FameEX Daily Market Trend | BTC Holds $87K as ETH Structure Stabilizes and Markets Price in December Rate Cut

2025-12-01 07:22:56

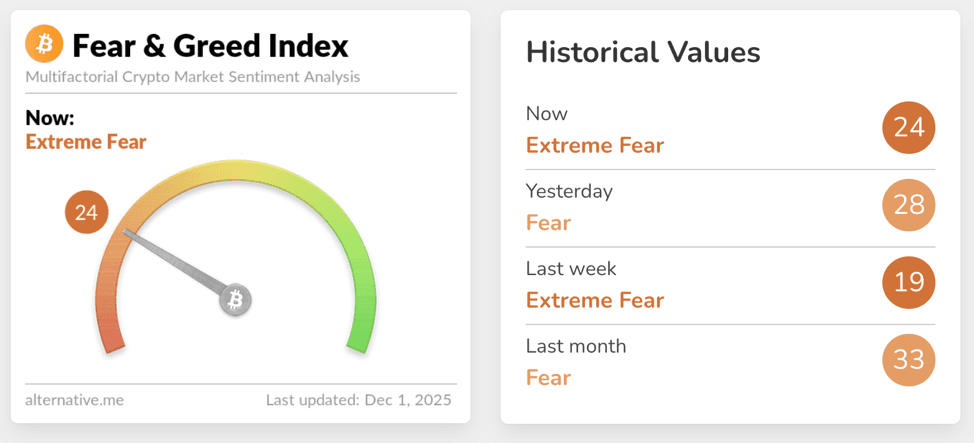

As the Fear & Greed Index fell again to 24, returning to Extreme Fear, BTC continued to fluctuate around the $87K area after a roughly 30% drawdown from its peak. A clear divergence has emerged between safe-haven and risk-oriented assets that U.S. equities and precious metals rebounded on strengthening rate-cut expectations, while the crypto market remained in a phase of deleveraging and confidence repair. ETF flows and options structures indicate that although institutions have started buying dips, they remain highly sensitive to near-term downside risks. The broader market resembles a prolonged structural rebalancing rather than the start of a new bullish trend.

1. Market Summary

- BTC has declined approximately 36% from its all-time high and is currently oscillating within the $86K–$88K range. The annualized futures basis remains near 4%, below the neutral 5–10% zone, signaling weak appetite for leveraged longs.

- ETH has repeatedly lost the $3,000 level, attempting to defend around the $2.9K area. Having fallen more than 20% over the past 30 days, ETH still shows no signs of overheating as stablecoin yields stay near 3.9 – 4.5%, and technical signals suggest a potential retest of the $3,200 resistance.

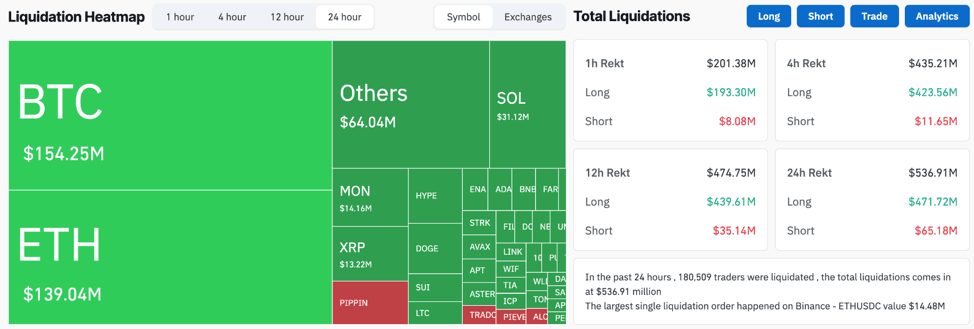

- The Fear & Greed Index dropped to 24 today, sliding from yesterday’s “Fear” back into “Extreme Fear.” Combined with roughly $217M in liquidations over the past hour that were dominated by long-side wipeouts, the data reflects continued forced deleveraging among long-term leveraged positions.

- On the macro front, the probability of a 25-bp rate cut in December has risen to around 87%. Markets generally expect the December FOMC meeting to mark a key policy turning point, pressuring the dollar while supporting gold, silver, and growth assets.

- Several risk narratives are re-emerging, including Tether’s forceful response to ratings-related FUD, expectations for a Chainlink spot ETF, the official launch of Cocoon which is a decentralized AI computation network within the TON ecosystem and renewed institutional focus on RWA and regulatory-aligned infrastructure projects such as Rayls. These developments may lay the groundwork for subsequent capital rotation.

