FameEX Daily Market Trend | BTC Options Pressure Builds Amid Extreme Fear as ETH Defends Key Support Levels

2025-11-26 07:15:42

With the Fear & Greed Index plunging to 15 and remaining in “Extreme Fear” for consecutive days, BTC continues to consolidate within the $87K–$88K range. Market focus is centered on this week’s roughly $14B in notional BTC options expiring, along with two critical liquidation clusters at $83,278 and $91,927. ETH fluctuates between $2.8K–$3K, with $2,812 and $3,096 acting as decisive leverage inflection points for both long and short positions.

While whale repositioning, macro data hinting at a slight cooling in core PCE inflation, and structural shifts in regulatory and venture capital flows collectively form a layered market environment defined by “high-level pullback, leverage reduction, extreme fear sentiment, yet continued long-term accumulation.”

1. Market Summary

- BTC has corrected roughly 30% from its October peak and now fluctuates between $87K–$88K, with this week’s $14B BTC options expiry making $89K–$92K the primary battleground for directional momentum.

- ETH trades within $2.8K–$3K. A breakdown below $2,812 could trigger about $939M in long liquidations, while a breakout above $3,096 may force around $578M in short liquidations.

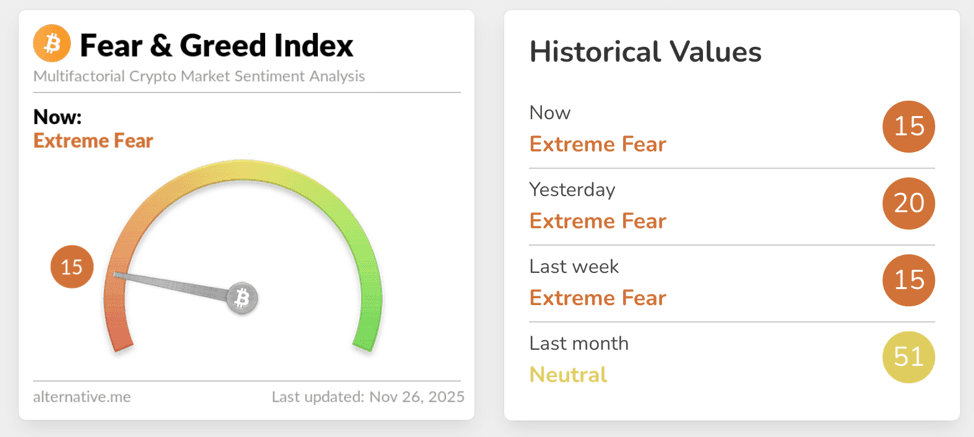

- The Fear & Greed Index has fallen from last month’s neutral 51 to today’s 15, showing meaningful de-risking and a shift toward defensive positioning.

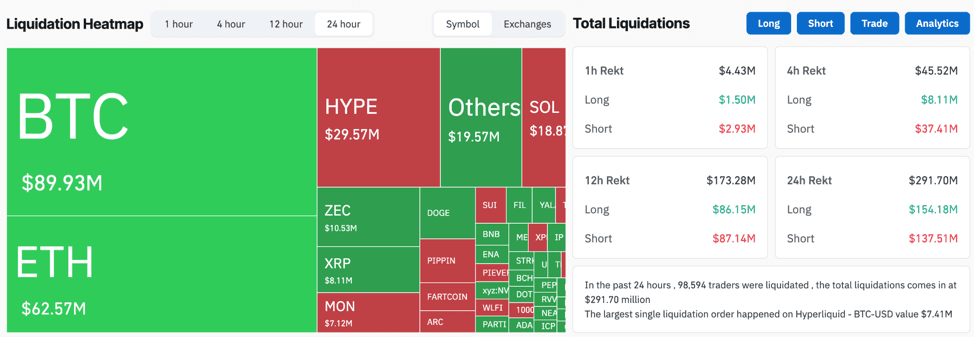

- Roughly $290M in total liquidations occurred over the past 24 hours with long and short volumes nearly balanced, while BTC and ETH funding rates oscillate between slightly positive and mildly negative. This reflects two-way positioning and continued deleveraging.

