FameEX Today’s Crypto News Recap | February 4, 2026

2026-02-04 06:42:13

Ethereum’s shift toward native rollups, progress on US government funding, and a broad liquidation wave set the tone for crypto markets, reinforcing deleveraging, liquidity repair, and defensive positioning. Crypto markets stayed in a defensive posture as positioning adjusted to a sharp liquidation cycle and renewed macro sensitivity, keeping flows focused on liquidity, hedging, and risk trimming rather than directional conviction. Across majors, participants treated spot as a reference while expressing views through derivatives, with intraday volatility driven more by forced de-risking and basis resets than by organic demand. The session’s price action looked less like a trend shift and more like a mechanical repricing of leverage, with risk appetite remaining subdued and attention rotating toward funding stability, liquidation pockets, and cross-asset signals that can tighten or relax credit conditions.

Crypto Markets Overview

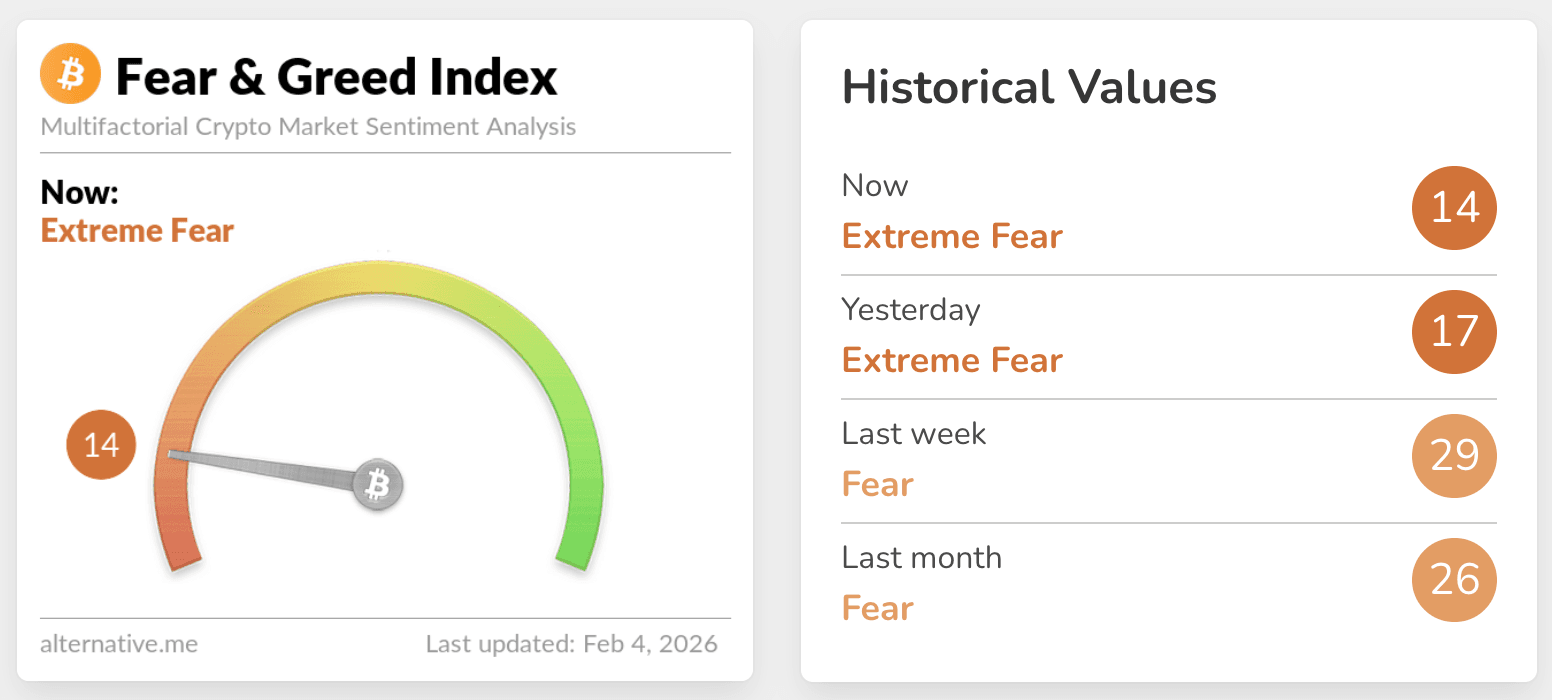

With the Crypto Fear & Greed Index at 14, the market remained in Extreme Fear. This reflects a cautious regime where traders prioritize capital preservation, lower exposure, and cleaner collateral management over chasing rebounds. Bitcoin continued to function as the market anchor, absorbing defensive allocations as participants parked in the most liquid benchmark while waiting for volatility to compress and for leverage to reset. Ethereum, by contrast, looked constrained by its derivatives leverage structure, as hedging activity and liquidation sensitivity shaped intraday behavior and limited follow-through even when spot stabilization. Crypto sector performance also reflected selective risk-taking, with relative firmness concentrated in narratives that can attract tactical flow even in drawdowns, while most broader beta exposures faded as traders reduced gross and refocused on execution quality.

