DUSK (Dusk) Token Price & Latest Live Chart

2026-01-26 08:35:21

What is DUSK (Dusk)?

Dusk Network is a public, permissionless Layer-1 blockchain designed specifically for regulated financial markets, rather than for generalized consumer crypto use cases. Its fundamental premise is that financial activity on public blockchains cannot scale institutionally unless privacy, compliance, and settlement certainty are treated as protocol-level guarantees, not optional features layered on top of transparent systems. Traditional public blockchains expose transaction flows, balances, and counterparties by default. While this radical transparency is suitable for open monetary systems, it conflicts directly with how capital markets operate, where confidentiality of positions, trading intent, and ownership structures is essential to market integrity.

Dusk addresses this incompatibility by redefining what “on-chain transparency” means. Instead of revealing raw financial data, the network verifies cryptographic proofs of correctness and compliance, enabling transactions to remain confidential while still enforceable and auditable. Therefore, Dusk positions itself closer to financial market infrastructure than to conventional smart-contract platforms. Its target applications include the issuance, trading, and settlement of regulated instruments such as tokenized securities, funds, and real-world assets (RWAs). By embedding privacy-preserving execution, deterministic finality, and programmable compliance into its base layer, Dusk aims to serve as a neutral settlement network where institutions, issuers, and users can interact under clearly defined legal and operational guarantees.

