount. Upon confirmation, click ‘Close Long’.

9.4 Post Only (Close Long): Click ‘Close’ on the trading page, you can select Post Only under Limit or Conditional orders, and enter Price and Amount. Upon confirmation, click ‘Close Long’.

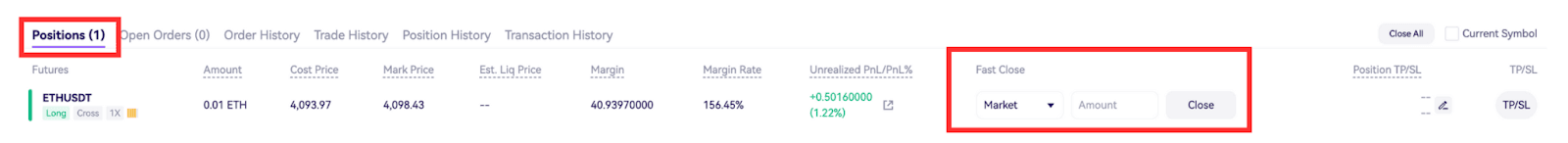

9.5 Close (Close Long): In the Positions section, click Close under the Fast Close area. Select either Limit or Market price, then enter the amount you’d like to close. If you choose a limit order, make sure the price you set matches your expectations.

