FameEX Weekly Market Trend | July 31, 2023

2023-07-31 09:58:00

1. Market Trend

Between July 27 and July 30, the BTC price fluctuated between $29,033 and $29,690, with a volatility of 2.26%. BTC dipped below $29,500 on the 1-hour chart but didn't see a substantial further drop, narrowing the price range to ($29,000-$29,500). $29,500 remains a formidable near-term resistance level, as previously noted. Recently, BTC once exceeded $29,500, reaching around $29,700, but failed to stabilize and retraced to around $29,200. Subsequently, BTC touched $29,500 twice but retraced immediately in both instances. This implies that modest bullish sentiment persists with low trader confidence. Market volatility is decreasing, the price range is compressing, and trading volume has declined. This situation often precedes a potential trend reversal. A bullish view would require breaking above $29,500 or stabilizing above $30,000 before making bullish trades. Caution is advised for potential bearish sentiment upon breaking below $29,000 to avoid significant price retracements. Due to limited profit opportunities, it’s best to wait for clearer chances before making trades.

Source: BTCUSDT | Binance Spot

Between July 27 and July 30, the price of ETH/BTC fluctuated within a range of 0.06338-0.06420, showing a 1.29% fluctuation. From the 1-hour chart, the ETH/BTC pair displayed relatively strong momentum from July 27 to July 29, continuously moving upwards along the 7-day moving average (1H) as support. However, the price fluctuations were minimal, and like BTC, the price range was compressed. On July 30, there was a price decline below the moving average, continuing downwards. As mentioned in the previous analysis report, the recent strategy for ETH/BTC involved using the moving average approach, and this same approach can still be applied in the upcoming price movements.

Based on overall analysis, the price fluctuations of most cryptocurrencies in the market are closely following BTC, with severe compression. Except for a few altcoins that show independent trends, the majority of cryptos are tracking BTC’s trends. The market is experiencing capital outflows, reduced trading volume, and a decrease in participants, leading to diminished overall profit potential. The only opportunity for profit lies in waiting for BTC to break out of its narrow price range and increase its volatility. The critical points for such opportunities have been provided in the previous analysis, so it’s essential to exercise patience and wait for the right market conditions.

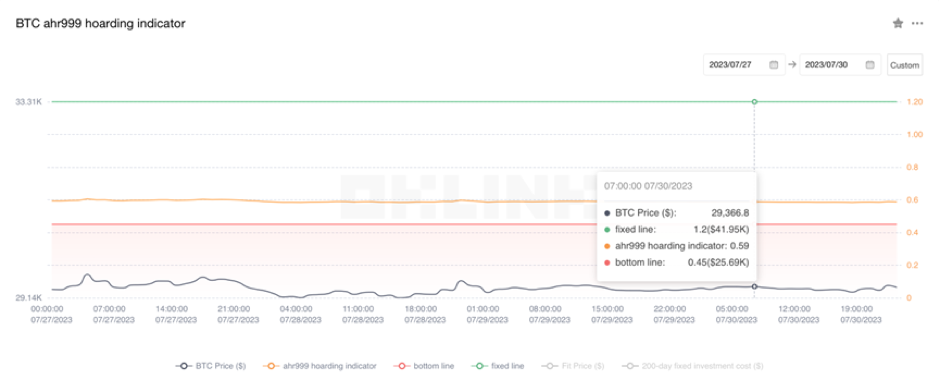

The Bitcoin Ahr999 index of 0.59 is above the buy-the-dip level ($25,690) but below the DCA level ($41,950). It is viable to purchase popular coins through DCA.

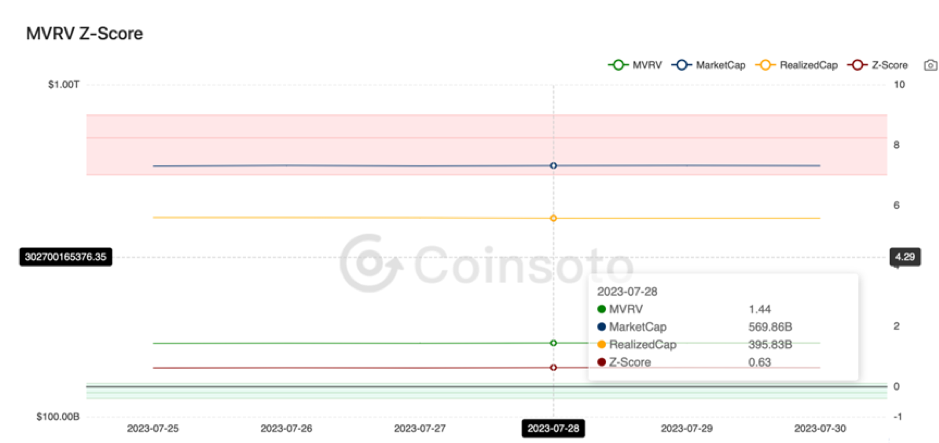

From the perspective of MVRV Z-Score, the value is 0.63. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.42-0.06).