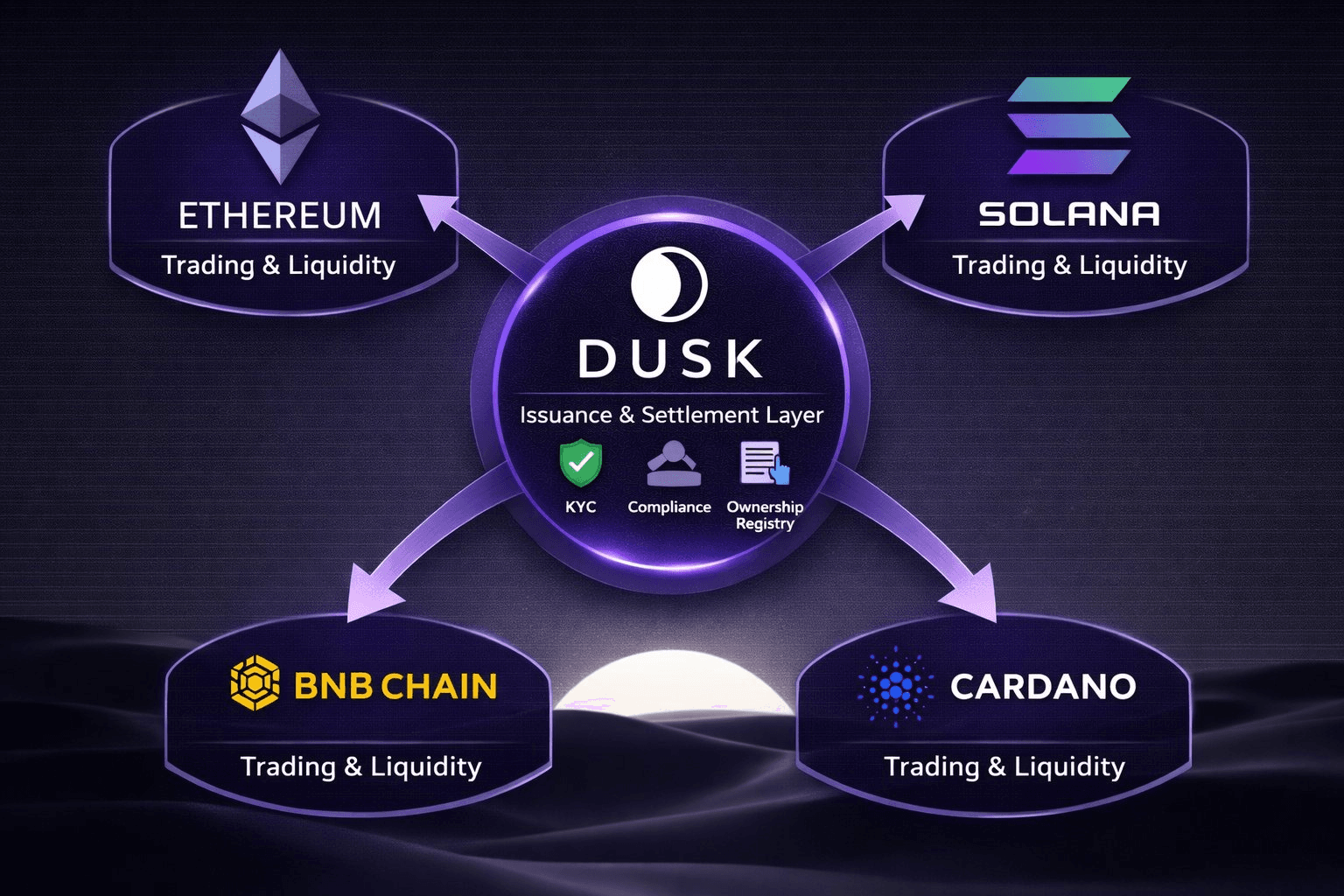

Dusk is the compliance-native issuance and settlement layer, with major chains providing trading and liquidity, source: X post

How does DUSK (Dusk) work?

Dusk Network is not designed as a general-purpose smart contract platform optimized for maximum composability or retail experimentation. If a blockchain is to support regulated financial activity, the most critical properties are settlement certainty, predictable execution, and enforceable compliance—not raw throughput or radical transparency. With this constraint in mind, Dusk makes a series of deliberate architectural choices across consensus, networking, transaction design, and execution. Together, these choices form a system optimized for financial-grade settlement rather than speculative application ecosystems:

1. Succinct Attestation (SA)

Most public blockchains rely on probabilistic finality. Blocks become more secure as additional confirmations are added, but are never truly irreversible. While acceptable for crypto-native transfers, this model is fundamentally incompatible with traditional and regulated finance, where settlement must be explicit, auditable, and legally final. Dusk addresses this through Succinct Attestation (SA), a committee-based proof-of-stake consensus protocol built around deterministic finality.

Each block progresses through three clearly defined phases: proposal, validation, and ratification. Those executed by randomly selected committees of stakers known as provisioners. Once a block receives a successful attestation, it is considered final and cannot be reverted. This attestation is a cryptographic object, not an assumption based on time or confirmations. For exchange users and institutional participants, this means transactions can be treated as settled, not merely likely to settle, which is a critical distinction for clearing, custody, and accounting workflows. SA also incorporates rolling finality, reducing fork risk over time and providing a clear framework for determining when a block transitions from accepted to confirmed to final. The result is a blockchain where settlement behavior more closely resembles traditional financial infrastructure than probabilistic crypto networks.

2. Network Propagation Design

In many blockchains, the peer-to-peer network layer is treated as a separate optimization problem. While flexible, gossip introduces redundant traffic and unpredictable delays. These issues become critical in committee-based consensus systems where timely vote delivery directly affects finality.

Dusk’s networking approach is inspired by structured broadcast models such as Kadcast, where messages are propagated along deterministic multicast paths rather than indiscriminately shared with all peers. Blocks, votes, and attestations are forwarded through an organized routing structure, minimizing duplication while ensuring rapid network-wide dissemination. For users, this design choice translates into more stable block times and faster confirmation under load, particularly during periods of high transaction activity. Rather than chasing peak throughput metrics, Dusk optimizes for consistent settlement performance, which is an attribute far more relevant to exchanges and regulated venues.

3. Dual transaction models

A defining feature of Dusk is its dual transaction model, which allows applications and users to choose between transparency and confidentiality without leaving the base layer. Moonlight is an account-based, transparent transaction model comparable to Ethereum. Balances, nonces, and transaction details are publicly visible, making it suitable for straightforward transfers, transparent accounting, and scenarios where disclosure is required or preferred.

Phoenix, by contrast, is a UTXO-based, zero-knowledge transaction model designed for confidential financial activity. Using cryptographic commitments, nullifiers, and zero-knowledge proofs, Phoenix hides transaction amounts, counterparties, and balance changes while still enforcing ownership, fee payment, and double-spend prevention. Crucially, Phoenix transactions remain verifiable without being publicly readable. The network validates cryptographic proofs rather than raw transaction data, enabling privacy without sacrificing correctness or compliance. This means Dusk can support both transparent flows and institution-grade confidential settlement on the same chain, without relying on external privacy layers.

