FameEX Today’s Crypto News Recap | February 6, 2026

2026-02-06 06:17:06

Kalshi oversight update, Bitcoin $60K liquidation drop, and Strategy Q4 crypto loss drive today’s market headlines. Today’s crypto market volatility was driven primarily by the passive contraction of risk positions rather than directional trading based on a shift in long-term investor conviction. As BTC prices declined rapidly, a large number of leveraged positions breached risk thresholds, triggering automatic liquidations designed to contain losses. This chain reaction of forced unwinds amplified selling pressure in a short period, producing what is effectively a deleveraging cascade. Bitcoin briefly fell toward the $60K region before stabilizing. This suggested that the most concentrated liquidation pressure had been flushed out, though this does not imply a restoration of proactive buying interest. Capital behavior broadly shifted toward exposure reduction and liquidity preservation, while derivatives market depth contracted under elevated volatility, increasing price sensitivity to sell flows. Institutional and large participants prioritized position adjustment and risk management over initiating new directional bets. The subsequent rebound lacked sustained follow-through buying, indicating that the market remains in an observation and risk recalibration phase.

Crypto Markets Overview

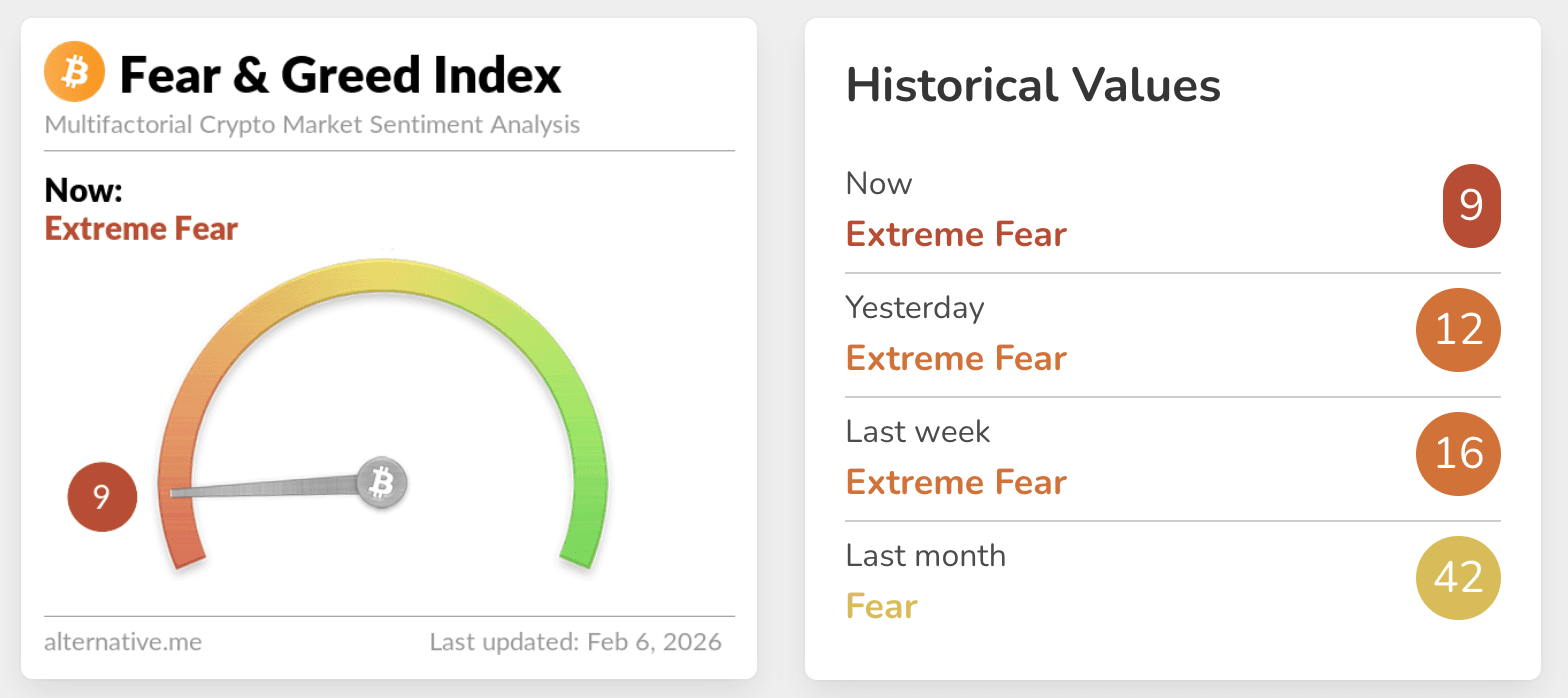

The broader crypto market continues to operate under a defensive structure, with the Crypto Fear & Greed Index is 9, placing sentiment firmly in Extreme Fear territory. This reflects a sharp deterioration in risk appetite, with capital flows focused on deleveraging and position trimming rather than active risk expansion. Traders are prioritizing position stability and liquidity security, shifting trading behavior toward risk control instead of volatility chasing. Bitcoin continues to function as the market anchor, absorbing capital rotation and defensive flows during volatility expansion. Ethereum remains more sensitive to liquidation pressure due to concentrated derivatives positioning, which has constrained relative price performance. Altcoin activity reflects selective rotation rather than broad risk re-engagement, suggesting that capital is still focused on balance sheet repair. Price action remains tightly linked to leverage compression, with market behavior driven more by positioning adjustments than trend-seeking inflows. Sentiment and risk management dynamics therefore dominate short-term trading conditions.

Source: Alternative

BTC Structural Break Triggers Liquidations While ETH Leverage Reset

