FameEX Weekly Market Trend | January 2, 2024

2024-01-03 03:39:55

1. Market Trend

From Dec. 28 to Jan. 2, the BTC price swung from $41,300.00 to $45,879.63, with a volatility of 11.8%. The last analysis report mentioned that BTC has been oscillating widely between $41000 and $43000 for over 10 days, and the upward potential on the technical side has already been cleared. Holding coins and waiting for a rise is still the current main theme. On January 2 at 2:00 AM, BTC started a slow upward movement, marked by increased trading volume (not a sudden breakthrough). This trend helped decrease the intensity of the bull-bear struggle and pullback severity during the ascent, enhancing market stability. The wide oscillation period of over 10 days concluded, paving the way for a new upward channel. The 1-hour, 4-hour, 1-day, and 1-week candlesticks display a typical bullish trend with rising moving averages and expanding trading volume. The harmonized rise of volume and price ensures the stability of this upward trend. Deep pullbacks are unlikely in the current market. Potential investors can consider entering trades around $45000-$45200, aiming for $48000. In a bull market, a simple strategy of holding coins and awaiting a rise is the safest. Given the current market conditions, this approach is optimal for welcoming the new uptrend.

Source: BTCUSDT | Binance Spot

Between Dec. 28 and Jan. 2, the price of ETH/BTC fluctuated within a range of 0.05221-0.05622, showing a 7.68% fluctuation. The previous analysis mentioned that the 1-hour and 4-hour timeframes have opened an upward channel, but on the daily chart, it needs to break and firmly hold above 0.05650 for a stable upward potential in the larger timeframe. It is advisable to wait for the stabilization above 0.05650 before entering the market. Recently, ETH/BTC didn’t touch this level, reaching 0.05622 and moving downward, erasing previous gains. It currently appears bearish from all timeframes. For a short-term reversal, a rapid surge in volume, breaking resistance with a minor pullback, and slow upward movement would be effective. Otherwise, it’s wise to avoid this coin for an extended period.

Based on overall analysis, the current market has introduced a new round of upward potential, with a continuous inflow of funds, rising trading volumes, and notably improved investor sentiment in recent days. Most cryptocurrencies have caught this upward trend (such as OP, ORDI, ARB, etc.). However, the outlook for ETH is not very optimistic. In previous bull markets, there were instances of ETH leading the overall market upward. Now, it seems challenging to see the former dominance, while the SOL series is showing impressive gains with diverse ecological layouts and sustained innovation leadership. In comparison, ETH appears relatively subdued. Regardless, we can still look forward to ETH’s performance in the end. In the face of the current market situation, it is still advisable to adhere to the core strategy of holding coins and waiting for a rise.

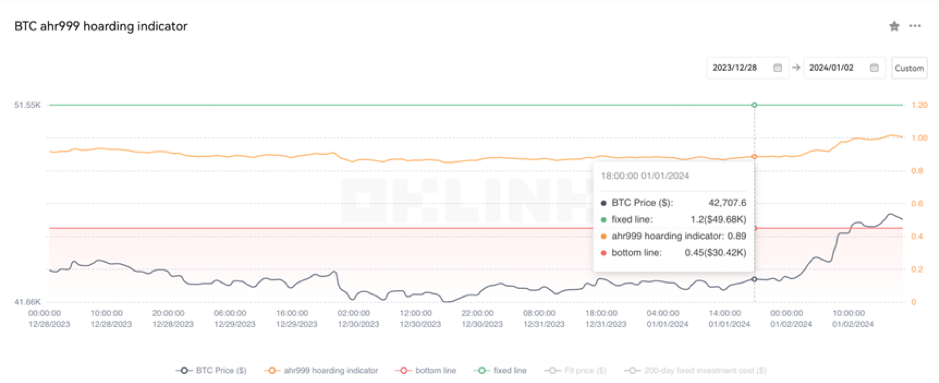

The Bitcoin Ahr999 index of 0.89 is between the buy-the-dip level ($30,420) and the DCA level ($49,680). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

