How Ethereum’s Fusaka Upgrade Reshapes Its Scaling Blueprint

2025-12-30 08:52:57

Ethereum mainnet is expected to activate the Fusaka upgrade at epoch 411392 on 3 December 2025. This hard fork touches both the execution and consensus layers. It introduces PeerDAS (EIP-7594), a series of Blob-Only Parameter (BPO) micro-forks to adjust blob-related parameters, and, on top of the already active 60 million block gas limit, it recalibrates overall block structure and cost boundaries. By design, Fusaka is not a simple upgrade that makes the chain faster through linear optimization. Instead, it explicitly positions Ethereum as a high-capacity settlement and data-availability layer for the rollup era, laying a more formalized technical foundation for a modular architecture and the long-term goal of approaching 100,000 TPS.

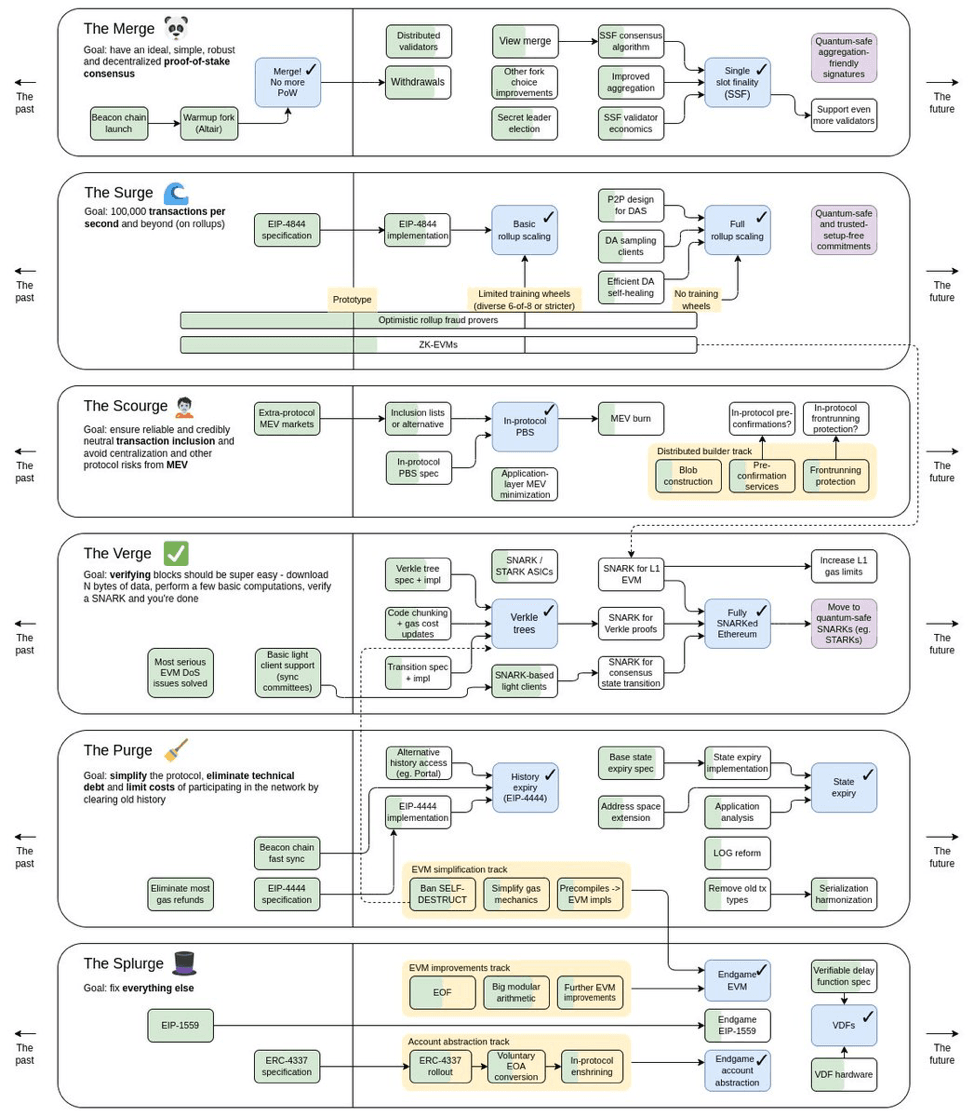

Unlike prior upgrades, Fusaka is not a narrow patch aimed at a single bottleneck. It is the first upgrade that systematically encodes Vitalik’s Surge, Verge, and Purge roadmap into a single version. By using PeerDAS to expand the data space available to L2s, pairing it with history expiry and synchronization changes to lower long-run node operating costs, and adding BPO as a mechanism for repeated capacity adjustments in the future, Ethereum can scale over the coming years via many small, predictable, and auditable steps, rather than relying on infrequent, high-risk, large-scale hard forks.

