10 Best Crypto Trading Tips and Tricks for Beginners: Uncover the Secrets of the Cryptocurrency Market in 2024

2023-12-07 11:11:45

In the fast-evolving world of cryptocurrencies, beginners might find themselves overwhelmed by the sheer complexity and volatility of the market. But fear not! Our comprehensive guide is your golden ticket to navigate the cryptic waters of cryptocurrency trading in 2024. We have meticulously compiled expert insights and practical strategies to help you uncover the hidden secrets of the cryptocurrency market. Whether you're looking to understand the basics, build a solid trading foundation, or simply stay ahead of the curve, this guide is your essential roadmap to crypto trading success in the digital age.

Entering the Cryptocurrency Market: Getting Started as a Beginner Trader

Embarking on your journey into the world of cryptocurrency trading can be both exciting and daunting. As a beginner, you are about to navigate a market that is constantly evolving and brimming with opportunities. This section is designed to demystify the process and set you on a path to becoming a confident and informed trader. We'll cover the essential steps you need to take to safely enter the cryptocurrency market, from understanding its basics to setting up your very first trade. Whether it's choosing the right exchange, creating a secure wallet, or making your initial investment, this guide provides you with the tools and knowledge you need to start your trading journey on solid ground.

An Overview of Crypto Trading for Beginners

Cryptocurrency trading involves buying and selling digital currencies through an exchange. As a beginner, you're stepping into a dynamic market that operates 24/7, offering both significant opportunities and risks. The volatility of cryptocurrencies means prices can rapidly increase or decrease, providing potential for profit but also posing the risk of loss.

In the field of cryptocurrency trading, traders speculate on the price fluctuations of digital currencies that lack a physical form. Traders often adopt a 'long' position when they anticipate an increase in the currency's value. If their prediction aligns with the actual price movement, it results in a profit. Conversely, a divergence between the predicted and actual price movement can lead to a financial loss. This aspect underlines the speculative nature of cryptocurrency trading, where outcomes can yield either profits or losses based on the accuracy of the price movement predictions. Understanding market trends, staying informed about the latest news, and learning the fundamentals of technical analysis are crucial in making informed trading decisions.

How to Start Trading in Cryptocurrencies?

When you're getting into crypto trading, there are several methods you can use. Before you start trading, it's really important to fully understand how the cryptocurrency market works. Also, you need to be aware of the risks that come with trading cryptocurrencies and make sure you know about the laws and regulations in your area, as they can differ a lot from place to place. When making decisions in crypto trading, keep these points in mind.

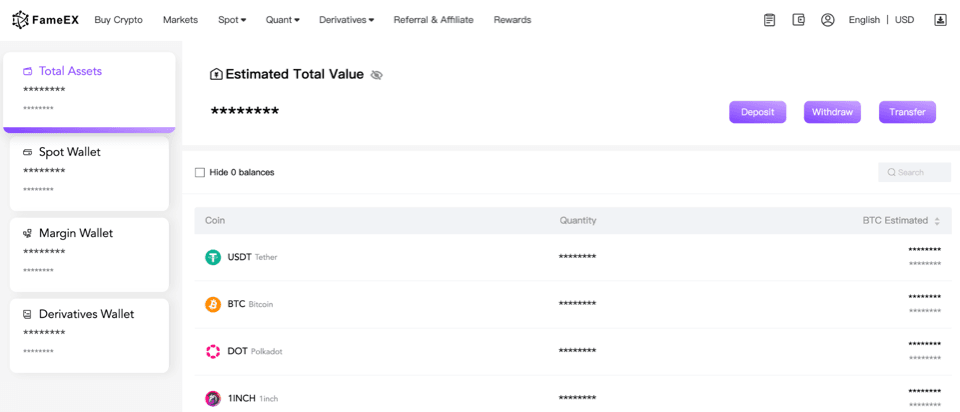

To start trading in cryptocurrencies, it's essential to first educate yourself about the market and its functioning, including blockchain technology and factors influencing market movements. Use reliable sources like blogs, forums, and educational websites for information. Then, choose a reputable crypto exchange with strong security, user-friendly features, and reasonable fees. FameEX is highlighted for its low transaction fees and robust security.

Crucially, create a secure crypto wallet to store, send, and receive cryptocurrencies. There are two main types: hot wallets (online) for frequent trading, though more vulnerable to threats, and cold wallets (offline) for higher security. Starting with a small investment is advisable to minimize financial risk while learning. Finally, develop a solid trading strategy, setting clear goals and defining risk tolerance, to guide your buying and selling decisions.

Essential Tips for Successful Crypto Trading

Cryptocurrency trading has evolved into a complex and dynamic field but offering immense opportunities for traders who are willing to navigate its volatile landscapes. In this section, we focus on key strategies and tips to enhance your success in crypto trading, highlighting the importance of informed decision-making and risk management.

1. Selecting the Right Cryptocurrency Exchange

The first step towards a successful crypto trading journey is choosing the right cryptocurrency exchange. This choice can significantly impact your trading experience, security, and profitability. A good exchange should offer a blend of features including:

