FameEX Daily Market Trend | BTC & ETH Stabilize Amid Extreme Fear and ETF Momentum

2025-11-25 08:51:19

A clear crypto market outlook covering BTC and ETH trends, institutional flows, sentiment shifts, and sector analysis to assess today’s market structure.

1. Market Summary

- BTC is stabilizing near $88K and ETH around $2,900–2,950, as the market attempts to build a floor after one of the fastest drawdowns since late 2022.

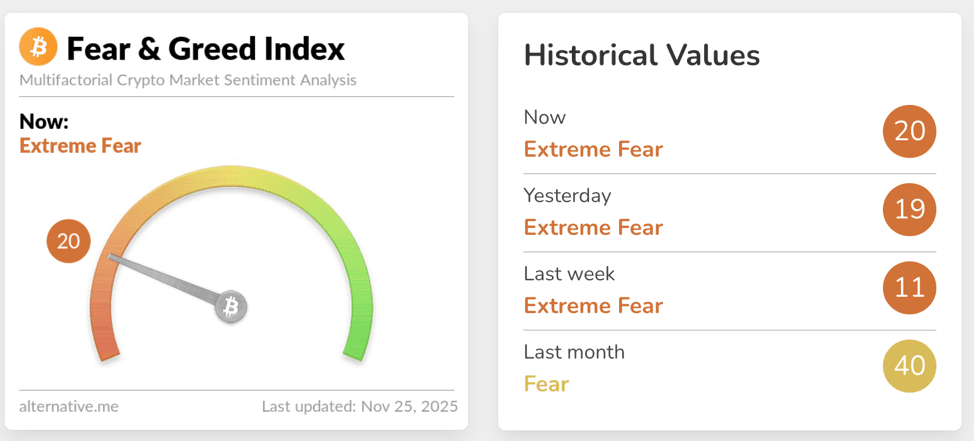

- The Crypto Fear & Greed Index sits at 20 (Extreme Fear), only slightly above last week’s lows, signaling a deeply risk-off but potentially contrarian environment.

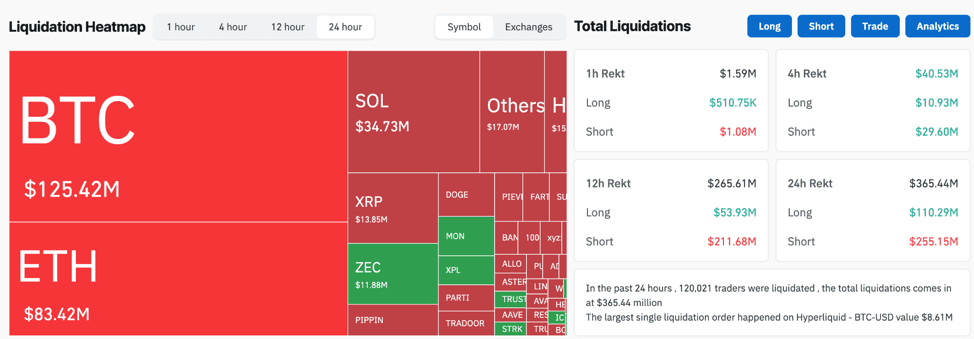

- Derivatives positioning remains fragile while total 24h liquidations are about $365M, with shorts (~$256M) exceeding longs (~$110M), while ETH open interest has jumped 6.26% to roughly $35.6B.

- Spot crypto investment products have seen about $4.9B in outflows over four weeks, but late-week $258M inflows and renewed BTC spot ETF buying hint at early bottom-fishing by institutions.

- Macro markets are preparing for a more supportive policy backdrop. Prediction markets now price around 81% probability of a 25 bps Fed cut in December, with only around 18% odds of “no change”.