For markets, the right way to judge Fusaka is not by asking how much TPS does it add on day one, but by assessing whether, in a world where rollups already dominate actual usage, Ethereum can secure its role as the core settlement and data layer of this new architecture without compromising decentralization and security and whether ETH, through fees, burn and staking yield, can continue to capture the economic upside of network growth.

What Is the Fusaka Upgrade?

The Fusaka upgrade is a major hard fork scheduled to go live on the Ethereum mainnet on 3 December 2025. Its name combines the internal codenames for the execution-layer upgrade (Osaka) and the consensus-layer upgrade (Fulu), underscoring that this release spans both layers. From a technical perspective, Fusaka is not a single new feature, but a bundle of interlocking protocol changes. Peer Data Availability Sampling (PeerDAS) was introduced via EIP-7594 as the core component, a Blob-Only Parameter (BPO) fork mechanism that can be invoked at a higher frequency, a recalibration of gas and block limits, extended history expiry, and a set of auxiliary changes around proposer lookahead, key standards, and synchronization flows.

The primary goal of Fusaka is to increase the volume of data the Ethereum mainnet can safely support without raising hardware requirements for validators and full nodes. This allows rollups to publish transaction data to L1 more frequently and at lower cost, improving the overall usability of the ecosystem. In parallel, Fusaka uses history pruning and consensus-layer refinements to make validator sync times and storage costs more sustainable over the long term. By introducing BPO as a parameterized way to tune blob capacity, Ethereum, for the first time, gains the ability to pursue many small, demand-driven capacity increases instead of relying on low-frequency, high-impact hard forks to reset its scaling envelope.

1. Fusaka’s Role and Structural Impact in Ethereum’s Scaling Roadmap

To understand the strategic position of Fusaka, it is necessary to look at how previous key upgrades have prepared the ground for the current roadmap.

The Merge in 2022 migrated Ethereum’s consensus from proof-of-work (PoW) to proof-of-stake (PoS), sharply reducing energy consumption and embedding security and economic incentives into the staking system. This gave the protocol a more stable foundation in terms of energy costs, long-run inflation control, and institutional adoption. The subsequent Shapella upgrade enabled stake withdrawals and turned staking from a one-way lock into a configurable yield instrument, allowing professional validators, institutional custodians, and restaking protocols to build multilayered markets on top of the PoS base.

In 2024, the Dencun upgrade introduced blobs via EIP-4844, creating a temporary data channel dedicated to rollups. This marked the transition from “L2-first” as a philosophy to “L2-first” as a resource allocation rule embedded in the protocol. L1 would no longer aim to host all activity directly, but instead focus on secure settlement and data availability. In May 2025, the Pectra upgrade further improved user ergonomics and validator composition through account abstraction and adjustments to staking parameters, making Ethereum more flexible and extensible both on the user side and in the staking market.

Prior to Fusaka, however, these upgrades still looked like parallel engineering tracks on the roadmap. Each addressed specific issues in consensus, withdrawals, data channels or account models, but they did not yet coalesce into a single, coherent scaling narrative. Fusaka is different in that it concentrates three major axes into a single moment in time. Along the Surge axis, it uses PeerDAS and blob parameter tuning to raise L2 data throughput; along the Verge/Purge axis, it relies on history expiry and sync optimizations to compress node load and curb unbounded growth of state and history; and on the execution layer it leverages the new 60 million gas limit and related EIPs to redraw the boundaries for per-block computation and data. In other words, Fusaka is the first genuine inflection point where Ethereum moves from one local fix at a time to integrating resources around a long-term roadmap. This signals that the protocol is starting to think in terms of full-stack architecture rather than isolated modules.