2. Perpetual Futures

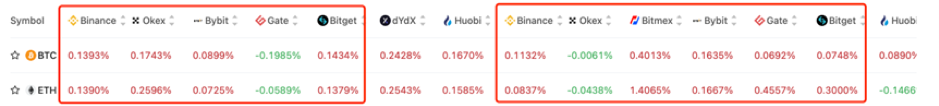

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

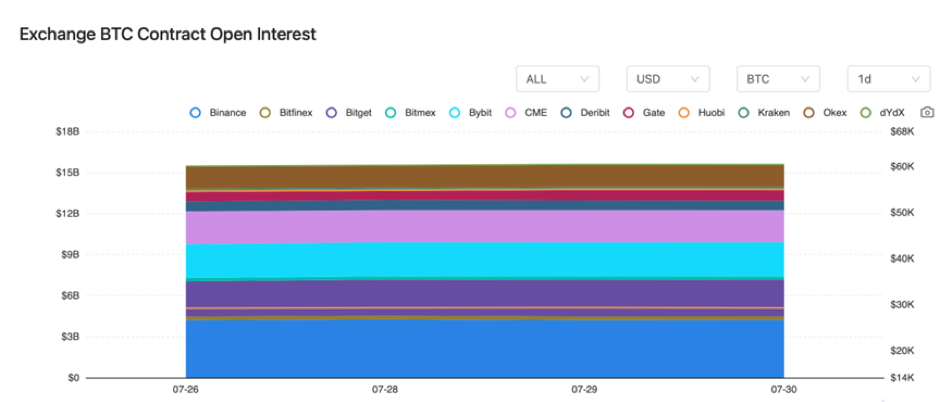

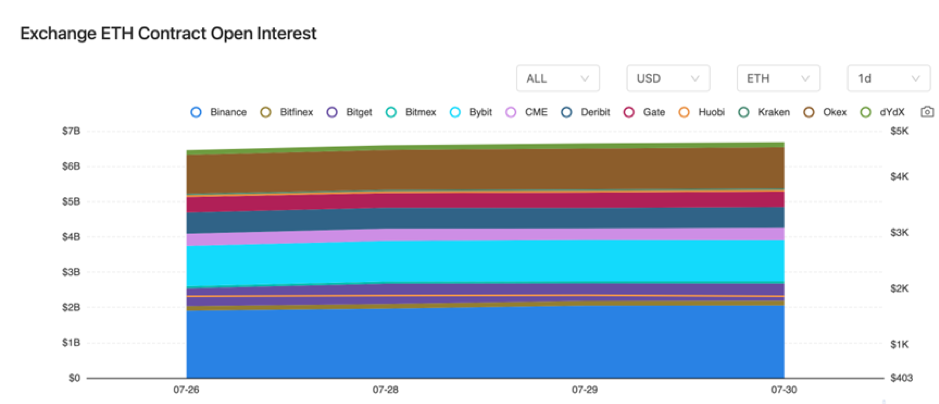

Between July 27 and July 30, the contract open interest of BTC remained unchanged, while that of ETH experienced a slight climb.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On July 27, data showed that Paradigm might have sold all of its MKR holdings, resulting in a profit of approximately $17.16 million.

2) On July 27, the Bank of Korea established the “Virtual Asset Real-Name Account Operation Guidelines”, requiring exchanges to maintain a reserve of at least 3 billion Korean won.

3) On July 27, Zuckerberg stated that Meta remains fully committed to the vision of the metaverse.

4) On July 28, the chairman of the U.S. SEC stated that the cryptocurrency industry has reputable participants.

5) On July 28, the Hong Kong Monetary Authority published its 2022/23 annual report, positioning Hong Kong as a global leader in developing virtual assets and technology complementarity.

6) On July 28, the UK and Singapore agreed to collaborate in developing global cryptocurrency regulatory standards.

7) On July 28, Tether’s market capitalization exceeded $83.8 billion, reaching a historic high.

8) On July 29, CME Bitcoin futures trading volume for July reached a new yearly high.

9) On July 30, Ripple projected that blockchain technology could save financial institutions $10 billion by 2030.

10) On July 30, Christopher Hui Ching-yu mentioned that 90 virtual asset-related companies have expressed interest in establishing their presence in Hong Kong.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.