FameEX Weekly Market Trend | May 12, 2025

2025-05-12 13:27:02

1. Key Insights on Crypto Market Trends

From May 8 to May 11, the BTC spot price swung from $96,698.9 to $105,654.45, a 9.26% range. The price increase was mainly driven by rate cuts in China and the UK, the Ethereum upgrade, and a new UK-US low-tariff deal.

In recent days, key statements from the U.S. Federal Reserve (Fed) and the European Central Bank (ECB) include:

1) On May 9, Fed’s Williams stated that uncertainty will remain a defining feature of the monetary policy landscape.

2) On May 9, Fed Governor Kugler indicated that both inflation and unemployment face upside risks; a short-term economic slowdown is possible.

3) On May 9, Fed’s Barr stated that tariffs are pushing inflation higher and slowing the economy, posing challenges for the Fed.

4) On May 9, Fed’s Bostic believed that policy adjustments are unwise amid rising uncertainty.

5) On May 9, ECB’s Simkus indicated that a June rate cut is necessary; U.S. tariffs are weighing on economic growth, calling for further easing.

6) On May 9, ECB’s Rehn said that if forecasts hold, a June rate cut would be appropriate.

In brief, Fed officials are focused on uncertainty and inflation, while ECB officials are leaning toward a rate cut in June.

Key Takeaways from the Latest Fed FOMC Statement and Powell’s Press Conference

FOMC Statement Highlights:

1) Rate Decision: Unanimous 12–0 vote to keep the benchmark rate steady at 4.25%–4.50%, marking the third consecutive pause.

2) Labor Market: Unemployment has stabilized, and the labor market remains resilient.

3) Balance Sheet: Ongoing reduction of Treasury and MBS holdings at the current pace.

4) Inflation Outlook: Inflation remains slightly elevated; risks of both high inflation and high unemployment have risen.

5) Economic Outlook: Uncertainty has “further increased”. Despite export volatility, economic activity continues to expand at a “solid pace”.

Highlights from Powell’s Press Conference

1) Rate Outlook: Currently, uncertainty requires the Fed to continue waiting, and all committee members support waiting. Trump’s calls for rate cuts have no impact on the Fed’s work. The cost of waiting is very low, and the Fed is in no rush to adjust rates. He added that in some scenarios, a rate cut this year may be appropriate, while in others it may not be, and expressed limited confidence in identifying the correct rate path. As situations evolve, Powell said the Fed can act swiftly at its discretion.

2) Inflation Outlook: Short-term inflation expectations have risen, while long-term expectations remain aligned with the target. Whether persistent inflation occurs will depend on the scale and duration of tariffs and on inflation expectations. If tariffs rise significantly and persist as announced, higher inflation will follow.

3) Economic Outlook: There are no signs of economic slowdown in actual data. The economy remains solid, uncertainty is very high, and downside economic risks have increased. GDP fluctuations do not fundamentally change the Fed’s position.

4) Labor Market: Wage growth has continued to slow. The labor market is at or near maximum employment. When conflicts arise between the dual mandates, the Fed considers the distance from each goal and the time needed to close the gaps.

5) Tariff Impact: Tariffs have had a much greater impact than expected. So far, no major economic effects from tariffs have been observed. The inflationary effect of policy may be temporary. Ongoing trade talks could materially shift the outlook. Survey respondents cited tariffs as a major factor driving inflation expectations.

6) Market Response: From the rate decision to Powell’s remarks, gold rose then fell by over $30, the U.S. dollar strengthened by about 30 pips, the 2-year U.S. Treasury yield fell then rose, ending down about 2 basis points, and U.S. stocks moved lower amid volatility.

7) Latest Expectations: Fed funds futures show the probability of a rate cut in June has slightly dropped to 23.8%, and markets still price in about 78 basis points of cuts for the year.

8) Other Remarks: Powell stated he never requested a meeting with the president, and all invitations came from the latter. He declined to comment on Trump retracting his threat to fire him and did not reveal whether he would remain a Fed governor after stepping down as chair.

LD Capital founder Jack Yi remains bullish on ETH, during which the price rose from $1,700 to $2,200. His analysis is mainly based on the following factors:

1) Ethereum’s foundational role in the crypto ecosystem and its Layer 1 development strategy;

2) The significant price correction from previous highs;

3) A large volume of short positions currently in the market;

4) The market influence of its ETF product as one of the major crypto assets.