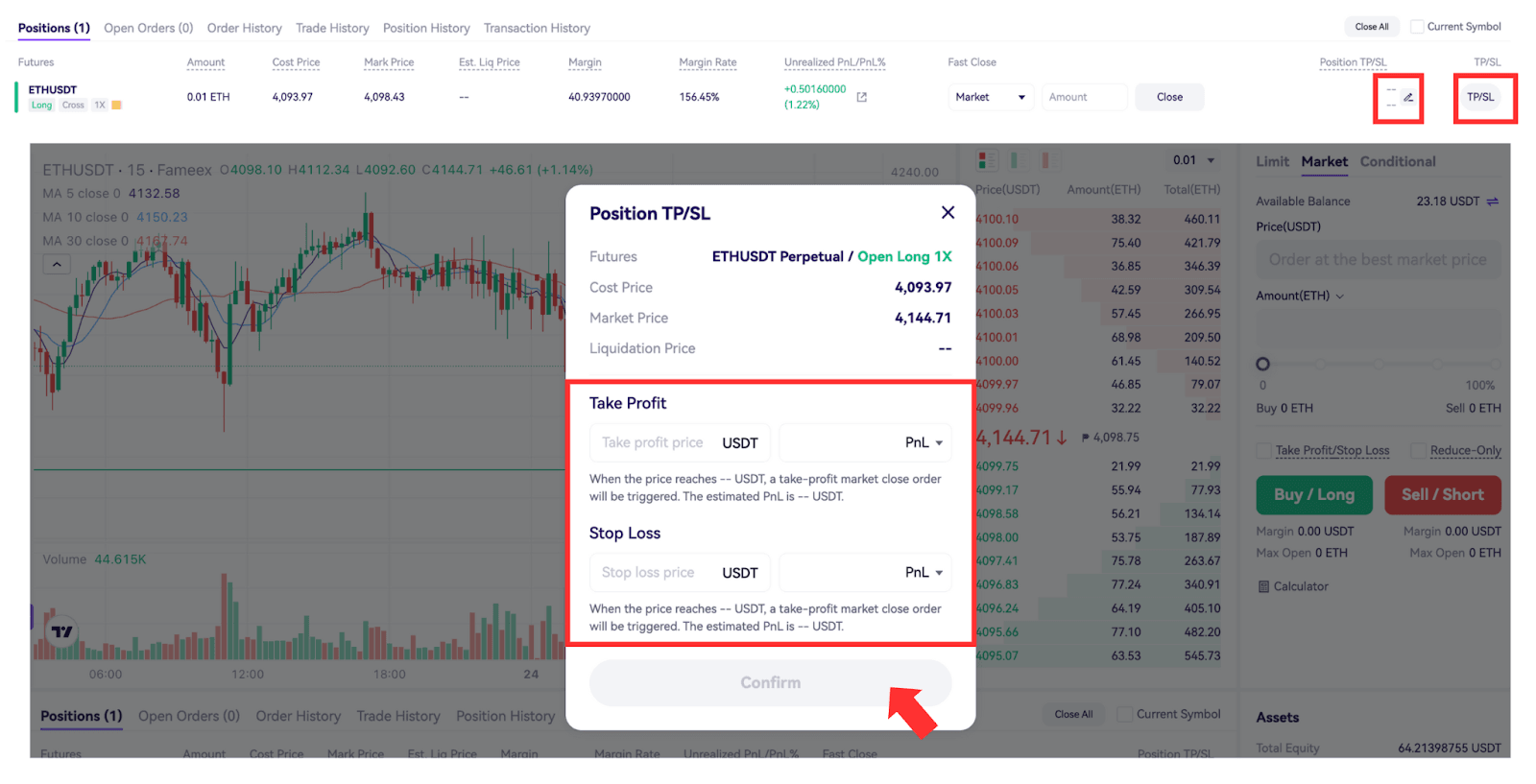

9.6 TP/SL Close (Close Long): On the Positions section, click ‘TP/SL’ to set up take-profit and stop-loss conditions for the current position by selecting Hedge TP/SL or One-way TP/SL.

9.7 Close All: After clicking on ‘Close All’, the system will close all of your positions at the best market price. Besides, all closed orders will be automatically canceled.

10. Buy/Long and Sell/Short (One-way Mode)

One-way mode means that you can only hold long or short positions of the same symbol, where profits and losses offset each other. In this mode, you have the option to use a “Reduce-Only” order type, which allows you to only decrease your existing position holdings and prevents the opening of positions in the opposite direction. When you anticipate a bullish market, select ‘Buy/Long’, and when you expect a bearish market, choose ‘Sell/Short’. You have various order types to choose from, including Limit, Market, Conditional, or Post Only orders.

