FameEX Weekly Market Trend | June 1, 2023

2023-06-01 08:42:00

1. Market Trend

Between May 29 and May 31, the BTC price fluctuated between $26,880.58 and $28,447.14, with a volatility of 5.82%. According to the 1-hour candle chart, after BTC broke through the recent strong resistance level at $27,000, it continued to move upwards in the early morning of May 29, accompanied by a certain amount of volume, ultimately surpassing the resistance level at $28,000 and reaching a peak of around $28,400. However, instead of consolidating or continuing to rise, the price experienced a downward oscillation, eventually falling below $27,000. This indicates that the recent market remains relatively weak and would benefit from additional positive news to stimulate growth and increased trading volume. Such developments are essential to facilitate a significant breakthrough. Perhaps only these factors can contribute to a turnaround.

Source: BTCUSDT | Binance Spot

Between May 29 and May 31, the price of ETH/BTC fluctuated within a range of 0.06682 to 0.06942, showing a 3.9% fluctuation. Looking at the 1-hour candle chart, the ETH/BTC pair has been oscillating upwards along the SMA since it reached a low of 0.06682 at 05:00 am on May 29, with a relatively steady trend. The daily chart has also been running above the 7-day SMA for many days, and all levels (1H, 2H, 4H, etc.) have seen multiple SMAs diverging upwards in a long pattern, with a relatively strong trend.

Based on overall analysis, after several attempts to surpass $27,000, the BTC price finally managed to break through and rise above $28,000. However, it quickly fell back to the starting point, indicating that the current market is highly fragile and lacks strong resistance. It is advisable to adopt a cautious approach and avoid excessive trading.

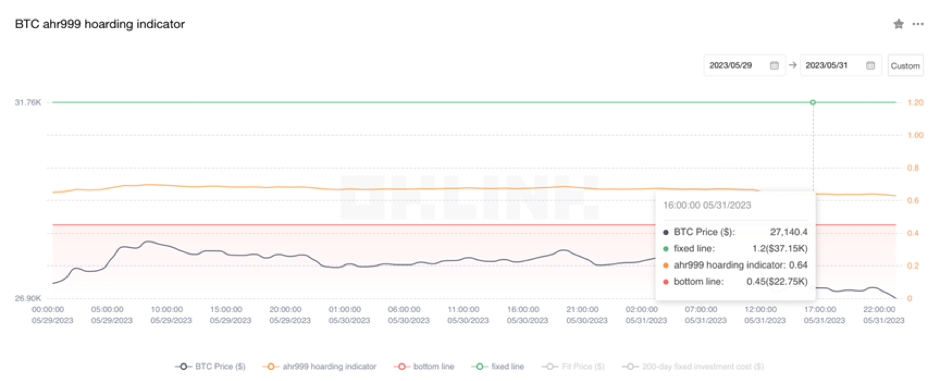

The Bitcoin Ahr999 index of 0.45 is above the buying-the-dip level ($22,750) but below the DCA level ($37,150). It is viable to purchase popular coins through DCA.

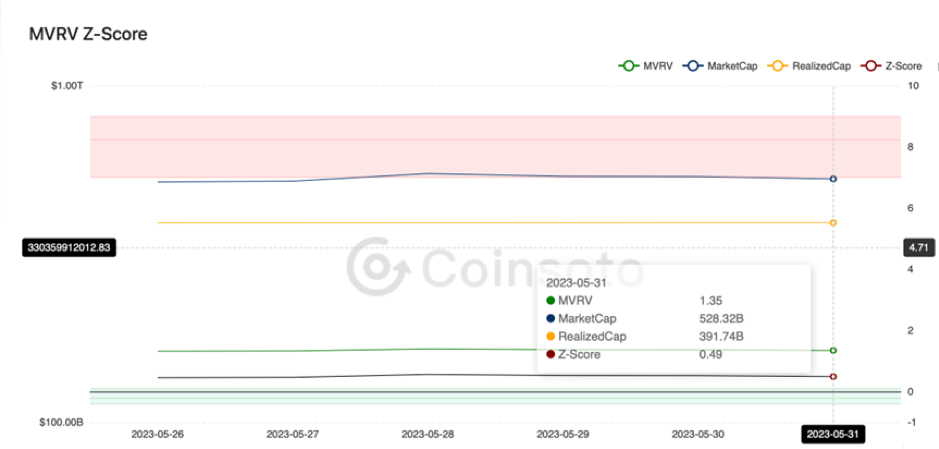

From the perspective of MVRV Z-Score, the value is 0.49. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buying-the-dip range (-0.33-0.09).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges were positive, indicating that long leverages are relatively high.

