How to Use a Trailing Stop Order

2021/09/23 20:37:05

Solve your problems and learn more about related topics via our tutorial video: How to Use a Trailing Stop Order?

Interested in more details? Read the whole article below!

1. What is a trailing stop order?

A trailing stop order allows traders to place a pre-set order at a specific percentage away from the market price when the market swings.

The trailing stop moves by a specified percentage when the price moves favorably. It locks in profit by enabling a trade to remain open and continue to profit as long as the price is moving in the direction favorable to traders. The trailing stop does not move back in the other direction. When the price moves in the opposite direction by a specified percentage, the trailing stop will close/exit the trade at market price.

In short, a buy order will be triggered when the last traded price ≤ stop price (trigger price). When the percentage of price decreases ≥ callback rate, the order would be executed at market price. When a trailing stop order is placed, your asset would not be frozen/held. The trailing stop order would be triggered if...

a) Available balance in spot wallet ≥ order amount, the order would be executed at market price.

b) The minimum order amount in the market ≤ available balance in spot wallet, then the order would be placed with all the available balance in spot wallet.

c) Available balance in spot wallet < the minimum order amount in the market, then the order would be canceled by the system.

2. Glossary

(1) Trigger Price: The trailing order would be triggered if the last traded price hits the “Trigger Price.”

(2) Callback Rate: when the order buying/selling condition has been fulfilled, the market price hit the preset “callback rate”, and the order purchasing amount would be bought at the market price.

(3) Total Purchasing Amount (Total): when purchasing, fulfilling the “trigger condition” and “callback rate”, then the total amount of token would be purchased at the market price.

(4) Selling Amount: when selling, it has to fulfil both “trigger condition” and “callback rate”, then your token would be sold at market price.

In order to prevent the user places the order accidentally to have a loss which can be avoided, FAMEEX limits the order with the following conditions:

a. Trigger price of the trailing stop order cannot be larger than or equal to the last traded price when purchasing.

b. When selling, the Trigger price of the trailing order cannot be smaller than or equal to the last traded price.

c. Callback ration limitation: ration ranges from 0.01% to 10%.

3.Take BTC/USDT as an example

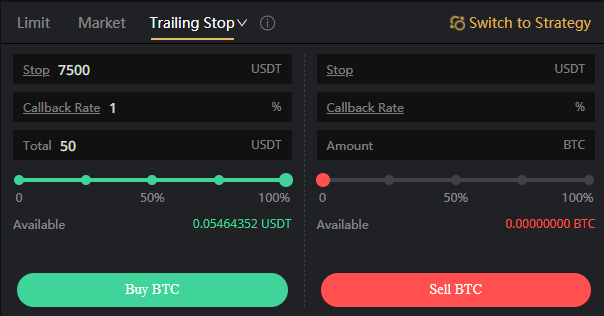

(1) Purchase

The price of BTC at 8000 USDT, the trader expects that the price of BTC is going to fall. When it falls to a certain price level, it will bounce back. In this case, this trader could use our trailing stop order to purchase BTC at market price when the market starts to bounce back from the retracement.

The trader expects the price to fall, and he sets the trailing purchasing order at the stop (trigger price) at 7500 USDT; furthermore, the callback rate reaches 1% and therefore the purchasing amount is 50 USDT. If the price of BTC falls from 8000 USDT, and the lowest price hits 7400 USDT, which means 7400 USDT ≤ Trigger Price (7500 USDT), the condition is fulfilled. After that, the price of BTC bounces back to 7575 USDT and the callback rate hits 1% (7575-7500)/7500=1%, the callback rate condition is also fulfilled. The trailing order will be triggered, and the order price will be the market price. The purchasing amount will be 50 USDT.

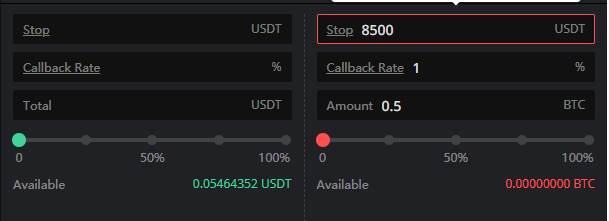

(2) Selling

The trader expects a bounce back in the price of BTC after a retracement happens when BTC reaches a high price level. Traders can use our trailing order to sell his/her BTC when the price bounces back to market price.

When BTC rises from 8000 USDT to the highest point at 8600 USDT, then 8600 USDT≥Trigger Price(8500), this condition has been fulfilled. When the price of BTC falls from the highest point at 8600 to 8514 USDT, which means 1% of retracement, then the callback rate is 1%, the trailing order will be fully triggered, and the order would be executed to sell 0.5BTC at the market price.