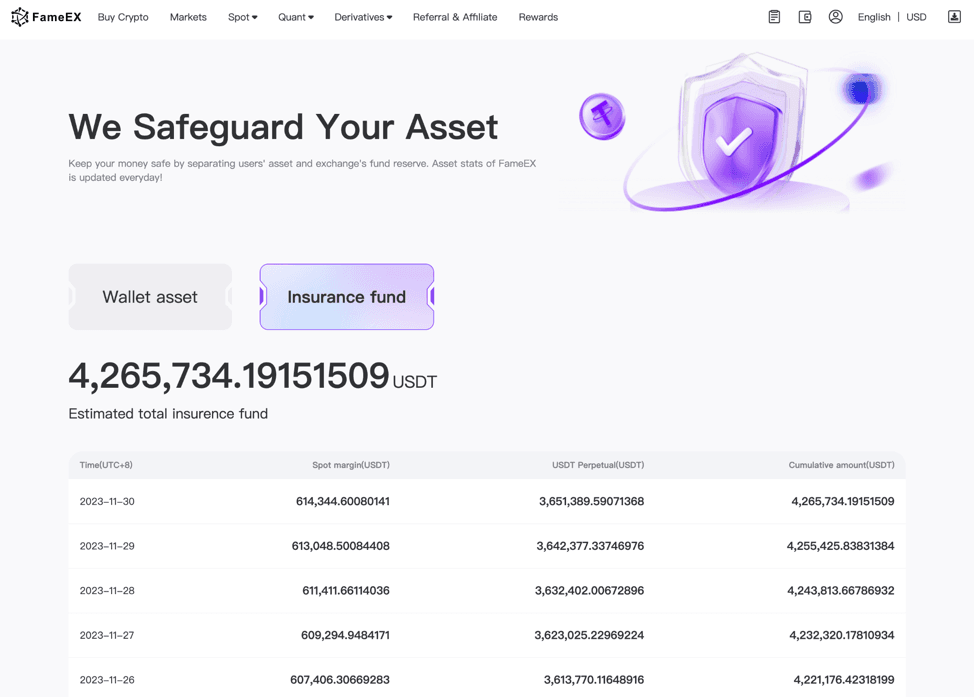

・Security Measures: Look for exchanges with robust security protocols such as two-factor authentication, cold storage for funds, and insurance against theft or hacking. With various cyber protection strategies, you can discover how crypto exchanges maintain the safety of their funds and manage their reserve funds. At FameEX, we prioritize the security of our users' funds with our Four-Layer Technology Protection system. This system incorporates a robust four-layer encryption strategy to safeguard funds, ensuring comprehensive protection across all facets of on-chain storage and both on-chain and off-chain security. This approach effectively shields against any form of technical threats. For full transparency, users can easily access information about the insurance fund on our official website, demonstrating our commitment to openness and trust for all our users.

・Variety of Cryptocurrencies: A wide range of available cryptocurrencies allows for diversified trading strategies and the opportunity to capitalize on emerging coins and to have a wide range of portfolio.

・User-Friendly Interface: Especially important for beginners, an intuitive and easy-to-navigate platform can significantly reduce the learning curve.

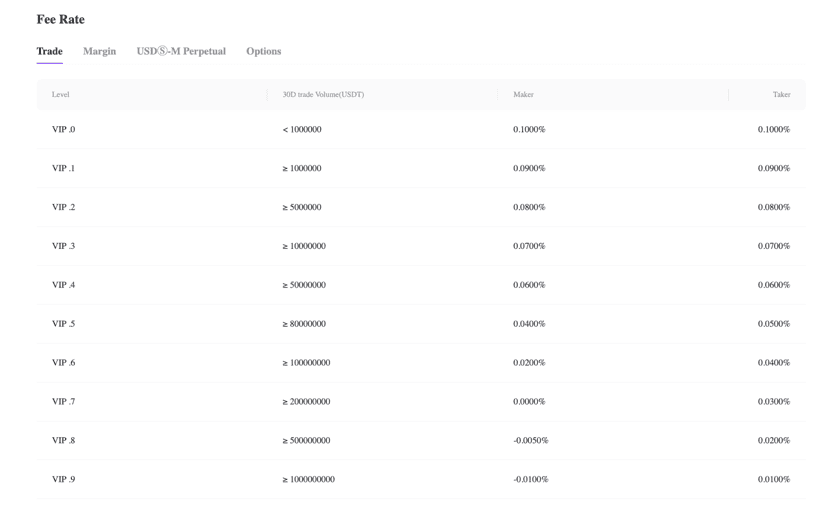

・Transaction Fees and Limits: Understand the fee structure and any trading limits, as these can affect your trading strategy and profitability.Reputation and Reliability: Research the exchange's history, focusing on user reviews, uptime statistics, and how they've handled past security breaches or technical issues. FameEX offers the lowest fees in the industry. You can find the details of our trading fees here:

・Regulatory Compliance: Opt for exchanges that adhere to regulatory standards, ensuring a level of transparency and security in your trading endeavors. For newcomers to the crypto world, understanding and complying with regulations can be overwhelming. It's important to be aware that regulation plays a crucial role in the exchange you use for withdrawing to fiat currency. Local regulations are especially significant when it comes to converting cryptocurrency to fiat.

Setting Up Your First Crypto Trading Account

Once you've selected the right exchange, setting up your first crypto trading account is the next crucial step. This process generally involves:

・Sign up and Complete Verification Process: Most reputable exchanges require some level of identity verification to comply with regulatory laws. This step is crucial for the security of your account and transactions. To get started, you'll need an email address or mobile number to sign up. While some exchanges require KYC verification before allowing trading, FameEX permits users to trade or deposit without completing KYC verification.

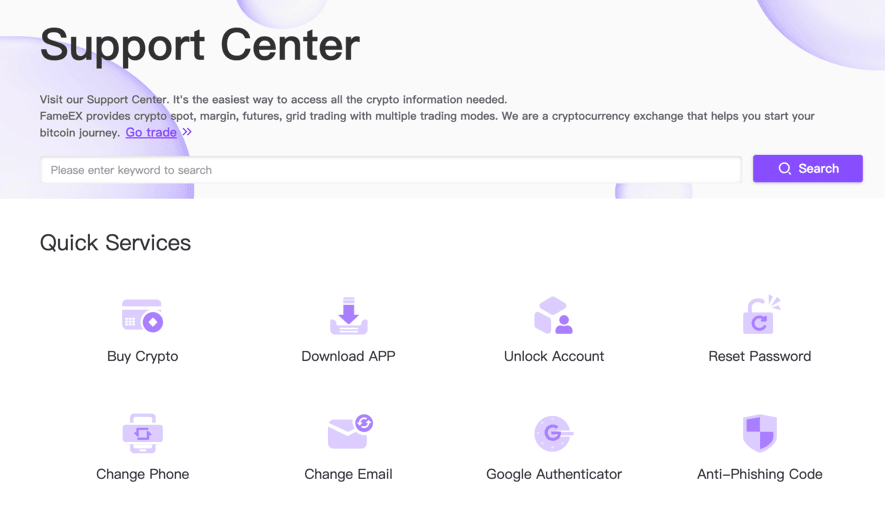

・Understanding the Interface: Take time to familiarize yourself with the trading platform. Many exchanges offer demo accounts or tutorials to help beginners. At FameEX, you can easily find our Support Center with all the operational guides to use when you encounter interface usage problems.

・Deposit Funds: Decide on your initial investment and deposit funds into your account. This could be in the form of fiat currency or cryptocurrencies, depending on the exchange's options. You can also use the credit card or debit card to add your fund into exchange or just deposit the fund as crypto into your account.