Security firm SlowMist stated on X that Ethereum’s Pectra upgrade (EIP-7702) is now live — a major leap forward, but one that also introduces new risks. Here’s what users, wallet providers, developers, and exchanges should be aware of:

For users: Private key protection should always be a top priority. Users should be aware that contracts with the same address on different chains may not share the same code and understand the details of the delegation target before proceeding with any operations.

For wallet providers: Check whether the delegated chain matches the current network and warn users about the risks of using delegation signatures with chainID = 0, as these can be replayed across different chains. Plus, display the target contract when users sign delegations to reduce phishing risks.

For developers: Ensure proper permission checks during wallet initialization (e.g., use ecrecover to verify the signer address). Follow the namespacing convention outlined in ERC-7201 to prevent storage collisions. Do not assume tx.origin is always an Externally Owned Account (EOA), using msg.sender == tx.origin to guard against reentrancy is no longer effective. Ensure that delegated contracts implement necessary callback functions for compatibility with mainstream tokens.

For centralized exchanges: Monitor and verify deposits to mitigate risks of fake deposits originating from smart contracts.

A research institute from a cryptocurrency exchange released the latest report, “Web3 On-chain Data Interpretation”, providing a comprehensive overview of the Web3 on-chain ecosystem dynamics in April this year.

The data shows a clear segmentation in the on-chain ecosystem:

1) Solana maintains its top position with an average of over 93 million transactions per day, demonstrating strong activity levels.

2) Ethereum saw a net inflow of $904 million in a single month, ranking first across the network, with the market generally attributing this to growing ETF expectations.

3) Bitcoin’s on-chain performance also signals positive trends: large holders owning over 10,000 BTC have continued to accumulate, UTXO net growth has shifted from negative to positive, and on-chain activity is gradually recovering.

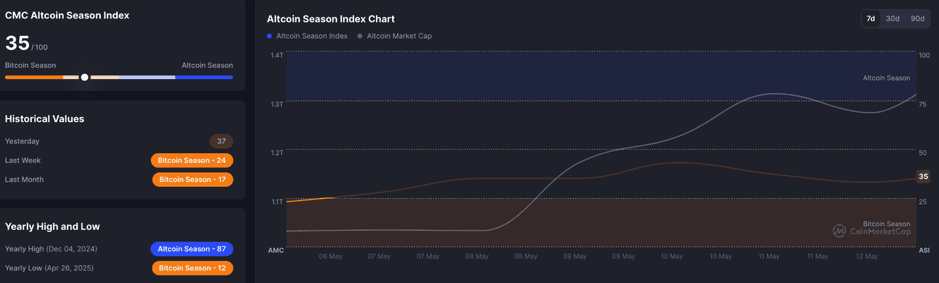

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

Altcoin Season Index: https://coinmarketcap.com/charts/

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

Fear & Greed Index, source: https://coinmarketcap.com/charts/

In recent days, the total market capitalization of cryptocurrencies, trading volume, market activity, and altcoin prices have all been increasing. ETF funds continue to see net inflows, and market confidence has largely been restored. The prices of major coins and large-cap altcoins are also continuing their upward trend. The current Fear and Greed Index stands at 73, approaching the top end of the recent market sentiment range.

3. Perpetual Futures

The 7-day cumulative funding rates for BTC and ETH on the top 9 exchanges are 1.0635% and 1.0092%, respectively, indicating that as of May 12, the market remains predominantly bullish, with the bull market continuing its progression.

4. Global Economic and Crypto Sector Developments

Macroeconomy

1) On May 8, the U.S. initial jobless claims for the previous week were 228,000, below the expected 230,000 and the previous value of 241,000.

2) On May 8, Bank of England Governor Bailey stated: Inflationary pressures are easing, which is why we are able to cut interest rates today; inflation in the UK continues to fall. After the last Monetary Policy Committee meeting, Bailey was very hesitant about the direction of interest rates, remaining firmly committed to the 2% inflation target.

3) On May 8, the Bank of England lowered its interest rate by 25 basis points to 4.25%, marking the fourth rate cut in this cycle.

4) On May 9, the U.S. Office of the Comptroller of the Currency (OCC) stated that banks may buy and sell crypto assets held in custody by clients and outsource related services.

5) On May 9, the U.S. and UK reached a trade agreement: retaining a 10% baseline tariff on the UK, expanding market access for both sides, removing tariffs on UK steel and aluminum, implementing 0% tariffs on U.S. agricultural products, and applying a tiered tariff on UK car imports.

