FameEX Weekly Market Trend | August 15, 2025

2025-08-15 09:26:59

1. Core Market Overview

1) BTC Spot Performance

Price Range: [ 112,612.6 ] USD - [ 124,510.65 ] USD

Weekly Volatility: [10.57]%

(Calculation Formula: (High − Low) / Low × 100%)

Key Driving Factors:

Primary Factor: [Policy Events / Macro Data]

Trump’s threat to impose high tariffs on multiple countries has driven safe-haven capital into Bitcoin.

Secondary Factor: [Market Sentiment, etc.]

2) Central Bank Policy Updates

Recently, the Fed has leaned toward a dovish stance on rate cuts, signaling expectations for rate cuts. The ECB remains focused on financial stability, with no change in its position on cryptocurrency asset regulation.

3) Other Key Information

On August 8, Trump signed an executive order allowing U.S. 401(k) retirement plans to invest in cryptocurrencies. Retirement assets now account for 32% of U.S. household financial assets. Currently, the total assets in U.S. 401(k) retirement plans exceed USD 8 trillion, and this move is expected to bring an additional inflow of hundreds of billions of dollars into the cryptocurrency investment market, providing medium- to long-term support for Bitcoin’s price trend.

On August 9, David Sacks, the White House’s cryptocurrency and AI chief—often referred to as the “Crypto Czar”—stated that roughly USD 31 trillion in U.S. wealth still cannot be invested in Bitcoin ETFs. He questioned why top banks continue to prohibit or restrict such investments on their wealth management platforms, implying this may be the last remnant of the “debanking” campaign.