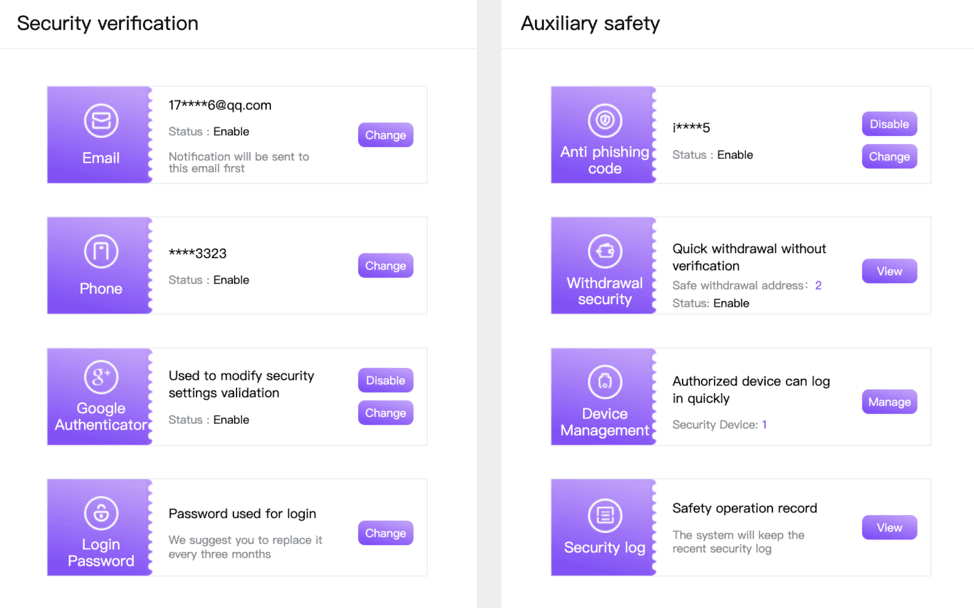

・Setting Up Security Features: Activate all available security features such as two-factor authentication and withdrawal whitelists. It’s very easy to protect your account's safety. At FameEX, we offer eight different verification methods to protect your account safety.

・Start with Small Trades: Begin with small trades to understand the market dynamics and the exchange's mechanisms without exposing yourself to significant risks. FameEX provides trial funds, allowing users to experiment with different products without using their own money. This approach offers beginners more opportunities to explore and gain experience.

2. Creating a Secure Crypto Wallet

A critical aspect of crypto trading is ensuring the safety of your assets through a secure crypto wallet. A crypto wallet not only stores your cryptocurrencies but also plays a pivotal role in managing and safeguarding your digital assets. Here’s how to set up and maintain a secure crypto wallet:

・Choosing the Right Type of Wallet: Crypto wallets come in various forms, including hardware wallets, software wallets, and paper wallets. Hardware wallets, such as Ledger or SafePal, are considered the most secure as they store your private keys offline. Software wallets are more convenient for active traders but are generally less secure than hardware wallets.

・Understand Public and Private Keys: Your wallet consists of a public key, which is like an account number that you share to receive funds, and a private key, which is akin to a PIN number used to authorize transactions. It’s crucial never to share your private key with anyone.

・Secure Backup of Your Wallet: Always back up your wallet, especially if you are using a software or mobile wallet. This usually involves writing down a recovery phrase. Store this backup in a secure location separate from your primary wallet.

・Regular Updates and Security Practices: Keep your wallet software updated to ensure you have the latest security enhancements. Also, employ good security practices like using strong, unique passwords and avoiding phishing scams.

・Using Multi-Signature Features: Some wallets offer a multi-signature feature, requiring multiple private keys to authorize a transaction. This is an additional security layer, especially useful for business or shared accounts.

・Consider Using Multiple Wallets: For added security, consider using multiple wallets to segregate your funds. You might keep a small amount in a more accessible wallet for daily transactions and the bulk of your assets in a more secure hardware wallet.

Be aware of the latest security threats and best practices in cryptocurrency security. Creating and maintaining a secure crypto wallet is fundamental to safeguarding your investments in the cryptocurrency market. By choosing the right type of wallet, understanding key security concepts, and implementing best practices, you can significantly reduce the risk of unauthorized access to your digital assets. Remember, the security of your crypto wallet is as strong as the measures you put in place to protect it.

3. Research and Fundamental Analysis: Key to Informed Decisions

Successful cryptocurrency trading requires more than just understanding market trends; it demands thorough research and fundamental analysis to make informed decisions. This approach involves evaluating the intrinsic value of cryptocurrencies and their underlying projects, assessing market dynamics, and staying abreast of global events that could impact the crypto market.

Evaluating News and Events

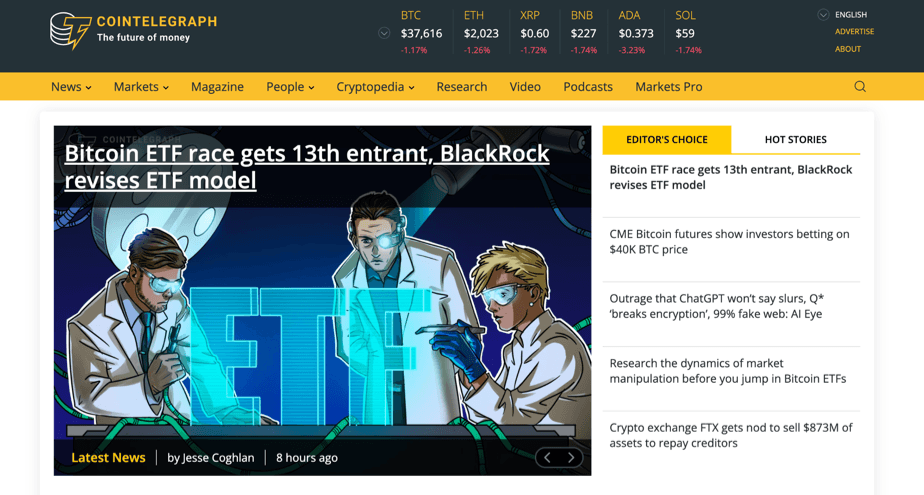

Follow reputable news sources dedicated to cryptocurrency and blockchain technology. This includes industry news sites, crypto-focused financial news platforms, and even specific crypto community forums or social media channels. You can find several news channels or websites, such as CoinTelegraph, CoinDesk, Decrypt, etc.