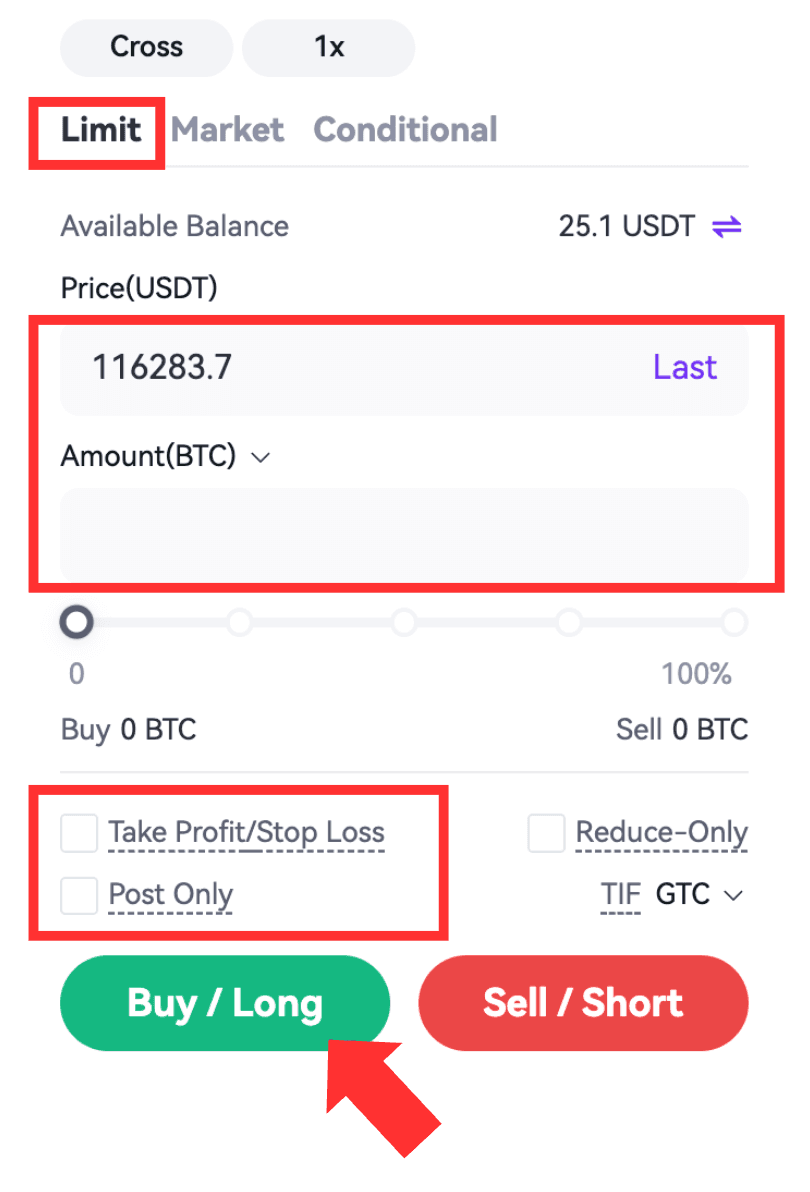

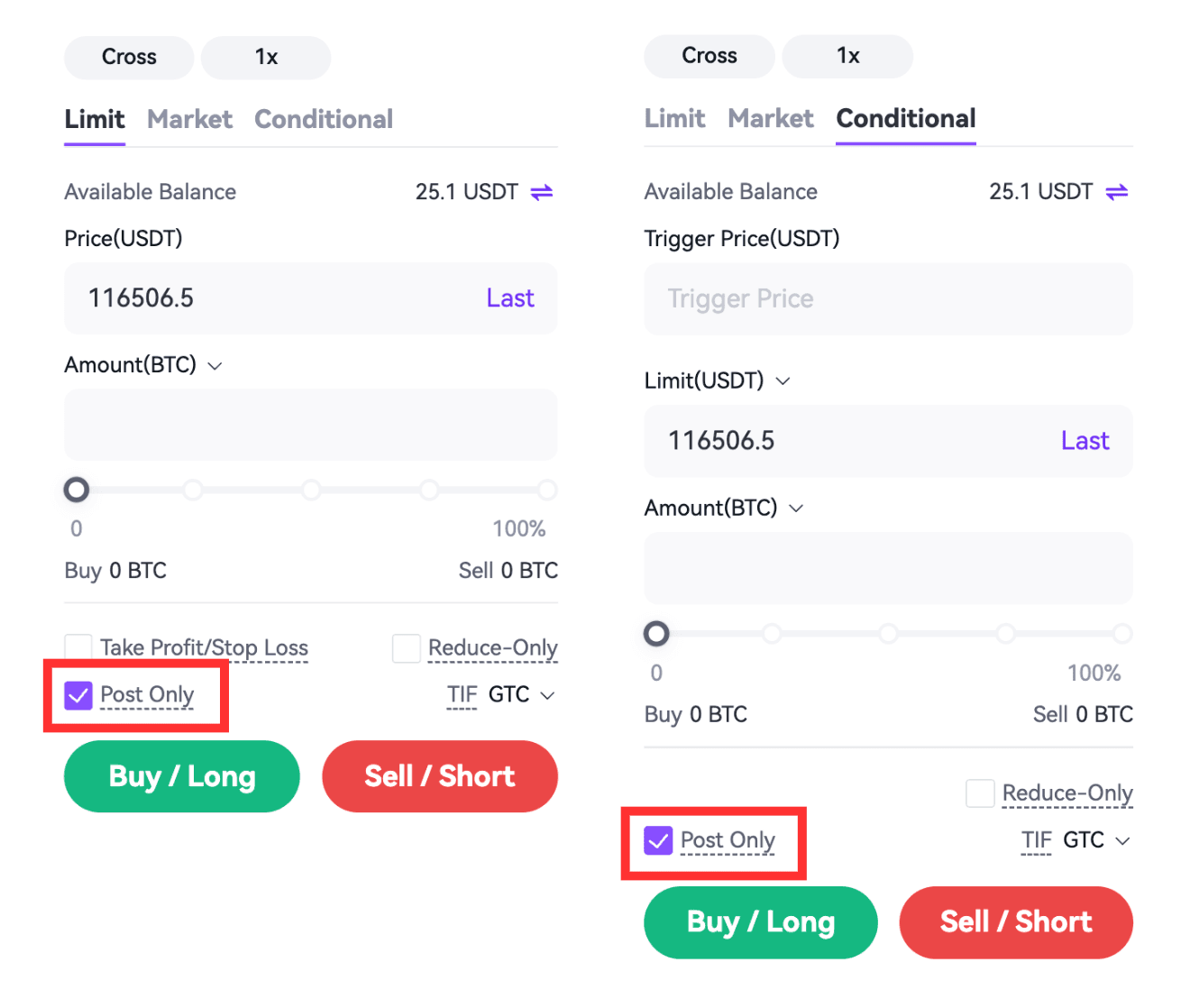

10.1 Limit Order: On the trading page, select Limit, and enter Price and Amount. In addition, you can select TP/SL and TIF type. Upon confirmation, tap ‘Buy/Long’ or ‘Sell/Short’. After placing an order, the limit order will only be executed when the opposing orders in the market match the specified price range.