Ethereum roadmap, source: Vitalik’s Tweet

2. How Fusaka Redefines Ethereum’s Scaling Model and Settlement-Layer Role

Among all the changes, PeerDAS, specified in EIP-7594, is the core engineering pillar of Fusaka. PeerDAS is a peer-to-peer data availability sampling protocol that allows nodes to download only fragments of block data and, through sampling and erasure coding, gain high confidence that rollup data has been fully published. This stands in sharp contrast to the prior model, in which nodes had to download entire blobs.

Structurally, this has two major implications. First, it decouples network-wide data throughput from the download and storage ceiling of an individual node, easing the burden on each participant and ensuring that taking part in consensus does not equate to shouldering the full data load. Second, it opens up space for systematically increasing the number of blobs in the future, allowing Ethereum, over a multi-year horizon, to raise the data bandwidth and blob capacity available to L2s multiple times without each step requiring a risky, large-scale hard fork.

This is also why the Blob-Only Parameter (BPO) fork mechanism exists. BPO is deliberately scoped to touch only a small set of blob-related parameters, such as the target number of blobs, the maximum, and the adjustment factor in the fee mechanism. That design allows the protocol to perform high-frequency, low-amplitude adjustments. From a governance and risk-management perspective, this is closer to tuning interest rates in monetary policy than rewriting the entire rule set. Ethereum can thus fine-tune blob supply in response to L2 demand, network load, and client performance in a more granular and responsive way.

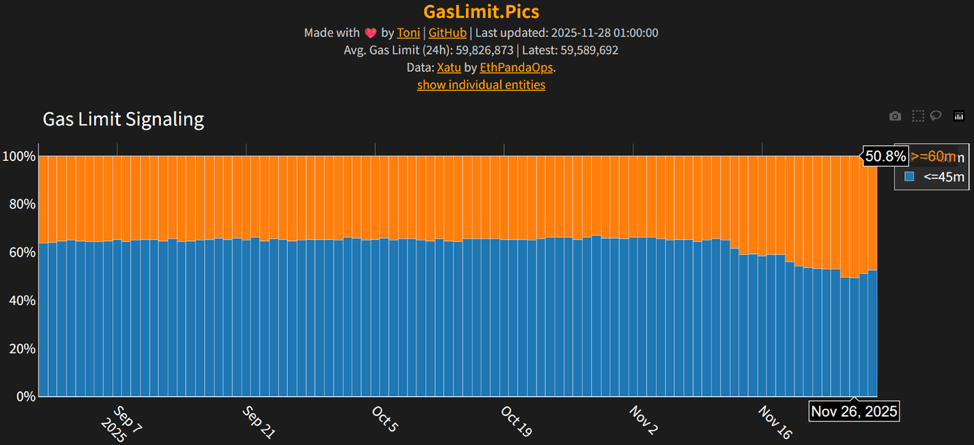

At the same time, the underlying execution layer has already undergone a significant structural change ahead of Fusaka. In November 2025, Ethereum’s block gas limit was raised from 45 million to 60 million, the highest level in nearly four years. This shift was not unilaterally triggered by core developers, but was activated once more than 510,000 validators had consistently signaled support, crossing the threshold defined in the protocol. Behind this change was nearly a year of community advocacy (for example, the “Pump The Gas” initiative), client-level optimizations, and repeated testing of safety margins.

Ethereum raises gas limit to 60 million, source: MetaEraHK’s Tweet

From a macro perspective, Fusaka matters not simply because it makes L2 data cheaper, but because it simultaneously reshapes Ethereum’s operating model on two fronts. On one side, it flattens and stabilizes the cost curve for rollup data submission, enabling expansion within a more predictable fee band. On the other hand, via the combination of the gas-limit increase and related EIPs, it establishes a more sustainable, gradually upgradable growth path for L1 execution and data capacity.

3. Analyzing Fusaka’s Role and Impact in Ethereum’s Long-Term Scaling Strategy

For rollups and upper-layer applications, Fusaka’s immediate effect is a repricing of data costs and capacity boundaries. Multiple analyses suggest that once PeerDAS is live and the first BPO fork has been executed, data fees for high-frequency L2s such as derivatives platforms, on-chain games and social protocols could fall by roughly 40 to 60% over time. This is not a trivial slight discount on gas, but a substantive expansion of the product design envelope.