2. Market Sentiment / Emotion Indicators

Market sentiment entered a blood-red state of Extreme Fear today, with the Fear & Greed Index dropping again from 28 to 24. This reflects a rapid contraction in risk appetite following consecutive market drawdowns. From a behavioral-finance perspective, such readings typically occur when leverage cleansing is still incomplete, investors lose conviction in near-term direction, and liquidity providers deliberately reduce exposure. This environment indicates that sentiment has shifted into a phase characterized by persistent bottom probing and muted reactions to positive catalysts, driven jointly by price pressure, macro uncertainty, and weakened technical structure rather than a clear reversal phase or the final stage of capitulation.

Source: Alternative

Over the past 24 hours, liquidations were particularly notable, totaling $537M, with long-side liquidations overwhelmingly dominant at $472M. Short liquidations amounted to only about $65M, highlighting a pronounced long-wipeout dynamic. BTC recorded $154M in daily liquidations, ETH saw $139M, and mid-large assets such as MON, XRP, and SOL also posted significant liquidation volumes. This high-intensity flush of long positions occurred as prices failed to reclaim critical levels such as BTC at $90K and ETH at $3,000, creating a synchronized expansion in both fear and liquidation magnitude.

Source: Coinglass

At the macro level, the central driver this week remains the rapid shift in Federal Reserve policy expectations. The probability of a 25-bp rate cut in December has climbed to roughly 87%, pressuring the dollar and real yields, and supporting gold, silver, and U.S. equity liquidity. Yet crypto has not rebounded in parallel, reflecting lingering sensitivity to prior leverage buildup, stalled ETF inflows, and structural sell-side pressure. Meanwhile, developments such as the anticipated Chainlink spot ETF, the launch of TON’s Cocoon decentralized AI compute network, and Tether’s response regarding reserve quality dominated today’s on-chain and project-level headlines. Although these catalysts have not immediately translated into price momentum, they strengthen the foundation for a potential narrative rotation heading into year-end and early next year, providing medium-term structural resilience even under prevailing fear and liquidation stress.

3. BTC & ETH Technical Data

3.1 BTC Market

Following several weeks of decline, BTC is largely holding within the $86K–$88K band and has yet to reclaim the $90K psychological threshold or the dense liquidity zone above $93K. Technically, the market remains in a post-downtrend consolidation phase. On the derivatives side, the main monthly futures contracts show an annualized basis of roughly 4%, down sharply from prior highs and aligned more with a conservative-neutral stance rather than typical bull-market premiums. This reflects hesitancy among professional traders to add leveraged long exposure.

In spot and ETF flows, BTC spot ETFs ended a four-week streak of sustained outflows following the Thanksgiving period, recording approximately $70M in modest net inflows this week. This signals more of a slowdown in sell pressure than a full recovery in risk appetite. On-chain indicators, including mining and network security metrics, remain elevated, suggesting no structural deterioration despite price weakness. Overall, as long as BTC holds the $85K–$86K short-term support range, the market is more likely to engage in time-based consolidation under extreme fear and gradually improving macro liquidity. The key near-term inflection lies in whether BTC can reclaim and stabilize above $90K, thereby reversing the current bearish pricing in options and ETF positioning.

3.2 ETH Market

ETH has underperformed BTC during this drawdown, falling around 21% over the past 30 days and repeatedly losing the $3,000 level before attempting to stabilize near $2.9K. The ETH and BTC weekly structure is approaching its first potential bullish ribbon flip since 2020, suggesting improving medium-term relative strength. Stablecoin yields across major lending markets remain low at roughly 3.9 to 4.5%, far below levels historically associated with market overheating, indicating a lack of excessive leverage or FOMO and allowing room for structural recovery in high-beta assets such as ETH.

After three consecutive weeks of large net outflows totaling about $1.74B, spot ETH ETFs finally recorded a net inflow of approximately $312.6M this week, marking a potential peak in institutional selling and the return of selective long-term allocation. Technically, $3,200 remains the pivotal resistance level. A retest and breakout supported by ETF flows and improving macro risk appetite would signal that the corrective phase since October is transitioning from directional decline to structural repair. Therefore, ETH appears to be in a valuation-narrative mismatch correction period, with low stablecoin yields, ETF inflow recovery, and reduced BTC correlation supporting medium-term rebound potential which assuming December rate-cut expectations do not undergo a disruptive repricing.