Bitcoin’s move toward the $60K range represented more than a simple price retracement. It marked a structural leverage flush. Onchain data showed USD 3.2 billion in single-day realized losses, exceeding the scale observed during several past black swan events, indicating forced repricing among holders under stress. Simultaneously, Bitcoin’s break below the 200-week moving average which is a long-term structural reference and triggered exposure reduction across risk models and quantitative strategies, further accelerating selling pressure. Derivatives liquidation data recorded approximately USD 2.71 billion in forced liquidations over 24 hours, with longs accounting for the majority, highlighting concentrated position unwinds as price momentum intensified. This produced classic liquidity compression dynamics, where rapid deleveraging drove outsized volatility. Even though Bitcoin rebounded nearly 10% from its intraday lows, the move largely reflected temporary stabilization following liquidation exhaustion rather than the rebuilding of directional demand.

Ethereum was similarly shaped by derivatives leverage and large-scale position rebalancing. Liquidation statistics showed significantly heavier long-side unwinds compared to shorts, while whale-scale short positions remained deeply profitable, reinforcing asymmetric risk release in the short term. This structure suggests that price movement was driven primarily by margin mechanics and positioning stress rather than fundamental narratives or fresh capital inflows. In ETF markets, Bitcoin-related products recorded record trading turnover alongside price declines, indicating that elevated volume was dominated by hedging and exposure adjustments rather than new speculative positioning. Overall, market focus has shifted toward absorbing the liquidity shock already released and reassessing macro risk conditions, rather than establishing a new directional trend.

Key News Highlights:

Kalshi Tightens Oversight as Prediction Market Scrutiny Grows

Prediction market platform Kalshi announced enhanced monitoring measures ahead of the Super Bowl, including the formation of an independent advisory committee, expanded abnormal trading investigation frameworks, and partnerships with third-party surveillance and forensic analytics providers to strengthen detection of insider trading and market manipulation. The move comes as Super Bowl-related contracts approach USD 168 million in wagers, against a backdrop of increasing regulatory and congressional scrutiny over prediction markets. This signals that event-based contracts are evolving from high-volume retail products toward structures requiring financial-market-grade governance and compliance standards. As oversight increasingly focuses on trade fairness, information asymmetry, and manipulation risks, platforms may need to elevate surveillance intensity and risk controls, potentially influencing liquidity provision models and transaction cost structures.