2. CMC 7D Statistics Indicators

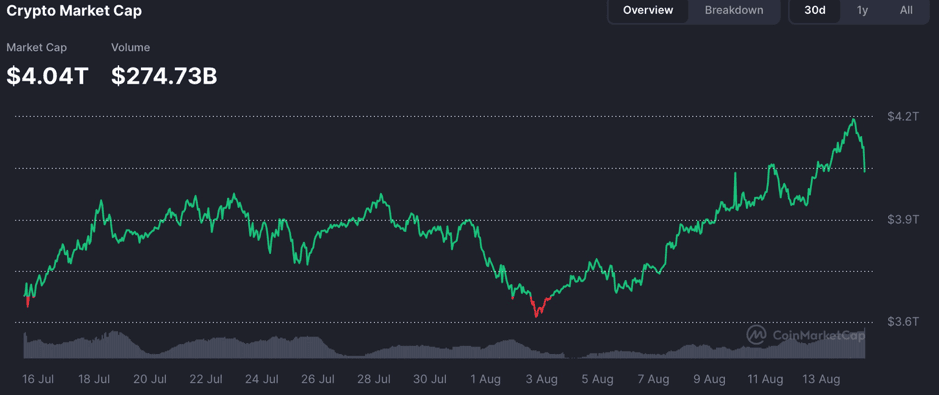

Overall market cap and volume, source: https://coinmarketcap.com/charts/

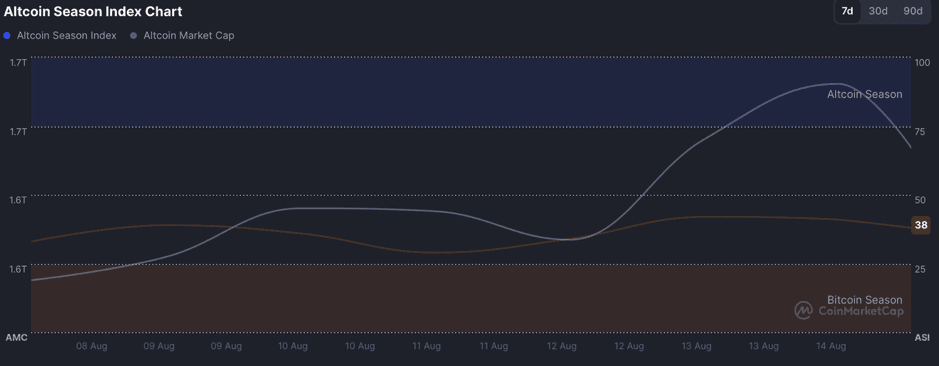

Altcoin Season Index: https://coinmarketcap.com/charts/

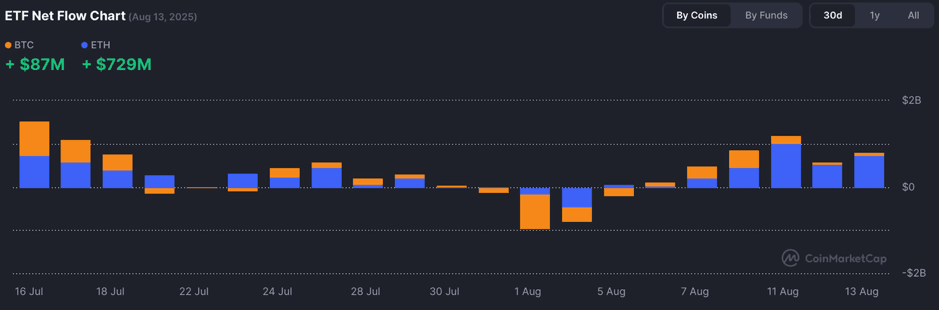

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

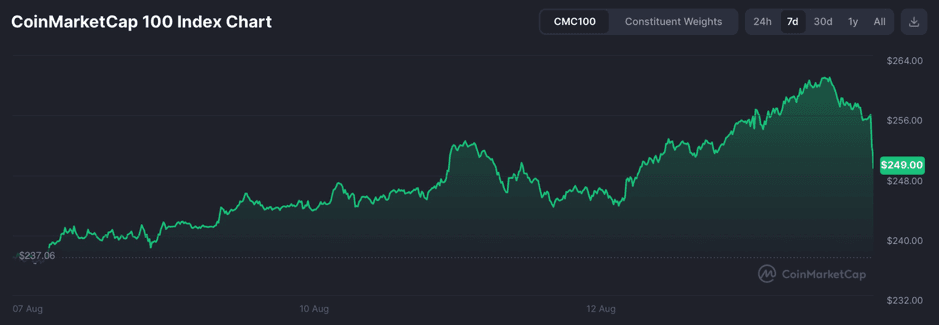

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

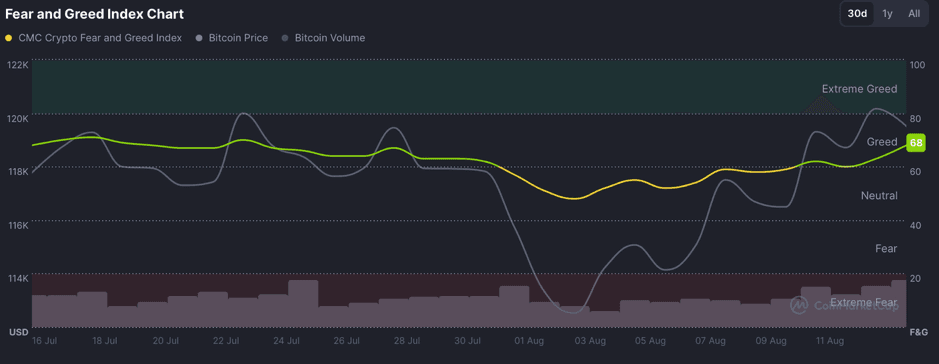

Fear & Greed Index, source: https://coinmarketcap.com/charts/

In recent days, the total cryptocurrency market capitalization and trading volume have continued to rise in tandem, signaling increased market activity. The altcoin season index is in the [25–75] range, indicating a rotation of funds toward [major coins such as ETH]. ETF funds have seen [net inflows for ten consecutive days], and with the Fear & Greed Index in the [Greed] zone, this reflects [strengthened] market confidence.

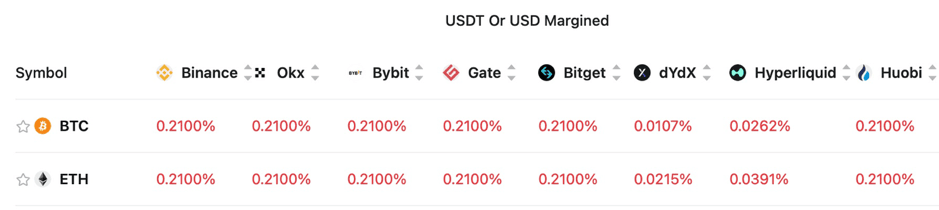

3. Perpetual Futures

The 7-day cumulative funding rates for BTC and ETH on the top 8 exchanges are 1.2969% and 1.3206%, respectively, indicating strong bullish sentiment across the market as of May 15, with expectations of a bull market.