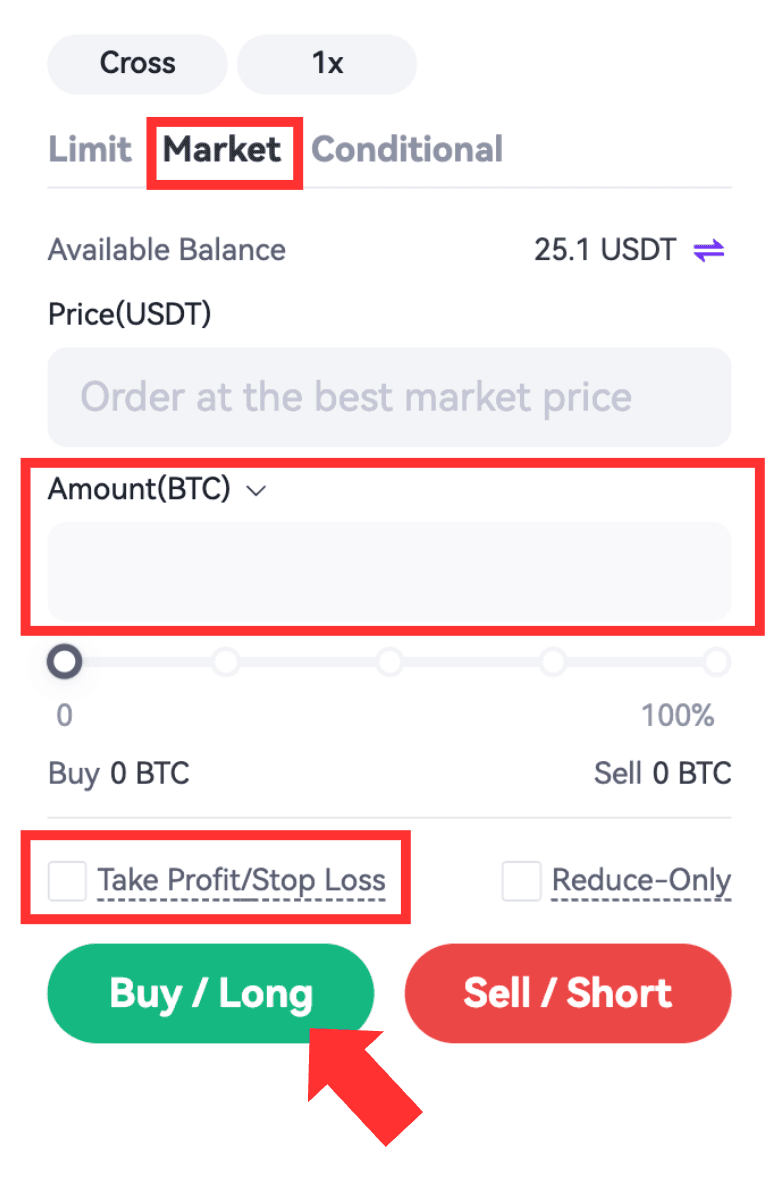

10.2 Market Order: On the trading page, select Market and enter the Amount. In addition, you can select the TP/SL type. Upon confirmation, tap ‘Buy/Long’ or ‘Sell/Short’. After placing an order, the market order will be executed at the best price in the current market.