6) On May 10, Trump posted on social media, stating that significant progress had been made in trade talks between the U.S. and China in Switzerland, and the two sides reached an agreement to “reset” their economic and trade relations.

7) On May 10, the Financial Times reported that the world’s largest financial institutions are reducing their holdings of U.S. dollar assets and increasing investments in the European market.

8) On May 10, Spain introduced Europe’s strictest cash controls: withdrawals over €3,000 must be declared 24 hours in advance.

9) On May 11, the CEO of CryptoQuant analyzed that Bitcoin has turned into a deflationary asset due to the Strategy purchases.

10) On May 11, China’s CPI year-on-year for April was -0.1%, as expected, and the previous value was -0.1%.

11) On May 11, it was reported that the U.S. would release its April CPI data next Tuesday. On Thursday, the U.S. will also release the weekly initial jobless claims, April retail sales month-on-month, and April PPI data.

Cryptocurrency Industry Updates:

1) On May 8, the Vice President of Digital Asset Research at Fidelity Investments stated that BTC's long-term performance has far outpaced traditional assets, offering strategic reserve value.

2) On May 8, U.S. medical company Wellgistics Health announced it would use XRP as a reserve currency and for real-time payment infrastructure.

3) On May 9, Andy from The Rollup Ventures disclosed that, due to Trump’s tariff policies, cryptocurrency funds are facing fundraising difficulties, except for a few institutions like Maven11 and Archetype.

4) On May 9, CZ stated that the inability to hold Bitcoin steadfastly often stems from a lack of understanding of technology, finance, and the world.

5) On May 9, Bloomberg reported that the G7 may discuss North Korea’s cryptocurrency attacks at the summit, involving billions of dollars.

6) On May 10, UAE state-owned oil giant Emarat announced it would accept cryptocurrency payments for gasoline through a partnership with Crypto.com.

7) On May 10, Loopscale released a post-hack report stating that all funds had been recovered and the refinancing feature would be resumed soon.

8) On May 10, DeFi platform Zaros announced it would cease operations due to depleted funds.

9) On May 11, the topic “Ethereum surged 40% in 3 days” topped Douyin’s trending list. 1confirmation’s founder stated that Ethereum’s rise signifies “the death of crypto VC.”

10) On May 11, The Kobeissi Letter analyzed that the Fed’s balance sheet reduction pace is slowing, with its current size reduced to $6.7 trillion.

Regulation & Crypto Policy:

1) On May 8, the U.S. Treasury Department planned to hold a closed-door roundtable with the crypto industry the following week. U.S. Vice President Vance was set to give a speech at the Bitcoin 2025 conference.

2) On May 8, the Texas Bitcoin Reserve Act SB 21 passed the DOGE committee review, with the final outcome expected in the next three weeks.

3) On May 8, Oregon passed SB 167, which clarifies the legal definition and standards for digital assets. Missouri may exempt capital gains tax on cryptocurrency and stock gains.

4) On May 9, Brazil’s B3 stock exchange planned to launch Ethereum and Solana futures.

5) On May 9, the U.S. SEC is exploring a tokenized securities registration exemption scheme to accelerate the application of distributed ledger technology.

6) On May 9, the Eurogroup President stated that the EU would strengthen the tracking of crypto transactions and incorporate them into anti-money laundering regulations.

7) On May 10, U.S. Treasury Secretary Janet Yellen stated that cryptocurrency must thrive globally, requiring U.S. leadership.

8) On May 10, Coinbase released over 10,000 pages of government communication documents, revealing that the U.S. SEC was aware of regulatory gaps early on.

9) On May 10, Arizona’s new crypto reserve bill could seize “long-term dormant” crypto assets.

10) On May 11, stablecoin legislation encountered obstacles in the Senate, with U.S. Democratic lawmakers accusing TRUMP token activities of corruption. U.S. senators urged the Treasury Department and the DOJ to investigate Binance’s ties with Trump.

11) On May 11, BlackRock met with the U.S. SEC to discuss crypto ETF staking and options trading issues. BlackRock updated its Ethereum ETF application, including “physical redemption” and quantum computing risk disclosures.

12) On May 11, Vietnam launched the Layer1 blockchain 1Matrix to enhance digital independence.

Other News:

1) On May 8, IBM’s CEO announced that AI had replaced hundreds of human resources employees.