CoinTelegraph, a prominent digital media outlet, covers news on blockchain, cryptocurrencies, and fintech trends.

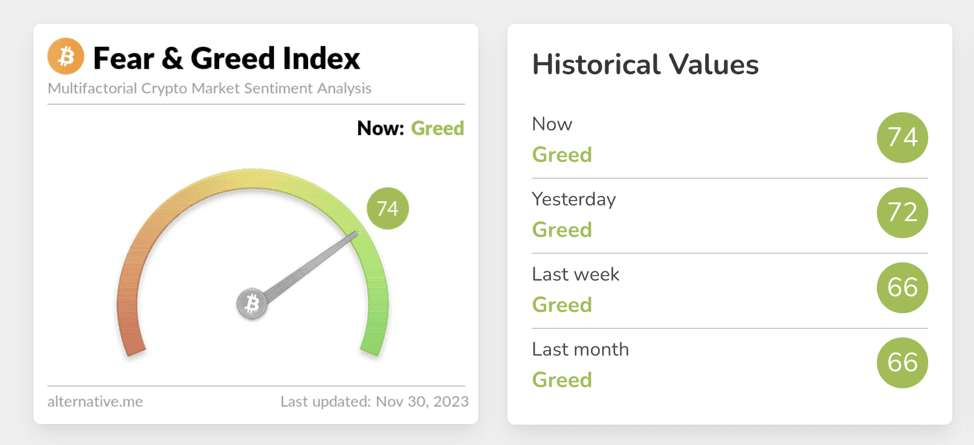

・Understand Market Sentiments: News and events can significantly impact market sentiment. Develop an ability to distinguish between news that will have a long-term impact versus short-term market noise. In cryptocurrency trading, understanding market sentiment is crucial, as emotions greatly influence the behavior of the market. When the market rises, traders often become greedy, leading to a fear of missing out (FOMO), while a decline can cause panic selling. To mitigate these emotional responses, the Fear and Greed Index was developed. It is based on the idea that extreme fear might signal a buying opportunity as investors might be overly worried, and excessive greed could indicate a potential market correction. This tool analyzes the current mood in the Bitcoin market and presents it on a scale from 0 (Extreme Fear) to 100 (Extreme Greed), offering insights into market sentiment and aiding in more rational decision-making. Further information on the data sources used for this index is provided below.

Fear & Greed Index from Alternative site

・Global Macron Events and Regulations: Be aware of global economic events and changes in regulatory landscapes that could affect the cryptocurrency market. This includes monetary policies, geopolitical events, and regulatory announcements from different countries.

・Technical vs. Fundamental News: While technical news relates to the market movements and trends, fundamental news is about the cryptocurrency's underlying technology, adoption, and real-world applications. Both are important for a comprehensive analysis.

Assessing Project Fundamentals

Before investing in any project, it is crucial to comprehend its underlying concept and purpose. This necessitates a deep dive to gain a thorough understanding of each token's project.

・Whitepaper and Roadmap Analysis: Start by reading the project's whitepaper and understanding its roadmap. Evaluate the problem the project aims to solve, the technology behind it, and the feasibility of its goals.

・Team and Community: Research the project team's background and expertise. A strong, experienced team is often a good indicator of a project's potential. Also, assess the community's size and engagement as it reflects the project's popularity and user adoption.Technology and Innovation: Analyze the technology underlying the cryptocurrency. Consider factors like scalability, security, and the uniqueness of the technology. Innovative features or solutions to existing blockchain challenges can be a positive sign.

・Partnerships and Ecosystem: Look into the partnerships and collaborations the project has established. Strong partnerships with established companies can be a testament to the project's credibility and potential for growth.

・Tokenomics: Understand the token economics, including the total supply of tokens, distribution plan, and how the tokens are used within the ecosystem. This can affect the token's value and demand.

・Track Record and Development Progress: Examine the project's history, how it has progressed against its roadmap, and its response to any challenges it faced. Consistent development progress and transparency are key indicators of a project's health.

Incorporating a comprehensive approach to research and fundamental analysis empowers traders to make more informed decisions, distinguishing between short-term hype and cryptocurrencies with long-term value potential. It’s a process that requires diligence, critical thinking, and an ongoing commitment to learning as the crypto landscape continues to evolve.

4. Top Tips to Diversify Your Crypto Portfolio

Diversification is a key strategy in managing risk and maximizing potential returns in your crypto trading endeavors. A well-diversified portfolio can help you weather market volatility and capitalize on different market cycles. Here are some top tips to diversify your crypto investments effectively.

Taking Advantage of Altcoins: How and Why?

While Bitcoin and Ethereum are the most well-known cryptocurrencies, there are many altcoins (alternative coins) that offer potential for high returns. Exploring these can diversify your portfolio and reduce risk. Altcoins can be more volatile and riskier than major cryptocurrencies. Conduct thorough research on the project's fundamentals, market potential, and technical aspects before investing. Consider allocating a smaller portion of your portfolio to higher-risk altcoins, balancing it with more stable investments. This can provide exposure to high growth potential while mitigating overall risk.

Understanding the Importance of Fiat in Your Crypto Portfolio

Keeping a portion of your portfolio in fiat currencies (like USD, EUR, etc.) can provide stability and liquidity. This is particularly useful in times of high volatility in the crypto market. Some fiat-based cryptocurrencies, such as USDT and USDC, provide stability to your portfolio and serve as a base for trading, offering opportunities for price arbitrage.

Cash Reserves for Opportunities: Having fiat reserves allows you to take advantage of market dips and buy cryptocurrencies at lower prices. It’s a strategic way to increase your holdings without selling other assets at a loss. Fiat can act as a buffer against the highly volatile nature of cryptocurrencies. In times of downturn, a fiat reserve can mitigate the overall impact on your portfolio's value.

