Data From Futures and The Price Activity of Ethereum Show That Bears Are Now in Charge

2023-03-08 09:55:40Given that the Shanghai fork is anticipated to quickly free a large quantity of ETH, investors are reluctant to establish long holdings.

Source: news.bitcoin.com

Ether's price dropped 6% on March 2 and 3, then traded in a narrow range around $1,560. Even though, a broader time frame's chart can show a descending channel or a somewhat longer seven-week bullish pattern, thus there is no obvious trend to be seen there.

Ether Price index. Source: TradingView

The imminent Shanghai hard fork, which will enable ETH staking withdrawals, can help to explain some of Ether's current lack of volatility. To support the network consensus process, those members were each needed to lock 32 ETH on the Beacon Chain.

The Shanghai Capella update, also known as Shapella, is anticipated for early April after a string of delays typical of modifications to the production environment, according to Tim Beiko, an Ethereum core developer and project manager. The Shanghai hard fork will have one more trial run on the Goerli testnet upgrade on March 14 before being implemented on the mainnet.

Risks of a Recession Are Rising, Supporting ETH Bearish

On March 7, Jerome Powell, the chairman of the US Federal Reserve, spoke before the Senate Banking Committee. Because "the latest economic statistics have come in better than expected," Powell predicted that interest rates will likely increase more than expected.

The likelihood of the Federal Reserve raising interest rates more aggressively than anticipated and selling assets is increased by evidence that the Fed is trailing the inflation curve. As an illustration, a Citigroup inflation "surprise" indicator increased in February for the first time in more than a year.

A more significant move by the Fed often portends a gloomy situation for risk assets, including cryptocurrencies, as investors seek safety in fixed income and the U.S. currency. In a recessionary climate, which many believe is either already here or is about to arrive, this change becomes more evident.

As the White House indicated that the cryptocurrency-friendly bank Silvergate had "had major challenges" recently, according to U.S. Press Secretary Karine Jean-Pierre, the regulatory climate is putting extra pressure on bitcoin businesses.

To determine if the $1,560 level is likely to act as support or resistance, let's examine the data on Ether futures.

ETH Derivatives Indicate a Decline in Longs Demand

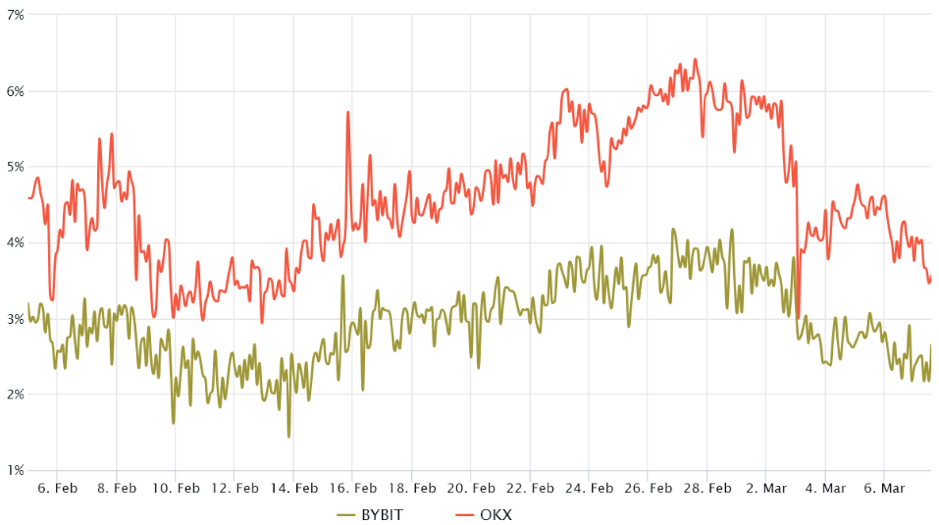

To cover expenses and related risks, the annualized three-month futures premium should trade between 5% and 10% in healthy markets. Yet, it is viewed as a negative indication when the contract trades at a discount (known as "backwardation") compared to conventional spot markets. This indicates that traders are lacking confidence.

Ether 3-month futures premium. Source: Laevitas

The graph above demonstrates how derivatives traders were a little uneasy on March 7 when the average Ether futures premium dropped to 3.1% from 4.9% the previous week. What's more, the indicator grew further away from the 5% neutral-to-bullish level.

Even yet, a decrease in the demand for leveraged long positions (bulls) does not always portend a decline in price movement. In order to understand how whales and market makers are estimating the likelihood of future price moves, traders should study Ether's options markets.

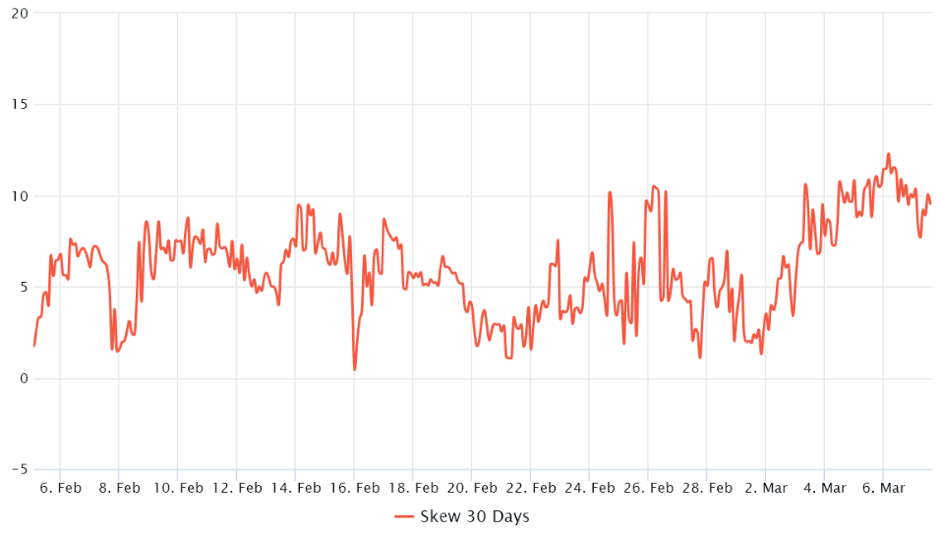

Market makers and arbitrage desks are overcharging for upside or downside protection, as seen by the 25% delta skew.

When markets are weak, options traders are more likely to see a price decline, driving the skew indicator more than 10%… The demand for bearish put options decreases in positive markets, where the skew indicator is often below -10%.

ETH 30-day options 25% delta skew: Source: Laevitas

On March 4, the delta skew crossed the bearish 10% barrier, indicating tension among professional traders. On March 7, there was a small recovery; but, because options traders are charging more for protective put options, the indicator is still edging closer to pessimistic predictions.

Investors making fundamentally-based choices will probably observe the first few weeks after the Shanghai upgrade to gauge the possible impact of the ETH unlock. The options and futures markets ultimately indicate that experienced traders are less likely to build long positions, increasing the likelihood that $1,560 will act as a resistance level in the coming weeks.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.