Expanding Your Investment Horizons: A Beginner's Guide to Crypto Derivatives

2023-09-04 08:58:35

The world of cryptocurrency continues to evolve, introducing more complex instruments that cater to diverse financial needs. Among these are crypto derivatives. As you begin your journey into this niche financial realm, let's delve into the intricacies of the crypto derivatives market.

What Are Crypto Derivatives and How Do They Work?

Cryptocurrency has carved a niche that is rapidly changing the dynamics of traditional trading. At the forefront of this evolution are 'crypto derivatives,' instruments that allow investors to gain exposure to cryptocurrencies without necessarily owning them directly. Just as in traditional finance where derivatives are built on underlying assets like stocks or commodities, crypto derivatives offer a way to bet on the price movements of digital currencies. But what exactly are these financial tools, and how do they function in the vast and intricate world of cryptocurrency? Dive in to uncover the mechanics and significance of crypto derivatives.

What Is a Crypto Derivative?

At its core, a crypto derivative is a financial contract that derives its value from an underlying cryptocurrency asset. Similar to traditional financial derivatives, they don't involve buying or selling the asset itself but rather the rights to buy or sell at predetermined prices. A crypto derivative is a financial contract that derives its value from the price of an underlying cryptocurrency or crypto asset. Just as traditional financial derivatives are tied to the value of assets like stocks, bonds, or commodities, crypto derivatives are tied to the price movements of cryptocurrencies like Bitcoin, Ethereum, and others. The most common types of crypto derivatives include:

- ・Futures: Agreements to buy or sell a certain amount of cryptocurrency at a predetermined price on a specific future date.

- ・Options: Contracts that give the holder the right (but not the obligation) to buy or sell an underlying cryptocurrency at a specified price within a certain time frame.

- ・Swaps: Contracts to exchange cash flows or returns from one crypto asset to another.

How Crypto Derivatives Work: The Basics Unveiled

Crypto derivatives are essentially contracts whose value is pegged to the price of a particular cryptocurrency. Instead of buying or selling the actual cryptocurrency, traders enter into an agreement to exchange the difference in price over time. For instance, in a Bitcoin futures contract, the buyer agrees to purchase Bitcoin at a predetermined price at a specified future date. Regardless of the market price on that date, the contract will be executed at the predetermined price.

Crypto derivatives offer a way for investors to gain exposure to the price movements of cryptocurrencies without necessarily owning the underlying asset. They can be used for hedging, speculation, and other investment strategies, but they also come with their own set of risks and require careful consideration.

Why Trade Crypto Derivatives?

Trading crypto derivatives offers several advantages to investors and traders. Firstly, they provide a mechanism to hedge against volatile price movements. By securing a price today for a future transaction, traders can protect themselves from potential drastic price drops or capitalize on price hikes. Secondly, they offer an opportunity for traders to leverage their positions. This means that traders can control a larger position with a smaller amount of capital, potentially amplifying returns. However, it's crucial to note that while leverage can increase profits, it also magnifies potential losses. Overall, crypto derivatives allow for speculative opportunities even in a stagnant or bearish market. Traders can profit from both rising and falling market scenarios, providing more strategic options compared to mere spot trading.

How They Differ From Traditional Derivatives?

While the foundational concept remains the same, crypto derivatives differ from traditional derivatives in several ways. The most evident difference is the underlying asset. In crypto derivatives, the asset is a cryptocurrency, such as Bitcoin or Ethereum, while traditional derivatives are tied to assets like stocks, commodities, or bonds. Another distinct characteristic is the decentralized nature of the crypto world. Many crypto derivatives platforms operate outside the purview of traditional financial regulators, leading to more innovation but also increased risk. Additionally, the crypto market is known for its extreme volatility, which makes crypto derivatives trading both a high-risk and high-reward endeavor compared to their traditional counterparts. The 24/7 trading nature of cryptocurrencies introduces unique market dynamics and liquidity considerations for traders and investors.

Exploring Types of Cryptocurrency Derivatives

In the rapidly evolving landscape of digital finance, cryptocurrency derivatives have emerged as pivotal instruments, enabling traders and investors to navigate the tumultuous waters of the crypto market with enhanced strategies and tools. Much like traditional financial derivatives that derive their value from an underlying asset, cryptocurrency derivatives mirror the price movements of underlying digital assets, such as Bitcoin or Ethereum. These tools not only amplify trading strategies but also introduce layers of complexity that necessitate a deep understanding. This article endeavors to elucidate the multifaceted world of crypto derivatives, exploring the intricacies of futures contracts, perpetual contracts, option contracts, and perpetual swaps.

