Why Is The Price Of Bitcoin Falling Today?

2023-09-06 07:35:31As overall market liquidity and the derivatives markets in particular keep going down, the price of Bitcoin is falling today.

Bitcoin price. Source: TradingView

The upward trend that helped Bitcoin achieve a year-to-date gain of 55.7% has all but disappeared as the price of Bitcoin has fallen 11.4% during the past 30 days. After Grayscale's legal triumph over the SEC, the price of bitcoin appeared to be on the upward trend, but as the losing streak in September continues, these gains have completely vanished. Some observers are comparing the present BTC marketplace to the pre-bull marketplace period encompassing 2015–2017 due to the decline in Bitcoin price. Let's look more closely at the elements influencing the price of Bitcoin right now.

As Confidence Among Investors In Bitcoin Stalls, Liquidity Diminishes

Beginning in 2023, traders holding short positions predominated over liquidations in the derivatives marketplace. On August 17, a flash drop that resulted in the liquidation of long positions worth over $213.5 million took bulls off guard. The Terra Luna crash in May 2022 saw the biggest ever amount of Bitcoin long liquidations.

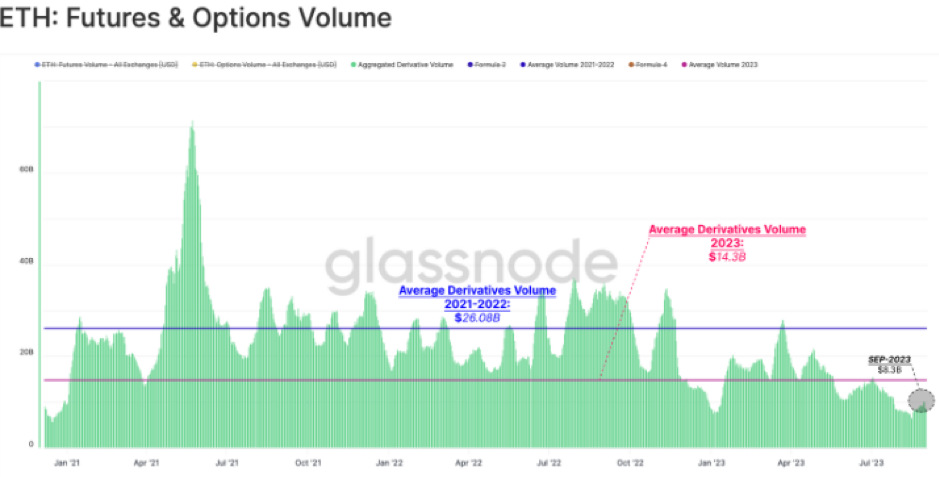

Since the flash crash, volatile currencies like Bitcoin and Ether have continuously lost value on the market. Despite the robust volume in the derivative markets at the beginning of 2023, risk appetite has significantly decreased from levels in 2021–2022, losing $6 billion per day daily. The amount of Ether derivatives has decreased, and so have the interests of Bitcoin bulls. Some analysts feel $22,000 is the next likely step for Bitcoin pricing given the decline in open interest.

Notwithstanding the decline in the volume of Bitcoin futures, over $8.76 million in long positions were liquidated in a 24-hour period, and open options have a skewed bearish bias, which appears to indicate that the bears are in charge. The price of Bitcoin is negatively impacted when long positions are liquidated without purchasing pressure from trading activity. The volume of BTC Ordinals is down more than 98%, and Bitcoin has also fallen to its lowest levels since the beginning of 2021.The Fear and Greed Index, a crucial investor sentiment indicator, has been on a downward trend over the past 30 days, shifting from neutral to fearful sentiment due to the lack of regular liquidity and trading activity.

Ether derivatives volume. Source: Glassnode

The long-term attitude of institutional investors seems not to have significantly been altered by the short-term volatility in the cryptocurrency market. Large institutions are promoting Bitcoin financial instruments despite a hostile regulatory climate in the United States, which might lead to a bull run. The SEC is now considering ETF proposals from 9 renowned investing firms. While a few investors have hypothesized that BlackRock might have been stifling the price of Bitcoin in advance of the launch of their anticipated ETF, the notion seems to be a hoax given that they stand to lose more from a BTC price decline.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.