4. Execution and compliance

Dusk smart contracts run on Piecrust, a virtual machine optimized for cryptographic and zero-knowledge workloads. Instead of executing expensive cryptographic operations inside generic bytecode environments, Piecrust offloads proof verification, signature checks, and hashing to native host functions, improving performance predictability and reducing execution overhead.

Dusk extends beyond generic smart contracts by introducing finance-specific execution frameworks. Zedger enables the issuance and management of regulated assets, embedding transfer restrictions, issuer controls, corporate actions, and audit logic directly into on-chain contracts. Citadel governs permissions and licensing, allowing selective disclosure and role-based access for issuers, custodians, and regulators. This architecture ensures that compliance is not an afterthought or an off-chain agreement. If a transaction violates predefined rules, it cannot execute, regardless of user intent. For regulated markets, this shift is one of the most significant advantages of blockchain-based settlement.

DUSK (Dusk) market price & tokenomics

DUSK is the native token of Dusk Network, serving both as the incentive asset for consensus participation and as the network’s primary settlement currency. Its tokenomics are designed to support a long-lived, regulated-finance-oriented Layer-1 rather than short-term liquidity dynamics. The maximum supply is capped at 1 billion DUSK, composed of two clearly defined components: 500 million tokens issued at genesis (initially as ERC20 and BEP20 representations and progressively migrated to native DUSK after mainnet launch), and 500 million tokens emitted over time to secure the network. This structure provides early clarity on total dilution while preserving sufficient issuance capacity for long-term security.

