FameEX Weekly Market Trend | September 5, 2025

2025-09-05 05:50:01

I. Core Market Overview

1. BTC Spot Performance

Price Range: [ 107,239.85 ] USD - [ 113,512.74 ] USD

Weekly Volatility: [5.85]%

(Calculation Formula: (High − Low) / Low × 100%)

Key Driving Factors:

Primary Factor: [Policy Events / Macro Data]

Secondary Factor: [On-chain Activity, Market Sentiment, etc.]

2. Central Bank Policy Updates

The Fed leaned dovish, signaling support for a rate cut at its next meeting. The ECB, meanwhile, focused on financial stability, with crypto asset regulation moving toward tighter oversight.

II. Market Health Index Analysis (Source: CoinMarketCap)

Source: https://coinmarketcap.com/charts/

Conclusion:

The total market capitalization edged higher, while trading volume slightly contracted, suggesting a stock-flow game. The Altcoin Season Index remained in the 25–85 range, indicating a rotation of funds into mid- and small-cap tokens. ETF inflows extended for over two consecutive weeks, and with the Fear & Greed Index in neutral territory, market sentiment appeared divided.

III. Derivatives Monitor (Source: CoinAnk)

1. Funding Rate

BTC 7D Avg Funding Rate: 0.1054% (Positive)

ETH 7D Avg Funding Rate: 0.0444% (Positive)

https://coinank.com/fundingRate/current

Interpretation: Sustained positive funding rates indicate longs dominance, with bullish expectations intact.