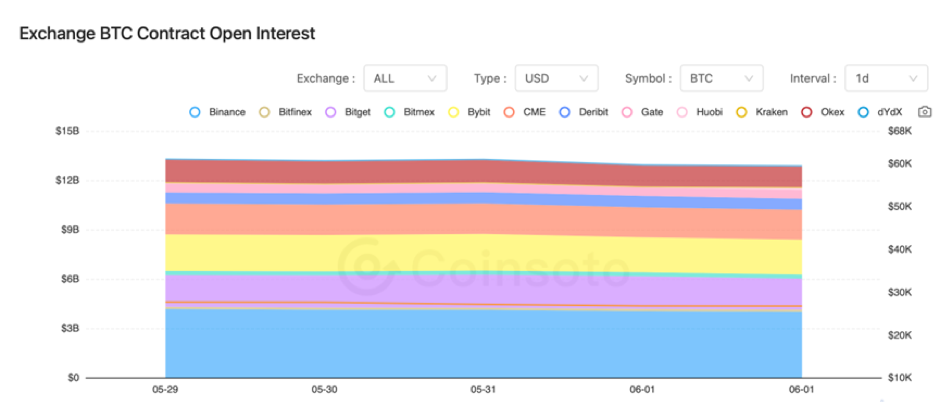

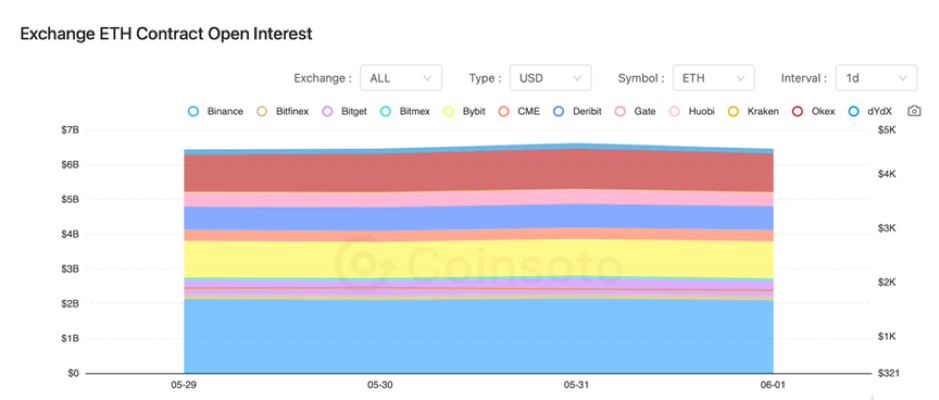

Between May 29 and May 31, there is little change in the contract open interest of BTC and ETH from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On May 29, BTC futures opened significantly higher with a gap of $1,015.

2) On May 29, OKX announced its seventh proof of reserve, with BTC, ETH, and USDT totaling a value of $10 billion.

3) On May 29, BKEX temporarily suspended withdrawals to assist law enforcement in investigating funds suspected of money laundering.

4) On May 29, Bali announced measures to crack down on foreign tourists using cryptocurrencies as a payment method.

5) On May 30, according to data, the total supply of Ordinals inscription tokens surpassed 10 million.

6) On May 30, China Guangfa Bank issued further regulations specifying the proper use of credit card funds, prohibiting the purchase of stocks, bitcoin, and similar assets.

7) On May 30, Tether introduced sustainable Bitcoin mining operations in Uruguay.

8) On May 31, the CEO of the Hong Kong Securities and Futures Commission prioritized investor protection as the foremost concern in the guidelines for virtual asset trading platforms.

9) On May 31, HKVAC, a virtual asset rating agency based in Hong Kong, was officially established, planning to launch virtual asset indices and exchange ratings.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.