FameEX Weekly Market Trend | June 15, 2023

2023-06-15 09:37:50

1. Market Trend

Between June 12 and June 14, the BTC price fluctuated between $25,602.11 and $26,433.21, with a volatility of 3.24%. According to the 1-hour candle chart, BTC has experienced little volatility and has maintained a relatively stable trend, running above the support level of $25,500. On June 13, 10:00 am witnessed a breakthrough as the price surpassed the long-held resistance of the 99-day moving average ($26,024), followed by a gradual ascent. Subsequently, upon the release of the US CPI data for May, it peaked at $26,433, only to retest the short-term support level of around $25,500 for a period of consolidation. Currently, the overall market volatility is not strong, with low trading volume and a weak trend. On June 15, the announcement of the Federal Reserve’s interest rate decision would provide valuable insight into the development of BTC, allowing traders to make appropriate assessments accordingly.

Source: BTCUSDT | Binance Spot

Between June 12 and June 14, the price of ETH/BTC fluctuated within a range of 0.06669 to 0.06786, showing a 1.75% fluctuation. Looking at the hourly candlestick chart, it becomes apparent that the trend of ETH/BTC remained within a downtrend channel throughout this period, firmly suppressed by the 7-day moving average. In addition, the recent ETH trend has been weaker than BTC, making it difficult for its price to gain momentum. Despite this, the overall volatility and trading volume are not significant, leading to a weak market trend and an increase in the number of observers.

Based on overall analysis, in recent times, the overall market has experienced minor volatility and weak market sentiment, accompanied by a decrease in trading activity. BTC needs to find new catalysts to stimulate market sentiment, whether by means of breakthroughs in an upward or downward direction. At present, the dominant approach is still to observe the market and look for opportunities to enter.

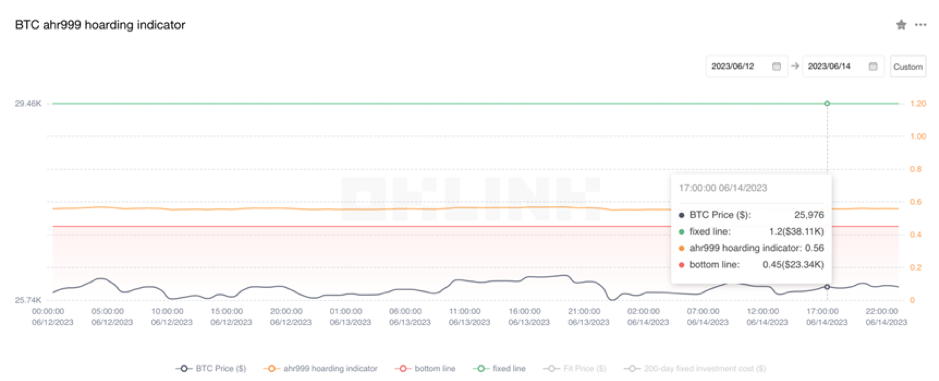

The Bitcoin Ahr999 index of 0.56 is above the buying-the-dip level ($23,340) but below the DCA level ($38,110). It is viable to purchase popular coins through DCA.

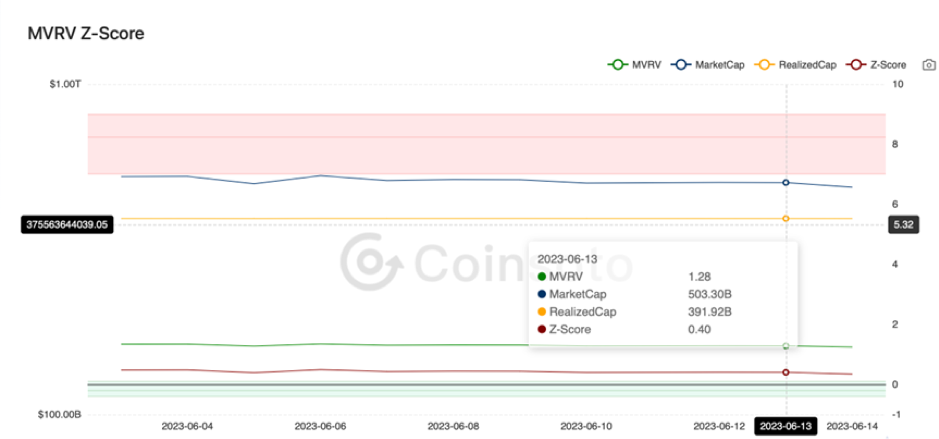

From the perspective of MVRV Z-Score, the value is 0.40. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buying-the-dip range (-0.42-0.06).