BTC:

ETH:

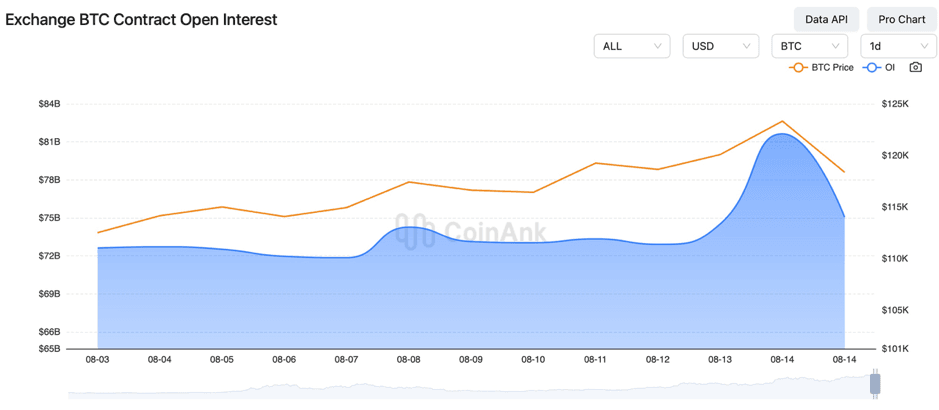

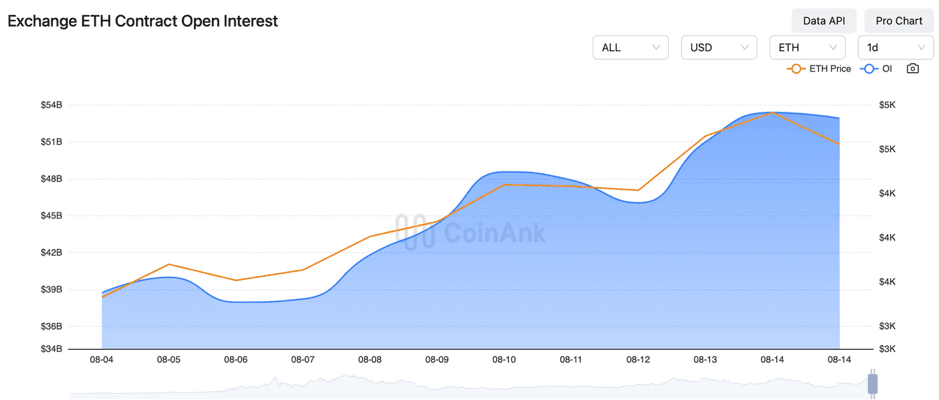

Recently, BTC and ETH contract open interest has been on the rise, with ETH seeing a particularly sharp increase. This suggests that higher-risk speculators are gradually taking larger positions in mainstream coins beyond BTC, reflecting strong overall optimism in the market.

4. Global Economic and Crypto Sector Developments

Macroeconomy

1) On August 6, Eurozone July Services PMI final reading: 51.0 (expected 51.2, previous 51.2) — bearish for gold, silver, and cryptocurrencies. U.K. July Services PMI final reading: 51.8 (expected 51.2, previous 51.2) — bullish for gold, silver, and cryptocurrencies.

2) On August 6, Trump imposed a 25% tariff on Indian goods, raising the total U.S. tariff rate on India to 50%.

3) On August 6, Trump said U.S.–Russia talks were productive, with a high likelihood of holding a summit with Zelensky and Putin. It was reported that an in-person meeting between the U.S., Russian, and Ukrainian leaders could take place as early as next week.

4) On August 7, Trump warned that countries importing Russian crude oil could face a 25% tariff. He announced plans for ~100% tariffs on chips and semiconductors, exempting U.S.-based manufacturing. The announcement followed a meeting with Jensen Huang.

5) On August 7, the Bank of England (BoE) announced its interest rate decision, holding the rate at 4.00%, in line with expectations and down from the previous 4.25%.

6) On August 8, the BoE cut interest rates by 25 bps; four policymakers voted to keep rates unchanged. The bank signaled rate cuts may soon end. Governor Bailey stated the BoE should not cut rates too quickly or too much.

7) On August 8, the Fed’s monetary policy turned more dovish, with gold briefly hitting a record high during early Asian trading.

8) On August 9, the CME “FedWatch” tool showed a 7.3% probability of the Fed holding rates unchanged in September and a 92.7% probability of a 25 bps rate cut.

9) On August 9, Canada’s July employment change: -40.8K (expected 13.5K, previous 83.1K).

