FameEX Today’s Crypto News Recap | January 29, 2026

2026-01-29 06:50:01

Gold’s market cap surged by USD 1.64T, US lawmakers revisited crypto market structure, and identity narratives resurfaced via Worldcoin, while BTC and ETH saw a tactical rebound amid Extreme Fear, leverage-driven flows, and consolidation. Crypto markets saw a tactical rebound, but sentiment stayed defensive as BTC and ETH continued to trade in tight ranges. Flows looked more like positioning adjustments than fresh risk-taking. Spot activity improved at the margin, derivatives leverage remained selective, and macro uncertainty kept buyers from chasing higher levels. The day’s tone was stabilization rather than recovery, with consolidation driven by cautious liquidity and hedging behavior.

Crypto Markets Overview

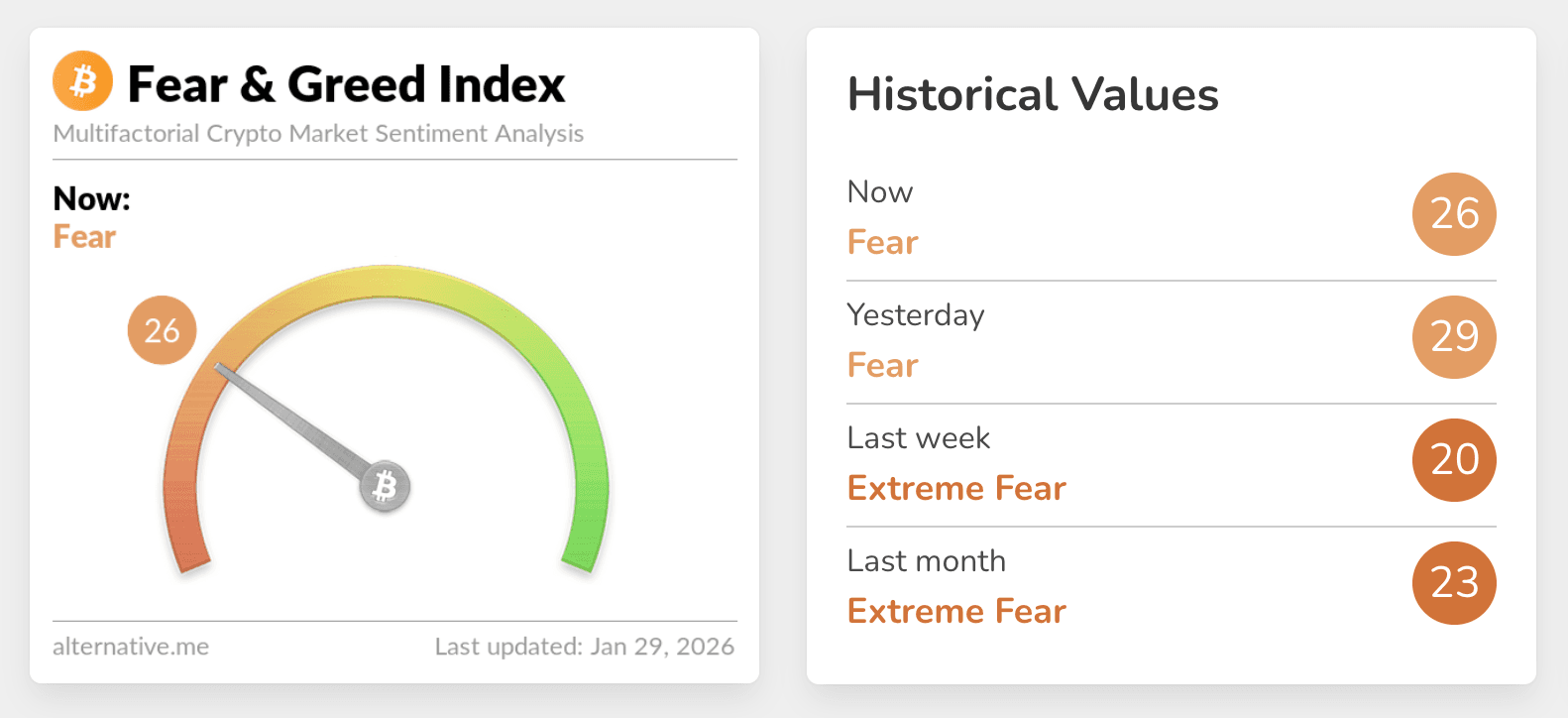

With the Crypto Fear & Greed Index at 25 (Extreme Fear), risk appetite remained subdued despite a modest price recovery across majors. BTC edged higher but stayed range-bound, with spot demand improving only incrementally and follow-through still constrained by overhead supply and cautious options positioning. ETH traded modestly as ETF flows provided a supportive signal at the margin, but the broader market still reflected a defensive posture rather than rotation into higher-beta assets. Overall, the session was characterized by consolidation: participants appeared to prioritize risk control and liquidity sensitivity over directional conviction.