2) On May 8, Trump proposed a new tax bracket of 39.6% for individuals with an annual income of at least $2.5 million, or couples earning $5 million, which faced opposition from within the U.S. Republican Party.

3) On May 9, Musk’s AI company xAI was negotiating a new round of funding, with a valuation of $120 billion.

4) On May 9, ChatGPT launched a deep code analysis feature for GitHub.

5) On May 10, Ukrainian President Zelensky announced that Ukraine was ready to immediately initiate a 30-day ceasefire.

6) On May 10, Microsoft founder Bill Gates announced that he would donate most of his personal wealth to the Gates Foundation, setting a goal to spend over $200 billion on charity before the foundation ceases operations in 2045.

7) On May 11, Trump stated that, under U.S. mediation, India and Pakistan had agreed to a full and immediate ceasefire.

5. Market Outlook

From May 15 to May 21, the medium-term trading strategy will still be applied: for the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900, respectively. It is recommended to place a sell order for the ETH spot at $5,125 and set buy orders for bottom-fishing at $1,240.

On May 9, Matrixport shared its weekly market report as follows:

Over the past 18 months, global monetary policy has greatly influenced the capital flow into crypto assets. With interest rates remaining high, traditional investors have begun to reassess their risk allocations, making the Fed’s policy communication particularly important.

The minutes of the November FOMC meeting, released on December 7, 2024, broke market expectations of four rate cuts in 2025, lowering the rate cut expectations to two.

On-chain data reveals the level of market divergence. Bitcoin’s market dominance (calculated by its share of the total market cap of all cryptocurrencies) has increased from 49% at the beginning of the ETE era to the current 64.5%, a level not seen since the DeFi boom of 2021. This trend has led to the highest risk-adjusted returns in core indicators of digital assets, reflecting a preference for quality assets.

Retail investor sentiment remains sluggish, with trading volumes on CEXs and DeFi protocols dropping to multi-year lows. Due to the lack of a clear market trend—there are no new disruptive DeFi applications, no major breakthroughs in Layer-2 technology, nor a widespread meme coin craze—retail investors generally continue to stand on the sidelines. Summer in the Northern Hemisphere typically exacerbates this trend, as vacation seasons lead to a reduction in trading activity. Since December 2024, discussions on social media about altcoins have decreased by over 40%, while discussions related to Bitcoin remain high, reflecting sustained market interest in Bitcoin as a macro hedge asset.

In the absence of major catalysts, sentiment-driven rallies in altcoins are difficult to form. Given the unfavorable technical, macroeconomic, and market structure factors for altcoins, the clearest tactical stance is to maintain long positions in Bitcoin through spot or perpetual futures, using altcoin perpetual futures as a hedging tool. The funding rate for altcoin perpetual contracts remains low.

On May 11, analyst 2Lambroz suggested that the altcoin season might be upon us, but noted that market dynamics have shifted. “People want to buy, but they lack confidence in any strong narratives,” he pointed out. Unlike 2021, there are currently no signs of retail investors entering the market. Traders are turning their positions over quickly, with little motivation to hold long-term positions.

Technical trader Moustache was more optimistic, sharing a chart showing that altcoins have repeatedly gone through accumulation phases before experiencing explosive growth. According to his analysis, the current structure is similar to that of 2016 and 2020. “The 2025 altcoin season has officially begun.” However, skeptics remain. Commentator Rekt Fencer pointed out that most altcoins have dropped by 90% since December of last year. A small 10% rebound this week has triggered excessive optimism, prompting him to mock the rally. “This is the altcoin golden age we’ve all been waiting for.”

CryptoQuant analyst Burak Kesmeci indicated that since February 24, 2024, CryptoQuant’s bull-bear market cycle indicator has been signaling a bear market. However, in recent days, the indicator has begun to show signs of a potential trend reversal. With Bitcoin returning above $100,000, the indicator has issued a bullish signal for the first time in several weeks. While this signal remains weak (with a coefficient of 0.029), its positive shift is seen as an encouraging sign. More importantly, the 30-day moving average (30DMA) of the bull-bear indicator has started to rise. If this indicator crosses above the 365-day moving average (365DMA), historical data suggests that Bitcoin may once again experience a parabolic rally.

Risk Reminder: The cryptocurrency market is highly volatile, and investors are advised to control their positions and implement stop-loss strategies. The above content is for reference only and does not constitute specific investment advice from this exchange.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.