FameEX Today’s Crypto News Recap | February 9, 2026

2026-02-09 06:18:33

Trump signals Dow optimism, Bitcoin ETF trading hits records, and Hong Kong backs Web3 growth, highlighting shifting capital focus. Today’s crypto market reflected a classic structural stabilization rather than an emotion-driven trend reversal. Bitcoin gradually established a short-term equilibrium zone above $71K. This suggested that selling pressure previously triggered by deleveraging and forced liquidations had been absorbed by liquidity. However, this price stability was driven more by capital reallocation than by proactive risk expansion. Ethereum’s upside elasticity remained constrained by derivatives position rebalancing and leverage compression, indicating that the broader market is still moving through a balance sheet adjustment phase. Overall capital behavior leaned toward caution and liquidity management, with traders prioritizing position durability and risk exposure over directional chasing. Under these conditions, the recent price recovery resembles a post-stress structural consolidation rather than the start of a new bullish narrative, leaving market activity characterized by observation and range stabilization.

Crypto Markets Overview

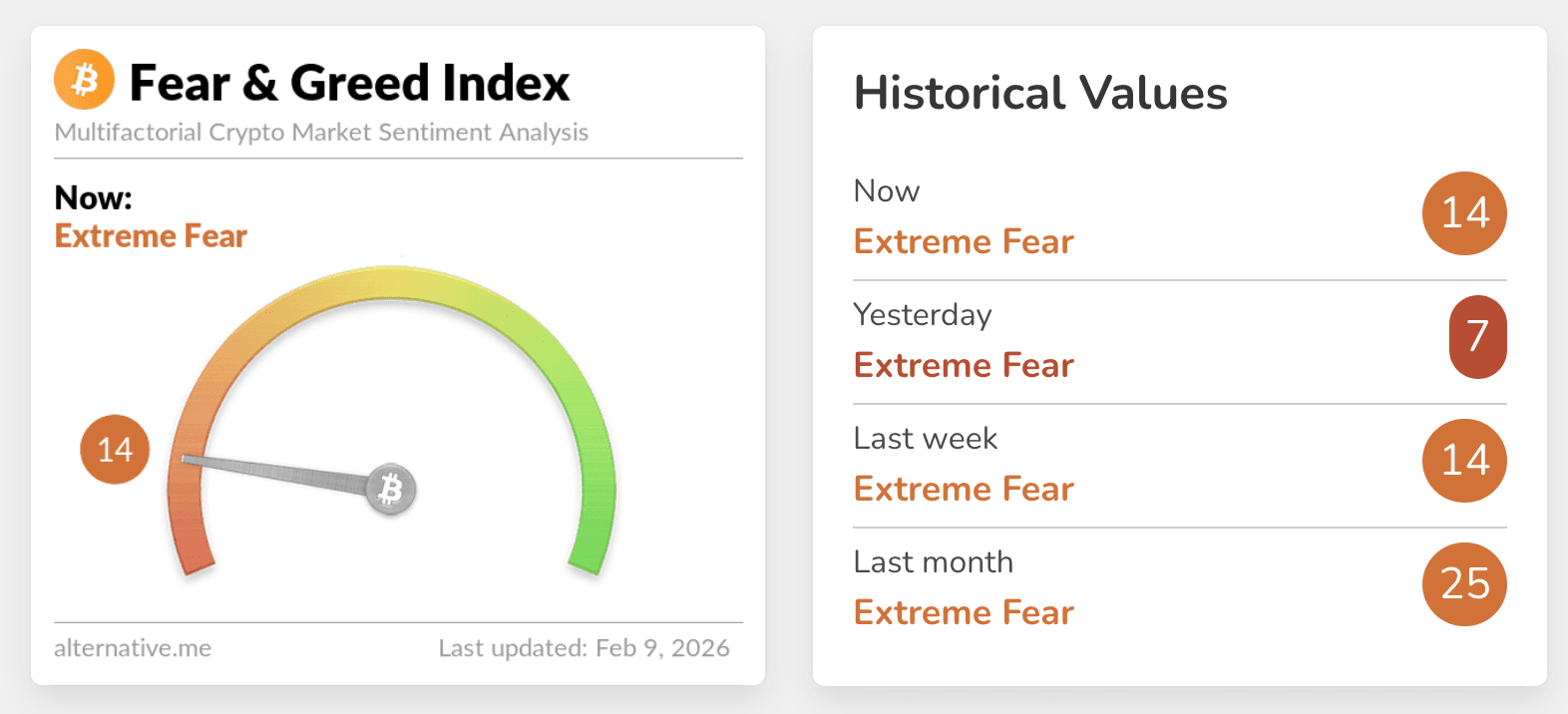

Today’s modest crypto rebound was primarily driven by structural position adjustments and liquidity flows rather than a broad recovery in risk appetite. The Crypto Fear and Greed Index currently stands at 14 as Extreme Fear, where sentiment remains highly defensive and capital behavior is centered on exposure reduction, leverage unwinding, and liquidity preservation. In such an environment, price movement is typically dictated by mechanical position adjustments rather than narrative-driven buying. Bitcoin continues to function as the market anchor, attracting defensive capital and serving as a liquidity and risk buffer for traders. Ethereum’s lower price elasticity reflects ongoing derivatives leverage reconfiguration, suggesting capital remains in a repair phase rather than expansion. Meanwhile, sharp volatility in select smaller tokens indicates localized liquidity rotation, but these movements resemble tactical short-term positioning rather than a broad improvement in market sentiment. The market maintains a structurally defensive posture, with recent gains representing post-risk rebalancing instead of speculative capital reentry.