Bitcoin Rapid Drop to $60K Sparks Market Deleveraging

A rapid deleveraging episode unfolded as Bitcoin briefly fell toward $60,000 before recovering to around $64,100, with volatility driven less by directional repricing and more by forced unwinds following the loss of key support levels. Roughly USD 817 million in leveraged positions were liquidated within hours, illustrating how one-sided positioning can magnify liquidity gaps once technical thresholds are breached. Market sentiment deteriorated sharply, with the Fear & Greed Index falling deeper into Extreme Fear territory, signaling a behavioral shift from dip-buying to capital preservation. Rallies were quickly sold into, and trading volume cooled as liquidation flows subsided. Concurrently, institutional capital outflows from spot Bitcoin ETFs exceeded USD 800 million over recent sessions, suggesting that macro-driven risk reduction is reinforcing derivatives deleveraging across asset classes.

Strategy Q4 Loss Highlights Corporate Bitcoin Volatility

Strategy reported a net loss of USD 12.4 billion for the fourth quarter of 2025, driven largely by Bitcoin’s quarterly decline, underscoring how corporate treasury exposure to digital assets can amplify earnings volatility during high-stress cycles. While revenue rose year-over-year to USD 123 million and management emphasized the resilience of its capital structure, equity markets repriced risk sharply, reflecting investor sensitivity to leverage, valuation compression, and asset concentration. The company’s expanded cash position of USD 2.25 billion and delayed debt maturities were presented as liquidity safeguards to mitigate near-term forced asset sales. From a market structure perspective, large corporate Bitcoin holders remain focal points during downturns, as balance sheet resilience directly influences perceived supply risk and cross-market risk premiums linking equity sentiment with crypto spot and derivatives positioning.

Trending Tokens:

- $RNBW (Rainbow)

Rainbow has attracted market attention following its announcement of a $RNBW token launch via a Continuous Clearing Auction on Uniswap. This positions the wallet token issuance as a structured and permissionless distribution event. The pre-bid and live auction phases introduce block-level clearing mechanics that emphasize price discovery and fair execution, aligning with broader trends in onchain market infrastructure. Auction proceeds will be deployed into an Arrakis-managed $RNBW/$USDC liquidity pool on Base. This signals the team’s focus on establishing early secondary market depth. The distribution framework also differentiates mobile wallet airdrops, highlighting Rainbow’s strategy of prioritizing wallet-native user participation. Official messaging frames $RNBW as an alignment mechanism that connects users with revenue sharing and ownership incentives rather than functioning solely as a transactional token. Rainbow’s approach integrates wallet infrastructure with tokenized user incentives, reflecting an emerging trend toward transparent onchain liquidity and user alignment.

- $DOOD (Doodles)

Doodles has become a focal point for the market as spot trading for the $DOOD token prepares to launch on a major regulated exchange, providing more standardized access channels for both retail and institutional participants. This listing marks $DOOD’s expansion from an NFT-centric cultural ecosystem into a more liquid token market, increasing cross-market visibility. Official disclosure of the Solana network contract details reduces the risk of asset transfer errors while improving operational transparency. Market interest is further supported by Doodles’ established brand presence and prior ecosystem expansion, which provide narrative context for token-based participation. Exchange integration introduces standardized custody and matching infrastructure, helping attract broader liquidity sources. This listing illustrates how NFT communities are extending participation models beyond collectibles into financialized trading environments.

- $ESP (Espresso Systems)

Espresso Systems is gaining attention following the release of $ESP tokenomics and its transition toward decentralized proof-of-stake consensus. The $ESP token is designed as the economic layer securing HotShot consensus, linking staking participation to Ethereum-inspired reward dynamics. The initial supply structure includes a fully unlocked community airdrop allocation, emphasizing early network distribution and user engagement while reserving resources for long-term ecosystem growth. Espresso’s core positioning centers on delivering fast finality and data availability for rollup-focused multi-chain environments, addressing fragmentation challenges across networks. Ecosystem partnerships reinforce its role as coordination infrastructure rather than a standalone chain competitor. The launch of $ESP strengthens Espresso’s positioning as a foundational coordination infrastructure aligned with the scaling trajectory of rollup-driven ecosystems.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.