FameEX Daily Market Trend | BTC Holds $90K While ETH Leverage Builds and Market Structure Resets

2025-11-28 08:09:22

Over the past day, the crypto market staged a technical rebound amid Extreme Fear, with BTC reclaiming the $90K threshold and ETH holding the $3K zone. However, the rebound was driven primarily by short covering rather than active spot demand, indicating that while prices have stabilized temporarily, sentiment and liquidity have yet to recover meaningfully. At the same time, leverage rotation from BTC into ETH has become increasingly pronounced, and selective risk capital has revisited Bitcoin L2 and Solana DeFi narratives. Overall, the structure reflects a transitional phase characterized by price recovery amid hesitant conviction.

1. Market Summary

- BTC trades above $90K but remains far below the Short-Term Holder (STH) cost basis near $104K, underscoring that the market remains in a repair phase.

- ETH holds the $3K area with its futures-to-spot ratio surging to 6.84. This signals that leveraged capital is rapidly reallocating toward ETH.

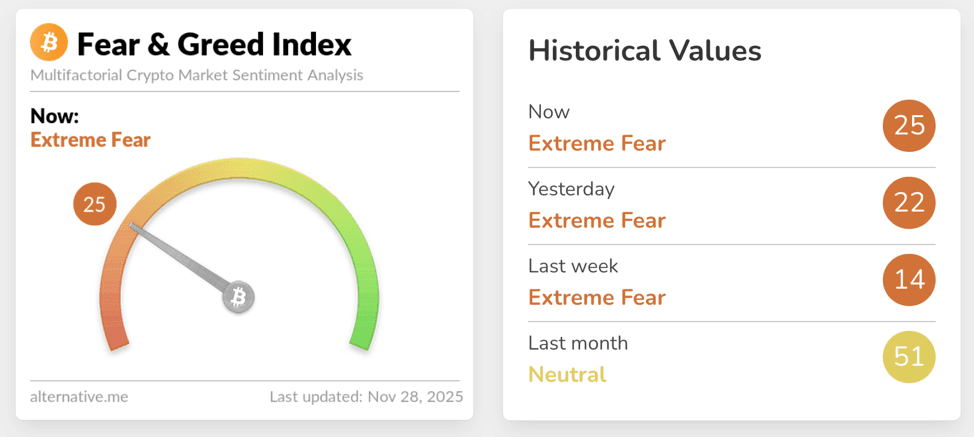

- The Fear & Greed Index rebounded to 25, still within Extreme Fear, but sentiment has improved relative to last week’s capitulation-like sell-off.

- Roughly $166M in liquidations occurred over the past 24 hours, with shorts accounting for nearly 70%, reflecting that the rebound was driven mainly by short covering.

- On the macro front, the probability of a 25bp Fed rate cut in December rose to 86.9%, with markets increasingly pricing a weaker dollar and lower yields heading into 2026.

2. Market Sentiment / Emotion Indicators

The market remains in a state of moderate stabilization within Extreme Fear. The Fear & Greed Index has risen for three consecutive days, indicating that the pressure from forced unwinds and panic selling has eased. However, this improvement in sentiment has not translated into meaningful spot demand. Metrics such as social activity, trading volumes, and Google Trends show that investors have stepped back from panic-driven behavior but remain broadly cautious, preferring to await clearer directional catalysts before re-engaging.

Short-Term Holder losses remain elevated. On-chain activity and UTXO profit/loss dynamics indicate that most mid- to long-term holders remain inactive, with no clear evidence of incremental capital inflows typical of trend reversals. In other words, today’s sentiment improvement reflects that less fear, not returning to greed. The market continues to wait for decisive triggers such as strong ETF inflows, confirmation of Fed easing, or a recovery in on-chain liquidity.

Source: Alternative

A total of $165.53M in liquidations occurred in the latest 24-hour period, with short liquidations totaling $104.36M which is substantially higher than long liquidations at $61.17M underscoring that the rebound was driven by short covering rather than long-side initiation. Liquidations were concentrated in BTC ($72.88M) and ETH ($27.26M), illustrating that the core volatility remains anchored in the deleveraging of major assets.

The futures structure similarly indicates ongoing deleveraging. BTC and ETH open interest continue to drift lower, cumulative volume delta has not shown meaningful long accumulation, and funding rates remain close to neutral, all signaling a market without strong directional conviction. Near-term risk stems from highly symmetric liquidation distributions. A BTC break above $95.5K could trigger over $1B in short liquidations, while a drop below $86.7K could create a comparable wave of long wipeouts. ETH shows a similar mirrored distribution at $3,166 and $2,868, making short-term price action highly sensitive to liquidation clusters rather than fundamentals or incremental spot inflows.

Overall, the structure reflects a classic repair phase in which rebounds are driven by short covering and leverage continues to reset lower. Only when open interest stabilizes, spot depth improves, or ETF/macro flows provide incremental capital can the market transition from passive deleveraging to active risk-taking. In the meantime, volatility remains liquidity-driven rather than trend-driven.

Source: Coinglass

Whale flows also reinforce the ongoing deleveraging regime. One large address that previously accumulated WBTC and ETH via recursive borrowing unwound over 18K ETH earlier, and recently sold 350 WBTC near the $88K region at a realized loss of over $10M. The remaining WBTC holdings remain deep underwater. This pattern of proactive deleveraging indicates that risk appetite is still impaired.

