FameEX Today’s Crypto News Recap | February 12, 2026

2026-02-12 06:55:21

Today’s crypto market reflected a structurally cautious trading environment, where price action was driven more by liquidity reallocation and derivatives position adjustments than by directional capital expansion. Bitcoin repeatedly tested support levels within key liquidity zones. This highlights limited follow-through buying momentum as activity concentrated around range rebalancing rather than aggressive upside chasing. At the same time, expanding spot trading volume coincided with continued ETF outflows. This suggested participants are actively managing exposure and liquidity rather than positioning for trend continuation. Ethereum maintained constrained price behavior under the combined pressure of leverage compression, derivatives repositioning, and capital outflows, preventing meaningful extension buying. Meanwhile, market discussion around shifts in stable asset capitalization relative to major crypto assets reflects ongoing portfolio reassessment rather than immediate directional repricing. Overall, trading rhythm remains cautious and structurally consolidative, with capital behavior centered on position durability, liquidity efficiency, and risk management, indicating that the market continues to operate within a consolidation phase rather than a breakout environment.

Crypto Markets Overview

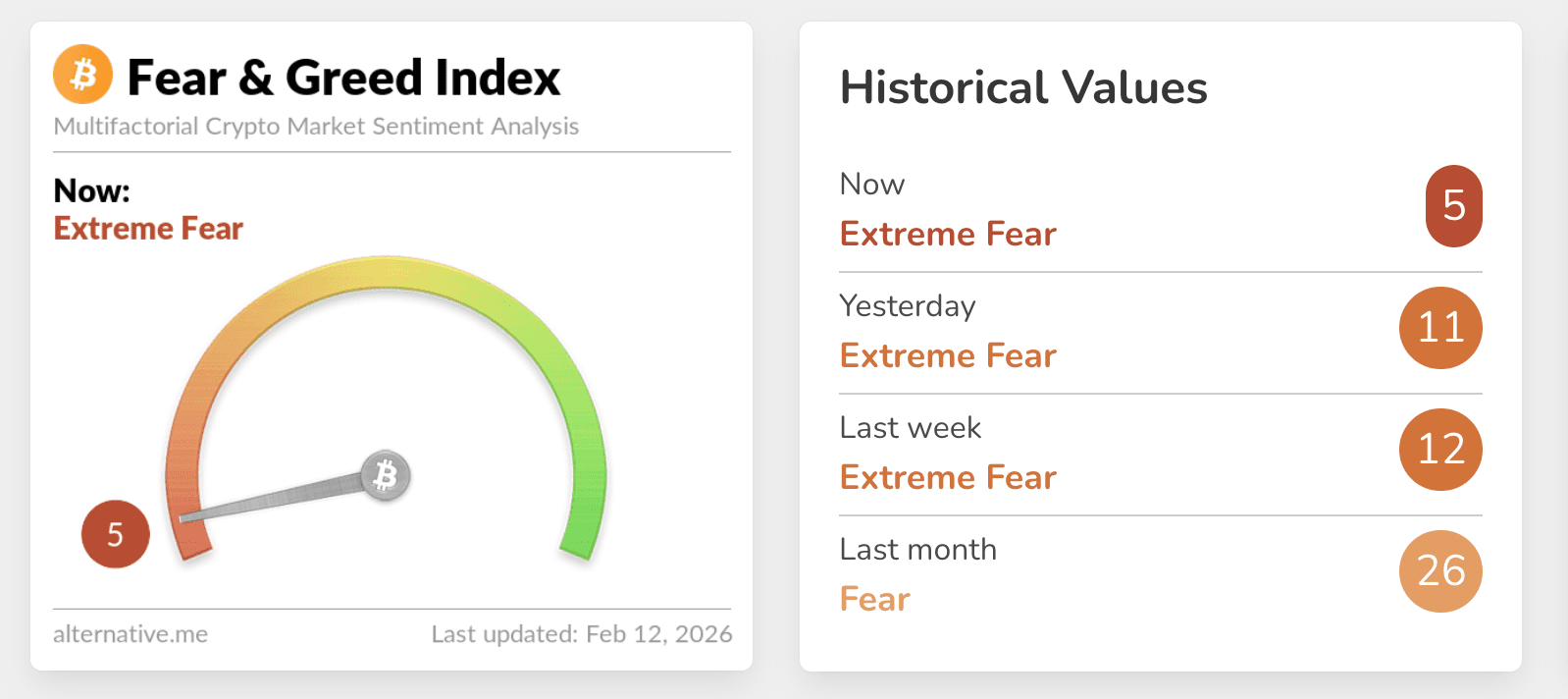

The Crypto Fear & Greed Index has fallen to a recent low of 5. This places sentiment firmly in the fear zone. This level signals subdued risk appetite, with capital deployment remaining measured and limited to incremental portfolio adjustments rather than proactive accumulation. Bitcoin’s 24-hour global spot trading volume reached approximately USD 8.923 billion, indicating a temporary expansion in trading activity. However, this increase occurred alongside ETF net outflows of roughly USD 275.81 million for Bitcoin products and USD 129 million for Ethereum products, reinforcing that liquidity preservation and exposure management remain priorities for a segment of market participants. Market attention has also expanded toward comparisons between stable asset capitalization and major crypto asset structures, underscoring a shift toward defensive capital positioning and allocation efficiency rather than short-term price acceleration.

Source: Alternative

BTC Liquidity Tests Extend Consolidation While ETH Momentum Remains Constrained

Bitcoin has repeatedly tested critical liquidity zones near $66K, with liquidation heatmaps indicating a relative liquidity gap around $60.5K. This structure increases the likelihood of mechanically driven price movement as position rebalancing and forced liquidations influence intrarange volatility. Recent growth in spot volume combined with ETF outflows suggests that activity is driven more by portfolio rotation and risk management than by directional buying expansion, leaving upside follow-through limited. Ethereum