4. Trending Tokens

- REVA (Reveel)

$REVA has gained market attention due to the underlying narrative of Reveel’s universal peer-to-peer payment network. The Reveel App enables multi-wallet, multi-chain, and multi-stablecoin P2P transfers, utilizing identity tools such as Pay(ID) to abstract blockchain complexity from end users. In today’s environment of Extreme Fear and widespread deleveraging, infrastructure capable of supporting seamless cross-chain and cross-currency payments for individuals, businesses, and future AI agents carries both medium-term narrative potential and real utility optionality. The launch of the initial airdrop eligibility checker sharply increased engagement among early users, boosting short-term trading activity and volatility. Over time, however, if Reveel establishes meaningful share in multi-chain stablecoin payments, $REVA valuation will shift from airdrop-driven speculation toward metrics such as network scale and fee capture, characteristics that typically offer high-beta performance during macro liquidity recoveries.

- RLS (Rayls)

Within the Rayls blockchain ecosystem, the core value proposition lies in providing institutions with a regulatory-aligned, privacy-preserving, and interoperable base layer combining private banking subnetworks with a public-chain environment. Banks can deploy Rayls nodes locally for private transactions and then connect to the public chain for regulated asset issuance and global distribution. Recent reports regarding Tether’s investment in Rayls’ core developer have refocused attention on the narrative of stablecoin issuer and compliant chain infrastructure. Against the backdrop of expanding demand for RWA tokenization, CBDC payment rails, and cross-border settlement, enterprise-grade privacy and scalability increase the likelihood of institutional pilots and regulatory interest. For the $RLS token, this implies that long-term demand will be driven not by retail speculation but by institutional deployment and settlement requirements, positioning it as a potential beneficiary of structural capital rotation even under current risk-averse market conditions.

- BILL (Billions Network)

Billions Network aims to build a trusted digital identity verification infrastructure for humans and AI agents. Its core mandate is to enable scalable and privacy-preserving identity authentication through cryptographic techniques such as zero-knowledge proofs, without exposing sensitive data. The token model features a fixed total supply of 10B $BILL with zero inflation, allocating approximately 32% to the community, 25% to contributors, 18% to the foundation, 15% to investors, and 10% to ecosystem development to reinforce a “community-first” distribution philosophy. As discourse intensifies around AI agents, biometric verification, and identity-layer protocols, markets are increasingly recognizing the strategic importance of a verifiable, platform-agnostic identity layer for human-AI interactions. While short-term action in $BILL may remain influenced by airdrops, unlocks, and sentiment cycles, medium-term value will depend on whether it becomes a widely adopted identity standard across chains and applications.

5. Today Token Unlocks

- $EIGEN: Unlocking 38.35M tokens, with 8.65% of circulating supply.

- $DYDX: Unlocking 4.17M tokens, with 0.52% of circulating supply.

- $ZETA: Unlocking 44.43M tokens, with 3.97% of circulating supply as the largest unlock today.

- $HOOK: Unlocking 8.33M tokens, with 2.75% of circulating supply.

- $MAV: Unlocking 20.37M tokens, with 2.70% of circulating supply.

6. Conclusion

The crypto market has entered a classic phase characterized by large price drawdowns, ongoing sentiment cleansing, and a macro backdrop gradually shifting toward easing. On one hand, the Fear & Greed Index remains entrenched in Extreme Fear, options markets continue to price downside protection, and liquidations remain concentrated on the long side, confirming continued unwinding of leveraged and sentiment-driven positions. On the other hand, the sharp rise in December rate-cut expectations, easing pressure on the dollar and real yields, alongside the transition of BTC and ETH ETFs from net outflows to net inflows and persistently low stablecoin yields, together create necessary conditions for structural repair. Whether BTC can defend the $85K–$86K support zone and reclaim $90K, and whether ETH can complete a structural rebound toward $3,000–$3,200, will determine if the correction evolves into a mid-term consolidation or extends into deeper retracement. Meanwhile, stablecoin-related, RWA-infrastructure, and identity-layer AI tokens continue drawing narrative attention, signaling that institutional and long-horizon capital is shifting from price chasing to allocating into assets aligned with future regulatory and macro frameworks. For traders, respecting the ongoing repricing of risk to avoid excessive short-term greed under Extreme Fear while adjusting leverage and exposure guided by ETF flows and options structure, it’s better to remain essential in preparing for any structural upside emerging early next year.

Disclaimer: The information provided in this section is for reference only and does not represent any investment advice or the official views of FameEX.