Understanding Futures Contracts in Crypto Derivatives

Futures contracts, a cornerstone of the traditional financial world, have comfortably made their transition into the realm of cryptocurrencies. In essence, a futures contract is an agreement to buy or sell a specific cryptocurrency at a predetermined price on a set future date. These contracts are standardized and traded on dedicated exchanges. Traders utilize them for various purposes, from hedging against potential price movements to speculating on price directions. With crypto's inherent volatility, futures contracts provide an avenue for traders to lock in prices, offering a degree of predictability in an otherwise unpredictable market.

Deciphering Perpetual Contracts in Crypto Derivatives

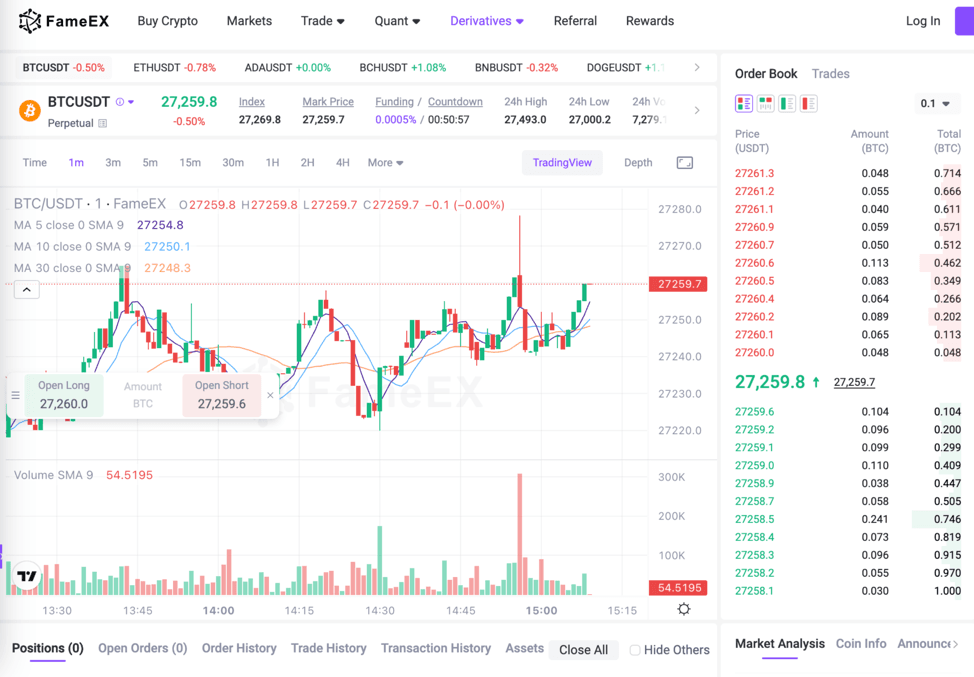

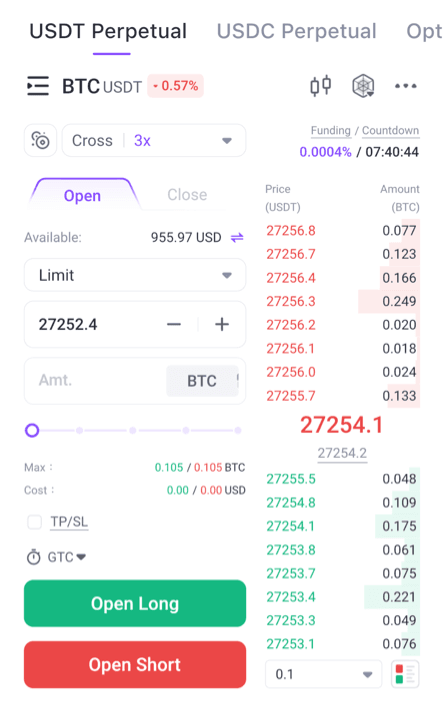

Perpetual contracts, often simply referred to as "perps," have garnered immense popularity in the crypto trading community. Unlike traditional futures contracts, which have a set expiration date, perpetual contracts have no expiry. They mirror the spot price of the underlying asset and include funding rates that facilitate the contract's price alignment with the spot price. This mechanism ensures that even though the contract doesn’t expire, traders are incentivized to keep the price close to the underlying asset. As a result, perpetual contracts offer a blend of futures trading benefits without the constraints of an expiration date.