In the DeFi sector, lower data costs can support more granular liquidation logic, higher-frequency auditing, and risk management frameworks. For gaming and social applications, more on-chain or rollup-level interactions can be moved away from centralized servers, improving verifiability and transparency of asset ownership and state transitions. For new rollups, a lower fixed cost of entry means more specialized L2s are likely to emerge, differentiating themselves through fee structures and UX, and intensifying competition across the rollup landscape.

From the perspective of ETH’s economic model, Fusaka introduces a mixture of positive and negative forces. On the positive side, if lower rollup costs successfully drive higher aggregate settlement volume, more transactions will ultimately be finalized and have their data published on Ethereum. This would increase blob-fee revenue and base-fee burn, reinforcing the more usage, tighter supply deflationary narrative. On the other hand, if users primarily perceive cheaper fees on some L2s at the front end and overlook the fact that all of this activity ultimately settles back to Ethereum L1, short-term market sentiment may underestimate the degree to which Fusaka supports ETH’s long-term value capture.

The deeper point is that Ethereum does not aspire to be a monolithic high-throughput smart-contract chain. It aims to be a global settlement and data layer with ETH as the native asset and rollups as the scaling shell. Fusaka is the first upgrade that makes this narrative verifiable in terms of actual throughput, data structures, and fee markets, rather than leaving it as a theoretical TPS target in a roadmap slide.

4. From PeerDAS to BPO: Fusaka’s Critical Role in the Scaling Process

Every scaling decision is, fundamentally, a redistribution of risk across different dimensions. From the standpoint of nodes and validators, the introduction of PeerDAS and history expiry lowers the amount of data each node must store and download over time, potentially reducing the time and hardware requirements needed to sync to the latest state. In theory, this helps preserve a sufficiently broad and diverse validator and node set.

However, as successive BPO forks gradually increase blob capacity, the bandwidth burden and operational complexity on the data-producer side will inevitably rise, concentrating more responsibility on operators with robust infrastructure and high-quality network connectivity. If the protocol and client implementations do not clearly define what hardware and network profile remains sufficient for ordinary home nodes to participate safely, the practical outcome of scaling could be to entrench the relative importance of large validators and infrastructure providers, undermining decentralization in certain scenarios.

The EIPs in Fusaka that touch on history expiry, block-size caps and DoS resistance are, in effect, attempts to balance on this boundary. On one side, they aim to free up as much space as possible for rollups and complex transactions, giving the application layer room to experiment. On the other hand, they limit per-transaction gas usage and adjust the cost of specific precompiles to prevent a single heavyweight computation or malicious payload from congesting an entire block.

Within this architecture, institutional staking providers and large validator clusters generally view Fusaka as a structural positive. More predictable data throughput, clearer history-management and storage boundaries, and aligned gas and block limits all make it easier to plan medium- to long-term capex, opex and risk capital deployment. At the same time, this raises the bar for governance and transparency. If future scaling debates or network-stress events occur, the community is likely to focus its scrutiny on the very operators and client teams that hold a disproportionate share of operational weight.

5. How Fusaka Advances Ethereum Toward a Modular Settlement Layer: Impact and Outlook

After Fusaka, the next major waypoint on Ethereum’s roadmap is the Glamsterdam upgrade, currently expected in 2026. Early plans indicate that Glamsterdam will introduce enshrined proposer-builder separation (ePBS) at the protocol level, reshaping roles and power dynamics within the MEV supply chain, and block-level access lists (BALs) to improve state-access efficiency and prepare for higher-frequency, larger-scale execution workloads.

Fusaka can be understood as the data and capacity upgrade, while Glamsterdam focuses on who builds blocks and how execution is orchestrated. If both land as designed and interact as intended, Ethereum could move from a regime of version-based upgrades to one of mechanism-based, continuously adjustable scaling frameworks, allowing it to recalibrate the trade-offs between decentralization, security and performance across market cycles and technology shifts.