Source: Alternative

BTC and ETH Market Structure and Liquidity Dynamics

BTC traded through key liquidity zones with $73K acting as a visible stress point and $76K as a near-term reference area where bids and short-covering intermittently stabilized tape, but follow-through remained thin as participants avoided paying up into resistance. The past 24 hours saw total liquidations of USD 754 million, dominated by long liquidations of USD 549 million versus short liquidations of USD 205 million, underscoring that the move was driven by leveraged long flushes rather than aggressive short pressure. Within that, BTC liquidations were concentrated around USD 223 million on longs and USD 49.777 million on shorts, aligning with the observed lack of upside continuation once forced selling eased. ETH showed a similar pattern, with long liquidations of USD 213 million and short liquidations of USD 83.8679 million, reinforcing that ETH’s path was shaped by leverage unwind and hedging demand, not by persistent spot accumulation. The market read as range organization after a leverage-driven displacement, where buyers required cleaner inventory and tighter funding conditions before re-engaging, keeping price action reactive to liquidation pockets and key levels rather than momentum.

Key News Highlights:

Ethereum Scaling Narrative Shifts Toward Native Rollups

Ethereum’s scaling conversation moved as Vitalik Buterin signaled a pivot away from the older assumption that L2s should be the primary scaling path, emphasizing that many L2 designs have not fully inherited L1 security and decentralization properties. For market structure, this matters because it reframes how participants assess long-term execution risk, bridge trust assumptions, and the distribution of economic activity across L1 and L2 environments. In a leverage-sensitive tape, narrative shifts like this can influence positioning in ETH-linked exposures by changing how traders price ecosystem cohesion, fee dynamics, and the credibility of future throughput improvements.

US Government Funding Deal Reduces Near-Term Policy Overhang

US lawmakers advanced a funding package expected to reopen most government functions, reducing a near-term policy overhang that can spill into risk assets through volatility in rates, data timing, and broader sentiment. For crypto markets, the relevance is indirect but practical, as clearer administrative continuity can stabilize the cadence of macro releases and policy processes that traders use to calibrate exposure. The result is not an immediate bullish impulse, but a modest reduction in uncertainty that can help liquidity providers reprice risk and tighten spreads, especially when markets are already navigating a leverage unwind.

Recent Market Volatility Triggers Broad Liquidation Wave Across Crypto

A renewed bout of cross-asset volatility triggered a large liquidation wave in crypto, reinforcing that recent price action has been driven as much by leverage mechanics as by discretionary risk-taking. As risk sentiment weakened across major markets, forced deleveraging became a primary transmission channel, tightening liquidity conditions and amplifying intraday moves through liquidation cascades and basis repricing. For market structure, the key takeaway is that positioning has become more sensitive to macro-driven risk-off impulses, pushing traders to prioritize margin efficiency, reduce directional leverage, and focus on execution around liquidity pockets rather than attempting to chase short-term rebounds.

Trending Tokens:

- $ELON (Echelon Market)

ELON token is gaining strong market attention following its live launch on the Aptos network, marking Echelon’s formal transition toward decentralized ownership and governance. The token introduction is positioned as the next phase of Echelon’s evolution after establishing itself as a core lending and money market layer across multiple Move based ecosystems. Market focus has centered on the airdrop activation and the opening of claims, which directly engage early users, points holders, and aligned ecosystem participants. The project narrative emphasizes long term alignment through structured distribution and emission design rather than short term liquidity extraction. Investor interest is further reinforced by Echelon’s prior seed financing led by a major digital asset trading firm and its history of partnerships across lending, stablecoin yield, and cross chain deployments. ELON is framed as a governance and coordination asset rather than a standalone speculative instrument. This positioning has made the token a focal point for participants tracking the maturation of DeFi infrastructure.

- $KIN (Kindred Labs)

KIN has entered active market circulation following its listing across a major exchange’s Alpha and decentralized exchanges, triggering heightened visibility within the social and agent focused AI narrative. The launch is closely watched due to the project’s emphasis on decentralized AI companions built around well-known intellectual properties spanning Web2 and Web3 domains. Market participants are focusing on the confirmation of the official contract address and the staged opening of claims, which underscores an effort to manage security risks during early distribution. Kindred’s positioning blends social interaction with autonomous agent design, aligning with broader interest in emotionally responsive AI systems. The project narrative highlights a shift from experimental AI tooling toward consumer facing applications with recognizable IP anchors. This combination has contributed to rapid attention concentration around the token. KIN is therefore being tracked as a representative asset within the emerging social AI and agent economy segment.

- $MGO (Mango Network)

MGO has attracted trading driven attention amid an ongoing competitive campaign that has increased short term participation across supported venues. Beyond the trading activity, market interest is tied to Mango Network’s positioning as a multi virtual machine Layer 1 infrastructure focused on addressing liquidity and user experience fragmentation. The project narrative emphasizes interoperability by combining modular stack design. Observers are evaluating Mango Network as an infrastructure layer aimed at unifying application deployment across heterogeneous blockchain systems. The competitive trading event has served as a catalyst to surface the token within broader market discussion. Attention is also supported by the project’s focus on cross chain communication and developer friendly architecture. MGO is being monitored as an infrastructure play aligned with long term scalability and composability themes.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.