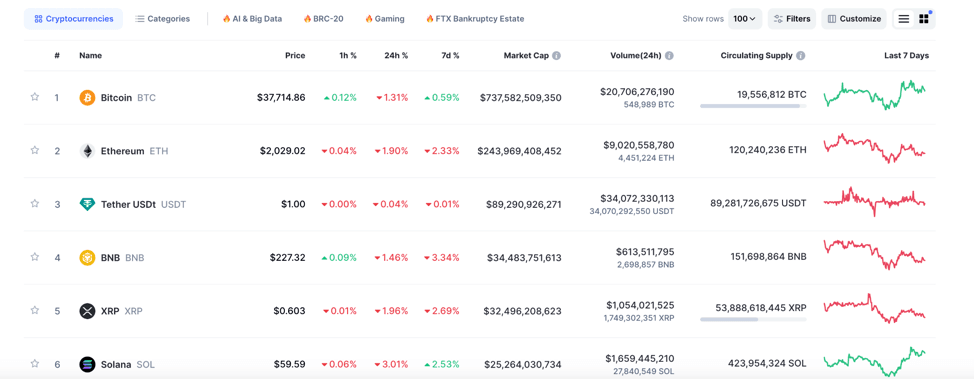

Managing Your Crypto Portfolio: The Role of Market CapThe market capitalization of a cryptocurrency is a key indicator of its size, stability, and growth potential. It is calculated by multiplying the current price of the coin by its total circulating supply. Large-cap cryptocurrencies (like Bitcoin, Ethereum) are considered more stable and less risky. They should form the base of your portfolio to provide stability. Mid and small-cap cryptocurrencies often offer higher growth potential but come with increased risk. These can be part of your portfolio to provide a balance between risk and reward.Regular Rebalancing: The crypto market is dynamic, and the market cap of coins can change rapidly. Regularly rebalancing your portfolio to maintain your desired risk level and investment strategy is important. You can always easily find the market capitalization of each token on CoinMarketCap to ensure accurate circulation data.

Rank for the top cryptocurrency: CoinMarketCap

Diversifying your crypto portfolio involves a mix of different cryptocurrencies, including major coins, altcoins, and fiat currencies, while considering their market capitalizations. It's about striking a balance between risk and potential returns, and continually adapting to the changing market conditions. This approach can help in reducing the impact of volatility and enhancing the overall performance of your investments in the cryptocurrency market.

5. Emotions and Psychology in Crypto Trading

The volatile and often unpredictable nature of the cryptocurrency market can significantly impact a trader's emotions and psychology. Understanding and managing these emotional responses is crucial for making rational decisions and achieving long-term success in crypto trading. Emotional discipline is as important as technical acumen in this arena.

Fear of Missing Out (FOMO): A Trader’s Biggest Enemy

Fear of Missing Out, or FOMO, is a common emotional response where traders fear being left out of potential gains. It often leads to impulsive decisions, like buying at peaks and selling at lows. To combat FOMO, focus on your long-term trading strategy rather than short-term market movements. Stick to your investment plan and avoid making decisions based on market hype or peer actions.Stay Informed, Not Influenced: While staying updated is crucial, differentiate between informative insights and hype-driven noise. Don’t let the euphoria around rising prices compel you to make hasty investments. Social media and forums can exacerbate FOMO. Limiting your time on these platforms can help maintain a more objective and less emotionally-driven approach to trading.

Maintaining Discipline in Trading

Having clear goals and steps in trading is very important, especially in the crypto sector, which is fraught with uncertainties and volatility. That's why practicing disciplined trading strategies is essential.

・Set Clear Trading Rules: Establish clear rules for entering and exiting trades. This includes setting target prices, stop-loss limits, and not overtrading. Stick to these rules irrespective of market conditions.

・Risk Management: Never invest more than you can afford to lose. Managing risk through proper position sizing and diversification helps maintain emotional balance.

・Take Breaks and Reflect: Regular breaks from trading can prevent burnout and provide time to reflect on your strategies and decisions. Use this time to analyze past trades and learn from them.

・Emotional Journaling: Keeping a journal of your trades along with the emotions and thoughts you had while making those trades can help identify patterns in emotional decision-making and improve future strategies.

・Avoid Revenge Trading: After a loss, it’s common to want to 'make up' for it with another trade. This 'revenge trading' is often driven by emotion rather than rational analysis and can lead to greater losses.

・Seek Support and Education: Engage with a community of traders for support, and continually educate yourself about market analysis and trading psychology. Learning from others' experiences can provide valuable insights.

Emotions and psychology play a significant role in crypto trading. By recognizing emotional triggers like FOMO and maintaining discipline through clear strategies and risk management, traders can make more informed decisions. Balancing emotional responses with analytical thinking is key to navigating the complexities of the cryptocurrency market effectively.

6. Effective Risk Management Strategies

Risk management is a critical component of successful cryptocurrency trading. Given the inherent volatility and unpredictability of the crypto market, applying effective risk management strategies can significantly reduce potential losses and improve the sustainability of your trading career.

Tackling Volatility in the Cryptocurrency Market

Recognize that volatility is a fundamental characteristic of the cryptocurrency market. It can present both opportunities for high returns and risks of significant losses. As discussed earlier, diversifying your portfolio across different cryptocurrencies can mitigate risk. Avoid putting all your funds into one asset or market segment.

- Use of Technical Analysis: Employ technical analysis to understand market trends and volatility patterns. This can help in making informed decisions about entry and exit points in trades.

- Stay Updated on Market News: Be aware of events that could trigger market volatility, such as regulatory changes, technological advancements, or macroeconomic factors. This knowledge can help you anticipate market movements and adjust your strategies accordingly.

- Position Sizing: Allocate only a portion of your total capital to a single trade. This ensures that a loss on one trade doesn’t significantly impact your entire portfolio.

Utilizing the Stop-Loss Trick in Crypto Trading

A stop-loss order is an automatic order to sell an asset when it reaches a certain price. It’s designed to limit an investor’s loss on a position.

・Setting Realistic Stop-Loss Levels: Place your stop-loss at a level that makes sense in the context of your market analysis and risk tolerance. It should be tight enough to minimize losses but also give the trade enough room to fluctuate.

・Using Trailing Stop-Losses: A trailing stop-loss adjusts with the price of the asset. As the price moves in your favor, the stop-loss moves along with it, helping to lock in profits while still protecting against a downturn.