Source: Alternative

BTC Stabilizes on Liquidity Replenishment While ETH Leverage Shapes Volatility

Bitcoin’s stability above $71K reflects structural balance following liquidity absorption. During last week’s volatility, price repeatedly entered high-density liquidation zones, forcing leveraged positions to unwind and generating short-term mechanical selling pressure. As these pressures were gradually absorbed by spot and arbitrage capital, the market naturally settled into a new equilibrium range. The stabilization has not been accompanied by strong proactive buying volume, indicating that participants remain focused on range management and risk discipline. Trading behavior under these conditions leans toward balance sheet repair and position reallocation, underscoring the market’s sensitivity to liquidity resilience. In contrast, Ethereum’s price responsiveness continues to be shaped by the derivatives leverage structure. Funding adjustments and open interest repositioning have restrained volatility expansion, resulting in price action that is more mechanical than sentiment-driven. Current ETH trading dynamics suggest participants are reducing leverage exposure and observing structural shifts rather than pursuing directional momentum. BTC stability and ETH constraint illustrate a typical post-deleveraging equilibrium phase where liquidity management and structural repair remain the dominant market priorities.

Key News Highlights:

Trump Highlights Dow Potential as Stock Rally Captures Market Attention

US equities staged a notable rebound, with the Dow Jones Industrial Average breaking a key psychological threshold and recording its strongest single-day gain in nearly a year. The U.S. President Donald Trump stated on social media that earlier expectations for index milestones had already been exceeded ahead of schedule, and he projected continued upside potential before the end of his term. He linked market performance to tariff policy and national security, bringing renewed focus to the relationship between political messaging and market sentiment. Historically, Trump has issued public remarks supporting equity purchases during periods of volatility, often coinciding with policy or trade developments that preceded market rallies. The latest statements have again positioned political signaling as a central topic in financial market discussions.

