FameEX Daily Market Trend | BTC Stabilizes Near $90K as ETH Derivatives Remain Defensive

2025-12-03 06:48:38

After retracing nearly 30% from the October all-time high near $126K, BTC has recently stabilized around $90K, with price action oscillating narrowly near $91K during today’s major trading sessions. The market remains in a mid-cycle correction following the prior one-way advance. Meanwhile, ETH has reclaimed and held the $3K region under the combined influence of the Fusaka upgrade and expectations of macro easing, yet the overall setup remains conservative. Futures premium, options skew, on-chain fee trends, and DEX volumes all suggest that no trend-level re-leveraging has occurred. At the macro level, markets have largely priced a December FOMC rate cut as a foregone conclusion, with the Federal Reserve ending quantitative tightening and Fed funds futures implying over 80% probability of easing. Although this has supported sentiment in risk assets, deleveraging and structural rebalancing across crypto markets remain ongoing.

1. Market Summary

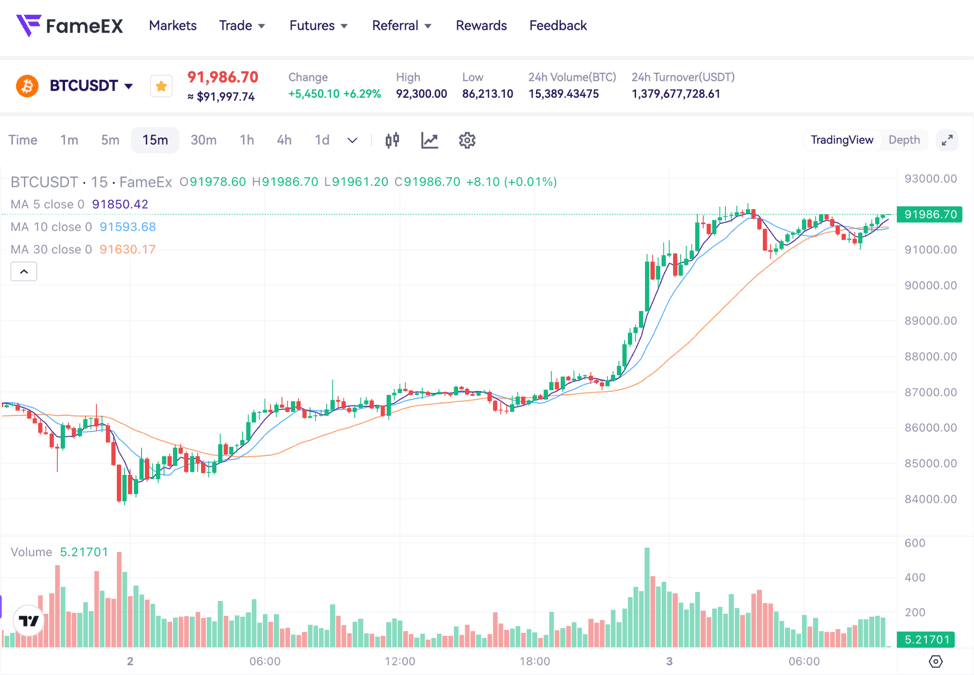

- BTC fluctuated near $91K across major spot and perpetual venues, rebounding notably from yesterday’s $86K low, yet still down roughly 30% from the $126K high in October, remaining within a high-level corrective range.

- ETH regained and held the area near $3K before and after the Fusaka upgrade, rising around 7–8% over the past two days. However, the two-month futures premium remains only about 3%, well below the 5–10% seen in healthier bull markets, indicating limited willingness to add leveraged long exposure.

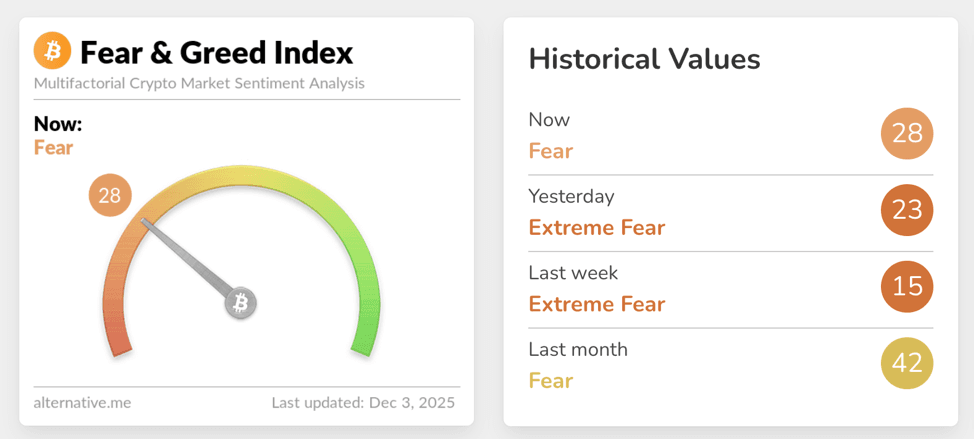

- The Fear & Greed Index has recovered from last week’s Extreme Fear reading of 15 to 28 today, shifting from “Extreme Fear” to “Fear,” though overall risk appetite remains far below levels seen during the October peak.