Over the longer term, Fusaka can be seen as the turning point that moves Ethereum from the aspirational 100,000 TPS phase into the phase of actual settlement-layer capacity sufficient to support a rollup ecosystem and high-frequency applications. It redefines the division of responsibilities between L1 and L2, and reframes how ETH captures value in this modular architecture. The goal is no longer to host all activity directly on L1, but to keep high-frequency interaction and computation on L2 while using ETH as the unit of account and settlement, with final clearing and data anchoring happening on L1.

Against this backdrop, the real significance of Fusaka is not as a short-term price catalyst, but as a clear structural signal that Ethereum is deliberately reshaping itself, in a measured and governable way, into a piece of global, institution-grade public settlement and data infrastructure.

Conclusion

The Fusaka upgrade marks Ethereum’s transition from patching individual bottlenecks to adjusting the overall architecture. In recent years, Merge, Shapella, Dencun, and Pectra have each addressed foundational issues in consensus, security, withdrawals and data channels. Fusaka is the first upgrade to integrate scaling (Surge), node lightness (Verge) and history cleanup (Purge) in a single release, allowing Ethereum to advance capacity, efficiency and sustainability at the protocol level in a coordinated way.

On the data side, PeerDAS and BPO provide rollups with lower data-publication costs and a more predictable capacity growth curve, enabling L2s to scale toward a user experience closer to Web2 while supporting high-frequency financial, gaming and social applications. On the execution side, the 60M gas limit and related EIPs redefine the feasible density of computation and data per block, ensuring that L1 can handle higher loads while remaining verifiable and accessible to a broad validator set. From a long-term governance and engineering perspective, the layered design introduced with Fusaka signals a shift away from reliance on occasional large hard forks toward a more manageable, forecastable, multi-stage scaling cadence.

For ETH as an asset, Fusaka’s impact will not be instantaneous, but its structural implications are clear. If reduced L2 costs translate into higher activity and settlement demand, blob and base-fee consumption will provide a more durable source of value capture, strengthening ETH’s dual role as settlement currency and security collateral. While higher bandwidth requirements and infrastructure pressure could, in some scenarios, heighten centralization risk, Fusaka also introduces clearer, more quantifiable node-burden and governance boundaries, giving the network a better chance to grow within a controlled decentralization envelope.

Ultimately, the importance of Fusaka does not lie in how much it can boost TPS on its own, but in how it reshapes Ethereum’s trajectory: security-first, rollup-centric scaling, parameter-driven governance and ETH as the sovereign asset. The upgrade moves Ethereum from being merely scalable in theory to being sustainably scalable in practice, and it lays the engineering groundwork for Glamsterdam and deeper changes envisioned on the roadmap. If the past five years were about laying the foundation for the modular era, Fusaka is the turning point that pushes Ethereum into its next, more mature phase.

FAQ

Q1: Will end users notice immediate changes once Fusaka is upgraded?

In the short term, the most tangible changes for end users will likely come from lower fees and reduced congestion on major L2s, especially during peak periods when confirmation delays and fee spikes should moderate. However, these effects typically will not fully materialize on day one. They tend to emerge over weeks and months as rollups adjust their fee policies and data-submission patterns. For most users, Fusaka should be viewed as a structural upgrade that lays the groundwork for the next several years of scaling, rather than a single event that instantly doubles TPS.

Q2: Does the Fusaka upgrade change ETH’s medium to long-term investment narrative?

Fusaka does not alter ETH’s core role as Ethereum’s native asset and sovereign currency, but it does strengthen the linkage between network growth and ETH demand. If lower rollup costs drive sustained increases in settlement volume and on-chain activity, then blob fees and base-fee burn will become a more structural feature of ETH’s economics, sharpening its profile as both “settlement fuel” and a long-term store of value tied to protocol usage.

Q3: Does Fusaka meaningfully increase centralization risk in the trade-off between decentralization and scaling?

Fusaka reduces the amount of history and data any single node must retain and download, which in principle supports a larger and more diverse node set. However, as subsequent BPO forks raise blob capacity, the importance of high-bandwidth, professionally operated infrastructure will grow. If the protocol and client teams do not proactively define reasonable hardware baselines and maintain transparency and openness in governance, future scaling debates could amplify concerns about latent centralization risks. Fusaka itself does not directly centralize the network, but it makes ongoing calibration between scaling and decentralization an even more central topic for Ethereum’s roadmap going forward.

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. For more information, please refer to here. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.