ETF and Derivatives Activity Observed During Recent Bitcoin Volatility

Market data surrounding Bitcoin’s sharp early-February price swings showed ETF and derivatives trading activity reaching record levels, drawing attention to market structure and liquidity dynamics. Major Bitcoin ETFs posted historic trading volumes alongside elevated options activity, with hedging-driven transactions playing a visible role. At the same time, traditional multi-asset portfolios adjusted exposure amid broader volatility, resulting in synchronized movement between digital and conventional risk assets. Despite price pressure, ETF structures did not experience widespread capital flight, and some products recorded net inflows. This indicated that activity reflected positioning and hedging adjustments rather than collective withdrawal. These developments have placed ETFs, derivatives, and cross-market mechanics at the center of recent Bitcoin market observations.

Hong Kong Reaffirms Web3 Positioning to Support Global Capital Connectivity

Hong Kong financial officials stated at a digital asset industry summit that the region continues to strengthen its role as an international financial hub and Web3 development platform. Leveraging institutional infrastructure and regulatory clarity, Hong Kong aims to help firms efficiently connect with investors and commercial partners. Officials emphasized that as digital assets and Web3 adoption accelerate, the region’s global capital linkages provide meaningful support for enterprise expansion. Simultaneously, Hong Kong is advancing regulatory frameworks designed to balance innovation with financial stability, offering a transparent compliance environment for industry participants. This policy direction is viewed as a regional signal of support for digital finance, reinforcing Hong Kong’s relevance within the evolving global Web3 ecosystem.

Trending Tokens:

- $HUMN (Human Network)

Human Network has attracted market attention primarily following its recent upcoming token announcement, as identity infrastructure within decentralized technology continues to emerge as a core narrative, particularly around digital identity and privacy-preserving systems. The project is positioned within a human-centric technology framework that emphasizes digital natural rights such as data ownership and secure identity, closely aligning with industry discussions surrounding user sovereignty and control. Its architecture combines wallet and identity functionality secured through Ethereum staking, while operating as an actively validated service within modular security layers, placing it at the intersection of infrastructure and user access. Recent communications focused on ecosystem positioning and framework expansion are viewed as important signals supporting the maturation of a participatory network model. Market observers interpret this as reflective of a broader shift toward identity-native financial rails, where authentication, custody, and access are tightly integrated. Narrative traction stems from the convergence of decentralized security guarantees and human-centric design principles, differentiating the platform from purely transactional networks. This reinforces market interest in infrastructure that embeds identity directly into core network primitives. As identity-driven architecture gains strategic relevance at the institutional level, Human Network is increasingly viewed as an exploratory layer linking decentralized verification with consumer-facing applications.

- $NEXIRA (Nexira)

Nexira is gaining momentum within the blockchain gaming infrastructure narrative as cross-game asset liquidity becomes an increasingly important theme in digital entertainment ecosystems. The platform is designed to enable seamless portability of shared currency and assets across multiple game environments. This allows tokens, items, and digital collectibles to function across contexts. Their recent reward campaigns have elevated community visibility while strengthening distribution mechanics and user coordination ahead of broader rollout phases. Market participants interpret these initiatives as strategic efforts to bootstrap liquidity and early network engagement within a game-centric economy. The interoperability focus aligns with industry experimentation around sustainable digital ownership models that extend beyond single-title ecosystems. Nexira’s positioning as cross-title infrastructure highlights its role in testing whether portable digital ownership frameworks can scale within consumer entertainment markets.

- $SOSO (SoDEX)

SoDEX is emerging within the decentralized exchange infrastructure narrative as high-performance onchain trading platforms increasingly seek to replicate professional market structure. Built on a dedicated high-throughput Layer 1 environment, the platform integrates onchain order book execution designed to support both spot and derivatives markets. Its public launch, accompanied by ecosystem incentive allocation, signals a transition into a liquidity formation and usage-driven growth phase. The reward framework emphasizes organic trading behavior, underscoring the platform’s strategy to attract sustained participation rather than short-term yield farming activity. Architectural priorities around matching efficiency and accessibility position SoDEX as a bridge between centralized trading familiarity and decentralized custody principles.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.