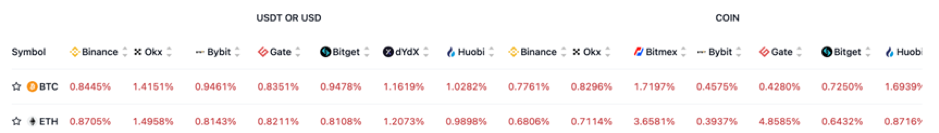

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

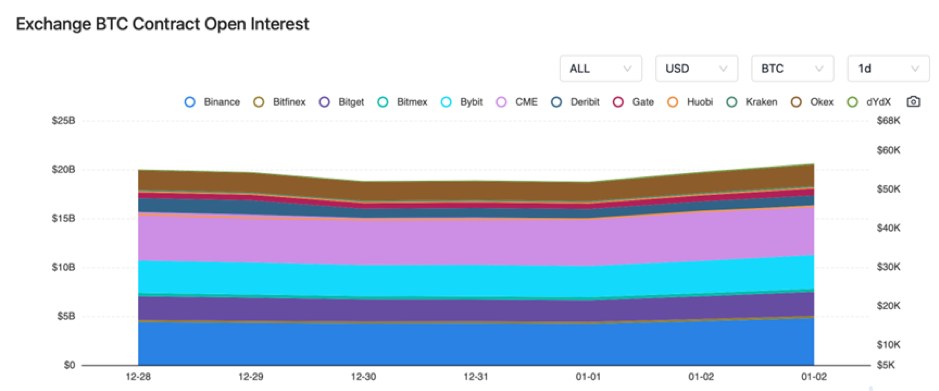

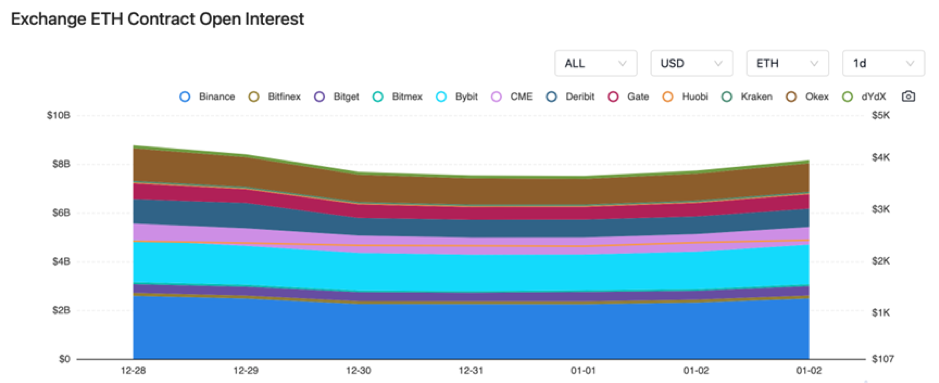

The BTC and ETH contract open interest both experienced a decline, followed by a gradual recovery.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On December 28, Coinbase’s Bitcoin reserves reached the lowest level since 2015.

2) On December 28, the Hong Kong Digital Asset Exchange signed a strategic cooperation memorandum with the Shanghai Technology Exchange.

3) On December 29, Ordinals’ cumulative fee income exceeded $220 million.

4) On December 29, a report stated that the United States is not 100% against NFTs.

5) On December 30, the U.S. prosecutor’s office “does not intend to pursue a retrial against SBF”.

6) On December 30, Guangxi police cracked a pyramid scheme case involving a live-streaming e-commerce application related to virtual currency, with the involved amount exceeding 3 billion yuan.

7) On December 31, the Osaka Digital Exchange launched a digital securities platform.

8) On December 31, ZKBase completed the destruction of 400 million tokens. It is about to launch a 1:1 token swap plan.

9) On January 1, Tether became the tenth-largest BTC holding address, with a floating profit of $1.148 billion from holding BTC.

10) On January 1, after reaching a historical high of $714.5, TRB plummeted by 70%, resulting in liquidations totaling $57.78 million in the past 24 hours.

11) On January 2, the total market capitalization of cryptocurrencies surpassed $1.8 trillion.

12) On January 2, DigiFT, a licensed digital asset exchange in Singapore, stated that it is actively exploring the possibility of entering the Hong Kong market.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.