FameEX Today’s Crypto News Recap | February 3, 2026

2026-02-03 07:54:34

US–India trade developments and Bitcoin ETF outflows weighed on market sentiment today, as crypto markets moved into structural consolidation, with capital focused on liquidity management and leverage reduction while BTC and ETH traded in ranges. Crypto markets opened the session with a tentative stabilization tone following last week’s volatility, as risk sentiment remained defensive and trading activity focused on balance sheet protection rather than directional expansion. Price action reflected selective positioning rather than broad-based conviction, with participants prioritizing liquidity management, leverage reduction, and short-term risk controls. Macro developments and regulatory headlines continued to shape expectations across risk assets, while crypto-specific flows showed signs of consolidation rather than renewed inflows. Overall market behavior suggested that traders were responding more to structural constraints and capital preservation needs than to momentum-driven opportunities, keeping the session firmly within a consolidation framework rather than a recovery narrative.

Crypto Markets Overview

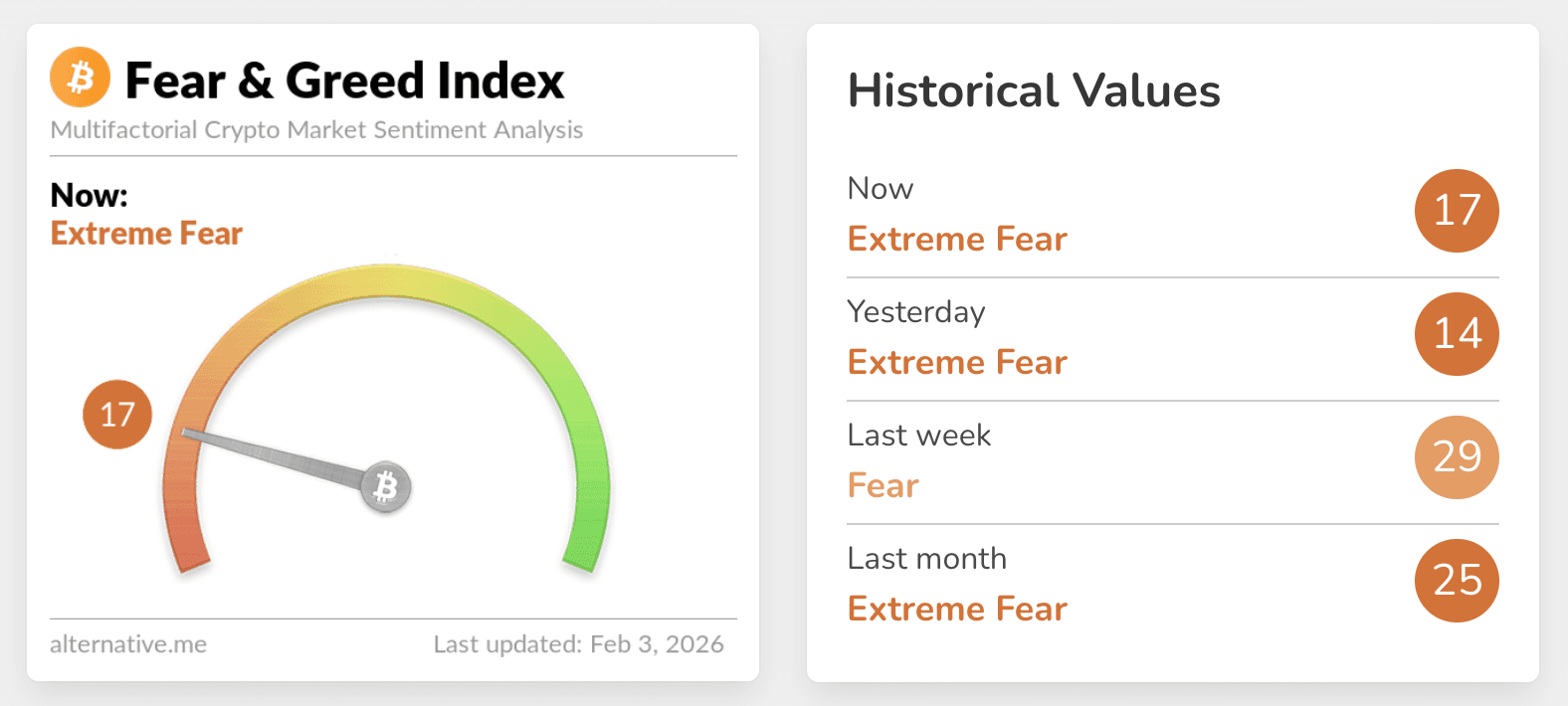

Crypto markets traded modestly higher on the day, but overall sentiment remained cautious. This reflects the Crypto Fear & Greed Index at 17, firmly in Extreme Fear territory. This reading underscored a market environment characterized by reduced risk appetite, conservative positioning, and a continued emphasis on defensive capital deployment. Bitcoin acted as the primary market anchor, absorbing defensive flows as participants sought relative stability amid broader uncertainty, while its role as a liquidity benchmark remained intact. Ethereum’s performance stayed constrained by derivatives positioning, where leverage structures and liquidation sensitivity limited upside participation and encouraged range-bound trading behavior. Activity among major altcoins was selective and event-driven, with short-term rotations rather than sustained trend formation, reinforcing the view that the market remains structurally cautious despite marginal price improvements.