continues to face leverage compression amid USD 129 million in ETF net outflows, with derivatives repositioning restricting upward price extension and reinforcing structural consolidation. Discussions surrounding potential capitalization crossover between stable assets and major crypto assets largely reflect capital allocation recalibration rather than immediate pricing signals. BTC and ETH price behavior remains governed by liquidity distribution, liquidation zones, and leverage adjustment, supporting an ongoing environment of range restructuring and structural repair without evidence of sustained directional momentum.

Key News Highlights:

Thailand Approves Crypto As Underlying Assets In Derivatives Markets

Thailand’s government has formally approved a Finance Ministry proposal allowing digital assets to serve as underlying instruments within the country’s derivatives and capital markets. This marks a step toward institutional integration of crypto assets. The policy aims to align Thailand’s financial markets with international standards while strengthening regulatory transparency and investor protections. Securities regulators will amend existing frameworks to permit Bitcoin and other digital assets to be incorporated into derivatives trading structures. Industry representatives interpret the move as recognition of crypto assets as an emerging financial asset class rather than purely speculative instruments. Officials emphasize that the initiative supports diversification, broader market participation, and enhanced risk management capabilities. Thailand is also positioning itself to attract institutional capital and deepen market liquidity. Retail activity remains active, although crypto payment restrictions persist as part of broader financial stability safeguards. The development is viewed as a significant milestone in Thailand’s digital finance modernization.

Crypto Lender Halted Withdrawals During Bitcoin Market Fall

Institutional crypto lending platform BlockFills temporarily suspended deposits and withdrawals during a period of sharp market volatility to manage liquidity stress. The company stated that the measure is intended to protect client assets while restoring platform liquidity, with restrictions remaining in place. Management is working closely with investors and clients to normalize operations as conditions stabilize. Despite the suspension, customers retain the ability to execute spot and derivatives trades to manage open positions. The platform primarily serves large institutional participants such as asset managers and hedge funds that account for significant trading volume. Bitcoin’s sharp price movement during the market decline intensified liquidity pressures across institutional channels. BlockFills emphasized that the suspension represents a temporary response to extraordinary market conditions rather than a structural business change. The event has drawn attention to liquidity management practices within crypto lending infrastructure.