2. Market Sentiment / Emotion Indicators

Today’s Fear & Greed Index reading of 15 marks another day in “Extreme Fear,” a sharp contrast to last month’s neutral 51. This shift illustrates how BTC’s roughly 30% pullback rapidly moved the market from FOMO-driven optimism into a risk-off stance. The adjustment is not merely emotional capitulation but the combined effect of “high price levels + macro uncertainty + leverage compression.” Recent U.S. PPI data show easing wholesale inflation pressure, with expectations that September core PCE may rise only 0.19–0.20% MoM, potentially reducing YoY readings from 2.9% to 2.8%, supporting the medium-term rate-cut trajectory. Meanwhile, weakening labor data and declining consumer confidence have created notable division within the December FOMC between another 25bp rate cut and a pause, exerting pressure on risk-asset valuations.

Source: Alternative

In derivatives, the $291M in liquidations over the past 24 hours shows that deleveraging remains active but more balanced compared with earlier high-volatility wipeouts. BTC’s average 8-hour funding rate is near 0.0042% and ETH’s is around 0.0021%. Although positive, several major exchanges briefly turned negative, indicating shorts’ willingness to pay for downward pressure while long-side leverage turns cautious. More importantly, within this week’s $14B BTC options expiry, around 84% of call strikes sit above $91K, while large put clusters are positioned near or below spot. This favors option sellers and protective put holders. If BTC fails to reclaim $89K–$90K before expiry, most calls will expire worthless, keeping short-term volatility compressed within a neutral-to-bearish band.

Source: Coinglass

Macro and long-term capital flows remain steady. Spot BTC ETF flows have softened but not reversed into persistent outflows. Crypto VC investment reached around $4.65B in Q3, up 290% QoQ, with strong allocations toward stablecoins, AI, infrastructure, and trading-related sectors, signaling sustained structural deployment. Regulatory developments also highlight long-term institutionalization, such as Polymarket receiving CFTC approval to operate an intermediated trading platform, and the UAE’s new financial law bringing DeFi, Web3, and digital-asset activities under central-bank oversight. Therefore, sentiment is extremely bearish, and leverage continues to unwind, yet long-term capital and regulatory frameworks are laying the groundwork for the next evolutionary phase.

3. BTC & ETH Technical Data

3.1 BTC Market

BTC continues to consolidate within $87K–$88K after a sharp pullback from above $89K, re-establishing structural balance. The average 8-hour funding rate remains slightly positive, while certain major derivatives venues briefly flipped negative. This signals cooling long-side aggressiveness and growing short-side pressure, though total leverage remains manageable. The key short-term technical focus remains the liquidation clusters:

• A breakdown below $83,278 could trigger roughly $1.5B in cascading long liquidations.

• A breakout above $91,927 could force around $1.77B in short liquidations.

These levels create a classic “compressed volatility with stacked leverage on both sides” setup where any decisive break could produce accelerated, high-volume price movement. BTC appears to be in the latter phase of a corrective cycle, awaiting the options expiry and macro catalysts to reset directional bias. Short-term price action remains characterized by range-bound volatility.

3.2 ETH Market

ETH trades within the $2.8K–$3K range, mirroring BTC’s corrective structure but with slightly more muted volatility. Funding rates remain mildly positive, although some platforms have tightened toward zero, indicating cooling long leverage and limited conviction from shorts. Its leverage boundaries are also clearly defined:

• A breakdown below $2,812 could trigger roughly $939M in long liquidations.

• A breakout above $3,096 could force around $578M in short liquidations.