10) BoE Chief Economist Pill warned the central bank may need to slow the pace of rate cuts from once per quarter.

11) On August 11, the Trump administration announced plans to appoint a veteran critic to lead the U.S. Bureau of Labor Statistics, potentially signaling upcoming reforms.

12) On August 12, U.K. July claimant count change: -6.2K (previously revised from 25.9K to -15.5K). U.K. July unemployment rate: 4.42% (previous 4.50%) — both bullish for gold, silver, and cryptocurrencies.

13) On August 13, U.K. Q2 GDP YoY preliminary: 1.2% (expected 1.0%, previous 1.3%). U.K. June 3-month GDP MoM: 0.3% (expected 0.1%, previously revised from 0.5% to 0.6%) — both bullish for gold, silver, and cryptocurrencies.

14) On August 14, the People’s Bank of China reported that, as of the end of July, the broad money supply (M2) had increased by 8.8% year-on-year.

Cryptocurrency Industry Updates

1) On August 6, reports indicated that JD CoinChain is preparing to apply for a Hong Kong stablecoin license, joining Standard Chartered Bank, AN Group, and Hong Kong Telecom in seeking similar approvals.

2) On August 6, 100 publicly listed companies worldwide held a combined total of over 955,000 bitcoins.

3) On August 7, daily transaction volume on the Ethereum network hit a new all-time high, surpassing the 2021 peak, driven mainly by stablecoin activity and ETH reserves.

4) On August 7, the China Development Press published a popular science book on stablecoins titled Stablecoins Closely Related to Every Citizen.

5) On August 8, Trident Digital announced a plan to raise $500 million to establish an enterprise XRP reserve.

6) On August 9, the Russian hacker group Greedy Bear recently stole over $1 million in cryptocurrency by forging MetaMask wallets and other means.

7) On August 10, Ant Group and China Rare Earth Group both denied rumors of cooperation on a rare earth RMB stablecoin.

8) On August 11, Ethereum’s year-to-date gains surpassed Bitcoin’s.

9) On August 11, APT, ARB, AVAX, SEI, LAYER, STRK, IO, PEAQ, and BB are scheduled for large token unlocks this week.

10) On August 12, the Singapore Exchange CEO stated that the Singapore Exchange might list cryptocurrency perpetual futures contracts before the end of the year.

11) On August 13, the U.S. state of Wisconsin proposed a new bill requiring Bitcoin ATMs to fully implement KYC procedures.

12) On August 14, Binance’s CSO stated that every day, North Korean hackers pose as job applicants, using AI tools such as voice changers and deepfake videos to forge identities.

Regulatory Policy Update

· Region: [United States / European Union] → [Bill First Reading / Regulatory Guidelines Issued]

· Focus: [Stablecoin Compliance / Tax Policy]

1) On August 6, Trump said he may soon announce the new Fed chair, with four candidates in consideration, excluding Bessent.

2) On August 6, China’s Ministry of State Security stated that a foreign company used cryptocurrency to scan and collect global iris data, posing threats to personal information and national security.

3) On August 7, a White House report recommended that Bitcoin miners be taxed only upon sale to avoid double taxation.

4) On August 7, the Wall Street Journal reported that the White House is preparing to issue an executive order to punish banks that discriminate against crypto companies.

5) On August 8, the U.S. SEC issued interim accounting guidance for crypto: certain stablecoins may be treated as cash.

6) On August 9, the U.S. CFTC discussed allowing some registered futures exchanges to trade spot cryptocurrencies.

7) On August 10, new EU rules granted banks a regulatory advantage in tokenized assets, potentially accelerating tokenization in Europe.

8) On August 11, Ukraine announced it would hold the first reading of its crypto market regulation bill at the end of August.

9) On August 12, El Salvador announced a plan to establish the world’s first Bitcoin bank.

10) On August 13, Vietnam announced it would pilot a digital asset exchange in its international financial center.

11) On August 14, the U.S. National Cryptocurrency Association formed its first advisory board, including former CFTC Chairman Chris Giancarlo.

5. Market Outlook

From August 15 to August 21, the medium-term trading strategy will still be applied: for the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900, respectively. It is recommended to place a sell order for the ETH spot at $5,125 and set buy orders for bottom-fishing at $1,240.

6. Trading Tips

BTC’s weekly chart is trending upward, and ETH’s main weekly rally continues. It is recommended to keep position size within ≤95% of total spot capital, set dynamic take-profit and stop-loss levels, and avoid blindly chasing gains or cutting losses with high leverage.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.