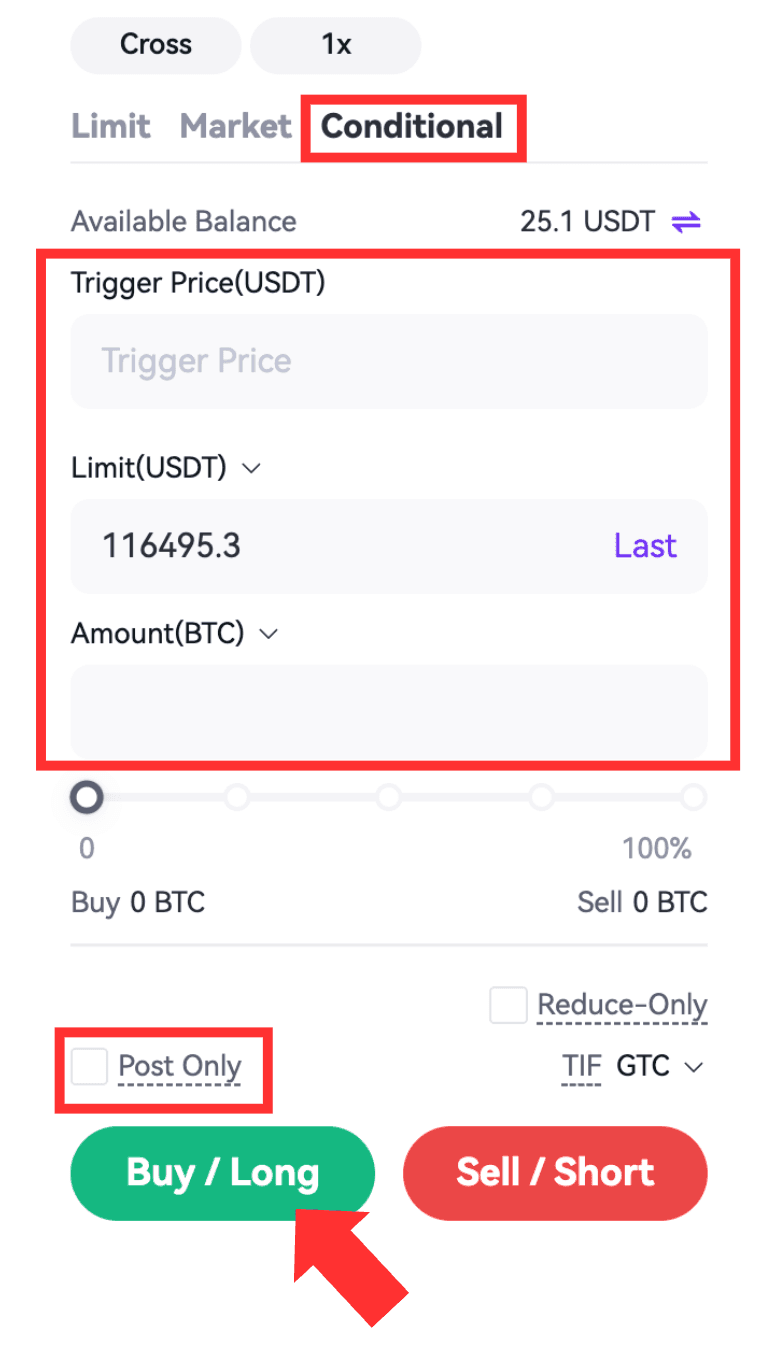

10.3 Conditional Order: On the trading page, select Conditional, and enter Trigger Price, Order Price, and Amount. In addition, you can select the TIF type. Once you have confirmed the details, tap ‘Buy/Long’ or ‘Sell/Short’. After placing an order, the trigger order will be placed if the market price reaches the trigger condition.

10.4 Post Only Order: On the trading page, select Post Only, and enter Price and Amount. In addition, you can select TP/SL and TIP type. Once you have confirmed the details, tap ‘Buy/Long’ or ‘Sell/Short’. After placing an order, the post-only order will be added to the order book and not executed in the market immediately. By placing a post-only order, if the order matches with an existing order, it will be canceled, ensuring that you will always act as a Maker.

