How to Use the Cryptocurrency Fear and Greed Index for Smarter Trading Decisions

2025-06-20 08:48:53

Picture a trader who buys crypto because bitcoin is rising. He feels excited but does not look at real market feelings. Soon, the market drops, and he gets scared. He sells his crypto and loses money. Many traders make choices based on feelings. The cryptocurrency fear and greed index helps traders understand the market. This tool checks the crypto market and tracks how people feel. It helps traders see when the market changes from fear to greed. By watching the crypto fear and greed index, traders can avoid quick mistakes. They can use bitcoin data to help with their choices.

Key Takeaways

- The Cryptocurrency Fear and Greed Index tells how people feel about crypto. It uses a score from 0, which means fear, to 100, which means greed. Traders can look at low scores to find good times to buy. This is when the market feels scared and prices might be low. High scores show lots of greed. This can warn traders to sell or be careful before prices fall. The index works best with other tools like charts and research. This helps traders make smarter choices. Using the index helps traders not make emotional mistakes. It helps them follow a plan for better results in crypto trading.

What Is the Cryptocurrency Fear and Greed Index

The cryptocurrency fear and greed index is a popular tool that helps traders understand the mood of the crypto market. This index gives a simple score from 0 to 100. A low score means the market feels fear. A high score means the market feels greed. Many traders use this tool to spot when people might be too scared or too excited about crypto. The crypto fear and greed index can help traders make better choices by showing the current market sentiment.

How the Index Works

The crypto fear and greed index collects data from many sources to measure how people feel about the crypto market. It looks at price changes, trading activity, social media buzz, and even search trends. The index updates often, so traders always see the latest market sentiment. The score changes as new data comes in. This helps traders react quickly to shifts in the crypto market.

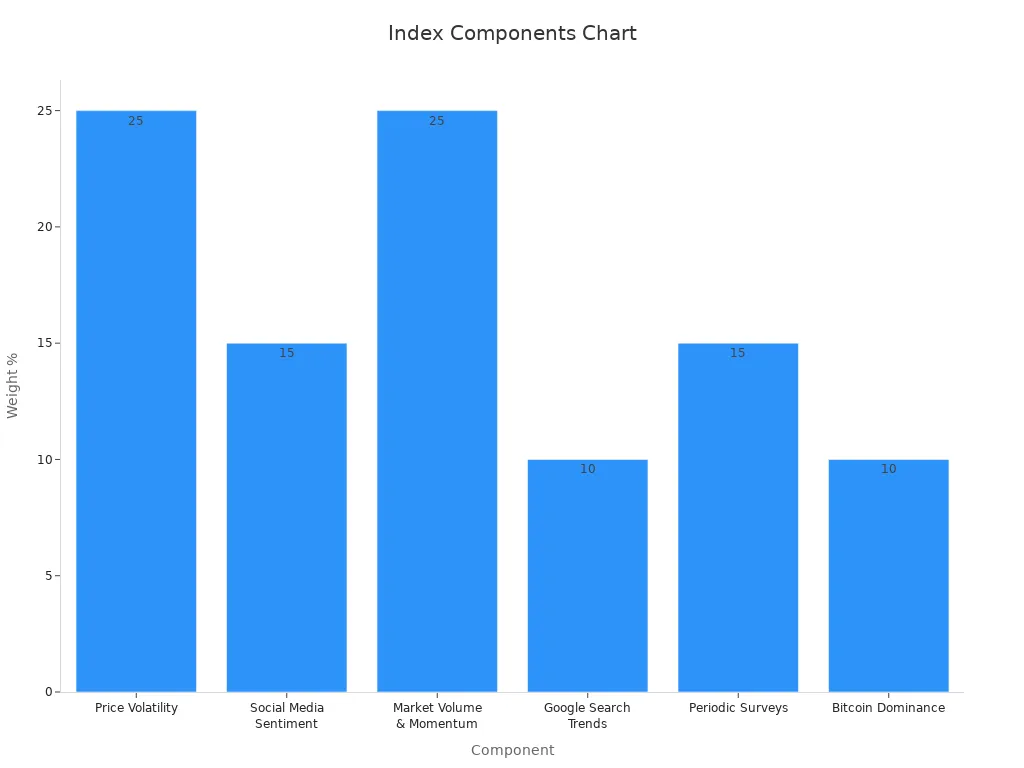

Here is a table showing the main parts of the index and how much each part matters:

| Component | Weight | Description |

|---|---|---|

| Price Volatility | 25% | Measures big price swings in crypto, showing fear or greed. |

| Social Media Sentiment | 15% | Checks posts on Twitter, Reddit, and YouTube for hype or panic. |

| Market Volume & Momentum | 25% | Looks at how much crypto is being traded and how fast prices move. |

| Google Search Trends | 10% | Tracks how often people search for crypto topics. |

| Periodic Surveys | 15% | Gathers opinions from crypto investors. |

| Bitcoin Dominance | 10% | Compares bitcoin’s share of the market to other coins. |

What It Measures

The crypto fear and greed index measures the overall sentiment in the crypto market. It uses six main data points. Price volatility checks for sudden drops or jumps in crypto prices. Social media sentiment looks at what people say online. If there is lots of hype, the index shows greed. If there is panic or fear, the score drops. The index also checks bitcoin dominance, search trends, and survey results. By combining all these, the cryptocurrency fear and greed index gives a clear picture of how the market feels. Traders can use this score to spot when the market might be overbought or oversold. This helps them avoid emotional trading and make smarter decisions.