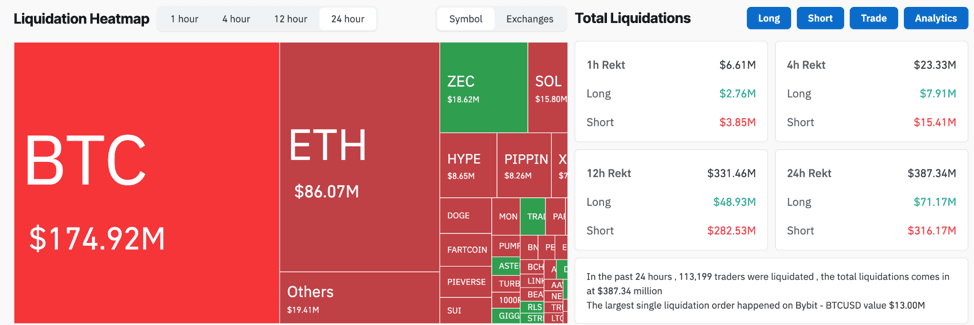

- Total liquidations over the past 24 hours reached roughly 387 million dollars, including about 316 million dollars in short liquidations, which is substantially above long liquidations of approximately 71.16 million dollars. This indicates significant short-side squeeze activity in a high-volatility environment, while a whale transaction moving 900.83 BTC (about 826 million dollars) also drew market attention.

- ETH futures volume has surpassed BTC for the first time on a major regulated futures exchange, with ETH options implied volatility exceeding BTC. Meanwhile, progress toward an EU-compliant euro-denominated stablecoin has made the ETH derivatives cycle and regulated stablecoins key intersecting narratives in the current mid-term landscape.

2. Market Sentiment / Emotion Indicators

The Fear & Greed Index has climbed from 15 (Extreme Fear) to 28 over the past two weeks, shifting one tier higher to “Fear.” This reflects that liquidation pressure has eased following sharp corrections and deleveraging, yet investor sentiment has not returned to neutral that let alone greed. This gradual recovery from extreme pessimism typically coincides with spot-based dip-buying and incremental accumulation from long-term capital. Short-term traders, however, continue to maintain low leverage, and the market remains cautious regarding whether the rebound can transition into a new trend. Discussions surrounding potential December event risk or whether BTC could retest levels below $80K remain elevated, underscoring sustained risk premia.

Source: Alternative

In terms of leverage and liquidation structure, data shows that total liquidations over the past 24 hours reached approximately 387 million dollars, with short liquidations of around 316 million dollars far exceeding long liquidations of roughly 71.16 million dollars. The largest individual liquidation, around 13 million dollars in a BTC perpetual contract, occurred on a major derivatives platform. Following multiple intense volatilities since November, short-dated implied volatility has risen well above long-dated tenors, while options skew shows far-dated tenors maintaining a modest bullish bias and near-dated tenors heavily stacked with puts. Significant open interest has accumulated around the $84K and $80K strikes for BTC’s late-December expiries, reflecting pricing of potential year-end downside risk. Meanwhile, aggregate crypto derivatives open interest remains in the hundred-billion-dollar range, indicating that capital has not exited, but is instead undergoing structural reallocation within a high-volatility regime.

Source: Coinglass

At the macro level, the Federal Reserve formally ended quantitative tightening on December 1 and reinvested maturing MBS into Treasuries, providing modest support to short-term liquidity. At the same time, the CME FedWatch tool places the probability of a December rate cut in the 80–90% range, with several major research desks pulling forward expectations for the first rate cut to December. Nevertheless, prominent investors and traders emphasize that even if the Fed delays or avoids cutting rates, the long-term structure of BTC remains largely unaffected, noting that recent price action reflects high-level froth compression and derivatives repricing rather than a reversal of the broader macro narrative. On the regulatory front, Qivalis, which is a consortium of ten European banks, is working toward launching a MiCA-compliant euro stablecoin by 2026, while U.S. policymakers aim to implement stablecoin legislation by 2026. Together, these frameworks are likely to shape the liquidity architecture and capital pathways of the crypto market in the coming years.