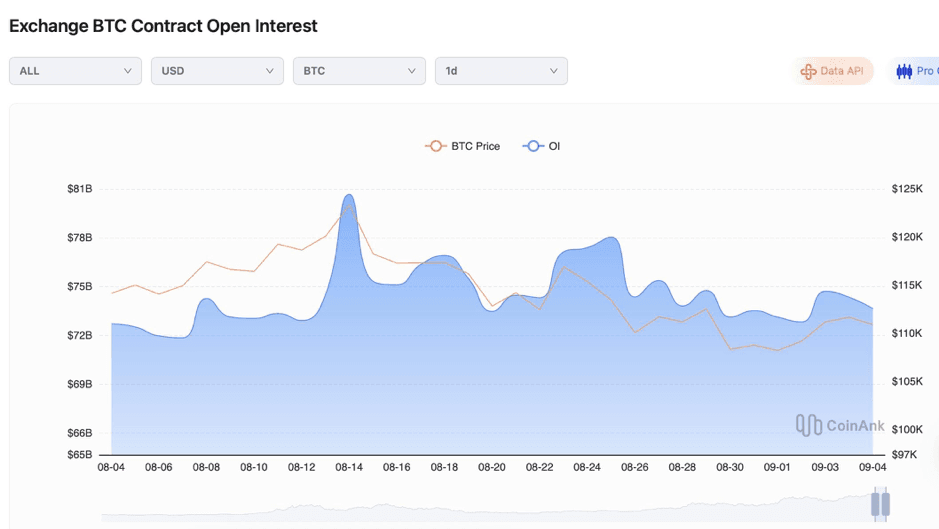

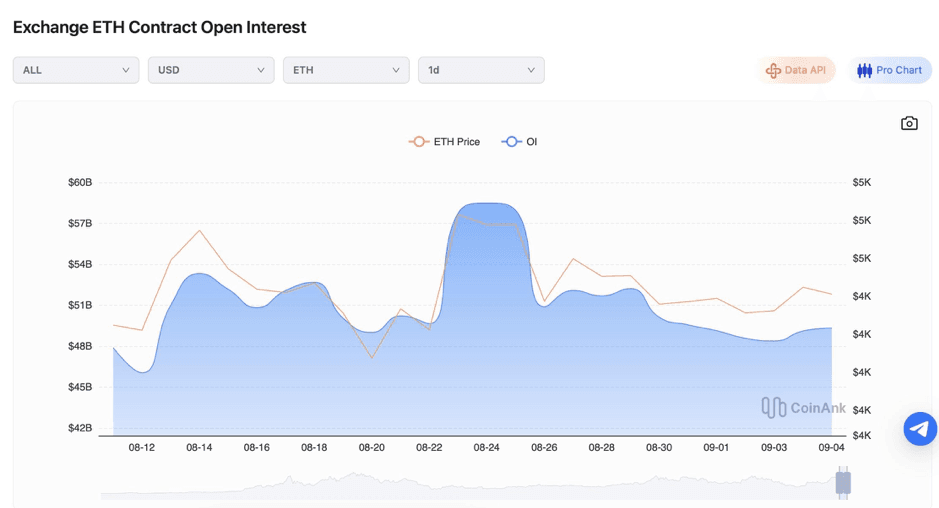

2. Open Interest Changes

Source: https://coinank.com/indexdata/oivol/exOiHist

IV. Global Economic and Crypto Sector Developments

1. Global Macroeconomy

· Aug 28: [U.S. Nonfarm Payrolls Release] → Result: [Below Expectations]

· Aug 31: [EU Troop Deployment to Ukraine] → Impact: [Stock and Crypto Markets Move in Tandem / U.S. Dollar Index Volatility]

1) On August 26, Bank of England MPC member Mann said that if downside risks to domestic demand emerge, strong policy action would be taken, with rates cut more significantly and more quickly.

2) On August 26, foreign media reported that the Trump administration was considering measures to influence regional Federal Reserve Banks and increasing scrutiny of the process for selecting Fed presidents.

3) On August 26, reports indicated that European nations may initiate a UN procedure on September 4 to reimpose sanctions on Iran.

4) On August 27, Brazil’s Finance Minister said the U.S. dollar is a store of value and will remain so for many years unless the United States continues to make mistakes, adding that weaponizing the dollar is what undermines it.

5) On August 27, the Fed’s third-highest ranking official suggested that rate changes could be considered at every policy meeting.

6) On August 28, U.S. Q2 real GDP growth was revised to an annualized 3.3% (vs. 3.10% expected, 3.00% prior).

7) On August 28, U.S. Initial Jobless Claims (to Aug 23): 229K (exp. 230K, prev. revised from 235K to 234K). Bearish for gold, silver, and crypto.

8) On August 28, Japan’s July unemployment rate: 2.3% (exp. 2.5%, prev. 2.5%). Bullish for gold, silver, and crypto.

9) On August 29, the IMF Deputy Managing Director said markets still trust the Fed’s independence, but warned that real risks should not be overlooked.

10) On August 29, Fed Governor Cook filed a lawsuit against Trump, with Powell also named as a defendant. Cook’s lawyer said a mortgage dispute may have stemmed from a “clerical error,” while a U.S. judge made no immediate ruling on Trump’s bid to remove Cook

11) On August 30, the U.S. Federal Appeals Court ruled Trump’s tariffs illegal. Trump rejected the ruling as “wrong,” while emphasizing that the current tariffs remain in effect.

12) On August 30, U.S. July core PCE YoY at 2.9%, highest since Feb 2025 (exp. 2.9%, prev. 2.8%).

13) On August 31, the European Commission President said the EU has a clear plan to deploy troops to Ukraine.

14) On August 31, U.K. Aug Manufacturing PMI final: 47 (exp. 47.3, prev. 47.3). Bearish for gold, silver, and crypto.

15) On September 1, Xi Jinping chaired the 25th SCO Council of Heads of State and delivered a key speech calling for the early establishment of an SCO Development Bank.

16) On September 1, BOJ Deputy Governor Himino said that despite three rate hikes so far, real rates remain low due to strong inflation, and further hikes would be appropriate if conditions improve. He added that if U.S. tariffs clearly do not affect Japan’s economy, it would support additional tightening.

17) On September 2, Eurozone Aug CPI (YoY prelim): 2.1% (exp. 2.0%, prev. 2.0%). CPI (MoM prelim): 0.2% (prev. 0.0%). Manufacturing PMI final: 50.7 (exp. 50.5, prev. 50.5). All bullish for gold, silver, and crypto.

18) On September 2, U.S. Aug ISM Manufacturing PMI: 48.7 (exp. 49, prev. 48). Bullish for gold, silver, and crypto.

