FameEX Weekly Market Trend | December 4, 2023

2023-12-04 11:44:25

1. Market Trend

From Nov. 30 to Dec. 3, the BTC price swung from $37,500.00 to $40,250.00, with a volatility of 7.33%. The last analysis suggested waiting for a second push to $38,000 before entering the market. If missed, one can enter at any position below $38,000, anticipating a breakthrough to $40,000. The current trend supports this, with BTC smoothly breaking $38,000 for the third time and surpassing $39,000, nearing $40,000. The trends at various levels are very healthy while moving averages are rising, suggesting a typical bullish trend. The $40,000 breakthrough is on the horizon. Analyzing the market with technical indicators is currently insignificant. Trends often follow market sentiment rather than technical indicators in bear or bull markets, making resistance and support levels less relevant amidst emotional swings. What needs to be considered now is how far this BTC market can continue in this wave. In this new stage, no one can definitively answer, so approach the market with caution. Even in profitable situations, respect the market as unexpected changes can occur anytime (implementing stop-loss, take-profit, and adjusting stop-loss points is crucial).

Around $47,000 is a key resistance level in the current upward trend, reflecting the previous high. With an optimistic view, BTC may reach approximately $47,000. If BTC breaks $40,000 and holds above it for an hour, consider adding positions or entering near $40,000. It’s advised to accumulate on dips, hold for upward movements, and avoid frequent trading during this period.

Source: BTCUSDT | Binance Spot

Between Nov. 30 and Dec. 3, the price of ETH/BTC fluctuated within a range of 0.05354-0.05553, showing a 3.72% fluctuation. ETH/BTC has been in a wide-ranging and oscillating trend recently, without significant profit potential. Given that the current position is at a low point in the past few months, there might be a trend of catching up in the future. Investors who are optimistic about catching up or holding long-term positions can enter between 0.05350 and 0.05400. Short-term investors are advised to choose other assets temporarily and enter the market after clear upward trends emerge at various levels.

Based on overall analysis, the current market is trending bullish, marked by ongoing BTC breakthroughs, record fund inflows, and on-platform trading volumes. Addresses and holdings of BTC for 1 and 5 years have reached unprecedented levels, profoundly influencing BTC’s future development.While a market correction may occur, it is essential to note that it is just a correction, not a sign that the market is ending; rather, it is a technical adjustment. While short-term bearish sentiments may be present, actively shorting appears imprudent. The prevailing strategies involve holding positions for an upward trend and aligning with the current market trend. Investing a small amount in trending cryptocurrencies (the BRC20 series, LUNC, etc.) can be considered.

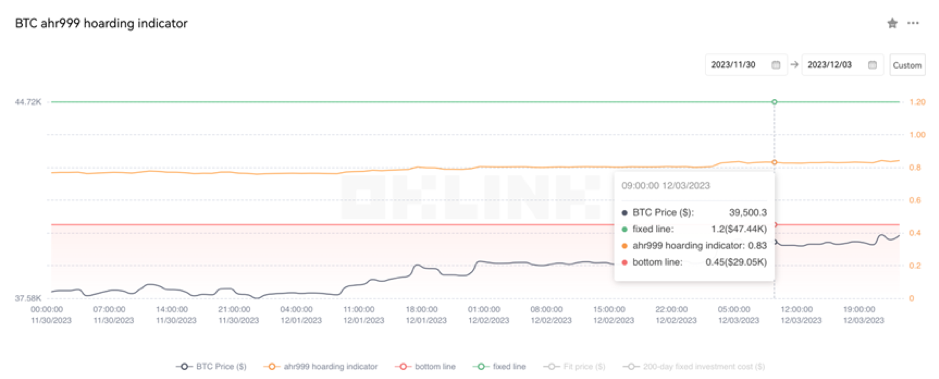

The Bitcoin Ahr999 index of 0.83 is between the buy-the-dip level ($29,050) and the DCA level ($47,440). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