3. BTC & ETH Technical Data

3.1 BTC Market

BTC is currently fluctuating near $91K. On the daily chart, the asset has staged a 5–6% rebound from the early-December low near $86K, yet remains substantially below the October all-time high above $126K. This resembles a second-stage deleveraging phase within a high-level range rather than a full bearish reversal. Options data indicate a significant concentration of put open interest at the $84K and $80K strikes for late-December expiries. Many professional traders are using put purchases or put spreads to hedge year-end volatility, and the skew curve remains downward-sloping, reflecting continued pricing of downside risk. Short-dated implied volatility (1-week to 1-month) also exceeds long-dated IV, implying expectations of further volatility episodes surrounding the FOMC meeting, presidential statements, and macro releases.

On-chain data shows that 900.83 BTC (around 826 million dollars) were transferred from a major custodial address to an anonymous wallet today, prompting discussion around potential OTC flows or sale intentions. However, subsequent wallet activity and exchange netflows have yet to show evidence of concentrated sell pressure. Meanwhile, some large corporate holders raising dollar liquidity through equity sales, which is reducing the possibility of forced BTC selling, has eased concerns about balance-sheet-driven liquidation cascades. The $80K region is therefore regarded as a key psychological and options-defined support zone. In terms of technical and derivatives structure, short-term overhead resistance lies between $93K–$95K. Without a decisive breakout ahead of the Fed meeting, BTC is likely to continue oscillating within the broader $80K–$95K range while rebuilding positioning.

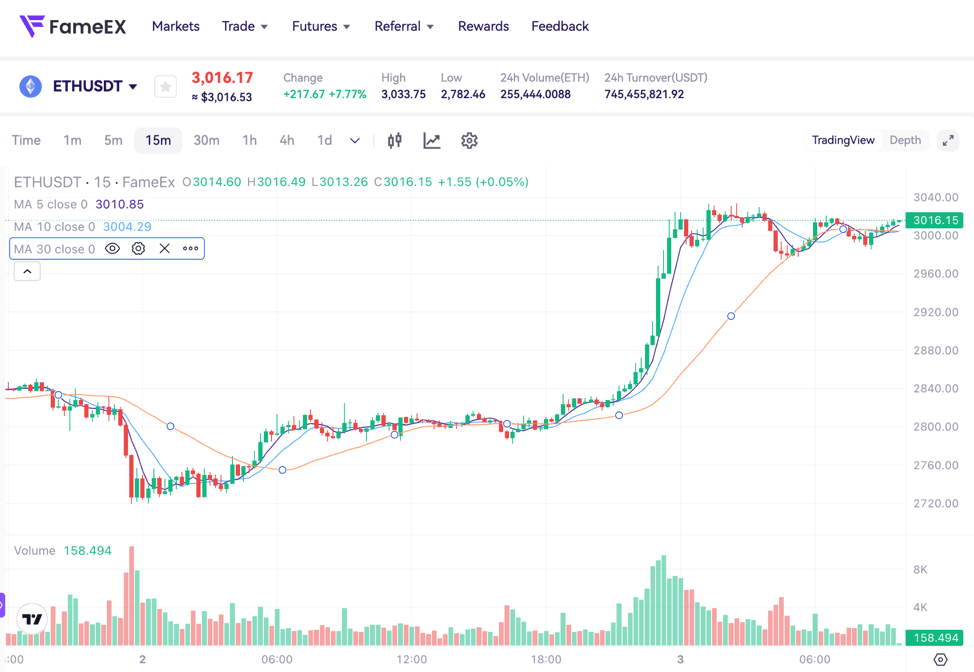

3.2 ETH Market

ETH has shown relative strength after a roughly 7% single-day rebound, trading and consolidating within the $3K–$3.01K zone under the momentum of the Fusaka upgrade and macro-easing expectations. However, from a derivatives standpoint, the annualized premium of ETH monthly futures relative to spot remains only about 3%, below the 5–10% often seen in healthier bull cycles. This implies that leveraged long exposure has not expanded meaningfully.

Over the past four weeks, weekly Ethereum fees have fallen from roughly 5.1 million dollars to 2.6 million dollars, a nearly 49% decline. Concurrently, DEX volumes have dropped from the 36.2 billion dollar peak to roughly 13.4 billion dollars, indicating a cooldown in DeFi activity and speculative leverage. Notably, competing chains such as Tron and Solana have seen their seven-day fees rise around 9% during the same period, suggesting migratory user behavior toward ecosystems offering lower fees and better throughput. This is pressuring ETH’s role as the primary blockspace pricing layer.