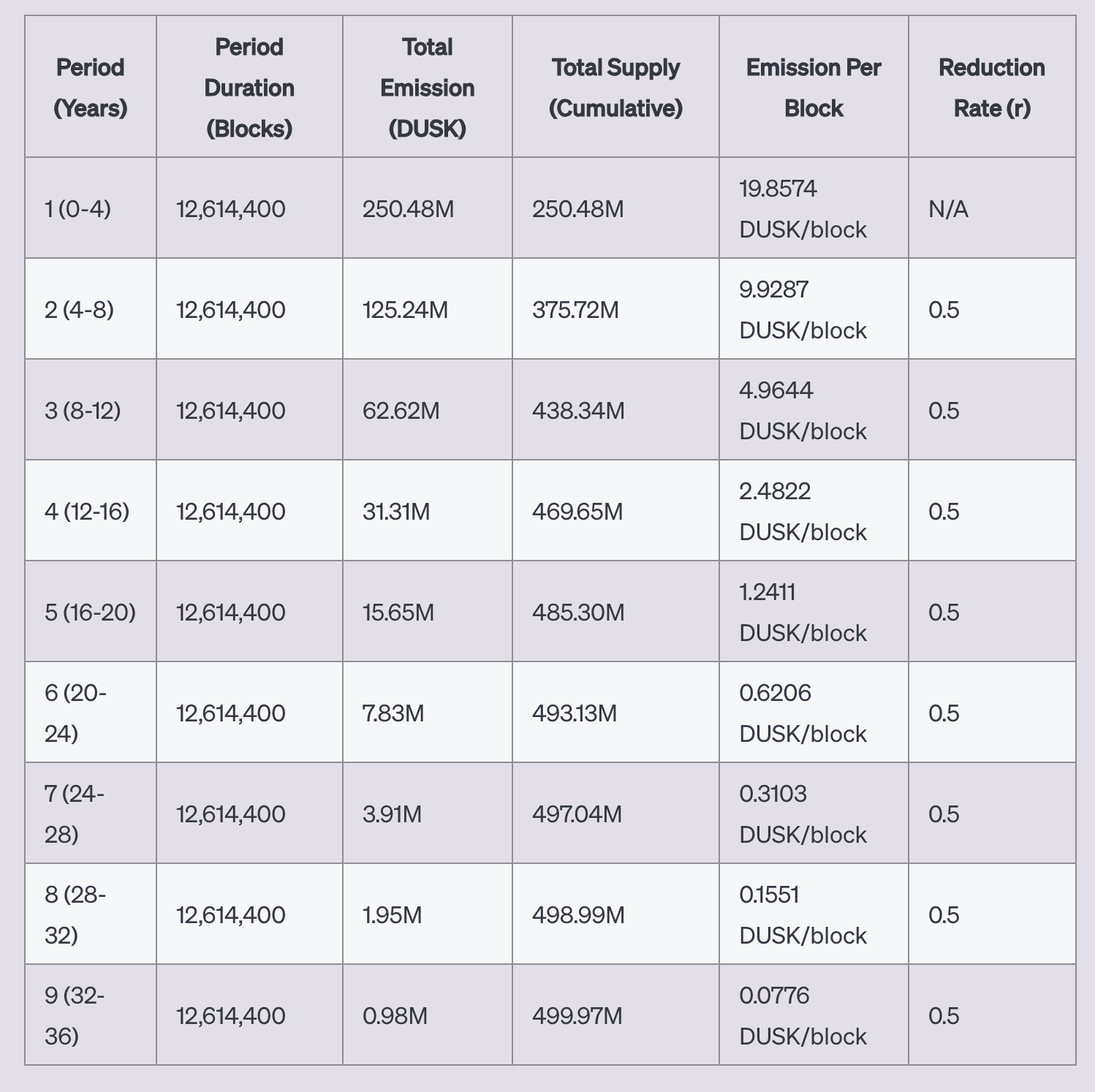

Token emission follows a 36-year geometric decay model, divided into nine four-year periods, with issuance halving at each interval. This approach mirrors the economic intuition of Bitcoin’s halving mechanism but extends it over a longer horizon with a smoother supply curve. In the early years, higher emissions are used to bootstrap validator participation and decentralization when transaction fees alone are insufficient. Over time, inflation steadily declines, shifting network security incentives toward real economic usage. From an investor perspective, this reflects an infrastructure-oriented monetary policy rather than a growth-subsidy model.

Token Emission Model, source: DUSK

DUSK has a focused and functional utility profile. It is required for staking in the Succinct Attestation consensus, for paying transaction and smart-contract execution fees, and for deploying applications and services on the network. Fees are calculated through a gas mechanism denominated in LUX, the smallest unit of DUSK, with users paying only for actual execution costs. Each block reward combines newly emitted DUSK with collected transaction fees and is distributed among block generators, validation and ratification committees, and the development fund. This ensures that all consensus roles are economically incentivized, reinforcing participation beyond simple block production.

Dusk’s staking and penalty framework emphasizes long-term stability over punitive enforcement. The minimum stake is set at 1,000 DUSK with no upper limit, and unstaking carries no lock-up or capital loss. Misbehavior and prolonged downtime are addressed through soft slashing, which temporarily reduces a validator’s effective stake and rewards instead of permanently burning tokens. DUSK’s token economy is characterized by predictable supply, controlled inflation, and strong alignment between token demand and network security. Its long-term value proposition is therefore closely tied to the adoption of compliant, on-chain financial settlement rather than speculative market cycles.

Why do you invest in DUSK (Dusk)?

The investment thesis for DUSK is grounded in the institutionalization of blockchain finance. As regulators increasingly demand privacy-preserving compliance, deterministic settlement, and auditable execution, infrastructure that natively supports these requirements becomes strategically scarce. Dusk occupies a niche that remains underdeveloped across the broader crypto ecosystem: enabling on-chain finance without forcing institutions to choose between confidentiality and compliance. Its architectural decisions, like committee-based finality, zero-knowledge transaction models, and compliance-aware smart contracts, are optimized for environments where legal certainty and operational predictability outweigh maximal composability or retail experimentation. For investors, DUSK represents exposure to a thesis that is orthogonal to typical DeFi or consumer crypto cycles. Its success is more closely tied to regulatory clarity, institutional adoption, and the growth of tokenized financial instruments than to speculative application trends.

Is DUSK (Dusk) a good investment?

DUSK is best evaluated as a long-term infrastructure investment, not a momentum-driven asset. Its performance will depend less on speculative narratives and more on whether regulated financial institutions, issuers, and venues adopt blockchain-based settlement and issuance at scale. For investors seeking exposure to the convergence of blockchain technology and regulated finance, particularly privacy-preserving, compliance-native systems, Dusk offers a differentiated approach with a coherent technical and economic design. However, its thesis requires patience, as adoption cycles in regulated markets are typically measured in years rather than months.

Find out more about DUSK (Dusk):

- Homepage

- Explorer: Etherscan, Bscscan

- Whitepaper

Explore the latest DUSK (Dusk) price and live chart, trade DUSK on FameEX, and access real-time market data! Get started now with a seamless trading experience!

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.