19) On September 3, BOJ Governor Ueda said he exchanged views on the economy and foreign exchange with PM Ishiba, and that the stance on rate hikes remains unchanged; if the economy and prices evolve as expected, policy will not change.

20) On September 3, U.K. Aug Services PMI final: 54.2 (exp. 53.6, prev. 53.6). Bullish for gold, silver, and crypto.

21) On September 3, Eurozone July PPI MoM: 0.4% (exp. 0.2%, prev. 0.8%). Bullish for gold, silver, and crypto. Eurozone Aug Services PMI final: 50.5 (exp. 50.7, prev. 50.7). Bearish for gold, silver, and crypto.

2. Industry Update

· Ecosystem Update: [Ethereum on-chain DEX trading volume in August set an all-time monthly record]

1) On August 26, Gemini partnered with Ripple to launch an XRP credit card, offering cashback rewards on purchases.

2) On August 26, the UAE held approximately 6,300 BTC, ranking fourth among countries by crypto holdings.

3) On August 27, Austria Group, one of Europe’s largest digital asset exchanges, was actively considering an IPO.

4) On August 28, Swiss crypto bank Sygnum and lending platform Ledn completed a $50 million Bitcoin-backed loan refinancing.

5) On August 28, a survey found that 27% of UK adults are open to including cryptocurrency in retirement plans.

6) On August 29, Coinbase became the crypto infrastructure partner for U.S. on-chain economic data. The U.S. government began publishing GDP data on blockchain, initially covering nine blockchains.

7) On August 30, Tether announced plans to launch USDT on RGB, expanding support for native Bitcoin stablecoins.

8) On August 31, Ethereum on-chain DEX trading volume exceeded $140.1 billion in August, setting an all-time monthly record.

9) On September 1, South Korean retail investors poured over $12 billion into U.S. crypto stocks this year.

10) On September 1, Japan Post Bank announced plans to launch a digital currency in 2026.

11) On September 2, Canary Capital CEO said XRP’s recognition on Wall Street is second only to Bitcoin; demand could surge after ETF launch.

12) On September 2, the Governor of California hinted at the launch of a “Trump Corruption Coin.”

13) On September 3, UAE company RAK Properties announced it would accept Bitcoin and other cryptocurrencies for real estate transactions.

3. Regulatory Policy Update

· Region: [U.S./APAC] → [Regulatory guidance issued / Stablecoin compliance / Tax policy]

1) On August 27, the Bank of Korea proposed providing central bank-backed guarantees for stablecoins.

2) On August 28, the U.S. CFTC planned to use Nasdaq’s monitoring system to expand cryptocurrency oversight.

3) On August 29, the U.S. CFTC issued guidance on foreign trading platform registration, providing regulatory clarity for non-U.S. platforms returning to the U.S. market.

4) On August 30, the Hong Kong SFC reported that Q2 saw the market value of the first virtual asset spot ETFs rise 73%, with licensed virtual asset platforms increasing to 11.

5) On August 31, U.S. and Dutch authorities shut down VerifTools, a platform using cryptocurrency to trade false identities.

6) On September 1, cryptocurrency began flowing into Australia’s A$4.3 trillion superannuation pool via self-managed pensions.

7) On September 2, EU regulators warned that tokenized stocks could mislead retail investors.

8) On September 3, South Korea announced it would share cryptocurrency trading information with tax authorities worldwide to increase transparency and prevent cross-border tax evasion.

V. Market Outlook

From September 4 to September 12, the medium-term trading strategy will still be applied: for the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900, respectively. It is recommended to place a sell order for the ETH spot at $5,125 and set buy orders for bottom-fishing at $1,240.

VI. Risk Alert

1) Macro Risk: Fed policy shift, escalation of geopolitical conflicts, etc.

2) Industry Risk: Regulatory surprise inspections

3) Technical Risk: Whale address activity, etc.

Trading Advice: BTC prices are experiencing a short-term pullback. Keep positions in spot holdings at ≤90% of total capital, and set dynamic take-profit and stop-loss levels to avoid blindly chasing gains or panic-selling with high leverage. Until this crypto bull market fully ends, establish medium- to long-term buy and sell points for major coins, hold steadily, and avoid frequent trading to improve the probability of success.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.