While the Fusaka upgrade brings material improvements in data availability, Rollup integration, and wallet experience, which is laying the groundwork for L2 scaling and settlement-layer evolution, the near-term demand environment remains soft. As such, the upgrade appears more like infrastructure preparation for the next cycle rather than an immediate catalyst for reversing fee or revenue trends. Additionally, a dormant ETH whale recently transferred 40,000 ETH, raising concerns about potential selling. The $2.8K–$2.9K band thus serves as near-term support, while the $3.2K–$3.3K zone represents critical structural resistance that must be reclaimed to validate sustained upside.

4. Trending Tokens

- ZEC (Zcash)

ZEC has regained attention as a long-standing privacy-focused L1 project during the current market adjustment as the balance between privacy narratives and regulatory alignment evolves. Zcash employs zero-knowledge proofs to offer optional shielded transactions, allowing users to access higher degrees of privacy on a public blockchain while maintaining a fixed 21 million supply and a Bitcoin-like halving schedule. With multi-chain wallets and trading terminals now supporting wrapped ZEC on Solana, the asset is no longer confined to a standalone privacy chain but has begun participating in broader liquidity networks across DeFi and derivatives venues. Amid tightening regulations on privacy coins, ZEC’s established cryptographic design, long-term community, and transparent governance position it as one of the few assets capable of surviving regulatory filtration. This serves investors seeking limited exposure to privacy demand during high-volatility regimes.

- DASH (Dash)

DASH represents a long-standing payments-oriented narrative, having been designed from inception for daily transactional use with faster confirmation times, lower fees, and a decentralized governance and treasury system. During the recent broad-market pullback, the market has reassessed whether established payments L1s with real-world utility can capture share in the next phase of regulated crypto payments infrastructure. Dash’s recent long-term strategic partnership with Zebec integrates DASH as the 19th chain supported by its multi-chain payments stack, enabling InstantSend functionality for near-real-time payroll and card-loading operations. This broadens DASH’s practical payment footprint, particularly across use cases such as on-chain payroll, cross-border payments, and high-value spending. For investors seeking payment-driven narratives supported by cash-flow potential, DASH increasingly resembles a payments infrastructure token rather than a purely speculative asset.

- TNSR (Tensor)

TNSR represents the professional-grade NFT liquidity infrastructure narrative within the Solana ecosystem. Recent developments include the Tensor Foundation’s acquisition of Tensor Marketplace and Tensorians, directing 100% of marketplace fees to the TNSR treasury while burning 21.6% of unvested supply and re-locking vested allocations for an additional three years, which is tightening alignment between protocol revenue and token value. Amid depressed NFT volumes and margin compression across most marketplaces, Tensor is pursuing a combined “protocol + marketplace” model, operating on an open-source, community-governed framework. As a result, TNSR functions more like an NFT liquidity infrastructure index token for Solana than a simple liquidity-mining asset. With Solana continuing to attract attention across derivatives, meme assets, and NFTs this cycle, governance tokens with clear revenue pathways and deflationary mechanics may remain favored by structural long-only capital should risk appetite rotate back toward high-beta segments.

5. Today Token Unlocks

- $CHEEL: Unlocking 2.67 million tokens, with 4.70% of the circulating supply.

- $BDXN: Unlocking 31.97 million tokens, with 19.96% of the circulating supply as the largest unlock today.

6. Conclusion

The market’s core theme is one of defensive rebalancing during a sentiment recovery. The Fear & Greed Index has rebounded from Extreme Fear, indicating that some of the forced selling and capitulation pressure has eased, though risk appetite remains far from neutral. On the leverage perspective, short liquidations far exceeded long liquidations over the past 24 hours, turning short-side chasing into fuel for the rebound, while significant put positioning at $84K and $80K highlights continued downside hedging among professional participants. At the macro level, the Fed’s end to quantitative tightening and elevated December rate-cut probabilities offer medium-term liquidity support, though markets remain unconvinced that easing alone can reignite the type of parabolic advance seen earlier in the cycle.

For ETH, despite support from the Fusaka upgrade and increased derivatives activity, weakening fees, declining DEX volumes, and rising fees on competing chains emphasize the need to treat the upgrade as a long-term infrastructural step rather than a near-term demand catalyst. Taken together with today’s whale flows, the advancement of regulated stablecoin frameworks, and the strengthening of privacy, payments, and NFT infrastructure narratives, capital has not exited crypto markets. Instead, it is shifting from broad Beta exposure toward more selective pricing of structural resilience, sustainable revenue, and narrative durability. In this environment, portfolio pacing, risk hedging, and disciplined volatility management carry greater importance than directional conviction alone.

Disclaimer: The information provided in this section is for reference only and does not represent any investment advice or the official views of FameEX.