2. Perpetual Futures

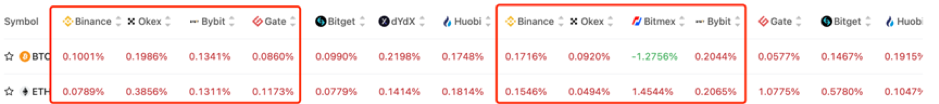

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

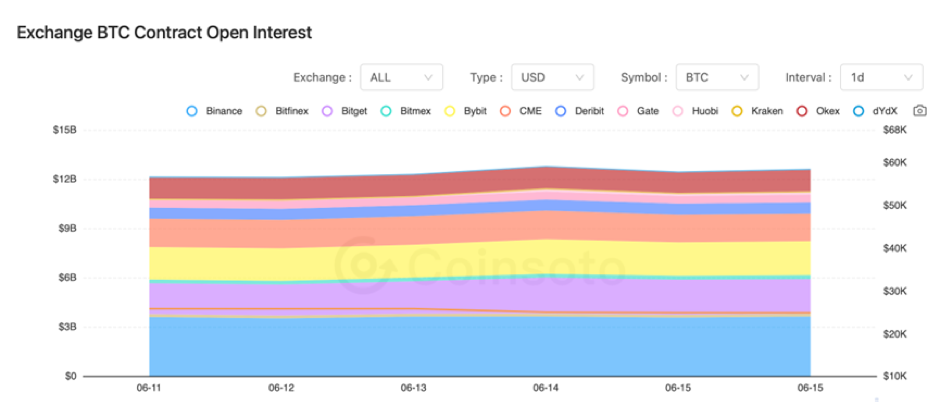

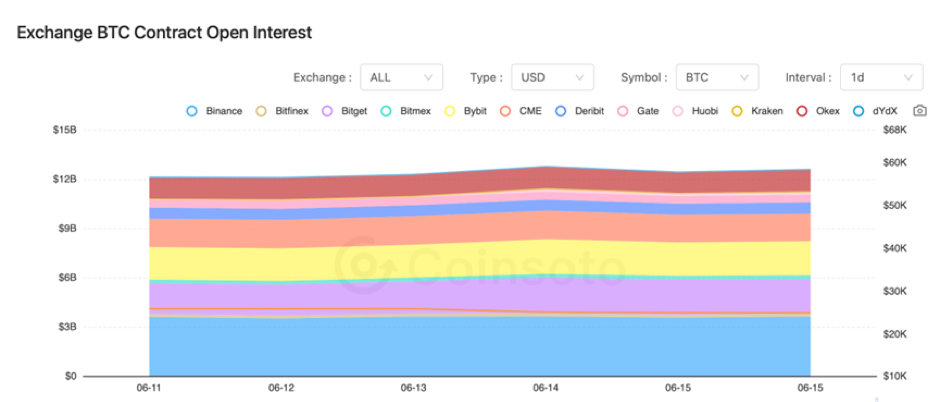

Between June 12 and June 14, the contract open interest of BTC slightly increased, while ETH remained unchanged.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On June 12, Gensyn completed a $43 million financing round led by A16Z.

2) On June 12, the market share of decentralized exchanges (DEX) reached a historic high, exceeding 20% in May.

3) On June 12, the Hong Kong government stated its ambition to introduce a regulatory framework for stablecoins by the end of next year.

4) On June 13, the Chairman of the U.S. SEC previously stated in 2018 that “BTC, ETH, LTC, and BCH are not securities.”

5) On June 13, the U.S. May CPI for the quarter recorded a yearly interest rate of 4%, reaching a new low since March 2021.

6) On June 13, Binance worked towards completing the acquisition of Gopax.

7) On June 14, Hong Kong Legislative Council member Wu Jiezhuang stated that he has been in contact with Coinbase to jointly explore development opportunities in Hong Kong.

8) On June 14, a lawyer from the U.S. SEC demonstrated a positive stance regarding Binance’s continued operations.

9) On June 14, the U.S. May PPI recorded a yearly rate of 1.1%, marking the 11th consecutive decline.

10) On June 14, the Bitcoin supply on cryptocurrency exchanges dipped to its lowest level since February 2018.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.