FameEX Weekly Market Trend | January 8, 2024

2024-01-08 11:27:05

1. Market Trend

From Jan. 5 to Jan. 7, the BTC price swung from $42,450.00 to $44,729.58, with a volatility of 5.37%. The prior analysis emphasized maintaining the strategy of holding and awaiting a rise, provided there are no significant structural changes. Despite slight BTC fluctuations in recent days, market trading activity has remained high. Most cryptocurrencies on the market have experienced a deep pullback. At the moment, BTC’s ability to resist decline is significantly stronger than any other currency and stronger than its own in the previous period. Recent BTC fluctuations show continuous attempts to breach $44,000 (multiple, yet unstable). Even if upward efforts lack stability, retracement remains above $43,000. Notably, trading volume during unsuccessful upward movements often surpasses downward ones (when the candlestick amplitudes are basically consistent), suggesting a potential upward breakthrough in the current market conditions.

On the 4-hour chart, the market has been closely following the MA60, showing strong support, making it difficult to fall below the MA60. Looking at the 1-day chart, the closing average prices in the past few days have been above the MA7, indicating a strong signal. Therefore, considering the above factors, it is recommended to implement a strategy of building up long positions at lower prices. It is advisable to boldly open positions near $43,200, with a stop-loss point at $42,700. For those with positions, it is recommended to be patient and hold for the rise.

Source: BTCUSDT | Binance Spot

Between Jan. 5 and Jan. 7, the price of ETH/BTC fluctuated within a range of 0.05050-0.05206, showing a 3.09% fluctuation. The previous analysis report stated that currently, at various levels, the market is in a bearish trend. To reverse the situation in the short term, a quick and aggressive surge in trading volume is needed. However, the recent trend continues to reflect the inherent weakness of ETH/BTC, persisting along a downward channel without clear signals of a bottom or reversal. Therefore, it is advisable to continue staying away from this currency.

Based on overall analysis, the current market is in a period of consolidation, with a noticeable reduction in BTC’s volatility (though the directional bias of fluctuations remains apparent). Other cryptocurrencies in the overall market still exhibit relatively higher volatility. Cryptos that experienced significant previous gains are now seeing progressively larger retracements, following a normal market pattern. As long as the upward structure of BTC remains intact, holders need not worry about short-term fluctuations in their balances. For spot traders, the primary strategy continues to be holding for potential rises, buying on dips, and disregarding insignificant fluctuations. For futures traders, setting stop-loss orders upon opening positions, gradually taking profits, buying on dips, and prioritizing long positions is recommended.

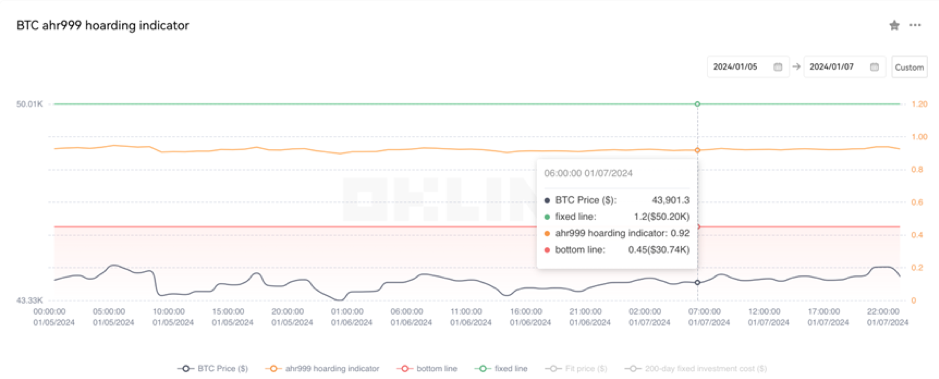

The Bitcoin Ahr999 index of 0.92 is between the buy-the-dip level ($30,740) and the DCA level ($50,200). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