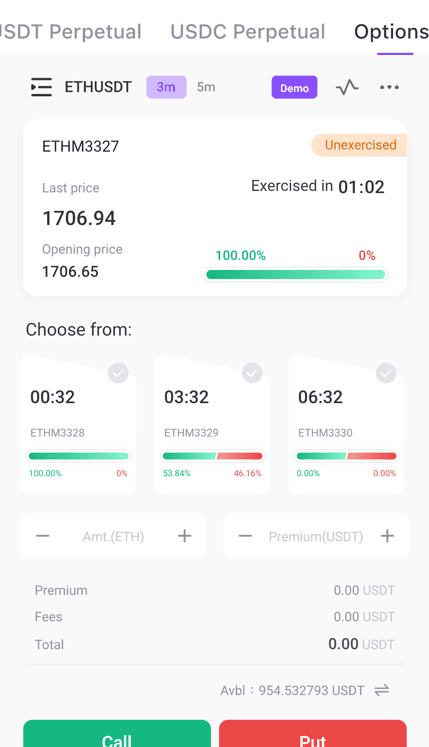

Delving into Option Contracts in Crypto Market

Option contracts represent a more sophisticated derivative tool in the cryptocurrency space. An option provides the buyer with the right, but not the obligation, to buy (call option) or sell (put option) a particular cryptocurrency at a specified price within a given timeframe or on a particular date. They serve as instruments for hedging or speculating on potential price movements. Their non-mandatory nature coupled with the potential for high returns, albeit with increased risks, makes them a compelling choice for seasoned traders in the crypto sphere.

Perpetual Swaps in Crypto Derivatives

Perpetual swaps bridge the gap between spot trading and futures contracts. Similar to perpetual contracts, they don't have an expiration date. However, a defining feature of perpetual swaps is the "swap" element, where traders can exchange the returns of one asset for the returns of another without actually holding the underlying asset. This allows for greater flexibility, enabling traders to benefit from price changes without the need for full ownership or delivery of the cryptocurrency. By offering this combination of flexibility and leverage, perpetual swaps have established themselves as a staple in the toolbox of many crypto traders.

Benefits of Cryptocurrency Derivatives

Cryptocurrency stands as a revolutionary asset class that has attracted considerable attention from retail and institutional investors alike. Amid the numerous innovations spawned by this digital financial revolution, cryptocurrency derivatives have emerged as powerful instruments that offer traders a range of strategic advantages. These benefits not only allow traders to tap into amplified returns, but also provide avenues to hedge against unpredictable market fluctuations and profit even when the market is in a downturn.

Leverage for Amplified Returns

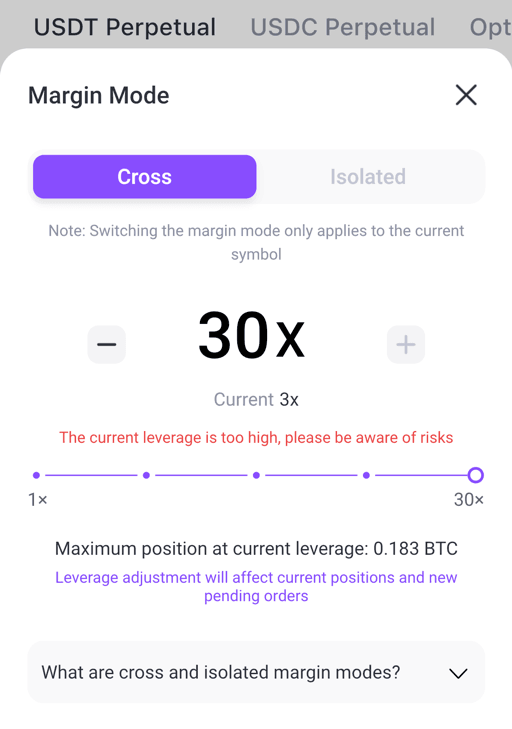

One of the primary attractions of cryptocurrency derivatives is the provision of leverage. Leverage allows traders to control a position that's significantly larger than their initial capital outlay. This means that even small price movements can lead to substantial returns, magnifying both potential profits and potential losses. For instance, with a 10x leverage, a 1% price movement in the underlying asset can translate into a 10% profit or loss on the derivative position. This amplified return potential empowers traders to maximize their profits, especially in a market as volatile as cryptocurrency. Currently, FameEX offers a leverage of up to 30X, whereas some other exchanges offer as much as 100X. Our decision to adopt this approach is to safeguard our users from the risk of liquidation and to better hedge their funds.

