FameEX Today’s Crypto News Recap | January 27, 2026

2026-01-27 09:59:40

Crypto markets staged a tactical rebound today, but sentiment remains firmly defensive beneath the surface. While short-term buying interest helped major assets stabilize after recent pullbacks, broader capital flows and macro signals continue to reflect caution. Persistent stablecoin contraction, elevated derivatives leverage, and rising political uncertainty have kept traders focused on risk management rather than directional conviction. The session is best characterized as stabilization rather than recovery, with markets probing for support amid unresolved macro headwinds.

Crypto Markets Overview

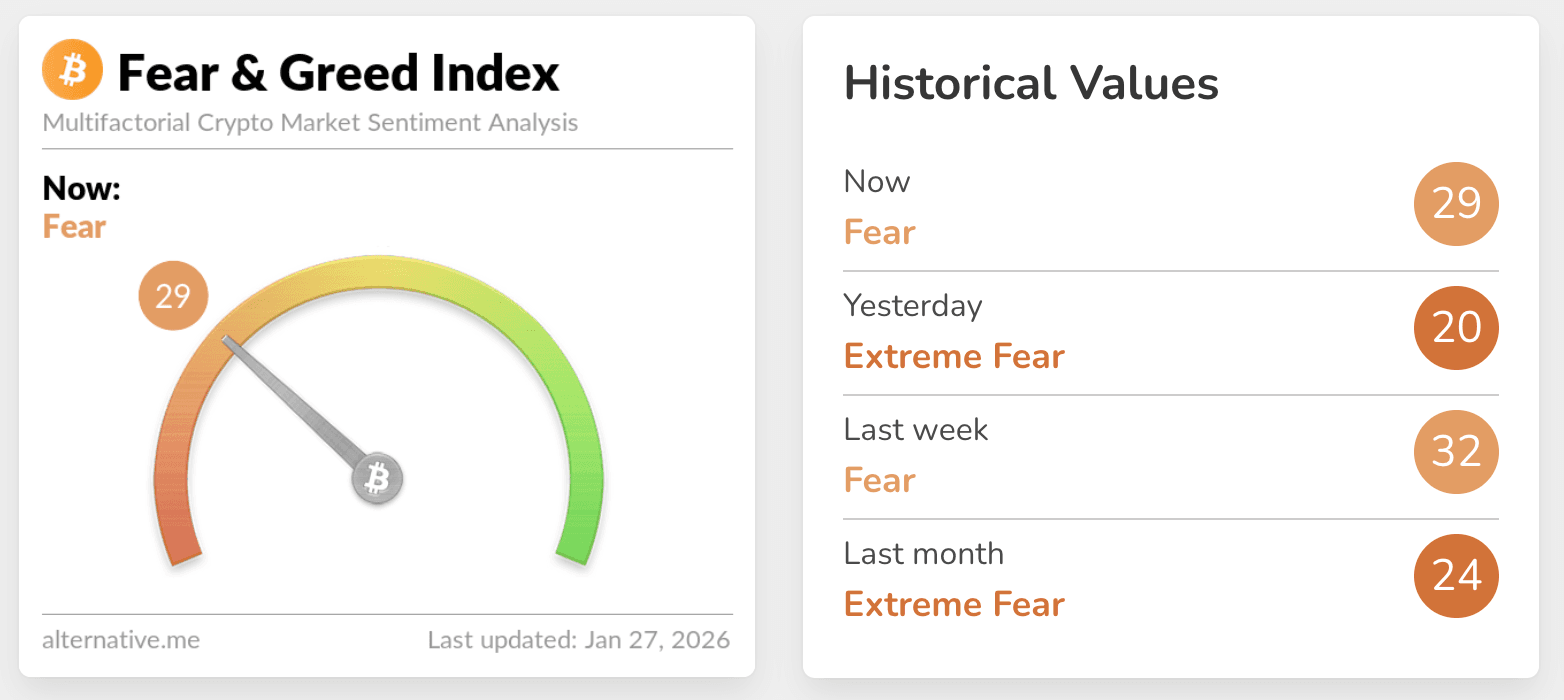

From a broader structural perspective, crypto markets showed signs of short-term stabilization without a meaningful recovery in risk appetite. The Crypto Fear & Greed Index rebounded to 29, indicating easing panic but still signaling fear-dominated sentiment. Bitcoin attracted incremental defensive inflows as the primary market anchor, while Ether lagged due to tighter derivatives constraints. Overall, the market appears to be in a stabilization and assessment phase rather than an early-stage risk-on transition.

Source: Alternative

BTC Broke $89K but Follow-Through Remains Limited

Bitcoin briefly reached the $89K level signaling tactical dip-buying after the recent drawdown. However, volume and order-flow dynamics suggest limited momentum chasing, with gains largely driven by short-covering and leverage repositioning rather than fresh directional risk. Derivatives data highlights heavy liquidation clusters near $84,347 on the downside and $92,355 on the upside across a major CEX. This reinforces a range-bound trading environment.

ETH Liquidation Risk Highlights Fragile Derivatives Structure

Ether continues to trade under the shadow of concentrated derivatives leverage. A break below $2,794 could trigger substantial long liquidations, while the upside remains capped by a dense short-liquidation zone near $3,064. This leverage concentration amplifies short-term price swings and discourages longer holding horizons.

US Winter Storm Temporarily Disrupts Bitcoin Hashrate

A severe winter storm across the US led to power outages and surging energy demand, prompting miners to curtail operations to support grid stability. Bitcoin’s network hashrate briefly dropped to a seven-month low before recovering as conditions improved. Given the US accounts for nearly 38% of global mining power, such events can materially impact short-term network metrics. However, the disruption is widely viewed as temporary rather than a fundamental threat to Bitcoin’s long-term security or supply dynamics.