How to Use the Crypto Fear and Greed Index

Identifying Buy Opportunities

Many traders want to know when to buy crypto. The crypto fear and greed index can help spot these moments. When the index drops below the 10th percentile, it shows extreme fear in the market. This level often means that most people feel worried about bitcoin and altcoins. At these times, prices may fall too much because of panic selling.

Historical data shows that when the market feels extreme fear, bitcoin has often started big rallies. For example, after a period of extreme fear, bitcoin once jumped by 32%. This pattern suggests that extreme fear can signal a potential change in market conditions. Traders who use the index can look for these low scores as possible buy opportunities. They do not need to guess how others feel. The index gives a clear number to guide investment decisions.

Tip: Extreme fear does not last forever. When the index is very low, it may be a good time to research and consider buying, especially if other signals also look positive.

Spotting Sell Signals

The crypto fear and greed index also helps traders know when to sell. When the index rises above the 90th percentile, it shows extreme greed in the market. At this point, many people feel excited about bitcoin and altcoins. Prices may rise too fast because of hype and fear of missing out.

When the market feels extreme greed, it often means that prices could drop soon. The index acts like a warning sign. Traders can use this signal to lock in profits or reduce risk. Selling during extreme greed can help avoid losses when the market turns. This approach supports smarter investment decisions and helps traders stay calm during wild price swings.

- The index updates daily, so traders can check for new sell signals often.

- Extreme greed does not mean prices will fall right away, but it does show a potential change in market conditions.

Setting Personal Thresholds

Every trader has a different style. Some like to take big risks, while others want to play it safe. The crypto fear and greed index lets traders set their own buy and sell points. They can look at the index’s history and decide what numbers work best for them.

Here is a simple way to set personal thresholds:

| Risk Level | Buy Threshold (Fear) | Sell Threshold (Greed) |

|---|---|---|

| Conservative | Below 10th percentile (~25) | Above 90th percentile (~75) |

| Moderate | Below 20th percentile (~35) | Above 80th percentile (~65) |

| Aggressive | Below 30th percentile (~45) | Above 70th percentile (~55) |

Traders can use these thresholds to plan entries and exits. They should remember that the crypto fear and greed index works best with other tools. It is not a magic signal. It helps traders make decisions based on data, not just feelings.

Note: The index works like a map. It shows the mood of the market, but it does not guarantee what will happen next. Combining the index with other research, like technical charts or on-chain data, can lead to better results.

The crypto fear and greed index gives traders a way to avoid emotional mistakes. By watching the index, they can spot buy and sell signals, set personal rules, and make smarter investment decisions in bitcoin, altcoins, and the wider crypto market.

Best Practices for Trading with the Index

Combining with Other Indicators

Smart traders use more than one tool. They look at the cryptocurrency fear and greed index and other indicators together. For example, they check moving averages, RSI, or MACD to see price trends. Using both the index and technical signals helps traders know if the market might change soon.

A deep learning study showed that using many technical indicators, like RSI and Bollinger Bands, helps traders see market momentum and trends. This way, traders get a better idea of what is happening. The Bitcoin Fear and Greed Index works best with technical analysis, on-chain data, and research about each project. If the index shows extreme fear and charts show a bottom, traders may find good times to buy and hold.

Tip: No single indicator is perfect. Using more than one tool helps traders lower risk and make better choices, especially when the market moves fast.

Avoiding Common Pitfalls

Some traders only use the fear and greed index. This can cause bad choices because market feelings can be slow to catch up with prices. The index shows how people feel, but prices may have already moved.

To avoid this mistake, traders should check other signals before acting. They should also set stop-losses to keep their money safe. It is important to stay calm and not trade with emotion. The market can change fast, so traders need to follow their plan and not chase hype.

- Use the index as a guide, not a rule.

- Watch for changes in trends and check with other indicators.

- Keep emotions out of trading choices.

By following these best practices, traders can use the fear and greed index to help them stay calm and make smarter moves in the crypto market.

The crypto fear and greed index shows if people feel scared or greedy. This helps traders know when to buy or sell crypto. Traders do better when they use this index with other tools. They also need to stick to their plan and not act on feelings. Trading with facts works best. Here is a simple table that shows how following a system can help:

| Aspect | Benefit |

|---|---|

| Trend Following | Finds strong moves in the market |

| Risk Management | Reduces losses with tested strategies |

| Real-time Analytics | Spots changes quickly |

| Transparency | Shows clear results for every decision |

By using these steps, traders can keep their feelings out of trading. This helps them make good choices with crypto every day.

FAQ

What does a low fear and greed index score mean?

A low score shows that most traders feel scared. They might sell their crypto because they worry about prices dropping. This can create good buying chances for smart traders.

How often does the index update?

The index usually updates once a day. Some websites may update it more often. Traders can check the latest score before making decisions.

Can the index predict future prices?

The index does not predict prices. It only shows how people feel right now. Traders use it as a guide, not a guarantee.

Should traders use the index alone?

Tip: Always use the index with other tools. Charts, news, and research help traders make better choices. The index works best as part of a bigger plan.

Is the index only for Bitcoin?

No, the index covers the whole crypto market. It uses Bitcoin data, but it also looks at other coins and market trends.