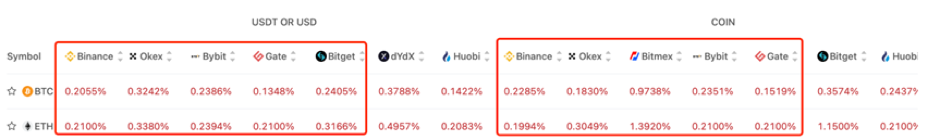

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

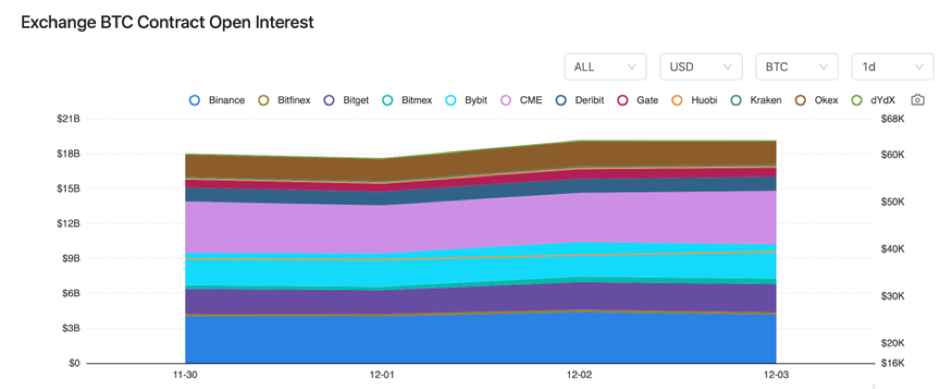

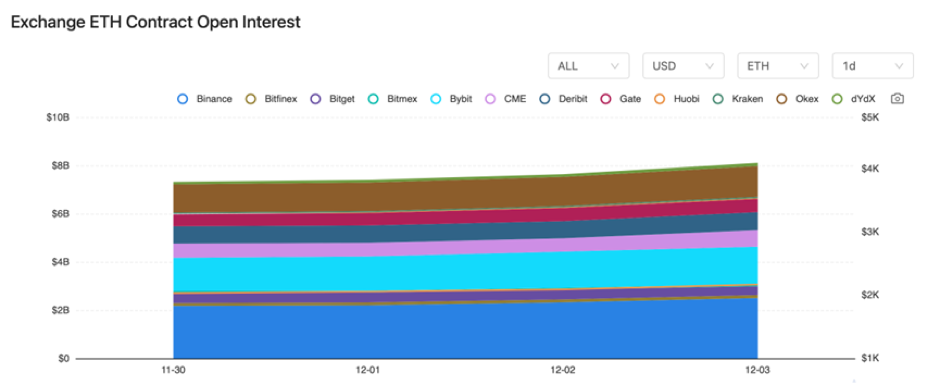

The open interest for both BTC and ETH contracts on major exchanges witnessed growth, with the open interest for ETH contracts growing at a higher rate than that of BTC contracts.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On November 30, Federal Reserve’s Daley stated no consideration of interest rate cuts at the moment.

2) On November 30, the Hong Kong Securities and Futures Professional Association suggested the Financial Secretary consider introducing an ICO mechanism.

3) On November 30, Coinbase released its fifth annual transparency report.

4) On December 1, 150 million DYDX tokens were unlocked on the same day.

5) On December 1, Coinbase CEO confirmed that there are no intentions to launch a token for the L2 network Base.

6) On December 2, Grayscale’s new Managing Director revealed that he has been investing in BTC since 2013.

7) On December 2, the top ten Ethereum whales reached a milestone with a combined holding of 41 million ETH.

8) On December 3, the Starknet ecosystem hosted over 170 Dapps.

9) On December 3, Solana founder announced that Solana and Ethereum can coexist.

10) On December 3, The total number of Bitcoin addresses surpassed 50 million for the first time.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.