2. Market Sentiment / Emotion Indicators

Market structure today is defined by a clash between extreme fear in sentiment indicators and hard evidence of buyers stepping in around the $80,000 to $85,000 BTC price zone. The Fear & Greed Index at 20 captures how abruptly the mood flipped from euphoria to panic, echoing prior stress episodes such as the COVID crash and the FTX collapse, yet on-chain and derivatives data show that forced selling has been absorbed more quickly this time.

Source: Alternative

With roughly $365M of liquidations in the last 24 hours, skewed toward short positions, and models like the capitulation-volume framework suggesting that prior clusters of three consecutive high-volume red weekly candles frequently marked cycle lows, a growing group of analysts now treats $80,000 as a probabilistic bottom rather than a mid-cycle top. While fund-flow data confirm this is already the third-largest outflow run on record, surpassed only by the March tariff sell-off and the 2018 washout. This creates a structurally interesting setup that positioning is lighter, psychology is pessimistic, ETF investors are near cost basis, yet macro liquidity. This helped by expectations for Fed easing and selective institutional buying are slowly rebuilding a floor beneath the market.

Source: Coinglass

3. Key Events of the Day

- Crypto investment products extended their four-week outflow streak to $4.9B, but $258M of late-week inflows and renewed BTC ETF demand signal tentative stabilization in institutional sentiment.

- Senior ETF analysts flag that five new spot crypto ETFs (including products tracking XRP, DOGE and LINK) are expected to launch within six days, adding depth and breadth to listed crypto exposure.

- Japan’s FSA moves toward requiring liability reserves at exchanges to cover hacks, while the ECB warns that large stablecoin runs could spill over into the $25T U.S. Treasury market, reinforcing the push for stricter oversight.

- 81% probability of a 25 bps Fed cut on December 10, overshadowing today’s U.S. PPI release and keeping dollar and rates volatility firmly in focus.

- In altcoins, Monad’s heavily oversubscribed public sale, AVAX One’s accumulation of 13.8M AVAX, and continued Multicoin buying of AAVE underline that strategic treasuries and funds are using the correction to scale exposure to chosen ecosystems.

3.1 Institutional Insights

The institutional tape continues to deliver mixed but progressively less bearish signals. On one side, Citi highlights that ETF outflows of nearly $4B since early October have pushed BTC back toward the average cost basis of ETF holders and closer to the bank’s $82,000 year-end bear-case. This aligns with flow data showing the third-largest outflow sequence on record across crypto ETPs. A recent session saw over $238M of net inflows into BTC spot ETFs, and the product mix is evolving as XRP, DOGE and LINK spot ETFs prepare to list, potentially unlocking new channels of demand beyond BTC and ETH. On-chain, we continue to see whale-driven positioning shifts. One address wired 470 BTC (≈$40M) into an asset manager associated with BTC products, while another newly created wallet deployed $5.35M in collateral to open a 20X leveraged BTC short worth about $43.5M on a major derivatives venue. This evidence that high-conviction bears remain willing to express directional views even into support. This paints a picture of institutions that are cautious at the benchmark level but still willing to fund infrastructure, L1s and DeFi blue chips in size.

3.2 Ecosystem/Protocol Updates

On the ecosystem side, capital continues to flow into core infrastructure and RWA-linked primitives, even as headline prices struggle. The upcoming Monad mainnet launch and the completion of its $269M public token sale that oversubscribed by 144% with more than 850,000 participants underline persistent demand for high-throughput, EVM-compatible L1s, albeit at more moderate valuations than earlier “super-chain” cycles. At the same time, Sui’s R25 upgrade introduced yield-bearing RWA-backed tokens rcUSD and rcUSDp, adding another datapoint to the trend of onchain treasuries backed by diversified real-world assets, a design that could appeal to more conservative DeFi users. In DeFi credit, the legal dispute between Core Foundation and Maple over the syrupBTC product has triggered a rare court-ordered injunction in the Cayman Islands, spotlighting the friction between traditional legal agreements and “decentralized” protocols; the outcome will matter for how future exclusive partnerships and intellectual property are structured in DeFi.