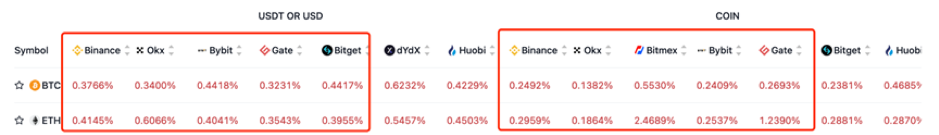

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

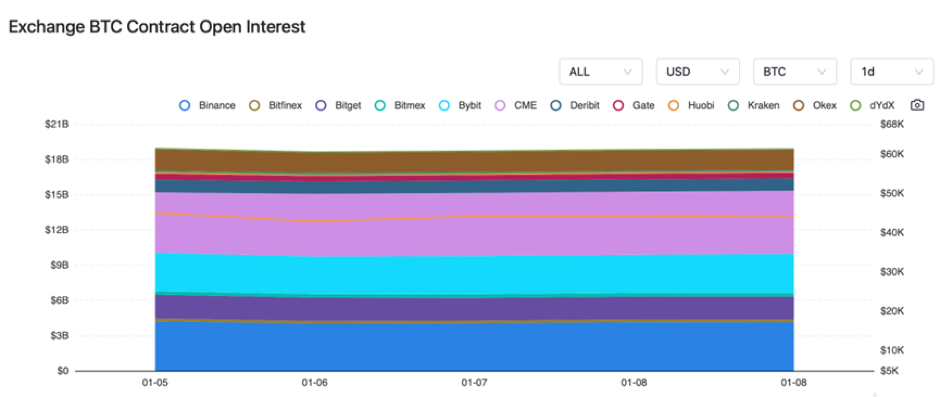

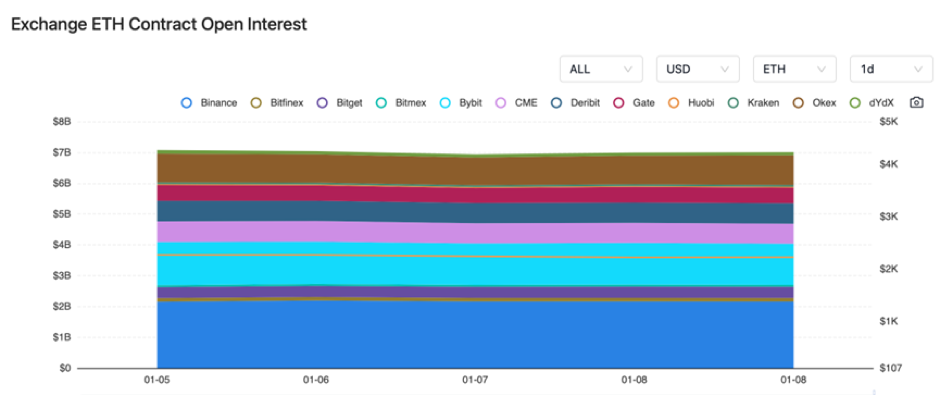

The BTC and ETH contract open interest both remained relatively stable from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On January 5, the People’s Bank of China suggested initiating the digital renminbi pilot prudently.

2) On January 5, Ordinals Inscription accumulated fee income breaking through 5,400 Bitcoins.

3) On January 5, Nansen stated withdrawals of over 200,000 ETH were pending in Celsius.

4) On January 6, Grayscale included XRP in its digital large-cap fund.

5) On January 6, Nebraska proposed a bill supporting the rights of Bitcoin users.

6) On January 6, DEX platforms’ total trading volume approached $1 trillion in 2023.

7) On January 6, according to Bloomberg analysts, the SEC may approve 11 spot Bitcoin ETF applications at once.

8) On January 7, TVL on Base Chain was $727 million, growing by 16.11% in the last 7 days.

9) On January 7, Curve decided to launch a MIM/crvUSD liquidity pool.

10) On January 7, Tencent applied for a blockchain patent to enhance transaction on-chain efficiency.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.