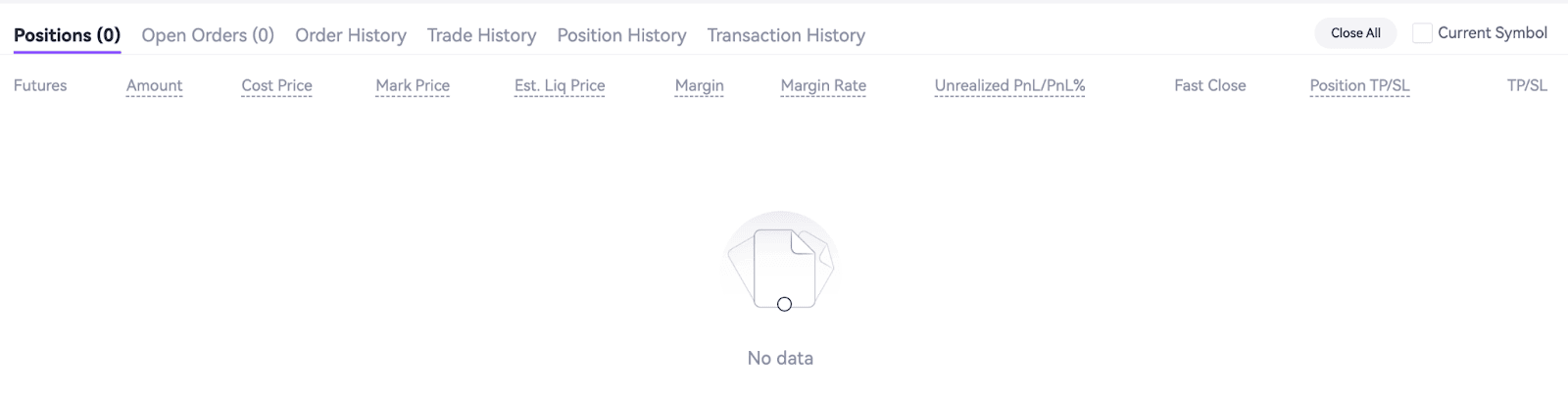

11. Check Your Positions

After placing your order, executed positions will appear under current ‘Positions'. Unfilled orders will show under 'Open Orders', where they can be canceled if not yet matched. You can also view 'Trade History', 'Position History', and 'Transaction History' from this interface.

12. Reverse Orders (One-way Mode)

12.1 Place a Reverse Order

Under the one-way mode, you can only hold a position in one direction. For example, if you hold long positions and decide to sell those positions to enter positions in the opposite direction, the system will close existing positions and open new positions for the remaining portion in the opposite direction.

12.2 Reduce-Only for the One-way Mode

“Reduce-Only” is a trading option in which you can only reduce your existing positions and cannot increase your positions. If you have no positions, a reduce-only order cannot be placed. In the scenario where you already hold positions and decide to place an order in the opposite direction, if the order amount exceeds the position size, only the existing positions will be closed without initiating any further positions in the opposite direction.

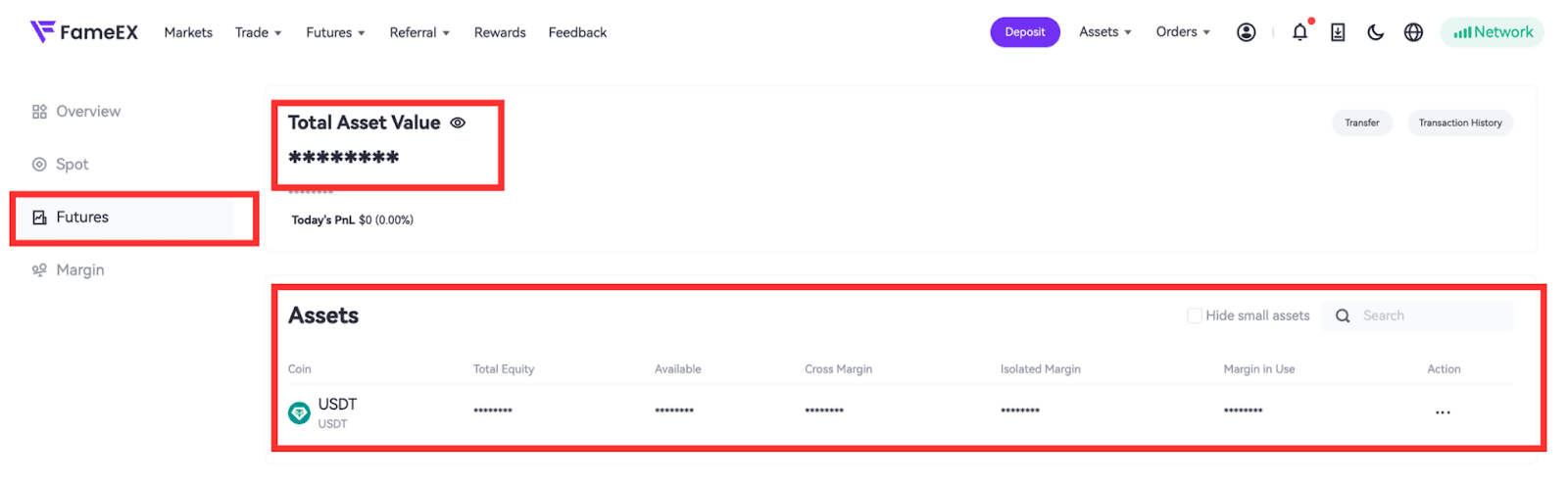

13. Check Your Assets

Click 'Assets' in the upper right corner to enter. Then, click 'Futures’ account. In this section, users can view their current Futures positions, account balance, profit and loss records, transaction history, and futures trial fund status.