3.3 Macro & Tech Developments

Macro and regulatory developments are increasingly intertwined with crypto stability. On the monetary front, the Fed’s December meeting is now widely expected to deliver a 25 bps rate cut, with odds near 81% for easing vs 18% for a hold, even as key data such as PCE get rescheduled, leaving investors with less clarity into the decision. In parallel, the ECB’s latest financial stability review flags stablecoins as a potential transmission channel of stress into the $25T U.S. Treasury market, given the scale of T-bill and bond holdings at the largest issuers. The report argues that a disorderly run on major stablecoins could force rapid reserve liquidations, potentially amplifying volatility in sovereign debt and money markets. In Asia, Japan’s FSA is reportedly moving to require exchanges to hold liability reserves to cover hacks and operational failures, while also revisiting rules that could allow banks to hold crypto assets, consistent with the country’s push toward regulated, bank-aligned digital-asset infrastructure. On the cybersecurity front, the SitusAMC breach prompted commentary from Ethereum co-founder Vitalik Buterin that “privacy is not a feature, but a hygiene practice,” reinforcing the idea that privacy-preserving architectures will increasingly be viewed as baseline requirements for financial systems, whether centralized or onchain.

4. BTC & ETH Technical Data

4.1 BTC Market

Bitcoin is attempting to consolidate above $88,000 after last week’s plunge to around $80,600, a level that multiple analysts now treat as the cycle floor. The current structure is a classic tug-of-war between macro-driven dip buyers and structurally lighter ETF demand. On the downside, liquidation bands show that a break below $83,500 could trigger roughly $2.23B of long liquidations across major venues, while a move above $92,200 would put about $1.18B of short positions at risk of being squeezed. At the trend level, BTC trades below its 20-day EMA near $94,600, and technical analysis from several desks suggests that a sharp rejection at that dynamic resistance would keep the door open to a deeper retest of the $73,000–$75,000 area, where spot bids are expected to be heavier.

4.2 ETH Market

ETH is staging a more convincing rebound than BTC, trading around $2,900–2,950, up nearly 5% on the day, but still below the key $3,150–$3,350 resistance band highlighted by recent technical analyses. The derivatives picture is notably different from BTC. ETH futures open interest has increased by 6.26% in the last 24 hours to about $35.6B, a sign that traders are re-leveraging into the move, with a substantial share of that OI concentrated on a handful of major CEXs. At the same time, onchain data from earlier this month showed large ETH treasuries and funds adding aggressively below $2,700, reinforcing the notion of a corporate and fund-driven floor under the asset. On the upside, a clean daily close above $3,350 would likely force shorts to cover, with spot-driven flows and ETF re-engagement potentially pushing ETH back into a higher-range regime. For now, the market is treating ETH as a higher beta to BTC’s direction, with elevated sensitivity to both equity risk sentiment and developments around L2 and staking narratives.

5. Altcoin Trends & Sector Rotations

Altcoin performance continues to diverge sharply by narrative, even as the aggregate complex remains under pressure. On one side, Solana has rebounded about 14% from its recent $121.50 low, but derivatives metrics remain fragile: funding on perpetuals has turned negative, 2-month futures basis has compressed toward 0%, and open interest has dropped around 27% in 30 days, signaling reduced conviction in leveraging long SOL. XRP products attracted nearly $90M in inflows even as broader funds saw outflows, while SOL ETPs suffered about $156M in redemptions, likely reflecting a shift in institutional risk budgets toward assets with immediate ETF catalysts like XRP, DOGE and LINK. Beyond majors, AVAX benefits from AVAX One’s aggressive treasury accumulation, AAVE from ongoing institutional stacking, and Bitcoin-DeFi plays such as Stacks are gaining mindshare as credible avenues to deploy stablecoins and programmability against native BTC collateral.