X Money External Beta Launch Planned Within Months

Elon Musk announced that X’s upcoming payment system, X Money, is expected to enter a limited external beta within one to two months as part of the platform’s broader financial integration strategy. The system is already operating in an internal closed beta and is designed to embed payment functionality directly into the X ecosystem. Musk described payments as a core feature to increase user engagement and platform utility. The long-term vision centers on enabling users to manage communications, social interaction, and financial activity within a unified application environment. While speculation exists around crypto functionality, the initial rollout is likely focused on traditional payment partnerships. X continues expanding its AI infrastructure to support future platform capabilities. The initiative reflects Musk’s long-standing objective to integrate financial services into a multifunctional digital platform.

Trending Tokens:

- $OM (MANTRA)

MANTRA is regaining market attention as the narrative around compliance driven real world asset infrastructure gains momentum, closely aligning with the broader trend of institutional blockchain adoption. PyseEarth receiving a Non Objection Certificate from Dubai’s VARA and launching through MANTRA Finance is viewed as a concrete example of embedding regulatory logic directly into tokenization workflows rather than a purely speculative milestone. This development demonstrates that regulated assets can progressively enter onchain settlement environments while maintaining jurisdictional oversight, a condition increasingly prioritized by traditional capital allocators. More than a quarter million dollars in private institutional capital has already been committed to the PYSE Green Velocity offering, reinforcing the perception that compliant RWA rails are transitioning from experimentation toward live capital deployment. Some people argue that infrastructure capable of integrating regulatory frameworks directly at the settlement layer may reduce onboarding friction for traditional finance participants. Therefore, the narrative focus shifts away from short term liquidity rotation toward structural alignment between blockchain execution and formal asset issuance processes. As discussions around RWA tokenization continue to scale, MANTRA’s positioning as a compliance oriented L1 keeps investor attention centered on institutional readiness and regulatory credibility.

- $AZTEC (Aztec Network)

Aztec is returning to market focus as the programmable privacy infrastructure narrative accelerates, particularly within Ethereum’s next phase of scaling discussions. Recent communication surrounding the upcoming AZTEC token launch, alongside framing of an emerging privacy arms race, reinforces the view that transparency by default blockchain architectures are approaching practical limitations. Aztec’s positioning emphasizes that privacy is no longer an optional feature but a foundational requirement for real world applications and institutional adoption, especially in financial environments where full data exposure is not viable. Its zero knowledge rollup architecture is designed to deliver confidential computation without sacrificing composability, positioning privacy as an integrated layer rather than an external add on. Market participants interpret this shift as an early signal that privacy tooling is moving from niche experimentation toward standardized infrastructure. The broader implication is that programmable privacy can enable granular control over information disclosure while supporting compliant onchain activity. This narrative aligns with expectations that Ethereum scaling will increasingly incorporate privacy primitives into its core developer stack.

- $RAVE (RaveDAO)

RaveDAO is attracting attention through a DAO narrative that blends community culture, builder engagement, and immersive experiences into a cohesive ecosystem identity. Its participation in an AI and Web3 campus builder forum alongside a branded community event is viewed as a deliberate strategy to merge technical community touchpoints with lifestyle driven social coordination. Rather than positioning itself purely as protocol infrastructure, RaveDAO frames shared experience and social collaboration as integral components of ecosystem value. Market observers see this hybrid positioning as reflective of a broader movement toward culture native DAOs that treat community energy as a compounding asset. The event structure emphasizes builder dialogue followed by community activation. This signals that recurring offline engagement can strengthen participant identity and retention. This approach suggests that DAO growth strategies may increasingly rely on real world social loops to reinforce ecosystem resilience. As experimentation in Web3’s social layer continues, RaveDAO highlights how cultural branding and developer ecosystems can converge into a unified participation model.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.