Stop-loss orders help remove emotion from trading decisions, as they are set when you initiate a trade and are based on objective analysis rather than in-the-moment emotions. Review and adjust your stop-loss orders in response to changing market conditions or new information about the asset you are trading. Effective risk management in crypto trading involves a balanced approach that includes understanding market volatility, diversifying your investments, using technical analysis, and applying tools like stop-loss orders. By implementing these strategies, traders can better navigate the crypto market's uncertainties and protect their investments. Remember, in the volatile world of cryptocurrency, managing risk is just as important as identifying opportunities.

7. Tips to Avoid Scams in the Cryptocurrency Sphere

The cryptocurrency sphere, while offering immense opportunities, is also rife with scams and fraudulent activities. Being vigilant and informed is essential to safeguard your investments. Here are some essential tips to help you steer clear of scams and protect your assets.

Protecting Against Phishing Attacks

Phishing is a common tactic used by scammers to trick individuals into giving away sensitive information like wallet keys or login credentials. They often use fake websites, emails, or social media messages that appear to be from legitimate sources.

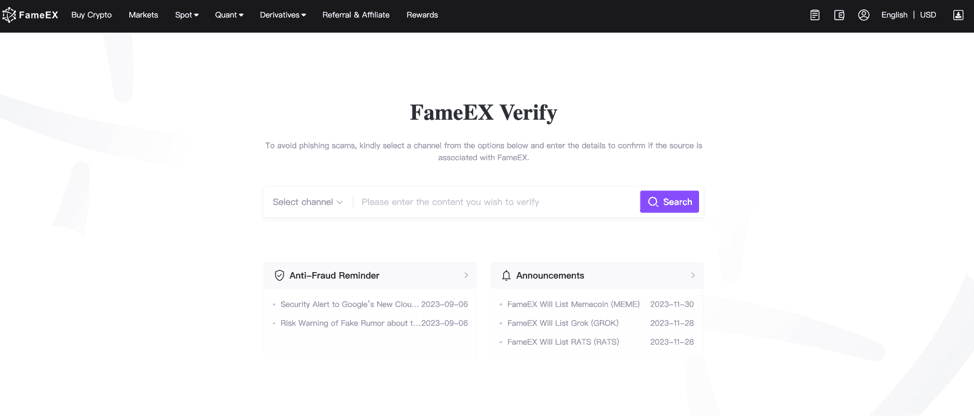

・Verify Sources Rigorously: Always verify the authenticity of the website, email sender, or social media message. Check for official website links, official email domains, and be wary of messages asking for urgent action or personal information. At FameEX, we have implemented channel verifications so users can easily distinguish between our official channels and potential scams.

・Beware of Suspicious Links: Avoid clicking on links or downloading attachments from unknown or unsolicited sources. These could lead to phishing sites or contain malware.

・Educate Yourself on Common Scams: Familiarize yourself with the common types of phishing attacks and scams in the crypto world. The more informed you are, the better you can spot and avoid these threats.

・Secure Your Email: Your email is often linked to your crypto accounts. Use a strong, unique password and consider using a dedicated email address for your crypto activities.

・Regularly Update Security Software: Keep your computer and mobile devices protected with the latest security software. Regular updates can help protect against new forms of malware and phishing tools.

・Stay Skeptical: Always maintain a healthy level of skepticism, especially when deals seem too good to be true or when you receive unsolicited investment advice.

・Report Suspicious Activity: If you encounter a potential scam, report it to the relevant authorities or platforms. Your action can help protect the community.

By being cautious and taking proactive steps to protect your information and assets, you can significantly reduce the risk of falling victim to phishing attacks and other scams in the cryptocurrency sphere. Always remember, in the digital world of crypto, your security and vigilance are your best defenses.

8. Why Technical Analysis is Your Best Friend in Crypto Trading?

Technical analysis is a crucial tool for cryptocurrency traders, offering insights into market trends, price movements, and potential future changes. It involves analyzing statistical trends gathered from trading activity, such as price movement and volume. Understanding how to effectively use technical analysis can greatly enhance your trading decisions and strategies in the volatile crypto market.

How Technical Analysis Helps You Understand Market Price Trends?

Technical analysis helps in identifying both short-term and long-term trends in cryptocurrency prices. By understanding these trends, traders can make more informed decisions about entry and exit points. It involves the use of various charts and patterns, such as candlestick patterns, trend lines, and moving averages, which can indicate potential price movements and market sentiment.

・Volume Analysis: Volume, the amount of a cryptocurrency traded over a period, is a key component in technical analysis. High trading volumes can validate the trend direction, providing a more reliable indicator of future price movements.

・Support and Resistance Levels: Identifying key support and resistance levels through technical analysis helps in understanding where the price might pause or reverse. These levels can be used to set target prices and stop-loss orders.

Applying Technical Analysis to Your Crypto Trading Plan

Use technical analysis to develop and refine your trading strategies. For example, if the analysis suggests an uptrend, you might consider buying and holding until the indicators signal a potential reversal. Technical indicators can also be used for risk management. By identifying potential price reversals, traders can set stop-loss orders to limit potential losses.

While technical analysis focuses on price movement and market trends, combining it with fundamental analysis, which looks at a coin's underlying value, can provide a more holistic approach to trading. The field of technical analysis is broad and continually evolving. Regular learning and practice are essential to stay up-to-date with new tools and techniques. For a more in-depth technical analysis, you can explore our guide here.