Hedging Against Market Volatility

Cryptocurrency markets are known for their price volatility, which can be both an opportunity and a risk for investors. Cryptocurrency derivatives, especially options and futures, allow traders to hedge their positions, protecting their portfolios from adverse price movements. By taking opposing positions in the derivative market, investors can offset potential losses in their spot holdings. For instance, if an investor holds Bitcoin and fears a price decline, they can take a short position in a Bitcoin futures contract, ensuring that any loss in their Bitcoin holding is counteracted by gains from the short position.

Ability to Profit in Bear Markets

Traditional investing wisdom revolves around buying low and selling high. However, the introduction of cryptocurrency derivatives has flipped this narrative, giving traders the ability to profit even when prices are falling. Through short selling, investors can bet against the price of a cryptocurrency, earning profits as its value declines. This is particularly beneficial in bear markets when asset prices are on a consistent downward trend. By utilizing cryptocurrency derivatives, traders can diversify their strategies, making profits irrespective of the market's directional momentum.

Risks Associated with Cryptocurrency Derivatives

In the complex financial landscape, cryptocurrency derivatives have emerged as a notable segment to allow investors to gain exposure to cryptocurrencies without actually holding them. These instruments, such as futures, options, and swaps, are contracts that derive their value from an underlying cryptocurrency asset. However, along with their numerous benefits, they bring a myriad of risks. Understanding these risks is paramount for both individual and institutional investors to navigate the tumultuous waters of cryptocurrency derivatives.

Price Volatility and Market Risks

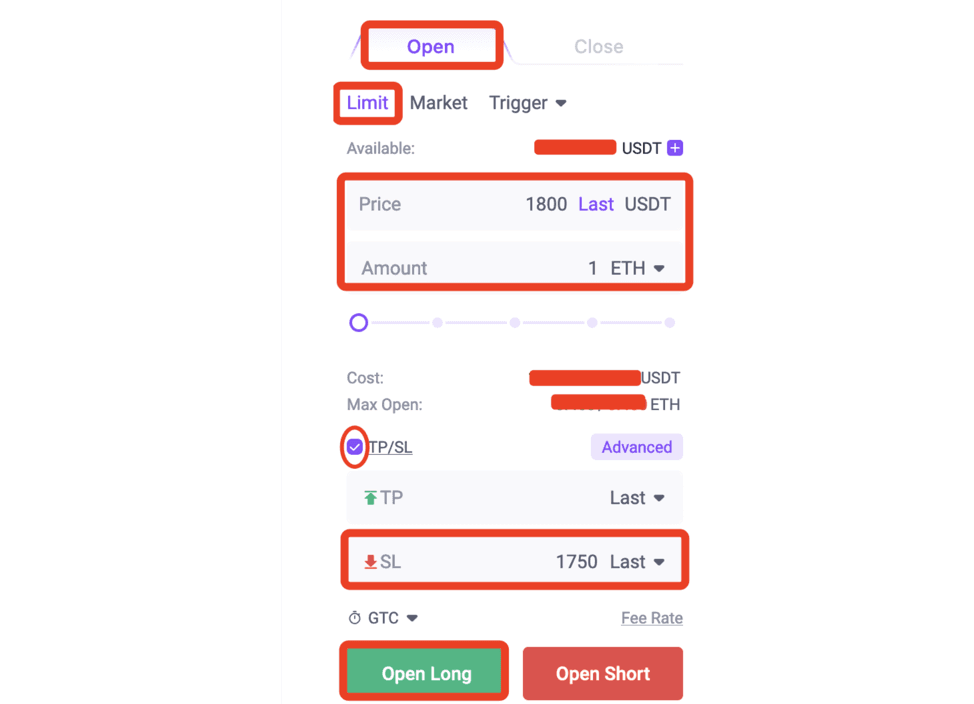

The cryptocurrency market is infamously volatile. Bitcoin, Ethereum, and other major digital currencies often experience substantial price swings over short periods, driven by factors such as technological advancements, regulatory news, and macroeconomic events. Derivative contracts, being anchored to these volatile assets, inherently bear the brunt of this turbulence. Investors can face sudden and significant losses, especially in the case of highly leveraged products. Additionally, there's the potential for 'liquidation events' in some derivative exchanges, where positions are automatically closed out, leading to substantial losses. It's essential for traders to use risk-management tools and be aware of market indicators to mitigate such risks. FameEX perpetual futures offer Take Profit (TP) and Stop Loss (SL) order features. Traders can set the trigger price and TP/SL price to manage risk when executing the futures. These features can be used during times of significant market volatility.