This reinforces ETH’s “two-sided congestion with no confirmed trend” profile. On-chain, an early ICO “ancient whale” deposited roughly 20,000 ETH into a CEX, raising concerns over high-level distribution. Even so, ETH continues rebalancing between supply rotation and leverage reduction, keeping price action within a range until a decisive breakout emerges. In the current situation, short-term ETH strategies favor reacting to liquidation-triggered volatility rather than aggressively chasing direction.

4. Trending Tokens

- XTM (Tari)

Tari is a privacy-focused digital-asset infrastructure protocol built in Rust and designed as a merged-mined sidechain with Monero, enabling creators to issue scarce digital assets and collectibles. With phase one of the XTM airdrop now live, early contributors and miners are unlocking tokens, creating typical airdrop dynamics where supply pressure interacts with speculative expectations. Given ongoing regulatory scrutiny of privacy assets, valuation discounts may persist long-term; however, if Tari succeeds in driving real usage across gaming, IP-driven content, and immersive digital experiences, XTM could become a key narrative within the privacy and entertainment segment.

- MON (Monad)

Monad represents the new wave of high-performance Layer-1 competition. Its mainnet is now live, with the team positioning it as an EVM-compatible chain capable of delivering throughput 100 to 1000X higher than existing networks. The MON token quickly attracted capital following the mainnet launch and airdrop, benefiting from the dual narrative of a new chain and a technical breakthrough. However, the risks persist, including uncertain valuation discovery and early-stage liquidity depth. If Monad secures rapid integration of top-tier DEXs, perpetual-futures protocols, and stablecoins while growing TVL and developer activity, MON could transition from a narrative-driven asset into one supported by fundamentals. Otherwise, it may undergo a corrective repricing phase before establishing long-term equilibrium.

- SSS (Sparkle)

Sparkle combines AI-driven functionality with Web3 social interaction. The platform enables users to learn and deploy AI tools while earning tokens through content creation and engagement. Its ecosystem includes the cross-platform AI tool PromptHero, and earlier iterations featured an astrology-themed lifestyle app, tradable NFTs, PvP elements, and SBT characters. Recent controversy emerged over inaccurate circulating-supply data on major analytics platforms; Sparkle clarified that the actual circulating amount is 152M SSS (15.2% of total supply). Uncertainty around supply data and unlock cadence has amplified volatility, making SSS highly sensitive to sentiment and liquidity conditions.

5. Today Token Unlocks

- $AMI: Unlocking 27.72M tokens, with 27.54% of circulating supply.

- $ALT: Unlocking 246.58M tokens, with 5.23% of circulating supply.

- $HUMA: Unlocking 126.26M tokens, with 7.28% of circulating supply as the largest unlock today.

6. Conclusion

Across price action, derivatives, on-chain flows, and macro conditions, the current crypto market does not resemble a full bull-to-bear reversal but rather a structural rebalancing following earlier rapid gains. BTC remains confined to $85K–$89K, while ETH continues stabilizing within $2.8K–$3K, alongside prolonged extreme-fear readings that indicate heavily compressed leverage but no meaningful long-term capital outflows. Options flows, liquidation clusters, and whale activity together define the short-term volatility framework. BTC’s options expiry will determine the outcome around $89K–$92K, while ETH’s ability to defend $2,812 and reclaim $3,096–$3.1K will guide overall leverage sentiment.

The more probable baseline scenario remains “high-range consolidation with time-based correction,” rather than an immediate descent into a deep bear phase. With core PCE softening modestly and uncertainty surrounding the December FOMC, markets continue to navigate interest-rate and growth ambiguity. Meanwhile, structural forces, including VC deployment, regulatory clarity, high-performance L1 developments, and AI-social narratives, are quietly laying groundwork for the next cycle. For traders, the current environment favors disciplined leverage management and monitoring of liquidation thresholds rather than attempting aggressive bottom-fishing amid extreme fear. Once structural rebalancing is complete, patient and systematic capital will be best positioned to capture the next major trend inflection.

Disclaimer: The information provided in this section is for reference only and does not represent any investment advice or the official views of FameEX.