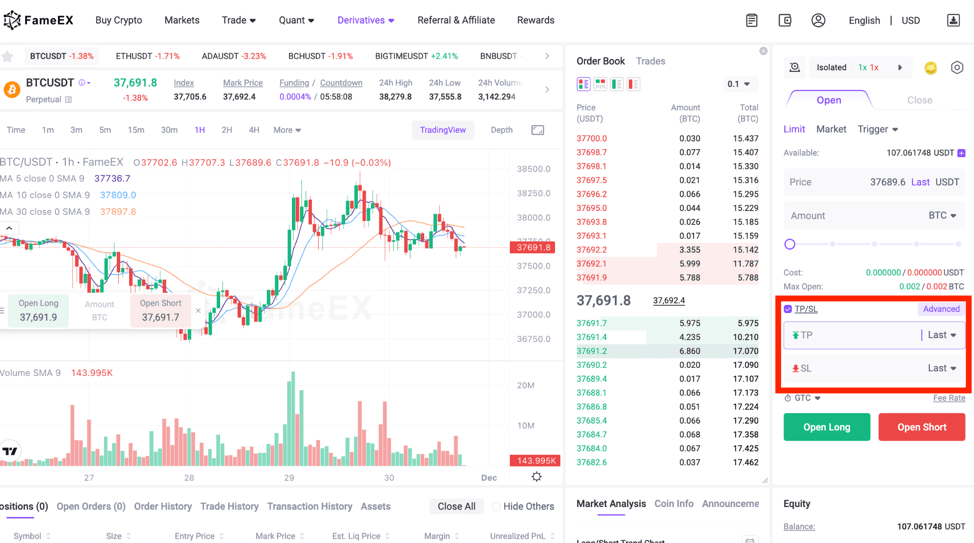

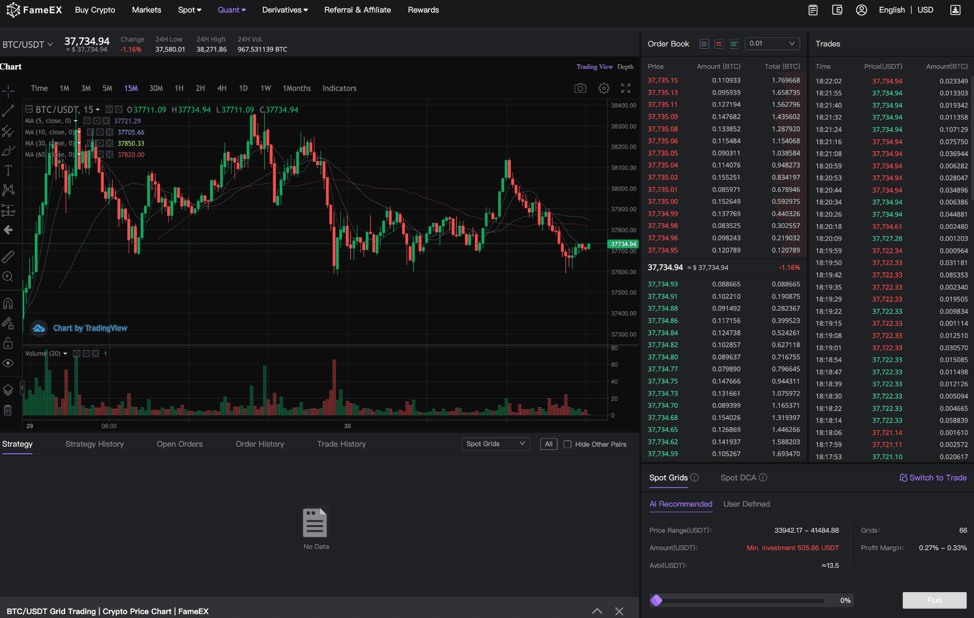

Leaning on Trading Bots for Technical Analysis

Trading bots can automate the process of applying technical analysis, executing trades based on predefined criteria and indicators. This can be particularly useful in a market that operates 24/7. Many trading bots offer the feature of backtesting, which allows traders to test their trading strategies against historical market data to gauge their effectiveness.

At FameEX, we offer a Grid Trading Bot that allows users to automate their trading strategies, focusing on buying low and selling high. This automated quantitative AI tool executes trades directly with the assets you hold in your account. Furthermore, FameEX assists in setting up your parameters with the AI tools, enabling you to determine the optimal grid size that matches your investment amount.

Bots follow strict trading strategies based on technical analysis, eliminating emotional biases that might affect human traders. While trading bots can be highly efficient, they are not infallible. Regular oversight and adjustments based on market changes are essential for successful bot trading. Technical analysis is a powerful tool in the arsenal of a crypto trader, providing critical insights into market trends and potential future movements. Whether used manually or through automated trading bots, it forms the backbone of effective trading strategies, risk management, and decision-making processes in the dynamic world of cryptocurrency trading.

9. Top Crypto Trading Strategies

Cryptocurrency trading strategies vary greatly, and choosing the right one depends on your risk tolerance, time commitment, and investment goals. Some traders prefer the fast-paced world of day trading, while others opt for long-term investment strategies. Understanding and mastering various trading strategies can significantly enhance your chances of success in the crypto market.

Day Trading: Seizing Short-Term Opportunities

Day trading involves entering and exiting positions within the same trading day. This strategy aims to capitalize on short-term market fluctuations. Day traders heavily rely on technical analysis to make quick, informed decisions. They utilize various chart patterns, indicators, and trading volumes to predict short-term price movements. While day trading can offer quick profits, it also comes with higher risk and requires constant market monitoring. It's not recommended for beginners or those unable to dedicate time to market analysis.

Mitigating Risks with Effective Trading Strategies

Spread your investments across different cryptocurrencies to mitigate risk. Diversification can protect your portfolio from volatility in any single asset. Define your trading goals and set clear limits on your trades, including entry, exit, and stop-loss thresholds. Maintain a disciplined approach to trading, avoiding decisions driven by fear or greed. Stick to your strategy even in volatile market conditions. Regularly review and adjust your portfolio based on performance and changing market conditions.

Why Long-Term Investment Could Be the Best Strategy?

Long-term investment, often referred to as 'HODLing' in the crypto community, involves buying and holding cryptocurrencies for an extended period, regardless of short-term market fluctuations. Long-term investors can benefit from entire market cycles, which could lead to substantial returns as the market grows over time. Unlike day trading, long-term investing requires less time and constant market monitoring, making it suitable for those who cannot dedicate hours each day to trading. By focusing on the long-term potential of cryptocurrencies, investors can avoid the stress and risks associated with short-term market volatility. Long-term strategies often rely more on fundamental analysis, assessing the underlying value and potential of a cryptocurrency, rather than short-term price movements.

Each crypto trading strategy comes with its own set of risks and rewards. Whether you choose day trading for its short-term gains or long-term investing for its potential for growth over time, understanding your personal risk tolerance and market dynamics is key. Combining various strategies and continuously adapting to the market can also lead to a more robust and successful trading experience.

10. Security Measures in Crypto Trading

Security in crypto trading is paramount, given the digital and often decentralized nature of cryptocurrencies. Implementing strong security measures is crucial to protect your investments from theft, hacking, and other malicious activities. Here are key practices and precautions to ensure security in your crypto trading activities.

Secure Your Trading Accounts

Strong, Unique Passwords: Use strong, unique passwords for your trading accounts and change them regularly. Avoid using the same password across different platforms. Always enable 2FA on your trading accounts. This adds an extra layer of security beyond just the password. Secure your email account linked to your trading accounts. Use a strong password and 2FA, as email is often a target for hackers to gain access to your crypto accounts.