Counterparty Risks

Another significant concern in cryptocurrency derivatives is counterparty risk. When you enter a derivative contract, you are essentially trusting the other party to fulfill their obligations, whether that's delivering an asset or cash. In decentralized platforms, where smart contracts facilitate transactions, bugs or vulnerabilities can pose risks. Meanwhile, on centralized platforms, the solvency and operational integrity of the platform become the key concerns. If a central platform faces bankruptcy or mismanagement of funds, users could stand to lose their investments.

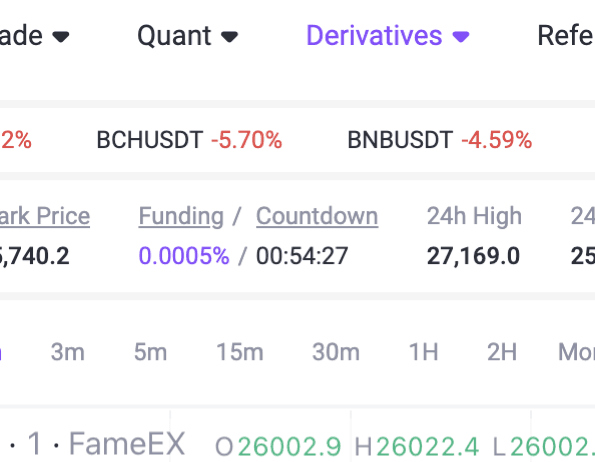

FameEX's perpetual futures trading employs a funding fee mechanism designed to align the futures market price with the spot price. This fee is applied three times daily in the UTC+8 time zone. The dynamics of this mechanism are straightforward: when the funding rate is positive, traders holding long positions (expecting the price to rise) pay those with short positions (anticipating a drop). Conversely, a negative funding rate means traders with short positions compensate those holding long positions. This system serves as a balancing tool to ensure that the futures market price remains in tandem with the spot price. As such, traders need to be cognizant of these funding periods and rates, as holding a position during these times might either necessitate a payment or result in a fee receipt, contingent on the prevailing funding rate and their respective trading position.

Regulatory Risks

Regulation in the cryptocurrency sphere is still a developing area in many jurisdictions. The regulatory stance on cryptocurrency derivatives varies widely across countries, with some embracing them and others outright banning or heavily restricting their use. Investors face the risk of sudden regulatory changes, which can heavily impact the legality, adoption, and value of these derivatives. A sudden clampdown or change in regulation can result in the rapid devaluation of positions, and in some cases, even the inability to exit or fulfill a contract. As such, staying informed about regional regulatory shifts and having a contingency plan is crucial for participants in this market. Under the regulatory framework, some exchanges won't allow users to trade derivatives such as perpetual futures, in certain markets.

Understanding the Role of Underlying Assets in Crypto Derivatives

Derivatives stand as sophisticated financial instruments that derive their value from an underlying asset, such as Bitcoin or Ethereum. These assets, often volatile and unpredictable, serve as the bedrock upon which crypto derivatives are built. By understanding the intrinsic relationship between derivatives and their underlying assets, one can navigate the complex waters of crypto finance with more clarity and confidence. This article delves deeper into the concept of underlying assets and their influence on the landscape of crypto derivatives.

What are Underlying Assets?

Underlying assets are the fundamental financial instruments or tangible entities from which derivatives derive their value. In traditional finance, they can range from stocks, commodities, interest rates, and currencies. In the cryptocurrency market, these underlying assets are primarily the digital coins or tokens such as Bitcoin, Ethereum, and other altcoins. Simply put, if a derivative is a bet or contract based on the price movement of an asset, then the asset in question is the underlying asset.

How do Underlying Assets Influence Crypto Derivatives?

The dynamics between underlying assets and crypto derivatives is akin to the relationship between the foundation of a building and the structure itself. The value and volatility of the underlying asset directly influence the price, risk, and potential returns of the derivative. For instance, if Bitcoin is the underlying asset for a specific derivative product and its price surges, the derivative's value will likely increase in tandem. Conversely, if the cryptocurrency's price plummets, the derivative could lose value. Moreover, underlying assets provide a level of security for the derivative, acting as collateral. This interconnected relationship necessitates that traders and investors pay keen attention to the health and trends of the underlying assets when dabbling in crypto derivatives.