Source: Alternative

BTC and ETH Market Structure

Bitcoin’s move above $79K shortly occurred alongside clearly defined liquidation clusters that continue to shape short-term market behavior, with downside risk concentrated below $74,955 where long liquidation intensity could reach USD 1.302 billion, and upside pressure building above $82,757 where short liquidation intensity is estimated at USD 886 million. These zones illustrate why follow-through buying remains limited, as price advances are met with hedging and profit-taking rather than aggressive leverage expansion.

Ethereum displayed a similar structural setup, with key downside sensitivity below $2,229 where long liquidation intensity could reach USD 809 million, while upside pressure above $2,460 aligns with approximately USD 497 million in potential short liquidations. In both markets, trading dynamics remain driven by leverage positioning and risk management, reinforcing a range-bound structure rather than directional conviction.

Key News Highlights:

US and India Trade Agreement Reshapes Global Risk Sentiment

The announcement of a trade agreement between the United States and India, including a reduction in tariffs on Indian goods from 50% to 18% and a shift in India’s energy procurement toward US suppliers, introduced a notable macro signal for global markets. While details remain limited, the agreement reduced uncertainty around trade frictions and currency pressures, contributing to a modest improvement in broader risk sentiment. For crypto markets, the development reinforced the importance of macro policy alignment and capital flow expectations, even as direct transmission effects remain indirect and gradual.

Bitcoin ETF Outflows Highlight Structural Pressure

US spot Bitcoin ETFs continued to face sustained outflows, with approximately USD 2.8 billion withdrawn over the past two weeks, leaving the average ETF purchase price below current market levels. This dynamic highlighted the ongoing pressure on institutional positioning, as capital rotations and risk rebalancing weighed on spot demand. Although total assets under management remain substantial, the shift underscored how ETF flows can amplify short-term structural headwinds without necessarily triggering disorderly market behavior.

Ethereum Supply Movements Linked to Long-Term Funding Initiatives

On-chain data indicated that a portion of ETH sold by Ethereum co-founder Vitalik Buterin was associated with a previously disclosed long-term donation initiative, involving a total transfer of 16,384 ETH to a multisignature address. The sales were framed as programmatic funding actions rather than discretionary market timing, helping contextualize supply movements within broader ecosystem support efforts. Market impact remained contained, with participants largely viewing the transactions as structurally neutral rather than sentiment-driven.

Trending Tokens:

- $INX (Infinex)

$INX has entered active market focus following Infinex formally positioning itself as a unified, non custodial onchain access layer backed by the Synthetix ecosystem. The project narrative centers on simplifying fragmented DeFi interactions by allowing users to move across protocols and chains through a single smart account architecture. Recent official communications confirmed that INX can now be traded directly on Infinex while also being available across Ethereum, Solana via Sunrise, BSC, and a wide range of centralized exchanges. This multi venue distribution significantly lowers access friction and broadens liquidity reach at launch. Market attention is further driven by Infinex transitioning from its origins as a decentralized perpetual protocol into a broader application layer focused on usability and security. The emphasis on non custodial design and onchain key management aligns with growing demand for self custody without sacrificing convenience. As DeFi users seek aggregation rather than isolated protocols, INX is being viewed as a gateway token tied to usage across multiple ecosystems. The combination of cross chain availability and a product focused narrative has positioned INX as a notable short term attention asset.

- $MNT (Mantle Network)

$MNT is trending following the activation of Mantle Super Portal and the official expansion of Mantle into the Solana ecosystem. The launch enables instant cross chain teleportation of MNT between Ethereum and Solana, reinforcing Mantle’s positioning as a distribution and liquidity layer rather than a single chain asset. This development is paired with immediate DeFi access on Solana, including trading, swaps, liquidity provision, and yield strategies through integrated platforms. Mantle has also emphasized full deposit and withdrawal support alongside centralized exchange trading, reinforcing a CeDeFi flywheel narrative that blends onchain yield with exchange level efficiency. The messaging frames MNT as a mobile asset designed to move across chains, venues, and capital markets. This aligns with Mantle’s modular Ethereum layer two architecture and its origins under the BitDAO community.

- $FIGHT (Fight.ID)

$FIGHT is gaining attention as Fight.ID demonstrates sustained execution in connecting onchain activity with real world fan experiences. The project narrative focuses on transforming passive sports fandom into participatory ownership through events, quests, rewards, and identity based engagement. Recent activations include live FightMania events, creator face off competitions, and geolocation quests that verify real world attendance for onchain rewards. These initiatives directly tie physical presence and community contribution to digital incentives, reinforcing the project’s experiential thesis. Additional momentum comes from VIP access campaigns around major UFC events and the expansion of Fight Points into onchain systems. Fight.ID has also run creator and contributor campaigns that reward meaningful participation rather than speculation, positioning FIGHT within the broader fan economy narrative. The ongoing Road to TGE campaigns, including NFT based participation mechanics, keep community engagement active and visible. As the official UFC Web3 partner, Fight.ID benefits from brand alignment that differentiates it from generic social tokens.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.