Safeguard Your Wallets

Consider using hardware wallets for storing large amounts of cryptocurrencies. These wallets store your private keys offline, making them immune to online hacking attempts. Regularly backup your wallet, especially if it’s a software wallet. Store the backup in a secure location separate from your primary wallet. While online wallets are convenient for quick transactions, they are more vulnerable to hacking. Limit the amount of cryptocurrency you store in online wallets.

Be Cautious with Transactions: Always double-check wallet addresses before sending or receiving transactions. One small error can result in the irreversible loss of funds. Avoid trading or accessing your crypto wallets over public Wi-Fi networks. Use a secure, private, and encrypted internet connection. Be cautious of phishing websites. Always verify the URL of the exchange or wallet service you are using.

Stay Informed and Vigilant: Stay informed about the latest security threats in the cryptocurrency space. Knowledge is your first line of defense. Keep your computer and smartphone updated with the latest security patches and updates.

Use Reputable Exchanges and Services: Choose cryptocurrency exchanges and wallet services with a strong track record for security and customer service. Consider factors like transaction fees, available cryptocurrencies, and the geographic location of the exchange. FameEX is an excellent choice for your needs, as we are licensed in three countries and have implemented very strict security measures. In the cryptocurrency market, FameEX offers the lowest transaction fees for all traders compared to other exchanges. This distinction positions FameEX as one of the best choices for a cryptocurrency exchange.

Regular Security Audits: Periodically review and update your security measures. This includes checking the security settings on your accounts, updating passwords, and reviewing your wallet backups.

By adhering to these security measures, you can significantly reduce the risk of losing your assets and ensure a safer trading experience. Remember, in the world of cryptocurrency, being proactive about security is not just a recommendation, it’s a necessity.

What are the Common Pitfalls of Crypto Trading and Tips to Avoid Them?

In the rapidly evolving cryptocurrency trading, both new and experienced investors often encounter various pitfalls that can significantly impact their financial success. Here are some common mistakes made in crypto trading and provide practical tips to navigate this complex market effectively. Understanding these challenges is crucial for anyone looking to profit from the volatile yet potentially lucrative world of cryptocurrencies.

Avoiding the Common Mistake of Putting All Eggs in One Basket

Diversification is a fundamental principle in investment, and it's especially pertinent in the volatile cryptocurrency market. Many traders fall into the trap of investing heavily in a single cryptocurrency, which can lead to significant losses if that particular asset underperforms. To mitigate risk, it's advisable to spread investments across various cryptocurrencies, considering factors like market capitalization, project potential, and technology. Diversification not only reduces risk but also provides opportunities to capitalize on the growth of multiple assets.

Ignoring Proper Exit Strategies

A well-defined exit strategy is essential for successful crypto trading. Many traders focus solely on when to enter the market, neglecting the importance of knowing when to exit. Setting clear goals and limits for both profits and losses can help maintain discipline and prevent emotional decision-making. Implementing stop-loss orders and taking profits at predetermined levels can safeguard your investments against market volatility and ensure that you lock in gains and minimize losses.

Steering Clear of Bad Trading Tips and Strategies

The crypto market is rife with misinformation and unfounded advice. Relying on tips from unverified sources or adopting strategies without proper understanding can be detrimental. It's crucial to conduct thorough research, utilize reliable information sources, and develop a sound trading strategy based on market analysis and personal risk tolerance. Continuous learning and adapting to market changes are also key to staying ahead in the crypto trading game.

Choosing the Right Time for Buying and Selling Cryptocurrencies

Timing is everything in cryptocurrency trading. While it's impossible to always buy at the lowest point and sell at the peak, understanding market trends and indicators can significantly improve timing decisions. Technical analysis, including studying charts and patterns, and fundamental analysis, which involves evaluating the underlying factors affecting a cryptocurrency's value, are both important tools. Staying informed about market news and developments is also crucial for making timely and informed trading decisions.

Conclusion

The journey into cryptocurrency trading in 2024 is an exciting and dynamic venture, filled with both opportunities and challenges. For beginners, the key to success lies in a well-rounded approach that balances education, strategy, and risk management. It is essential to start with a solid understanding of the market fundamentals, select the right cryptocurrency exchange like FameEX, and set up a secure crypto wallet. Diversifying your portfolio across various cryptocurrencies and incorporating fiat currencies can mitigate risks and enhance potential returns. Embracing technical analysis as a tool for informed decision-making, while also acknowledging the importance of fundamental analysis, is crucial in navigating market trends and price movements.

Equally important is the psychological aspect of trading; maintaining emotional discipline and avoiding pitfalls like FOMO are critical for long-term success. Implementing effective risk management strategies, such as using stop-loss orders and understanding market volatility, can help in safeguarding your investments. Staying vigilant against scams, particularly phishing attacks, and ensuring the security of your trading accounts and wallets is paramount in this digital trading space.

In a nutshell, by following these tips and strategies, beginners can confidently step into the world of crypto trading. It’s a journey of continuous learning and adaptation, but with the right approach, it can be both rewarding and enriching. Remember, the cryptocurrency market is not just about the potential for financial gain; it's a gateway to understanding and participating in the future of digital finance.

FAQ About Crypto Trading Tips

Q: How do I start crypto trading for beginners?

A: Begin by learning about cryptocurrencies and blockchain, set clear trading goals, start with a small investment, practice using an account with trial funds, and understand market risks.

Q: What are the best tips for beginners in crypto trading?

A: For beginners, it's crucial to diversify investments, stay updated with market trends, use stop-loss orders, make decisions based on research, and regularly review your strategy.

Q: How do I choose a reliable crypto exchange?

A: Choose a crypto exchange by checking its reputation, ensuring it has robust security measures, comparing fees, assessing the user interface and customer support, and verifying regulatory compliance.

Q: What are the essential tools for technical analysis in crypto trading?

A: Essential tools for technical analysis include price charts, trend lines, moving averages, volume indicators, and oscillators like RSI and MACD.

Q: What are the secrets of cryptocurrency trading?

A: Successful cryptocurrency trading involves continuous learning, adapting to market changes, managing risks effectively, leveraging technical analysis, and maintaining discipline in trading strategy.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.