6. Trending Tokens

- KO (Kyuzo’s Friends)

$KO is riding a powerful blend of IP, social gaming and AI at a time when the market is actively searching for “next-cycle” consumer narratives beyond pure leverage. Kyuzo’s Friends is an AI-driven Web3 social game that brings the well-known DNAxCAT IP into an interactive environment where users can explore maps, build and upgrade structures, and engage in both cooperative and competitive play with friends. Crucially, the project is officially licensed and integrated with the Sui ecosystem and LINE’s DApp Portal, giving it access to an existing mainstream user base rather than relying solely on crypto-native demand. The team recently announced an $11M fundraising round led by a mix of Web3 funds and strategic partners, alongside primary listing and airdrop campaigns on a major CEX’s “alpha” platform, which are helping bootstrap both liquidity and community.

- SBTC (Stacks)

Stacks’ narrative is re-accelerating as Circle’s new xReserve infrastructure selects the Stacks ecosystem as its first Bitcoin Layer 2 pilot, enabling the launch of a USDC-backed stablecoin for Bitcoin DeFi. Through xReserve, Stacks can issue stablecoins that are 1:1 interoperable with native USDC, tapping into Circle’s multichain liquidity while inheriting Bitcoin’s settlement finality via Stacks’ Proof-of-Transfer design. This combination positions the ecosystem as a credible hub for Bitcoin-denominated capital markets, from lending and DEXs to yield products. As integration work progresses toward year-end, traders are increasingly viewing Stacks-related assets as leveraged plays on Bitcoin’s monetary premium plus DeFi yield, particularly attractive in an environment where investors are searching for ways to keep BTC exposure onchain while still accessing stablecoin liquidity and credit.

- CC (Canton Coin)

Canton Coin anchors the Canton Network, which is expressly designed as a public, institution-grade blockchain with configurable privacy and a focus on tokenizing real-world assets across asset classes. Unlike purely permissionless chains that prioritize openness above all, Canton emphasizes fine-grained privacy controls, legal enforceability and interoperability between previously siloed financial systems—features that matter for banks, brokers, and asset managers that must navigate strict regulatory and data-protection regimes. The recently released “Cantonomics” framework lays out how Canton Coin will support decentralized governance, incentivize validator participation, and facilitate cross-application settlement in an environment where large institutions can safely move tokenized securities, funds, and collateral. With major financial institutions already participating in early deployments, CC is emerging as a liquid proxy for the institutional tokenization theme, one that sits at the intersection of TradFi’s balance sheets and onchain settlement rails. In a market where regulators are increasingly vocal about stability and privacy, Canton’s positioning as a compliant, privacy-aware RWA backbone could become a key differentiator.

7. Today Token Unlocks

- Zircuit (ZRC) – Unlock of 128.25M ZRC ($1.20M) with 5.851% of circulating supply and bringing total unlocked supply to approximately 25.89%.

8. Conclusion

Today’s market structure is defined by a paradoxical mix of fear and resilience. Sentiment gauges and fund-flow data confirm that the October to November drawdown has shaken confidence, while ETF redemptions rank among the worst in history, and macro uncertainty remains elevated. Yet price action and on-chain behavior suggest that forced sellers have largely been absorbed around $80,000 in BTC, while ETH is quietly rebuilding a base near $3,000 with rising derivatives interest. Regulatory headlines from Japan’s liability reserves to the ECB’s stablecoin warnings show that digital assets are now systemically relevant, prompting stricter oversight rather than outright bans. At the same time, capital continues to fund infrastructure (Stacks, Canton), next-generation L1s (Monad), and RWA-linked primitives (rcUSD on Sui, AVAX treasuries, AAVE credit), indicating that long-term builders and treasuries are using the volatility to deepen their footprint. For traders, respect the downside risk implied by fragile macro and ETF flows, while recognizing that extreme fear, thin positioning, and continued institutional and corporate accumulation are historically associated with high-conviction accumulation zones rather than cycle tops.

Disclaimer: The information provided in this section is for reference only and does not represent any investment advice or the official views of FameEX.