Source: Alternative

Range-Bound BTC Tests Liquidity Clusters as ETH ETF Inflows Offset Defensive Positions

BTC continued to consolidate around key on-chain and derivatives levels, with the market showing signs of insufficient chase as upside attempts met restrained spot follow-through. Liquidity maps highlighted notable liquidation sensitivity near $91K, where aggregated short-liquidation intensity was estimated around USD 1.133 billion, while downside vulnerability increased below $87K with long-liquidation intensity near USD 494 million. A separate cluster of data showed elevated sensitivity above $92,363 (short-liquidation intensity around USD 1.587 billion) and below $84,193 (long-liquidation intensity around USD 829 million). This underscored how leverage could amplify moves if price tags these levels. Short-term holder cost basis near $96.5K remained a key pivot for positioning, while nearer supports around $83.4K and $80.7K framed the downside risk if consolidation breaks.

Options positioning appeared more defensive, with bearish skew and dealer gamma below $90K implying that volatility could rise if the market slips into lower liquidity pockets. Intraday leverage behavior also stood out: a monitored whale opened a high-leverage short (40x) of 71.31 BTC around $88,120.6. This reinforced the sense that short-horizon leveraged tactics were still influencing tape. On the ETH side, spot ETF flows were constructive but not decisive: total net inflows were USD 28.0951 million, led by USD 27.3431 million into BlackRock’s ETHA, while the broader market remained in consolidation rather than trend re-acceleration.

Key News Highlights:

Gold’s One-Day Market-Cap Expansion Nears Bitcoin’s Entire Market Cap

Gold added approximately USD 1.64 trillion in market capitalization within 24 hours, a scale nearly matching Bitcoin’s current total market cap of around USD 1.74 trillion. This showed a powerful shift in global capital allocation. This divergence highlights how macro hedging demand is being absorbed by traditional safe-haven assets rather than risk-oriented alternatives. For crypto markets, the implication is structural rather than directional. When capital prioritizes balance-sheet protection and inflation hedging through commodities, liquidity available for speculative positioning tends to thin. This environment often suppresses momentum-driven follow-through, reinforcing consolidation and range-bound behavior across digital assets even when short-term rebounds occur.

Us Lawmakers Revisit Crypto Market-Structure Legislation as Amendments Take Focus

US senators returned to Capitol Hill to reassess amendments to a long-anticipated digital asset market-structure framework, with proposals spanning governance restrictions, implementation timing, and regulatory capacity requirements. While no immediate policy outcome was delivered, the renewed legislative focus reintroduced medium-term uncertainty into institutional positioning. Market participants tend to respond to such phases by tightening exposure, especially when the scope and enforcement timeline remain fluid. From a market perspective, prolonged ambiguity around trading venue obligations, custody standards, and regulatory oversight often translates into cautious liquidity provisioning rather than expansion. This reinforces defensive trading behavior across centralized and on-chain markets.

Worldcoin Draws Attention as Biometric “Proof-Of-Personhood” Narrative Resurfaces

Reports suggesting that an OpenAI-linked initiative is exploring a biometric-based, bot-resistant social platform renewed attention on Worldcoin and broader identity primitives within crypto. Beyond the token-level reaction, the development highlights a deeper structural theme: the growing intersection between digital identity, privacy preservation, and regulatory compliance. Projects tying biometric verification to consumer-facing platforms face both adoption potential and elevated scrutiny, as data governance and user consent become central considerations. For the market, this reinforces a selective risk framework, where narratives linked to identity and privacy may attract episodic capital interest, but also carry higher regulatory and reputational risk premiums.

Trending Tokens:

- $TRIA (Tria)

Tria is positioned as a self-custodial “crypto-native banking” layer aimed at interoperable payments for developers and AI-enabled workflows. Market attention is currently anchored to its points program timeline, with Season 1 nearing completion and a snapshot scheduled for Jan 30, which typically concentrates short-term user activity and liquidity sensitivity. The product narrative blends spending, trading, and yield in a unified interface, framing Tria less as a single-feature wallet and more as a payments-and-balance-sheet stack. Its stated interoperability focus to routing value across chains efficiently aligns with broader market interest in reducing friction between settlement networks.

- $ANB (ANT.FUN)

ANT.FUN is presenting itself as a decentralized trading venue expanding toward a broader finance-plus-content ecosystem, which places it in a competitive category where attention often follows product releases and community campaigns. The project’s “Gray Airdrop Test” was framed as an anti-fraud filter after alleged misuse of transaction hashes during a prior event. This signals that distribution integrity is becoming a central operational concern. These measures can reduce sybil pressure and improve fairness, but they can also introduce temporary constraints on circulating behavior while verification is underway. The blind-box distribution mechanic adds uncertainty to allocation outcomes, which can increase short-term volatility in participation flows and secondary-market behavior.

- $ZAMA (Zama)

Zama sits in the privacy infrastructure segment, emphasizing Fully Homomorphic Encryption (FHE) as a path to confidential smart contracts on public blockchains. The completion of its public auction bidding phase and the milestone of Total Value Shielded exceeding USD 121 million highlight growing experimentation with privacy-preserving settlement and computation. The auction’s settlement phase and the upcoming allocation visibility introduce a time-defined catalyst window, with claims scheduled to open on Feb 2, which can concentrate operational attention and liquidity monitoring.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.