On the security and regulatory front, a major exchange temporarily froze deposits and withdrawals following unauthorized transfers from a Solana hot wallet. Meanwhile, a DeFi AMM continues to process the distribution of roughly $8M in recovered funds. Russia also proposed an amnesty for illegally imported mining equipment in order to bring more miners under regulatory oversight. These developments collectively illustrate that despite price stabilization, the market continues to operate in a high-sensitivity, risk-reappraisal environment.

3. BTC & ETH Technical Data

3.1 BTC Market

BTC is consolidating above $91K after rebounding from the $81K–$85K zone formed during the recent sharp decline. However, the rebound lacks active buying support. Spot demand remains muted, and order book depth is thin, causing price to move passively through low-liquidity regions. A dense cost-basis cluster of roughly 400K BTC near $84K has provided structural support, but sustaining upside requires clear spot absorption between $84K and $90K.

In futures, open interest continues to decline and volume momentum remains weak, confirming that short covering that is not new long positioning is driving the rebound. Funding rates remain close to neutral. A significant risk lies in concentrated liquidation zones where a break above $95.5K could trigger more than $1.6B in short wipeouts, while a drop below $86.7K carries an equivalent long-liquidation risk. Overall, BTC remains in a range-bound repair phase rather than a confirmed trend reversal, with the $81K–$95K range likely defining near-term price dynamics.

3.2 ETH Market

ETH’s structure is more aggressive than BTC’s. It holds above $3K, with the global funding rate near neutral, but leveraged positioning has expanded significantly. The futures-to-spot ratio at 6.84 is the highest among major assets, indicating that professional traders are treating ETH as the preferred high-beta directional play.

Technically, $2.8K has repeatedly been validated as strong support, overlapping with high-timeframe fair-value gaps and key moving-average clusters. If $3K is confirmed as support, the next upside targets lie at $3,050 and the $3,390–$3,400 liquidity band. If $3K fails, a retest of $2.8K remains likely. Liquidation clusters are also well-defined. A move above $3,166 could trigger over $1B in short liquidations, while a drop below $2,868 could force nearly $800M in long liquidations. ETH’s leverage-heavy structure implies heightened sensitivity to shifts in risk appetite, as spot participation has yet to recover.

4. Trending Tokens

- GUA (SUPERFORTUNE)

SUPERFORTUNE integrates metaphysics, AI, and blockchain, standing out amid today’s fragmented narrative environment. The project’s initial airdrop activity has drawn strong attention from Asian markets. Since its value is anchored more in narrative propagation and community momentum rather than fundamentals, GUA behaves as a high-beta asset typically reactive to sentiment cycles, particularly during early-stage market stabilization.

- MERL (Merlin Chain)

Merlin Chain, a Bitcoin Layer 2 backed by the Bitmap ecosystem, centers on extending the utility of native Bitcoin assets. Its newly launched “Institutional HODL+” framework introduces a compliant, yield-bearing treasury model for BTC, attracting a U.S.-listed company committing 500 BTC to the pilot program. This represents a meaningful milestone for BTC-native financialization. MERL’s trajectory will depend on whether institutional adoption of BTCfi continues to scale and whether cross-chain, custody, and compliance frameworks prove operationally robust.

- MET (Meteora)

Meteora is a Solana-based dynamic liquidity pool protocol whose DLMM mechanism enables refined AMM liquidity management, particularly suited for efficient capital usage and low-slippage conditions. Solana’s dominance in tokenized equity trading, which maintains over 95% market share for four consecutive months, strengthens the narrative surrounding MET. The team’s upcoming event in Abu Dhabi aims to deepen ties with ecosystem partners, institutions, and market makers. MET’s performance mirrors overall Solana DeFi liquidity, positioning it as an early beneficiary when risk appetite improves.

5. Today Token Unlocks

- $W:Unlocked 40.32M tokens, with 0.81% of circulating supply.

- $SIGN:Unlocked 96.67M tokens, with 7.16% of circulating supply as the largest unlock of the day.

6. Conclusion

Today’s market remains defined by the combined dynamics of sentiment repair and leverage reset. Although BTC reclaimed the $90K region, the move was driven primarily by short covering, with neither spot demand nor new leveraged longs providing reinforcement indicating a liquidity-repair rebound rather than a trend inflection. ETH shows a stronger leverage profile, with an elevated futures-to-spot ratio suggesting renewed risk allocation, though its dependence on derivatives leaves it more exposed to liquidation-driven volatility.

Sentiment has lifted moderately from Extreme Fear, but incremental demand capable of supporting trend formation has not yet emerged. Leverage indicators continue to soften, with declining open interest and neutral funding reflecting cautious positioning. Symmetric liquidation bands above and below spot levels imply that near-term price behavior will remain liquidity-driven rather than fundamentally anchored.

At the macro level, rising expectations of rate cuts and shifting dollar dynamics are gradually influencing risk-asset pricing. On-chain and exchange structures are stabilizing but have not yet shown clear evidence of capital re-engagement. Overall, the market is transitioning from extreme fear into a structural repair phase characterized by deleveraging, position adjustment, and selective narrative rotation. Confirming the next stage of trend development will require consistent improvement in spot depth, ETF flows, and cost-basis alignment across major assets.

Disclaimer: The information provided in this section is for reference only and does not represent any investment advice or the official views of FameEX.