Use Cases for Beginner Investors

Beginners often grapple with understanding the myriad of ways to make their money work for them. While there are countless investment strategies and vehicles to consider, some foundational use cases can provide novice investors with the clarity they seek. From diversifying portfolios to speculating on price movements and even honing risk management tactics, understanding these fundamental methods can be the difference between stagnation and profitable growth.

Diversifying Investment Portfolios

One of the golden rules of investing is to not put all your eggs in one basket. Diversifying an investment portfolio means spreading your money across various types of assets such as stocks, real estate, or commodities, or cryptocurrencies. In the cryptocurrency market, diversification can refer not only to various altcoins but also to products like derivatives and grid strategies. This diversification not only provides multiple avenues for potential returns but also helps in cushioning the blow should one or more of the investments underperform. Especially for beginner investors, a diversified portfolio reduces the risk of substantial losses and offers a balanced approach, ensuring that a decline in one sector can potentially be offset by gains in another.

Speculating on Price Movements

While long-term investment strategies are often recommended for beginners, some might be drawn to the allure of making quick gains by speculating on price movements. This approach involves making short-term bets on the price fluctuations of assets, such as buying a cryptocurrency with the expectation that its price will rise in the short term and then selling it for a profit. Grid trading, cryptocurrency, and commodities are common arenas where price speculation takes place. However, it's essential to note that while the rewards can be substantial, the derivative risks are equally high. It's vital for new investors to be well-informed and cautious when treading these volatile waters.

Risk Management Strategies

No investment is free from risk, but understanding and implementing risk management strategies can significantly mitigate potential pitfalls. For beginners, it's crucial to know your risk tolerance – the amount of risk you're comfortable taking on and the level of loss you can endure. Establishing this will guide your investment choices. Using tools like stop-loss orders, which automatically sell an asset when it reaches a certain price, can limit losses in volatile markets. Trading derivatives, such as futures, can be seen as a hedging strategy when the market is moving in the opposite direction. Additionally, continuously educating oneself, staying updated with market trends, and seeking advice from financial professionals can further fortify a beginner's investment journey against unnecessary risks.

Conclusion

Expanding one's investment horizons is not merely about diversifying portfolios but also about understanding the evolving financial instruments available in the market. Crypto derivatives represent a significant frontier in this expansion, offering an opportunity to both hedge and speculate on cryptocurrency price movements without holding the underlying assets. For beginners, while these instruments present an exciting potential for profit, they also come with their complexities and risks. It's imperative for investors to educate themselves, practice with caution, and consider their risk tolerance before venturing into this dynamic segment of the cryptocurrency market. As with all investments, informed decisions backed by robust research will always set the foundation for a successful and sustainable investment journey.

FAQ About Crypto Derivatives

Q: What Factors Should I Consider When Selecting a Crypto Derivatives Exchange?

A: When selecting a crypto derivatives exchange, several factors come into play. First and foremost, assess the exchange's liquidity by checking its trade volume and order book depth. This ensures fewer price discrepancies and smoother transactions. Equally important is the platform's security measures, including its use of multi-signature wallets, cold storage, and encryption protocols. It's essential to scrutinize the fee structure, taking into account both trading fees. A user-friendly interface can significantly enhance your trading experience, especially if you're newer to the field. Additionally, consider the leverage options provided, but always align them with your risk tolerance. Compliance with local laws and regulations signals the exchange's commitment to legitimate operations. Prompt and efficient customer support can be a lifesaver in complex situations, while a broad range of derivative products like futures, options, and swaps can open up diverse trading avenues. Making an informed choice based on these factors can greatly influence your crypto derivatives trading experience.

Q: What Are the Potential Benefits of Investing in Cryptocurrency Derivatives?

A: Cryptocurrency derivatives, such as futures, options, and swaps, derive their value from underlying cryptocurrencies. Investing in these instruments can offer several benefits. Firstly, they provide leverage, enabling investors to amplify potential gains with a smaller initial outlay. Secondly, they present hedging opportunities, allowing traders to mitigate the risks associated with cryptocurrency price fluctuations. Moreover, these derivatives enhance market liquidity and foster efficient price discovery by attracting diverse market participants. Lastly, they can serve as an effective tool for portfolio diversification, helping investors spread risks and optimize returns.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.