Stablecoin Market Cap Contraction Signals Persistent Risk Aversion

On-chain data shows that total stablecoin market capitalization has declined by over USD 2.2 billion in the past 10 days, signaling capital exiting the crypto ecosystem. Such contractions typically coincide with declining risk appetite and rotation into fiat or traditional safe-haven assets. Historically, meaningful crypto market recoveries tend to follow renewed stablecoin issuance. The current contraction suggests fresh capital inflows remain limited.

Rising US Government Shutdown Risk Weighs on Crypto

Prediction markets indicate the implied probability of a US government shutdown by month-end has surged toward 80%. Political gridlock and legislative delays have heightened macro uncertainty, reinforcing defensive positioning across risk assets. Crypto markets experienced renewed selling pressure as traders reduced exposure, with sentiment shifting further toward capital preservation rather than opportunistic risk-taking.

Trending Tokens

- $TTD (TradeTide AI)

TradeTide AI has drawn attention following the broader availability of its native token, $TTD, across multiple trading venues. The platform focuses on AI-driven trend prediction, automated strategy generation, and cross-chain execution, aiming to lower barriers to quantitative trading. Improved liquidity has increased visibility, while market participants monitor whether real-world performance can support sustained adoption. Recently, $TTD stands out as an active name within the AI-driven crypto narrative.

- $ZKP (zkPass)

The launch of $ZKP marks zkPass’s transition into a live and tokenized privacy infrastructure. By combining 3P-TLS with zero-knowledge technology, zkPass enables verifiable data sharing without OAuth APIs. Growing demand for decentralized identity and privacy-preserving data solutions has brought increased attention to the project. Market focus now centers on ecosystem expansion and real-world token utility.

- $VOOI (Vooi)

VOOI positions itself as a perpetual DEX aggregator offering leveraged trading across both EVM and non-EVM networks. Through chain and account abstraction, it streamlines user interaction across multiple derivatives venues. Recent revenue performance on Orderly Network indicates growing real trading demand. Sustainability of liquidity growth and user retention will remain key focus areas.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.